Cash Flow Forecasting: The Key to Making Smart Business Decisions

Running out of cash—tied with an inability to secure funding—is the No. 1 reason startups and small businesses fail. [1] A 2023 Software Advice survey found that 56% of small businesses were denied funding—more than once—in the last two years due to poor cash flow.*

Cash flow forecasting can help avoid these issues by giving you a sense of how much money you have on hand to take on new projects, pay off debt on time, and meet your future funding needs. However, many small businesses lack guidance in this area, and nearly a third (32%) of small-business owners admit they need more help. [2]

With insights from Gartner research [3], we explain everything you need to know about cash flow forecasting. We also spoke with Catherine Hayes [4], operations director and head of finance at a digital marketing firm in the U.K., to get expert guidance and understand why cash flow forecasts are indispensable for small-business success.

Catherine Hayes

Operations director and head of finance, Tao Digital Marketing

What is a cash flow forecast?

A cash flow forecast estimates how much money will flow both in a business (e.g., from selling products or services) and out of it (e.g., from paying rent or purchasing assets).

Cash flow is different from business income. It refers to liquid money—i.e., readily available cash that you can spend or invest. However, income also includes your business revenue from credit sales.

By looking at past patterns, cash flow forecasts make guesses about future trends. Say, if your sales spike around the holidays, you can budget to buy more raw ingredients, or if winter is slow, you can plan to spend less.

Software spotlight

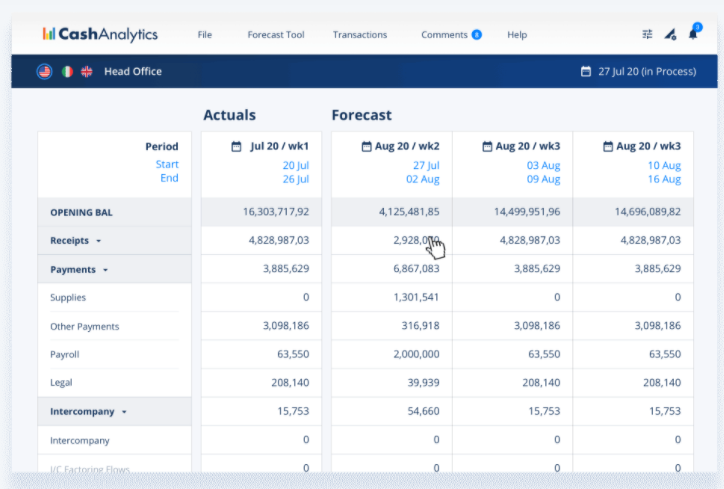

Nearly half (48%) of small businesses use cash flow management software to track expenses and create financial projections or forecasts.* These tools aggregate data from across your business, such as accounting records, bank transactions, and payroll, to give real-time updates on your cash balance.

Example of a cash flow forecast created in accounting software CashAnalytics

Benefits of cash flow forecasting

By serving as a diagnostic tool, cash flow forecasting helps uncover the root cause of your cash troubles. Discussed below are a few business situations where this practice helps.

1. Identify periods of low sales

Without adequate sales, you won't be able to cover your operating expenses or invest in growth opportunities. By analyzing historical spend patterns, cash flow forecasting can identify periods where your projected expenses exceeded projected income. Visibility into periods of low sales and their causes (say, seasonal dips or significant expenditure) allows your business to come up with strategies to boost sales, such as launching a new marketing campaign or offering sales promotions.

2. Collect money faster

When customers owe you money but take a long time to pay, it can be tough to sustain operations. Cash flow forecasting allows you to visualize payment cycles and spot potential delays in receivables. This foresight can help you adapt your collection strategy by shortening payment terms, offering early payment discounts, etc. Hayes advises small businesses to be especially rigorous about collecting money in the early stages. "During this phase, your business loses more money in operations than it earns, so be almost paranoid about timely collections," she suggests.

3. Prevent overspending

Escalating expenses—from material procurement to payroll—can quickly erode your financial stability. Cash flow forecasting helps you watch every dollar you spend by showcasing variances between forecasted spend and actual spend. This visibility enables opportunities to trim expenses without compromising quality and keeping a rein on your cash outflows.

4. Manage stocks better

Inventory sitting idle is a missed opportunity, while insufficient inventory can lead to customer dissatisfaction. Cash flow forecasting helps maintain the perfect balance in inventory control. By predicting how much inventory you'll need based on what you usually sell, cash flow forecasting saves you from buying too much or too little.

5. Prepare for growth

As your small business grows, you'll need more of everything—staff, inventory, resources—and faster than ever. But without adequate funds, growth will be challenging. Cash forecasting helps you continually reassess resource allocations, ensuring you pay off your liabilities and expenses on time and stay financially healthy to secure funds from creditors when you need them.

Case study: How cash flow forecasting enabled Tao Digital's growth

Four years ago, U.K.-based marketing agency Tao Digital set a strategic goal to expand through the acquisition and optimization of web assets. "This was a costly project, so we needed to ensure we have the funds to employ the right team," shares Catherine Hayes, head of finance at Tao Digital.

