QuickBooks Self-Employed

No reviews yet

Overview

About QuickBooks Self-Employed

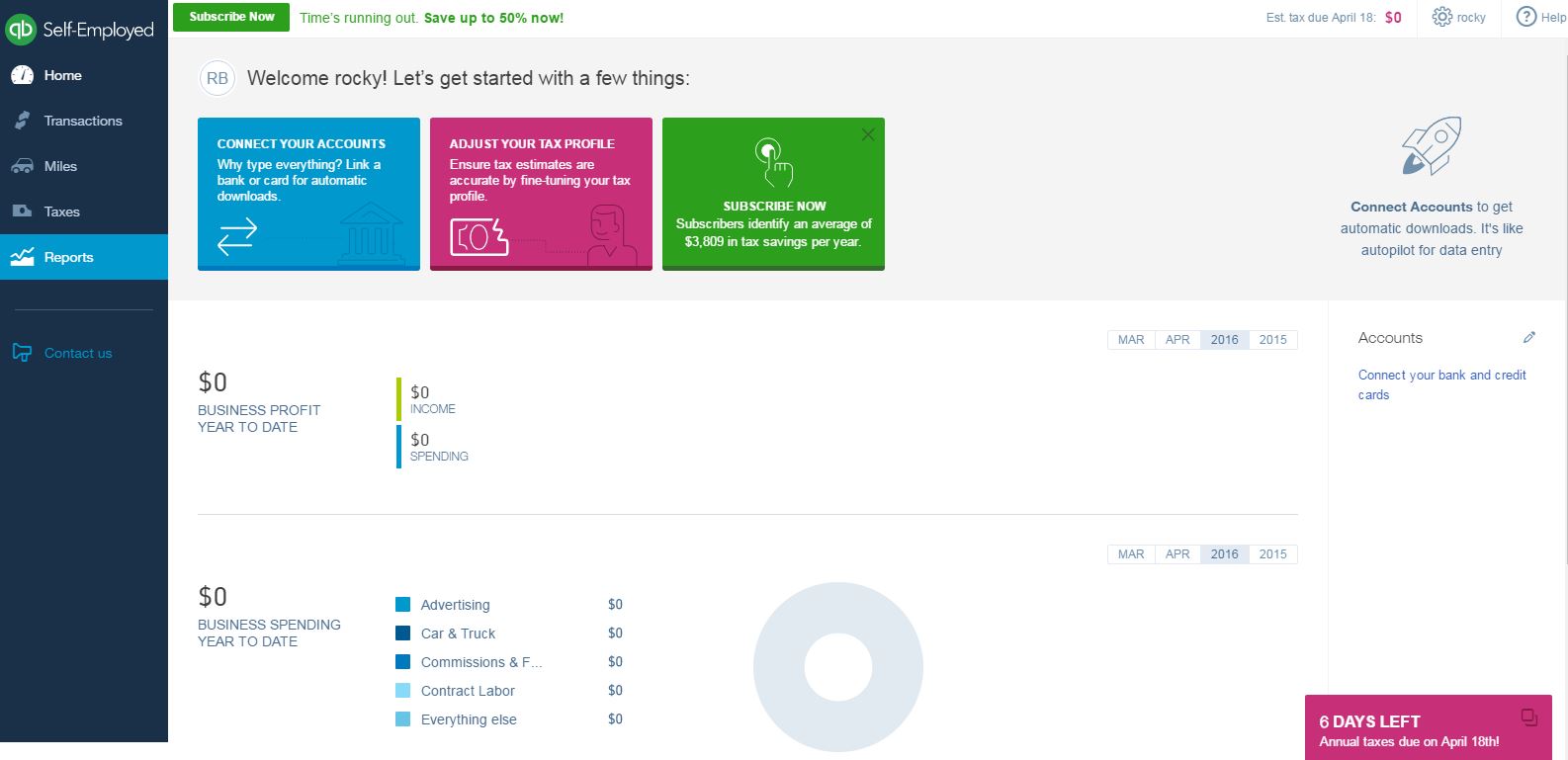

QuickBooks Self-Employed is a cloud-based accounting solution that helps small and midsize businesses across various industries to automate expense categorization to help that helps them to track expenses for travel, assets, advertising and insurance among others.

QuickBooks Self-Employed’s 'TurboTax' feature enables professionals to file taxes online and manage record entries by exporting Schedule C to the solution. In addition, the solution automates the calculation of quarterly taxes and updates users with tax estimates for the year.

QuickBooks Self-Employed enables professionals to connect with their bank accounts for tracking and monitoring. Users can also segment business and personal expenditures and share expense summaries.

QuickBooks Self-Employ...

Awards and Recognition

FrontRunner 2022

Software Advice's FrontRunners report ranks top products based on user reviews, which helps businesses find the right software.

QuickBooks Self-Employed Pricing

Free trial:

Not Available

Free version:

Not Available

Other Top Recommended Accounting Software

Be the first to review QuickBooks Self-Employed

Share your thoughts with other users.