Best Accounts Receivable Software of 2026

Updated January 27, 2025 at 9:54 AM

- Popular Comparisons

- FrontRunners

- Buyers Guide

- Related Software

Compare Products

Showing 1 - 25 of 261 products

Compare Products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Average Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

Alphabetically (A-Z): Sorts listings by product name from A to Z.

Sage Intacct operates within the Sage Business Cloud portfolio as a comprehensive cloud-based financial management software, exp...Read more about Sage Intacct

Sage Intacct's Best Rated Features

See All

Sage Intacct's Worst Rated Features

See All

Sage 50 Accounting is an accounting solution designed to cater to the needs of small and medium-sized businesses. It offers a su...Read more about Sage 50 Accounting

Sage 50 Accounting's Best Rated Features

See All

Sage 50 Accounting's Worst Rated Features

See All

Xledger is a cloud-based enterprise resource planning (ERP) solution that caters to midsize and large businesses and helps them ...Read more about Xledger

NetSuite is an AI-powered cloud-based business management suite that incorporates ERP, financial management, CRM and eCommerce f...Read more about NetSuite

NetSuite's Best Rated Features

See All

NetSuite's Worst Rated Features

See All

AccountMate is a hybrid accounting solution that caters to small and midsize businesses and offers them tools and functionalitie...Read more about AccountMate

Plus & Minus is an integrated enterprise resource planning (ERP) financial solution built around a single-file , single-format s...Read more about Plus & Minus

Connected is a hybrid integrated accounting and enterprise resource planning (ERP) that caters to small and midsize businesses a...Read more about Connected

Plooto is an all-in-one platform that enables businesses to automate their domestic and international accounts payable and accou...Read more about Plooto

Plooto's Best Rated Features

See All

Plooto's Worst Rated Features

See All

FreshBooks is a web-based accounting platform designed for small businesses across industries such as marketing, legal services,...Read more about FreshBooks

FreshBooks's Best Rated Features

See All

FreshBooks's Worst Rated Features

See All

Sage Accounting is a cloud-based accounting and invoice management solution for small to midsize businesses. It offers accountin...Read more about Sage Accounting

Sage Accounting's Best Rated Features

See All

Sage Accounting's Worst Rated Features

See All

Quadient Accounts Receivable By YayPay is a cloud-based accounts receivable (AR) automation solution aimed to serve credit, coll...Read more about Quadient Accounts Receivable by YayPay

Quadient Accounts Receivable by YayPay's Best Rated Features

See All

Quadient Accounts Receivable by YayPay's Worst Rated Features

See All

Sage X3 is a powerful ERP software solution designed for midsized national and global manufacturers, distributors, and after-sal...Read more about Sage X3

Sage X3's Best Rated Features

See All

Sage X3's Worst Rated Features

See All

Paystand is a B2B payments platform designed to automate accounts receivable and payable processes. It serves finance teams acro...Read more about Paystand

Paystand's Best Rated Features

See All

Paystand's Worst Rated Features

See All

SAP S/4HANA Cloud is a cloud-based and on-premise enterprise resource planning (ERP) solution. It is suitable for small, midsize...Read more about SAP S/4HANA Cloud

SAP S/4HANA Cloud's Best Rated Features

See All

SAP S/4HANA Cloud's Worst Rated Features

See All

Sage 300cloud (formerly Sage Accpac) is an enterprise resource planning (ERP) software system that serves small and medium-size ...Read more about Sage 300

Sage 300's Best Rated Features

See All

Sage 300's Worst Rated Features

See All

Gaviti is an AI-powered invoice-to-cash automation platform designed to help B2B companies accelerate collections, improve cash ...Read more about Gaviti

Gaviti's Best Rated Features

See All

Gaviti's Worst Rated Features

See All

Alevate AR is an AI-enabled automation platform that streamlines accounts receivable operations. The platform automates key proc...Read more about Alevate AR

ChargeOver is a cloud-based standalone billing and invoicing solution designed for businesses across all industries. The platfor...Read more about ChargeOver

ChargeOver's Best Rated Features

See All

ChargeOver's Worst Rated Features

See All

Eleven helps small and medium-sized accounting firms to streamline their practice and scale. With this cloud accounting app, you...Read more about Eleven

Eleven's Best Rated Features

See All

Eleven's Worst Rated Features

See All

Patriot Accounting offers accounting software for American businesses and accountants. Patriot Accounting is affordable and easy...Read more about Patriot Accounting

