Fixed Asset Software Buyers Guide

This detailed guide will help you find and buy the right fixed asset accounting software for you and your business.

Last Updated on November 08, 2023Fixed assets are tangible items, e.g. machinery, buildings or land, that a business owns and expects to use in its operations for a significant amount of time (typically, longer than a year). These items are essential business tools and as such are important to safeguard and maintain. However, many companies are still using spreadsheets to track this critical information.

Smart managers and business owners looking to automate the process of tracking fixed assets are beginning to look specifically at fixed asset systems—but there are dozens of such programs, which can make picking the right solution challenging. We’ve created this buyer’s guide to make that process a little bit simpler.

Here’s what we’ll cover:

What is fixed asset accounting software?

What are the benefits and potential issues of fixed asset accounting software?

What are the market trends of fixed asset accounting software?

What is fixed asset accounting software?

This type of software automates the process of tracking assets through the various stages in the asset lifecycle, from acquisition through disposal. With the right asset manager software, a business can improve efficiency and financial strength by maintaining its existing assets while avoiding unnecessary equipment purchases and upgrades.

These systems allow for greater transparency into important asset characteristics, including:

Location

Check-in and check-out

Due date for return

Maintenance scheduling

Audit history

Cost

Depreciation

Fixed asset software can also aid in minimizing taxes and insurance costs by accurately calculating tax and automatically checking for tax code and regulatory compliance. Using fixed asset depreciation software and schedules to precisely calculate taxes with a frequently upgraded program enables a company to maximize tax savings while automatically staying up-to-date with relevant changes to tax laws.

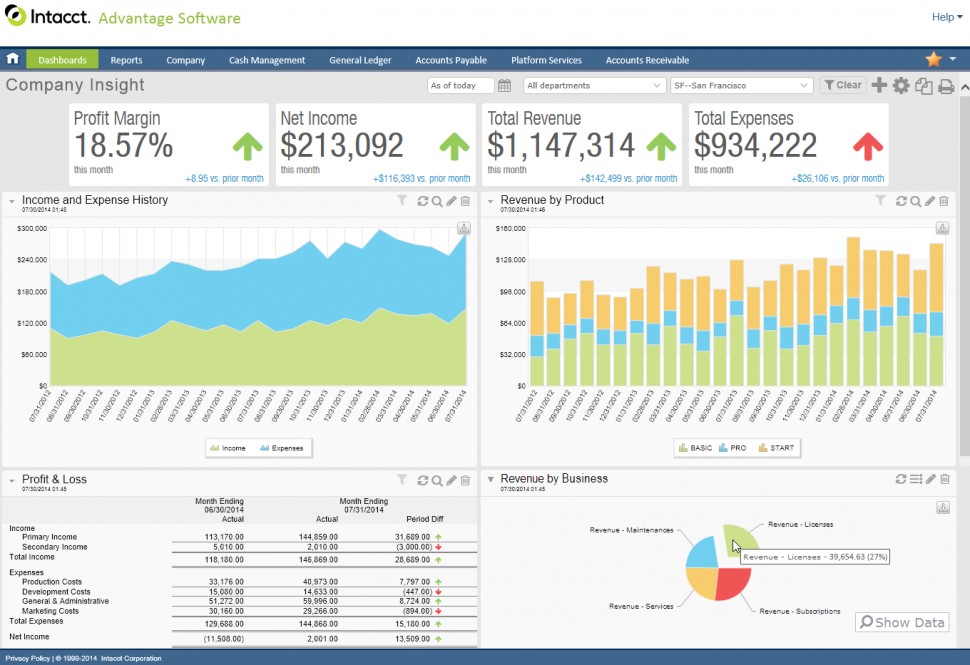

Screenshot of Intacct user dashboard

These programs can integrate with the general ledger, allowing information to easily be combined and compared with general accounting records. This promotes a seamless and consistent view of a company’s financial situation and the status of its assets. Some software packages can even incorporate and track conversion of asset value in other currencies. This automated feature clearly expands the geographic communication options of a company’s assets and potentially makes it easier to sell assets overseas.

What type of buyer are you?

Depending on your industry and needs, you may want to look for specific features or characteristics designed for accounting for fixed assets. For instance, a company using barcodes to catalog its assets should look for the corresponding method, whereas a company that prefers radio frequency identification (RFID) should find a solution with that feature included. A business using a certain type of tax system, such as ProSeries, might want to look for asset accounting software that can import data from that type of program.

When searching for a fixed asset management system, pay attention to the following criteria:

Does the system incorporate a specific type of inventory cataloguing (i.e., barcodes, RFID etc.)?

Does it use the right methods to calculate depreciation?

Is it tailored to your company size?

Can it integrate with a general ledger software program or other programs preferred by the company (ProSeries tax systems etc.)?

Can the program adequately track sales of such assets and provide information about the gains or losses from the sale?

Can the system track maintenance schedules and issue reminders when maintenance is due?

Will the company want to take advantage of features which allow collaboration and interaction between different departments in managing these assets?

You’ll also want to consider whether you want a standalone system to be installed on-premise, or if you’d prefer a Web-based system with lower up-front costs.

What are the benefits and potential issues of fixed asset accounting software?

Fixed asset management software provides the following concrete benefits:

Simplified processes. Fixed asset software automates workflow processes and reduces errors due to manual data entry. This increases visibility into various actions, such as transferring assets, adding or disposing of assets, tracking depreciation and managing inventory. Additionally, these systems should integrate directly with other accounting modules, allowing for seamless data transfer between applications.

Accurate depreciation. Tracking asset depreciation using spreadsheets is highly inefficient and puts businesses at a greater risk for human error. The best fixed asset software solutions will update automatically when laws change, they minimize human data entry and they are guaranteed to provide accurate calculations.

Improved data transparency. Tracking assets throughout their lifecycle provides businesses with an accurate audit trail and financial record. The fixed asset system acts as a secure database, storing all asset-related information in one searchable location.

Any time you purchase a new program, implementation is a critical consideration. Ensure you have an adequate training program and that you involve all potential users involved in the selection process, so they look forward to using the new system, rather than having it be forced on them by their superiors.

What are the market trends of fixed asset accounting software?

There are a few trends affecting the fixed asset software market:

Software as a service (SaaS). In most industries, accounting included, more programs are being developed as Web-based platforms with a monthly fee for service. This eliminates the need for an expensive IT infrastructure and shifts the costs to being a long-term operational expense, rather than a major up-front capital investment. A web-based fixed asset system enables businesses to access their fixed asset data in real-time, from any location.

Industry specialization. Because manufacturers have different needs than retailers or real estate investors, most vendors are beginning to tailor their program to specific industries. This forms a highly specific and usable solution with all the features you need and none of the ones you don’t.

Tax compliance. One of the main uses of fixed asset management software is tax compliance, ensuring not only that the company is in full compliance with all state, federal and local regulations but also that it's taking full advantage of all potential tax breaks. Fixed asset systems can streamline the process of preparing compliance reports and often include pre-configured report options.

The Vendor Landscape

There a number of different products providing management tools in their systems, but below are some of the major players, by industry type:

These types of buyers... | Should evaluate these systems... |

Commercial | Epicor, Sage, Netsuite, Microsoft Dynamics, SAP |

Public sector | Sage Accpac, Serenic |

Nonprofit | Accufund, Sage, Serenic |