Find the best Payroll Software for Accountants

Compare Products

Showing 1 - 20 of 184 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

Asure Payroll & Tax Management

Asure Payroll & Tax Management

Asure’s end-to-end Payroll, HR, and Time and Attendance solutions were developed specifically for small to mid-sized businesses. With the modern Asure platform, remain compliant, support your employees, and free up time to focus o...Read more about Asure Payroll & Tax Management

Rippling

Rippling

Rippling gives businesses one place to run HR, IT, and Finance. It brings together all of the workforce systems that are normally scattered across a company, like payroll, expenses, benefits, and computers. So for the first time e...Read more about Rippling

Justworks

Justworks

Justworks makes it easier to start, run, and grow a business. With Justworks, entrepreneurs and their teams get access to big-company benefits, automated payroll, compliance support, and HR tools - all in one place. Justworks PEO...Read more about Justworks

isolved

isolved

isolved is the most-trusted HCM technology leader, providing the best combination of software and services to meet the needs of today’s People Heroes – HR, payroll, and benefits professionals. From talent acquisition to workforce ...Read more about isolved

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Meet Eric, a software expert who has helped 1,534 companies select the right product for their needs.

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Tell us more about your business and an advisor will reach out with a list of software recommendations customized for your specific needs.

STEP 1 OF 4

How many employees are in your company?

Paycor

Paycor

Paycor empowers leaders to build winning teams. Paycor’s human capital management (HCM) platform modernizes every aspect of people management, from recruiting, onboarding and payroll to career development and retention, but what r...Read more about Paycor

WorkforceHub

WorkforceHub

WorkforceHub is a cloud-based time, attendance, and leave management system for small to mid-size businesses. This software can capture time data from web-based clocks or physical clocks for employees onsite, mobile, and working a...Read more about WorkforceHub

BambooHR

BambooHR

Instead of using fragmented spreadsheets, limited or clunky software, and physical paper, BambooHR helps you centralize your data and automate the way you complete key HR tasks. As you hire, onboard, and pay your employees, every ...Read more about BambooHR

GoCo

GoCo

GoCo is a cloud-based human resources, benefits and payroll solution designed for small businesses. The platform automates the process of collecting required documents for newly hired talent, enrolling new employees in benefits pl...Read more about GoCo

Paylocity

Paylocity

Paylocity is a cloud-based human capital management (HCM) platform that provides human resources and payroll management tools to help businesses manage core HR functions. Key features include payroll processing, benefits administr...Read more about Paylocity

Dayforce HCM

Dayforce HCM

Dayforce makes work life better. Everything we do as a global leader in HCM technology is focused on improving work for thousands of customers and millions of employees around the world. Our single, global people platform for HR, ...Read more about Dayforce HCM

Rise

Rise

Rise is a cloud-based human resources (HR) solution that helps companies engage with their employees and action all HR functions such as managing time and attendance, managing payroll and create customized workflows. The platform ...Read more about Rise

Humi

Humi

Humi is a best-in-one HR, payroll, and benefits software solution for Canadian businesses. A flexible platform for all of your people operation needs, Humi stores employee data and streamlines tasks related to onboarding, time off...Read more about Humi

Collage HR

Collage HR

Collage is a cloud-based human resources (HR) and benefits management platform built for the needs of small and midsize businesses. Collage also digitizes group benefits enrollment and can sync with any insurance provider in Canad...Read more about Collage HR

WorkMax TIME

WorkMax TIME

WorkMax TIME is a cloud-based time tracking solution that helps any business track and manage employees and job costs with three workflows. The three workflows include real-time data collection and allocation, real-time data colle...Read more about WorkMax TIME

Patriot Payroll

Patriot Payroll

Basic Payroll: $17/month + $4 per employee or contractor. You run payroll and handle your tax filings. Full Service Payroll: $37/month + $4 per employee or contractor. You run payroll, but let us handle the payroll tax filings. ...Read more about Patriot Payroll

iCIMS Talent Cloud

iCIMS Talent Cloud

Support the entire candidate experience from start to finish with a unified recruitment platform. iCIMS offers best-in-class recruiting products for your hiring life cycle, available as part of one unified talent cloud platform, o...Read more about iCIMS Talent Cloud

