Find the best Construction Payroll Software

Compare Products

Showing 1 - 20 of 183 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

isolved

isolved

isolved is the most-trusted HCM technology leader, providing the best combination of software and services to meet the needs of today’s People Heroes – HR, payroll, and benefits professionals. From talent acquisition to workforce ...Read more about isolved

WorkforceHub

WorkforceHub

WorkforceHub is a cloud-based time, attendance, and leave management system for small to mid-size businesses. This software can capture time data from web-based clocks or physical clocks for employees onsite, mobile, and working a...Read more about WorkforceHub

BambooHR

BambooHR

Instead of using fragmented spreadsheets, limited or clunky software, and physical paper, BambooHR helps you centralize your data and automate the way you complete key HR tasks. As you hire, onboard, and pay your employees, every ...Read more about BambooHR

GoCo

GoCo

GoCo is a cloud-based human resources, benefits and payroll solution designed for small businesses. The platform automates the process of collecting required documents for newly hired talent, enrolling new employees in benefits pl...Read more about GoCo

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Meet Eric, a software expert who has helped 1,534 companies select the right product for their needs.

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Tell us more about your business and an advisor will reach out with a list of software recommendations customized for your specific needs.

STEP 1 OF 4

How many employees are in your company?

Paylocity

Paylocity

Paylocity is a cloud-based human capital management (HCM) platform that provides human resources and payroll management tools to help businesses manage core HR functions. Key features include payroll processing, benefits administr...Read more about Paylocity

Dayforce HCM

Dayforce HCM

Dayforce makes work life better. Everything we do as a global leader in HCM technology is focused on improving work for thousands of customers and millions of employees around the world. Our single, global people platform for HR, ...Read more about Dayforce HCM

TeamBridge

TeamBridge

Zira is a cloud-based employee scheduling and performance management system designed to automate complex team processes. Zira tools include a web-based manager and admin application that is ideal for creating and publishing schedu...Read more about TeamBridge

Rise

Rise

Rise is a cloud-based human resources (HR) solution that helps companies engage with their employees and action all HR functions such as managing time and attendance, managing payroll and create customized workflows. The platform ...Read more about Rise

Humi

Humi

Humi is a best-in-one HR, payroll, and benefits software solution for Canadian businesses. A flexible platform for all of your people operation needs, Humi stores employee data and streamlines tasks related to onboarding, time off...Read more about Humi

Collage HR

Collage HR

Collage is a cloud-based human resources (HR) and benefits management platform built for the needs of small and midsize businesses. Collage also digitizes group benefits enrollment and can sync with any insurance provider in Canad...Read more about Collage HR

Arcoro

Arcoro

The Arcoro human resources (HR) management solution is the bridge to better HR. With over 10,000 customers and 360,000 daily users in 20 countries around the world, Arcoro offers configurable, easy-to-use, cloud-based HR software ...Read more about Arcoro

WorkMax TIME

WorkMax TIME

WorkMax TIME is a cloud-based time tracking solution that helps any business track and manage employees and job costs with three workflows. The three workflows include real-time data collection and allocation, real-time data colle...Read more about WorkMax TIME

Triton HR

Triton HR

Triton HR's cloud-based, HR solution for small to midsize companies, integrates payroll services, employee benefits, and essential HR applications into a cloud-based single single sign on system. Tailored to fit a broad spectrum o...Read more about Triton HR

iCIMS Talent Cloud

iCIMS Talent Cloud

Support the entire candidate experience from start to finish with a unified recruitment platform. iCIMS offers best-in-class recruiting products for your hiring life cycle, available as part of one unified talent cloud platform, o...Read more about iCIMS Talent Cloud

Eddy

Eddy

Eddy is the all-in-one HR Suite built for local businesses. With Eddy, businesses can streamline tedious HR processes and improve their employee experience by moving away from paper and spreadsheets and into our intuitive, web-bas...Read more about Eddy

Criterion HCM

Criterion HCM

HCM Without Compromise. Criterion provides human capital management (HCM) software for midmarket organizations, helping organizations in construction, financial services, nonprofits and higher education streamline their critical ...Read more about Criterion HCM

Papaya Global

Papaya Global

Papaya Global is a SaaS fintech company providing global payroll technology and the only one with an embedded payments platform designed for the workforce needs of global enterprises. Papaya's comprehensive technology, known as ...Read more about Papaya Global

Mirro

Mirro

Mirro helps leaders better understand their teams and let colleagues grow alongside each other, building positive and ever-evolving team journeys. The platform comes with an activity feed, which allows users to view project update...Read more about Mirro

ADP Workforce Now

ADP Workforce Now

ADP Workforce Solution is suited for businesses with more than 50 employees looking to streamline HR processes. ADP Workforce Now includes capabilities such as payroll processing and tax filing, performance management, compensatio...Read more about ADP Workforce Now

Time Tracker

Time Tracker

Time Tracker is an employee time and attendance tracking solution designed to simplify employee tracking and reduce administration using automation functionality. With Time Tracker, businesses are able to examine and track employe...Read more about Time Tracker

Popular Comparisons

Buyers Guide

Last Updated: March 16, 2023A vital part of running a small construction business is managing the payroll of your employees in accordance to state and federal regulations.

However, small businesses face various payroll and tax calculation issues such as delays in releasing paychecks, inaccurate payments due to manual data entry, as well as lack of or poor communication among employee, supervisor, and timekeeper regarding standards and deadlines.

