Blue J Tax

About Blue J Tax

Blue J Tax Pricing

Contact Blue J Legal for pricing details.

Starting price:

$20,000.00 per year

Free trial:

Not Available

Free version:

Not Available

Other Top Recommended Business Intelligence Tools

Most Helpful Reviews for Blue J Tax

1 - 6 of 6 Reviews

Anonymous

10,000+ employees

Used less than 6 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

3

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed May 2019

Tax Foresight - Review

Overall, the experience has been good so far! It will be great if more scenarios can be included to further increase the usefulness of the tool.

PROSI like the user platform of Tax Foresight, as it is pretty easy to navigate and use. Instructions on the page itself is easy to follow as well. The reports that are generated are very nicely presented. There are also continuous customer support (ie: providing training sessions, sending emails etc.).

CONSI think there can be more scenarios for the different tax issues that might come up. Currently, the number of circumstances are rather limited. And sometimes, the responses that can required might not be available from the client.

Selina

Accounting, 10,000+ employees

Used monthly for less than 6 months

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed May 2019

Feedbacks

I believe Tax Foresight allowed me to reduce errors and saved tremendous amount of time while producing accurate results. I like the classifiers and case finders features that ensures the research is comprehensive. Tax Foresight allowed me to strengthen customer relationships and build trust within the internal team. I can now streamline my research and produce quality tax advice to clients.