Patriot Accounting's Best Rated Features

See All

Patriot Accounting's Worst Rated Features

See All

Spendesk is a cloud-based spend management solution designed to help businesses handle invoices, approval processes, expense rei...Read more about Spendesk

Spendesk's Best Rated Features

See All

Spendesk's Worst Rated Features

See All

Create. Send. Get Paid. Invoice Ninja is the leading small-business platform to invoice, accept payments, track expenses & time...Read more about Invoice Ninja

Invoice Ninja's Best Rated Features

See All

Invoice Ninja's Worst Rated Features

See All

Invoicing software and so much more. With Holded, you can handle electronic invoicing for your business and manage everything e...Read more about Holded

Holded's Best Rated Features

See All

Holded's Worst Rated Features

See All

Zenskar automates billing, collections, and revenue recognition for modern businesses, without the need for coding. With Zenskar...Read more about Zenskar

Zenskar's Best Rated Features

See All

Zenskar's Worst Rated Features

See All

DataSnipper is an automation platform designed to work within Excel, streamlining audit and finance workflows through AI-powered...Read more about DataSnipper

DataSnipper's Best Rated Features

See All

DataSnipper's Worst Rated Features

See All

Popular Comparisons

Your Guide to Top Accounts Receivable Software, July 2025

Software Advice uses reviews from real software users to highlight the top-rated Accounts Receivable products in North America.

Learn how products are chosenExplore FrontRunners

“Usability” includes user ratings for Functionality and Ease of Use.

“Customer Satisfaction” includes user ratings for Customer Support, Likelihood to Recommend and Value for Money.

Reviews analysis period: The reviews analysis period spans two years and ends the 15th of the month prior to publication.

Buyers Guide

This detailed guide will help you find and buy the right accounts receivable software for you and your business.

Last Updated on January 27, 2025Accounts receivable software automates a business’s invoicing and collections processes. As a result, businesses can better manage their cash flow cycle, increase accuracy and improve customer relations.

This guide will help you understand the role of accounts receivable software within the larger accounting software market, so you can make a more informed purchase decision. Here’s what we’ll cover:

What is accounts receivable software?

Common functionality of accounts receivable systems

What are the market trends of accounts receivable software?

What is accounts receivable software?

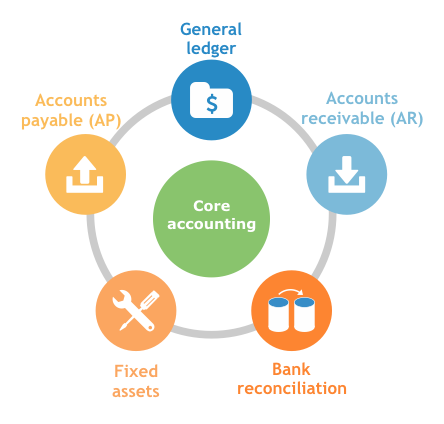

Accounts receivable software is one application among many under an umbrella category called “core accounting.” This core package contains all the basic functions required for a business to manage its finances, including:

Core accounting applications

General ledger (GL): Record of a business's financial transactions, used to prepare financial statements and reports. GL includes statements on assets, liabilities, equity, revenue and expenses.

Accounts receivable (AR): Money owed to a business, but not yet paid, for goods and services rendered; i.e., “assets.”

Bank reconciliation: Connects and compares bank account records to the account holder’s records (i.e., general ledger) to ensure that each record is accurate and balanced.

Fixed assets: Includes tangible items or property that the business owns and uses in its day-to-day operations, e.g. buildings or equipment. These assets are expected to be in use for longer than a year.

Accounts payable (AP): Money owed by a business to its suppliers and creditors; i.e., “liabilities.”

Common functionality of accounts receivable systems

Common capabilities of accounts receivable solutions include:

Invoicing | Create and send invoices for goods and services provided. Some systems allow users to set up recurring invoices to be automatically sent out on a specific schedule. |

Payment options | Accept payments in various forms, including cash, check, electronic funds transfer or credit card. Some systems include integration with various merchant or payment services such as PayPal. |

Customizations | Design custom invoice templates. Create professional-looking invoices by adding company logo, including payment terms (e.g., Net 15, Net 30) and client information. Often includes options for multi-currency invoicing. |

Contact management | Track paid versus outstanding balances. Some online invoicing systems allow users to see when customers view an invoice or send reminders when invoices are coming due or are late. |

AR analytics | Analyze AR data through configurable dashboards, reports and data visualization tools such as charts and graphs. Gain insights into customer aging, deferred revenue, recurring invoices and more. |

Mobile apps | Access AR data through mobile apps for iOS, Android or Windows phones. Send invoices, payment reminders etc. from mobile devices. |

What are the market trends of accounts receivable software?