To facilitate this, the marketing agency decided to budget for research and development (R&D) but couldn't identify—from their profit and loss statements alone—the months they would have surplus funds to take the plunge. They needed a more precise tool to understand their financial position at any given point.

Recognizing this gap, they started with a simple spreadsheet to project cash inflows and outflows for the next 12 months based on historical data. "By adopting a cash flow forecast, we could identify the months we could spend and the months we needed to reel our spending in," adds Hayes. Later, they transitioned to a software solution that directly extracted data from accounting records, further improving the efficiency and accuracy of the cash forecasting process.

Talking about what prompted them to shift from spreadsheet to software, Hayes explains: "If your business earns money from different sources, has fluctuating prices, and complex costs, you’ll quickly find that a basic spreadsheet isn't enough. You'll need advanced tools to help analyze data and provide up-to-date information."

Since introducing the forecast, Tao Digital has increased cash reserves by 33% and acquired five new assets that generate a healthy return on investment.

Two methods to forecast cash flow (and when to use them)

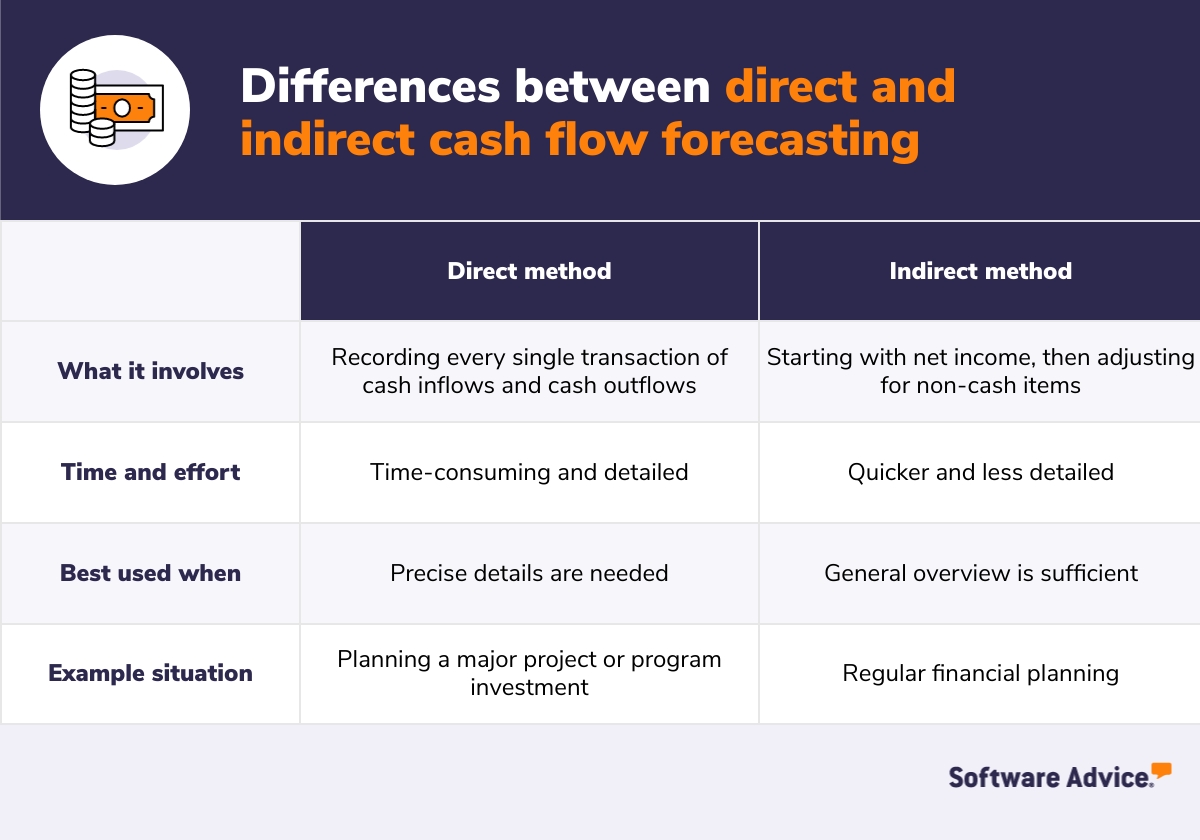

Based on your business needs, you have two options to create a cash flow projection: the direct method and the indirect method.

Method #1: Direct cash flow forecasting

The direct method includes counting every single dollar and cent you earn and spend. This means looking at all the money customers pay you and the money you pay for things such as salaries, rent, and supplies. The direct method is time-consuming but gives a detailed picture of cash movements and day-to-day liquidity.

How does it work? The direct method starts with an opening cash balance, to which cash inflow, such as customer collections, are added and from which cash outflow, such as payments made to suppliers, are subtracted to arrive at the total cash flow (i.e., cash on hand).

Best suited for: The direct method is best used to support short-term operational cash decisions [3], particularly when you're planning a major project or program investment that requires careful budgeting. Since it delves into day-to-day trends and granular transaction details, it’s better at predicting when cash will be coming in and out of your business and, therefore, well suited for short-term planning. Use this method to identify funding needs arising due to cash deficits or to take investment decisions in case of cash surplus.