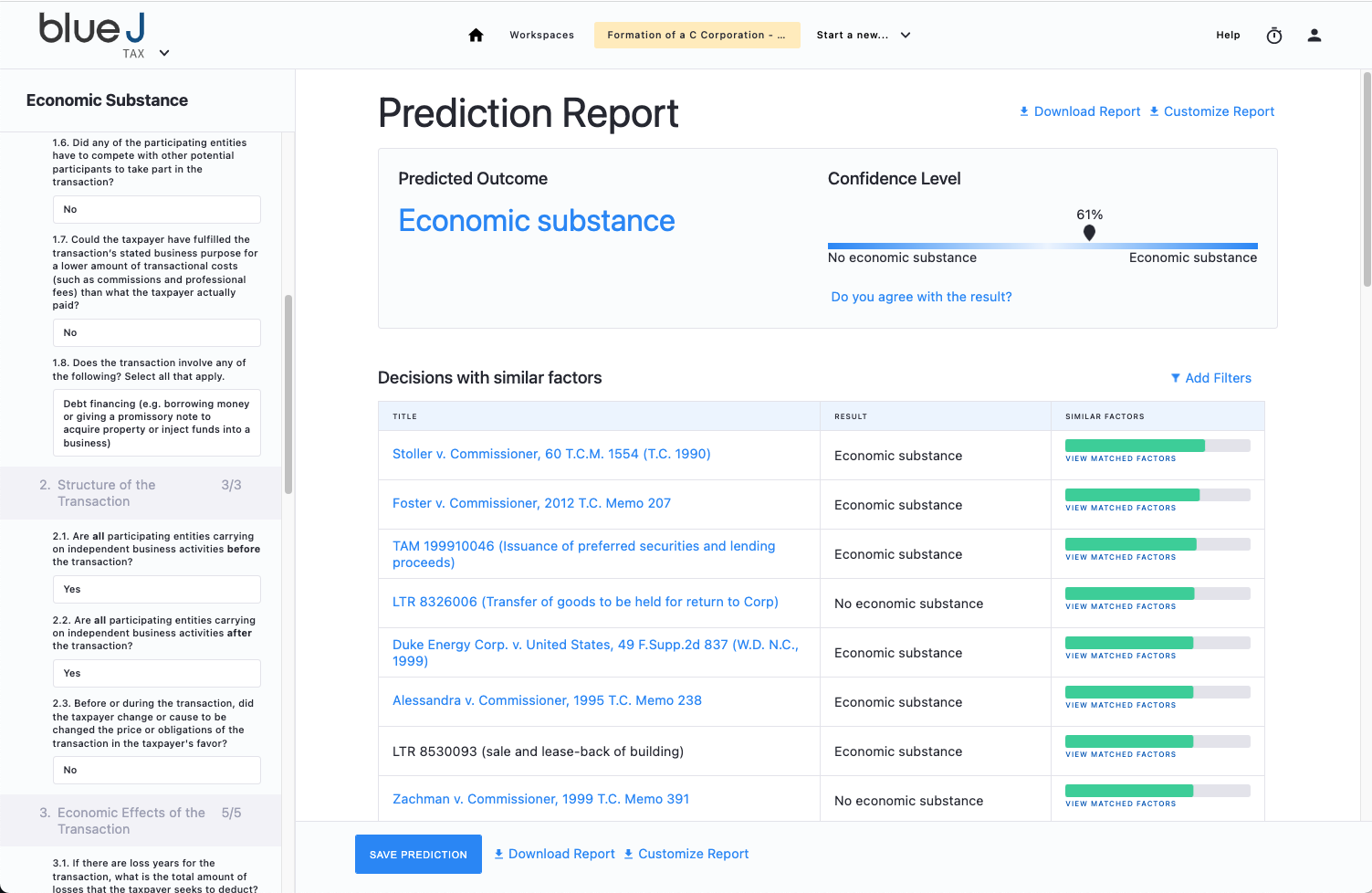

PROSTax Foresight is a powerful research engine that allows me to perform accurate research through case laws and precedent legal issues. It informs me the confidence percentage rating to determine how likely a court will rule the way of the predicted result, which allows me to triage my research needs. In addition, I can also revise my factors to increase/decrease the level of confidence. I like how Tax Foresight produces two sets of cases, "Similar Cases" and "References", which share factual features and important cases frequently cited in court judgments. Overall, I think Tax Foresight is an excellent tool that increased efficiency and comfort level in my research.

CONSAlthough the current classifiers cover the most frequently searched and requested, there are still a lot of topics that are not available on Tax Foresight. However, I am confident that more topics will be added going forward as the number of users and recommendations increase.

Eric

Verified reviewer

Law Practice, 10,000+ employees

Used less than 2 years

OVERALL RATING:

3

EASE OF USE

5

VALUE FOR MONEY

3

CUSTOMER SUPPORT

5

FUNCTIONALITY

2

Reviewed May 2019

Useful in when it applies, which is rare

Tax Foresight is great for giving you a starting place on answers to some questions. It won't be great on difficult questions, and the number of classifiers is very limited. That said, it can help you surface relevant case law on some common issues (e.g. GAAR), which is quite helpful.

PROSProvides a thorough walkthrough of questions that are relevant to a particular issue and allows you to change answers to see what the effect will be on the outcome. Also great a surfacing jurisprudence that most closely reflects your fact pattern.

CONSThere just aren't that many situations in which to use it because there are not very many classifiers compared with the number of questions a tax lawyer professional needs to answer. This is not a problem that the company can fix, the problem is that machine learning can only do so much, which leads to two problems. First, machine learning requires a huge amount of input to be accurate and in Canada there just isn't enough jurisprudence available. Furthermore, tax legislation changes so often that the machine learning algorithm cannot rely on cases going back too far, which further limits the potential pool of input. Second, machine learning still relies on human input to classify questions and answers. If the human trainer says that "these five issues" are generally determinative then that is what the algorithm will learn. As a result, it will miss edge cases (which is reasonable). But those edge cases are the ones that practitioners generally need the most help with. When a residency issue is straightforward, the algorithm will have no problem, but neither will the practitioner.

David

Legal Services, 51-200 employees

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

FUNCTIONALITY

5

Reviewed February 2019

Tax Foresight is on the Forefront of Legal Technology

It's a great program that substantially cuts down research time, allows you to verify your intuition, and frees up more time to focus on other aspects of the client-attorney relationship.

PROSThe final predictive outcome analysis also presents the user with a detailed legal analysis, foundational legal precedents, cases on point, etc. in a simple and easy to navigate format.

CONSOnly focused on Canadian law at the moment, but I am aware of plans to scale out to U.S. federal law.

Anonymous

5,001-10,000 employees

Used monthly for less than 12 months

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

4

CUSTOMER SUPPORT

4

FUNCTIONALITY

3

Reviewed May 2019

Taxforesight

Overall my experience has been positive, I foudnd the tool to be useful.

PROSThe software is easy to use and I like how it allows you to easily cross reference the findings with actual court cases. This allows you to complete a lot of research relatively quickly.

CONSThere could be a wider variety of topics that the tool allows us to research.

Smita

Accounting, 10,000+ employees

Used monthly for less than 6 months

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

4

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed May 2019

Great tool

Great tool to check to see a variety of indicators

CONSSome missing indicators but those will be developed