Small Business Guide To Set Up an Effective Accounting Function: 5 Essentials

A small business owner has many duties to juggle. Amid these numerous daily tasks, accounting keeps one mindful of the numbers driving the business and flags any concern areas before it’s too late. Gartner [1] says,

“Accounting and transactional finance processes are the backbone of any organization. The effectiveness and efficiency of these processes are critical in accurate and timely decision making.”

If you are a startup or small business owner seeking to get a better grip on your company’s finances, what we have here is a guide on the basics of small business accounting. With insights from Gartner research [1], as well as a seasoned accountant [2], we explore the accounting tasks vital for a small business’s survival and provide tips for establishing them successfully.

Which accounting tasks are important for a small business?

In a recent Software Advice survey*, 98% of businesses said they outsource some form of financial or accounting services. Outsourcing tends to save costs for new businesses strapped for cash while giving them confidence in their finances.

However, this approach typically only satisfies annual compliance needs; more must be done for the day-to-day management of finances. Even when you contract out specialized activities such as tax preparation, you still need a reliable system to regularly process invoices, track expenses, and maintain cash flow for payments falling toward the end of a month.

Bookkeeping, invoicing, cash flow management, financial reporting, tax filing, and budgeting are six basic accounting needs that every small business must fulfill to operate effectively. More often than not these tasks are interconnected, meaning they affect and rely on one another. For example, accurate bookkeeping is necessary for proper financial reporting, while budgeting relies on accurate cash flow projections.

Steps to set up basic accounting processes at your company

Whether you hire an in-house accounting talent, outsource services to an external advisor, or turn to software to do it yourself, follow these steps to ensure you have the right gear to carry out financially sound business operations.

1. Make arrangements to manage your money

Effective money management is the first crucial step in small business accounting. Make sure funds can flow both within and outside your company, and all business transactions are accurately tracked and approved.

Some tips to streamline and organize your finances:

Maintain a separate business bank account and use it for all transactions related to running your company. It’ll keep everything in one place, make tax time easier, and provide visibility to you into how much money has come in (and gone out of) the business.

Add a payment system to make it easy for your customers to pay you and for you to make payments to suppliers in a hassle-free manner. Choose from an array of payment systems, ranging from and to credit card and net banking.

If you have employees, use a to ensure they are paid accurately and on time. It’ll keep track of employee hours, calculate payroll taxes and deductions, and issue salaries.

2. Establish a bookkeeping routine

Develop a consistent bookkeeping routine to record all business transactions accurately and in a timely manner. Bookkeeping is the process of recording, organizing, and maintaining financial transactions happening within a business. It includes thoroughly tracking all income and expenses and entering them into the accounting system (daily or weekly).

Some bookkeeping tips to accurately log your day-to-day transactions:

Record transactions as they occur instead of waiting until the end of the month or quarter.

Maintain digital records of all business expenses (say travel, office supplies, rent) as well as income (invoices sent for services) so you don’t run around chasing paper receipts to verify a transaction.

Reconcile your accounts, such as bank accounts, credit card transactions, and other accounts regularly to ensure your financial records are accurate and up to date.

Take a basic bookkeeping course to improve your understanding of bookkeeping processes.

Consider hiring a bookkeeper or an accountant if bookkeeping isn’t your strong suit. Alternatively, outsource it to someone who can complete your records once a month and have someone internally maintain all receipts and invoices of business transactions.

Pro tip

There are many accounting software options that can simplify bookkeeping and make it more accessible to you if you don’t have an accounting background. It’ll also help you go paperless by recording all transactions in one secure location (with features such as scan and capture) for future review.

3. Keep track of your cash flow

Understanding cash flow is one of the most important things for any business. If you don’t have enough cash coming in to pay your bills, you could be the most successful business around and still fail. Cash flow involves tracking every dollar, where it’s coming from, and where it’s going, and taking steps to optimize the cash available with you.

Some tips to manage your cash flow and keep money in your pocket:

Send regular invoice reminders: Don’t let late payments hurt your cash flow. Raise invoices promptly and send reminders to customers who haven't paid yet. Offer discounts for early payments and to stay ahead of payment deadlines.

Negotiate better terms with suppliers: Try to negotiate for longer payment terms with suppliers to improve your cash in hand. Take advantage of early payment discounts where applicable.

Track and review all expenses: Make sure you record all business expenses to ensure that you are spending money on what is necessary. Categorize your expenses to identify areas where you can cut costs.

Monitor inventory levels: Inventory can be a huge source of cash leakage if not managed properly. Implement an system in place to ensure you are not holding onto excess inventory leading to wasted capital and making sure every penny counts.

James Shipp [2], a chartered accountant at a UK-based firm, says that cash in the bank is key for successful accounting.

James Shipp

Chartered accountant and partner, Lovewell Blake

4. Prepare financial statements

Produce detailed financial reports, such as the balance sheet, income statement, and cash flow statement, to indicate your financial health, profitability, liquidity, and solvency. These reports are paramount to comply with tax requirements and maintain transparency with other stakeholders such as investors.