Papaya Global

Papaya Global

Papaya Global is a SaaS fintech company providing global payroll technology and the only one with an embedded payments platform designed for the workforce needs of global enterprises. Papaya's comprehensive technology, known as ...Read more about Papaya Global

Mirro

Mirro

Mirro helps leaders better understand their teams and let colleagues grow alongside each other, building positive and ever-evolving team journeys. The platform comes with an activity feed, which allows users to view project update...Read more about Mirro

ADP Workforce Now

ADP Workforce Now

ADP Workforce Solution is suited for businesses with more than 50 employees looking to streamline HR processes. ADP Workforce Now includes capabilities such as payroll processing and tax filing, performance management, compensatio...Read more about ADP Workforce Now

Gusto

Gusto

Gusto is a modern, online human resource platform that helps any small business owner take care of all hr tasks. Gusto offers HR tools and HR services to help with managing employee onboarding, running payroll, administrating heal...Read more about Gusto

Popular Comparisons

Buyers Guide

Last Updated: March 16, 2023Whether you're a solo CPA or one of many at a large accounting firm, offering employee payroll services to clients can represent a significant boost to your bottom line.

It can also present significant challenges.

Not only do you need to ensure that all of your clients' employees are paid accurately and on time, but there's also the matter of making sure the government gets their correct cut too—something that's often easier said than done. The IRS estimates 40 percent of small to midsize businesses (SMBs) end up paying a payroll penalty each year due to an incorrect filing.

With so much on the line, having the right payroll software is crucial. But which system is best suited to meet your specific needs as an accountant?

This Buyer's Guide aims to provide some guidance. Below, you'll find information about payroll software functionality, pricing and more to help in your software search.

Click a link below to jump to that section:

What Is Payroll Software for Accountants?

Common Functionality Found in Payroll Software for Accountants

Benefits of Payroll Software for Accountants

How Much Does Payroll Software Cost?

What Is Payroll Software for Accountants?

Payroll software for accountants allows CPAs to manage worker wage information, calculate amounts for employee compensation and withheld taxes, do payroll runs, generate reports and more. Many popular payroll software systems cater to both internal accountants and outsourced accounting firms.

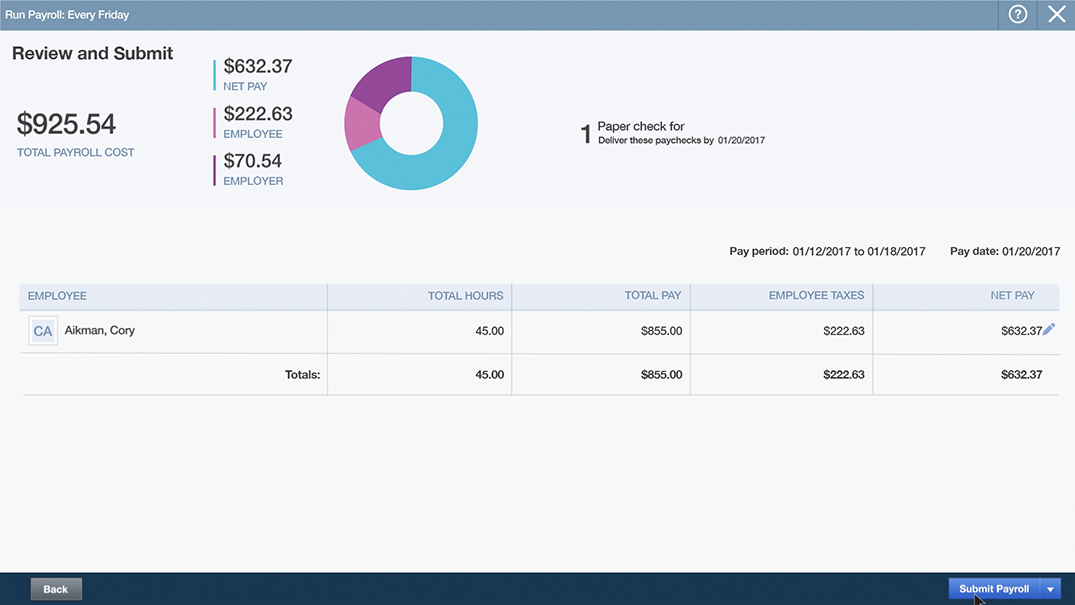

An example payroll run in QuickBooks Full Service Payroll

Payroll software offers accountants a secure digital environment to automate processes, set reminders and manage a vast amount of payroll data over time.