To avoid all of these challenges, small businesses need construction payroll software to automate the process of paycheck calculation, wage reporting and compliance management. It will help them avoid costly fines that result from manual errors.

Finding the right construction payroll software can be tough if you're doing it all on your own. That's why, we created this guide to help potential buyers understand the software, its features and the overall market.

In this guide, we'll cover:

What Is Construction Payroll Software?

Common Features of Construction Payroll Software

What Is Construction Payroll Software?

Construction payroll software helps small business HR managers automate the process of managing multiple payroll tasks, including direct deposit, current payroll costs and labor compensation reports. It helps them comply with union policies, tax withholding and labor pay regulations.

The software can also integrate with various leave management and time tracking functionality/tools to accurately calculate employee wages, bonuses and overtime.

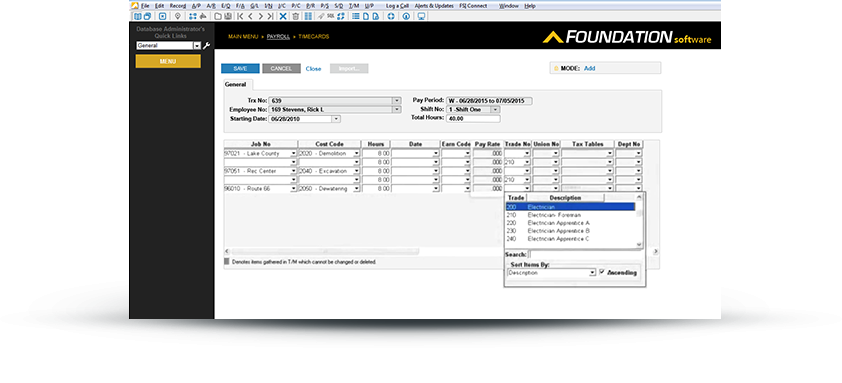

FOUNDATION's payroll dashboard

Common Features of Construction Payroll Software

This section looks at some of the common features of construction payroll software that most small businesses require for their processes.

Compensation management | Calculate labor wages based on attendance, employment terms and policies over a period of time—monthly, weekly or bi-weekly. |

Time-off tracking | Track time and attendance data for all employee types (hourly, salaried, remote or on-site) to calculate gross pay. |

Direct deposit | Deposit labor wages directly into employees' bank accounts for each pay period. |

Compliance management | Get real-time updates to comply with labor regulations such as Fair Labor Standards Act (FLSA) and Immigration and Nationality Act (INA). |

Tax filing | Calculate state and federal payroll taxes; also, manage tax filings and wage report forms such as DOL-4N and 1099-MISC. |

Reporting and analytics | Generate reports to get an overview of the gross-to-net payroll register, taxes, compensation analysis and other payroll data. |

Self-service portal | Allow employees to view their payroll data (pay stubs and tax deductions); let them manage their account information such as bank details and contact information. |

Multi-location payroll processing | Ensure accurate pay calculations for different states and regions so that remote workers are paid as per local labor standards and tax laws. |

What Type of Buyer are You?

As you begin shortlisting the construction payroll software, you need to understand the type of buyer you are to narrow down your requirements. The next section breaks down the two most common buyer types.

General contractors and house builders. These buyers need cloud-based payroll software to manage on-site employees. The software should be able to include 1099 contractors, manage rents, pay royalties and calculate federal withholding taxes.

These buyers also need to comply with Internal Revenue Service (IRS) rules and regulations related to vendors and independent 1099 contractors.

Government contractors. Public and government contractors have unique asks from their payroll calculation and compliance management systems. As these contractors are usually under scrutiny, they need to ensure accuracy and strictly adhere to the industrial dearness allowance (IDA) and central dearness allowance (CDA) payroll structures.

They also need to provide performance-related pay (PRP), with applicable government policies and conditions. Therefore, these buyers need software that offers a high level of automation, documents payroll records accurately and is customizable. These will ensure that employees are paid as per various special allowances.

Market Trends to Understand

The advent of cloud technology has influenced the way businesses execute payroll operations. Today, businesses are transitioning to cloud-based tools that help HR managers track payroll in real time and auto-generate payroll data cost. Here are some trends in this industry that you should keep an eye on in 2019.

Predictive analytics to improve payroll. Predictive analytics let businesses analyze payroll data and find profit trends based on the region. This helps them reassess labor deployment. The data can also help them understand the age of their labor, so that they start searching for replacements of those nearing the retirement age.

Machine learning and AI adoption grows. Many businesses are relying on machine learning and artificial intelligence (AI) to enhance their payroll operations. They rely on machine learning when outsourcing payroll functions. Preliminary data shows that AI and machine learning (http://bigdata-madesimple.com/artificial-intelligence-in-hr-and-payroll-embracing-disruption/ target=). Furthermore, businesses could deploy chatbots to resolve employee queries regarding wages, tax deductions or reimbursements. These chatbots can be monitored to spot potential flaws and provide useful insights for improving payroll operations.

Payroll solutions move to software-as-a-service (SaaS). Some businesses see the software-as-a-service (SaaS) model as the new era in the construction payroll industry. The SaaS payroll model allows businesses to distribute pay based on the number of employees or licensed users. This helps them determine labor count and increase the number when needed.