Here's a quick guide explaining vital financial reports:

Balance sheet | A document that shows what a company owns (assets), what it owes (liabilities), and what's left over for the owners (equity) at a specific point in time. |

Income statement | A document that shows a company's revenue and expenses over a specific period of time, indicating its profit or loss. |

Cash flow statement | A document that shows the amount of cash coming in and going out of a company over a specific period of time, providing insight into its ability to meet immediate financial obligations. |

Some tips to prepare these financial reports:

Establish a regular reporting schedule. Determine the that are most relevant to your business and publish reports that give you a grasp on those metrics as frequently as you need them (monthly, quarterly, or annually).

Use standardized accounting practices: Ensure the preparation and presentation method of your financial statements follow generally accepted accounting principles (GAAP), if you are in the US, or International Financial Reporting Standards (IFRS) if you’re outside of the US.

Make a habit of publishing statements regularly: If you plan to go public in the future, you should publish financial statements regularly (every year at a minimum). The Securities and Exchange Commission (SEC) requires publicly traded companies in the US to publish GAAP-compliant financial statements that are audited by an independent auditor. With reliable records by your side, you'll be ready when the time comes to go public.

Use software to produce financial statements: By tracking business transactions (payroll, expenses, accounts receivable and payable) and other activities, technology can help you create more accurate financial reports in just one click.

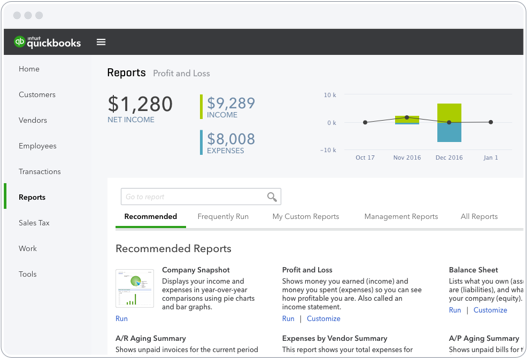

Financial reporting in accounting software (Source)

5. Ensure tax compliance

Avoid hefty fines and stay out of trouble by ensuring your business is compliant with tax laws. Small businesses have various tax obligations, including income tax, sales tax, and payroll tax.

Some tips to ensure compliance with tax laws:

Make sure you know the tax laws that apply to your business, including federal, state, and local taxes.

Keep track of your tax deadlines and mark them in your calendar to pay taxes on time. Late filings can result in penalties and interest charges.

Consult with a tax professional or accountant to identify tax-saving opportunities for you and ensure you are filing all applicable tax returns correctly.

Use tax preparation software to easily calculate the taxes applicable to you depending on your business structure and location.

Important tax returns for small businesses in the U.S.

Federal income tax return: All businesses need to file an annual federal income tax return with the Internal Revenue Service (IRS). When and how you file these returns will depend on your business structure (sole proprietorship, partnership, LLC, S corporation, or C corporation).

State income tax return: Most states also require businesses to file an annual state income tax return.

Employment tax returns: If you have employees, you will need to file several tax returns, including Form 941 (Employer's Quarterly Federal Tax Return), Form 940 (Employer's Annual Federal Unemployment Tax Return), and state payroll tax return.

Sales tax return: If you sell goods or services subject to sales tax, you will need to file a sales tax return with your state or local tax authority.

Excise tax return: If you engage in activities such as selling gasoline or tobacco products, you will be required to file an excise tax return.

Get started with these tools and software

Accounting for your small business doesn’t have to be overwhelming. You can make sense of all those numbers with the right tools and practices. There are several excellent accounting solutions that can help you streamline your finances. As we wrap up, we leave you with a few final tips.

Start off with a cloud accounting software solution that’s easy to use and provides you with integration options to combine sales and other data from your tech stack.

Keep your receipts and invoices organized with a tool that scans and extracts information from them to save time and reduce errors. Look for a standalone tool or check out billing and invoicing software that offers this feature.

Use billing and invoicing software to send automatic payment reminders to customers whose payments are due.

Use payment processing software to automate payments to suppliers and employees. One example is a payroll tool that can fetch details from your enterprise resource planning (ERP) system or accounting software, or let you upload a batch of invoices and create, review, or approve payments.

Related reading

If you want more information on accounting software, check out Software Advice's buyers guides to get the tool that best suits your specific needs:

If you're ready to make a purchase, read 5 Tips for Buying Software with Confidence.

Survey methodology

*Software Advice’s 2023 Financial Planning Survey was conducted in February 2023 among 270 respondents to learn more about how businesses determine and adjust their business plans based on developing tax changes, accounting needs, and more. All respondents were screened for involvement in financial planning within their organization.

Sources

Accounting and Transactional Finance Processes Primer for 2023, Gartner

James Shipp, LinkedIn

Note: The applications selected in this article are examples to show a feature in context and are not intended as endorsements or recommendations. They have been obtained from sources believed to be reliable at the time of publication.