Fixed Assets Manager

About Fixed Assets Manager

Fixed Assets Manager Pricing

Starting price:

$1,000.00

Free trial:

Not Available

Free version:

Not Available

Other Top Recommended Accounting Software

Most Helpful Reviews for Fixed Assets Manager

2 Reviews

Michael

1 employee

Used monthly for more than 2 years

OVERALL RATING:

4

EASE OF USE

3

VALUE FOR MONEY

3

CUSTOMER SUPPORT

3

FUNCTIONALITY

3

Reviewed October 2017

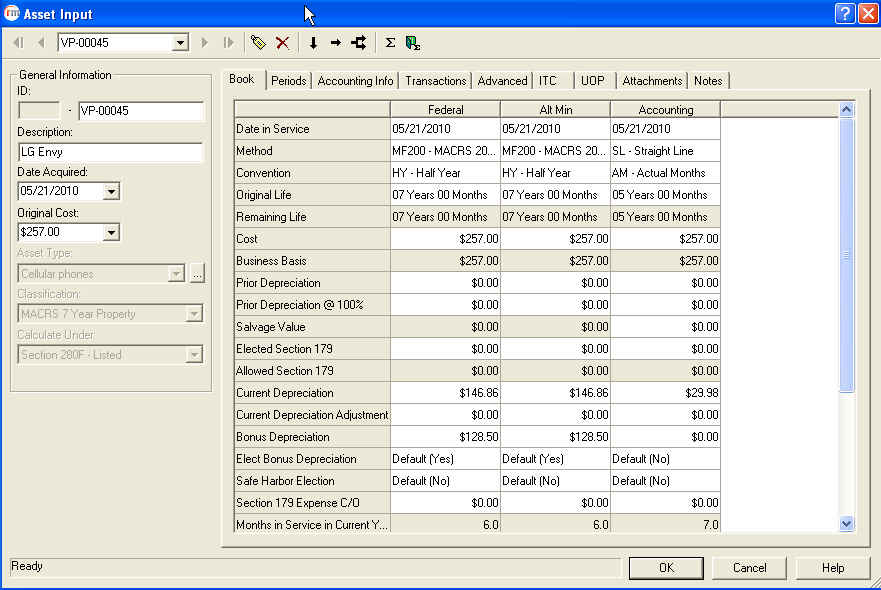

Intuit Fixed Asset Manager

You NEED a Fixed Assets software to track assets esp. when there's Lots of assets Need the reporting function that categorizes assets to certain groupings like chart of assets or property section

PROSExports to Intuit's ProSeries Tax software Categorization of assets to certain groups with reports available Can be used as a Stand Alone Fixed Asset software Relatively simple to use

CONSMUST be used and UPDATED annually as needed Time-consuming to enter and to customize reports Can't print a report just for any 1 particular asset Must buy EACH year's software to import to EACH year's ProSeries Tax software to link properly Don't group assets together or else it WILL be a problem when assets in the group gets 'disposed of/sold' (i.e. Don't groups vehicles 1-5 or equipment 1-5 together but list separated as each can be disposed of/sold)! NAME the assets properly so it CAN BE TRACKED to the Actual physical asset (i.e. don't just say Computer when the office has Lots of computers)! Annual cost is rising! Basic file functionality is LIMITED (i.e. copy or rename files)!

Michael

1 employee

Used more than 2 years

OVERALL RATING:

3

EASE OF USE

3

VALUE FOR MONEY

3

CUSTOMER SUPPORT

3

FUNCTIONALITY

3

Reviewed October 2017

Intuit's Fixed Asset Manager can be used as Stand-alone or part of tax software

Fixed Assets programs are a NECESSITY for tax professionals as any who REFUSE to use one or refuse to update their client's fixed assets are scammers who hurt their clients with overpriced fees! Use the program to track assets, especially if there's LOTS of assets. Forget using spreadsheets where many people just use the straight line depreciation and must calculate it MANUALLY which kills the efficiency and relative accuracy since you may mess up the depreciation/amortization if one does NOT pay attention to calculate them properly. Penny wise, pound foolish!! It's best used either for financial reporting (tax/book differences, if any) and Better if used with the related tax software as it NEEDS to be updated YEARLY for EACH tax year's program or else it will NOT 'link'! You can categorize the assets to be each for internal reporting (i.e. in QBs) but it MUST be done ANNUALLY so the records match one another.

PROSRelatively simple to use MUST have program to track assets esp. if there's LOTS of assets Can categorize assets to different listings (i.e. if you maintain separate property or groups with different fixed assets for them) Decent reporting Exports file for import into Intuit's ProSeries Can be used for a few years before needing the latest upgrade, provided you use it as a 'stand-alone' program.

CONSA Necessity to buy Yearly if you use ProSeries business since you'll need to import the information Don't need if you do NOT perform any Financial reporting as you can enter asset info in the tax return's depreciation section Relatively expensive for just a Fixed Assets software Intuit began to limit the use of the software to <2 years before you have to 're-license' it! Many [OLDer] accountants refuse to update their clients' fixed assets then complain about it and Still do NOT fix them! Must buy YEARLY to match tax software for 'link' to work!