Common Functionality Found in Payroll Software for Accountants

Browsing through payroll vendor websites can quickly become overwhelming if you're not sure what you're looking for. To help, here are some common functions you can expect to find in most systems:

Employee management | Track individual employee pay rates (hourly or salaried), withholding information for benefits and paid time off (PTO). |

Time tracking | Input hours worked, or pull them from an integrated time and attendance system, to calculate correct wages. |

Run payroll | Set a payment period (biweekly, monthly etc.) and calculate the total payroll cost for that period. |

Payroll allocation | Deposit owed payroll amounts to workers in their preferred form (direct deposit, check printing or pay card). |

Tax management | Calculate correct amounts for local, state and federal payroll taxes and file automatically. |

Accounting integration | Automatically log payroll amounts in the company ledger through integrated accounting software. |

Reporting | Generate standardized reports detailing organizational payroll costs. |

There can be small differences in features within these functions between products. For example, some products offer multistate or even multicountry payroll, while others don't. Another example is some payroll platforms can generate W-2s and 1099s for workers come tax time.

One increasingly popular feature is an employee self-service portal where workers can log in to do things such as update their bank accounts or download past pay stubs themselves. This article highlights a few benefits of implementing self-service features.

Benefits of Payroll Software for Accountants

In a 2015 report, Software Advice learned that one in every five payroll software buyers still relies on manual methods such as spreadsheets or pen and paper to handle their payroll needs. If you fall into this group, it's time for an upgrade.

Here are some benefits that dedicated payroll software can bring over manual methods:

Fewer errors. Clerical errors can lead to costly overpayments and penalties. Payroll software can calculate accurate wages and highlight any missing fields or strange discrepancies to ensure you don't make any major mistakes.

Less security risk. Features such as multifactor authentication and SSL encryption found in payroll software can mitigate the chances of your sensitive payroll data getting lost or falling into the wrong hands.

More time to focus on other needs. With features such as one-click payroll runs and automatic report generation, you can cut the time it takes to do payroll for a company from a few hours down to a few minutes.

How Much Does Payroll Software Cost?

How much you pay for a payroll software system is going to largely depend on two factors: the breadth of functionality in your system of choice and the number of employees you're doing payroll for. The more advanced the system is and the more employees you need to manage, the greater the cost.

Because most systems are cloud-based (meaning the software is hosted by the vendor on their own servers for you to access via a web browser), payroll software is almost always sold through subscription licensing. In other words, you should expect to pay a flat fee every month, every year or every pay period to use the software.

Software license prices can range from as little as $10/month for one employee all the way up to $3,500/month for 250 employees or more.

Download our payroll software pricing guide to learn specific cost information for popular systems such as Gusto, Xero and QuickBooks.

Final Considerations

We've covered the basics, but there are still a number of factors to consider when deciding which payroll system is right for you or your firm. Here are some last things to keep in mind during your search:

Do you need full service payroll? A number of payroll software vendors offer a “full service payroll" option where all you have to do is enter employee wage information and the vendor's team of experts will take care of the rest: running payroll, submitting tax forms, printing checks etc. This option tends to be geared toward small business owners who don't know a thing about payroll, but accountants can benefit too if they're looking to offload some work.

Pay attention to the UI and workflow. Payroll software products tend to have a lot of the same functions and features due to the payroll process being so standardized. Where they really differentiate is in their user interface (UI) and workflow. Demo systems and find one that's intuitively designed and easy to use.

Ask an expert. If you're overwhelmed by the software options available to you, don't worry. Give us a call at (844) 852-3639 and talk to one of our payroll software experts. We'll ask a few questions about your needs and send you a shortlist of best-fit, highly-rated products. This service is completely free, so don't hesitate.