Prospective AR software buyers should be aware of the following market trends surrounding on-premise and cloud-based accounting solutions:

While “accounting” as a horizontal market has historically been slow to move to the cloud, we’ve found that consumers are growing increasingly confident using cloud-based accounting solutions:

In 2015, 30 percent of small and midsize businesses (SMBs) reported using cloud-based accounting software compared with just 16 percent in 2014.

The largest percentage of SMBs surveyed in 2015 (43 percent) still use on-premise solutions, but the gap between these users is closing. Prospective AR software buyers should weigh their concerns versus the potential benefits and invest in a solution that best fits their needs.

For example, the top benefits and concerns cited by users in this survey include:

Top Benefits of Cloud-Based Accounting Software | Top Concerns With Cloud-Based Accounting Software |

33 percent: Ease of access | 28 percent: Security of data |

28 percent: Security/safety | 21 percent: Ease of use |

24 percent: Ease of use | 16 percent: Learning a new system |

(Source: Consumer Confidence in Cloud-Based Accounting - 2015.)

Examples of highly rated cloud-based systems include:

Quickbooks Online

Examples of highly rated on-premise solutions include:

BillQuick (available as either a self-hosted or cloud-hosted solution).

The vendor landscape

AR software can be purchased in one of the following ways:

Standalone, or best-of-breed AR solutions focus entirely on invoicing clients for the goods and services provided. A business might choose to purchase a standalone AR system for several reasons.

For example, a standalone system might appeal to a business using an accounting platform that doesn’t support online invoicing. Online invoicing platforms, such as Xero, allow businesses to send out automatic, recurring email invoices. Customers can click the payment link from the email and pay directly via credit card or online payment service, such as PayPal.

Businesses purchasing standalone AR software should first ensure that the solution integrates with the other accounting systems current in place. Specifically, the other applications within the suite of “core accounting”: Accounts payable (AP), general ledger (GL), bank reconciliation, etc. This ensures that the general ledger stays up-to-date with assets and liabilities and the bank records reflect transactions accurately.

Offered in suite means that AR is one application included as part of a larger accounting system. Most commonly, this would include the remaining applications under the “core accounting” umbrella: AP, GL and bank reconciliation.

However, more advanced systems will often have budgeting and forecasting capabilities as well as financial reporting, including expense reports, profit and loss statement and balance sheets. The AR data feeds into these modules and allows businesses to forecast future revenue based on past performance.

What type of buyer are you?

AR software is critical for many businesses. But what type of buyer are you and which solution best fits your needs? Here a few examples:

Self-employed: Freelancers, contractors and solo entrepreneurs need a way to manage both their personal and business expenses—often from the same account. Software solutions such as Quickbooks Self-Employed or Quicken Home and Business help users track income and expenses and separate transactions as either business or personal.

These solutions can also help categorize and track IRS Schedule C tax deductions, such as business travel expenses or advertising, making it easy to calculate and submit taxes. Additionally, both these solutions allow users to export data directly to TurboTax, a popular tax solution for self-employed individuals.

SMB buyers: This group represents the largest percentage of buyers who contacted Software Advice for accounting software recommendations in 2015: A combined 66 percent of these businesses earn $50 million or less in annual revenue.

Many SMB buyers are looking to purchase their first accounting solution to streamline and automate AR processes. Growing SMBs may want a more sophisticated solution that offers a payroll module or industry-specific functionality.

Some vendors, such as Intuit, offers a range of accounting solutions that support the varying needs of SMBs (click here to check out our breakdown of Intuit’s many Quickbooks offerings).

Enterprise buyers: Large, enterprise-level organizations require accounting functionality that is best met by advanced financial management platforms such as Intacct or NetSuite.

These solutions facilitate both short and long-term accounting needs, including core accounting, financial reporting and budgeting and forecasting. Most also offer a degree of payroll management and support industry-specific needs such as inventory management and fund accounting.