Method #2: Indirect cash flow forecasting

Instead of looking at every single transaction, the indirect method estimates money movement based on larger financial figures guided by what you usually spend. This is a less detailed and quicker way to forecast cash flow than the direct method.

How does it work? The indirect method starts with the net income (or profit) and uses balance sheet accounts to adjust for noncash items such as accounts receivable (money others owe to you) and accounts payable (money you owe to others). It's called the indirect method because it doesn't track cash inflow and outflow but relies on overall income and expense information from financial statements.

Best suited for: This method is best used for long-term and medium-term strategic planning [3], particularly to fund long-term growth and capital projects. This method typically focuses on a time horizon of greater than one year and is updated quarterly or monthly. Use it when you’ve fairly consistent income and expenses and you want a general overview of your future cash flow for regular financial planning.

Key mistakes to avoid when creating cash forecasts

Careful planning and streamlined processes are essential to avoid derailing the accuracy of your forecasts. Hayes shares an essential piece of advice that has worked for her team.

Catherine Hayes

1. Creating overly optimistic projections

One common area where small businesses go wrong is overestimating future sales and being too optimistic about it. If you overestimate how much money will come in, you'll spend too much on everything—from production to operations. Examine your historical sales data to identify trends and patterns and be conservative and realistic in your sales forecasts. Prepare for outcomes by creating best-case, worst-case, and most likely scenarios.

2. Not understanding your breakeven point

Many small-business owners don't calculate their breakeven point—i.e., the amount of revenue needed to cover operations and production costs, such as rent, electricity, and salaries. Keeping the breakeven point as the focus in estimates will help you price your products or services fairly and get realistic sales targets.

3. Not accounting for seasonality

Some businesses make more money at certain times of the year. Say, you're a swimsuit shop, you'll sell a lot in the summers but very little during winters. If you don't take these seasonal fluctuations into consideration, you’ll end up with inaccurate cash flow predictions.

4. Misjudging the timing of cash flow

It's crucial to log cash when it actually enters or leaves your business rather than when the transaction happens. If you made a sale this month, but the payment will come through only next month, you should record it in next month’s cash flow.

5. Not updating forecasts regularly

Cash flow forecast is not a one-and-done task. It should be updated regularly to reflect new information, say changes in suppliers or taking on a new loan. If you fail to update your cash forecast regularly, you'll be navigating with an outdated estimate that can leave your finances astray.

6. Not matching planning with forecasts

Another common mistake is not aligning business planning with cash flow forecasting. In the case of Tao Digital, even as they created forecasts to inject more money into R&D, Hayes shares that the first challenge they faced was not being able to recruit fast enough in the months they had surplus money—an event they hadn't planned for. Therefore, make sure your business plans and forecasts are in sync to avoid rendering your estimates unhelpful.

Resources and tips to create accurate cash flow forecasts

Now that we’ve covered the benefits, methods, and best practices of cash flow forecasting, take time to reflect on your cash flow problems and their root causes. Listed below are some tech tools and guidance to make the process easier.

Use live forecasting tools. Cash flow projections should be dynamic, not static. Your forecasts may become outdated almost immediately as the actual numbers start pouring in, hence the need for regular updates. That's why Hayes suggests scheduling updates to your forecasts at least once a week or every month. You can use cash flow management tools to automate updates, reduce delays and human error, and access real-time information to address any issues immediately.

Consolidate your digital tools. Seventy-eight percent of all small-business owners agree that having all their cash flow management products and data in one platform boosts productivity and simplifies operations. [5] "By unifying your digital systems, you'll be better equipped to manage inventory and identify cash flow gaps before they widen," says Hayes.

Stay close to your numbers. Assign someone in your team to take ownership of your cash flow forecast. "You can't expect an outside consultant to manage your cash flow externally. You can outsource different parts of your business, but cash flow is not one. It’s up to you to ensure your cash is managed well," opines Hayes.

The right software tools can give a clear, reliable, and accurate view of your past and future cash flow trends while allowing you to centralize your financial data. Some options to consider include sales forecasting tools and accounting platforms that provide specialized modules to analyze cash flow and manage financial records.

Not sure which software tools you need? Talk to our advisors. They will help narrow down the options for your unique business needs. Connect with our advisors over a chat or schedule a call to get free personalized software recommendations that fit your budget and requirements.

Survey methodology

*Software Advice's Financing Survey was conducted in April 2023 among 458 business leaders at U.S.-based small-to-midsize businesses who have role(s) in obtaining financing within their organization. The purpose of this survey was to learn about the challenges they face attaining traditional financing options and explore if they’re turning to alternative funding to finance operations, investments, etc.

Sources

The Top 12 Reasons Startups Fail, CB Insights

American Express Launches First Small Business Financial Confidence Report, American Express

What Are Direct and Indirect Cash Forecasting and When Should Each Method Be Used?, Gartner

Catherine Hayes, LinkedIn

New American Express Survey Finds That More Than Three Quarters of Small Businesses Are Looking To Consolidate Their Cash Flow Management Tools, American Express