Best Payment Processing Software of 2026

Updated January 14, 2026 at 6:00 AM

Written by Amita Jain

Senior Content Writer

Edited by Mehar Luthra

Team Lead, Content

Reviewed by Cameron Pugh

Senior Advisor

Talk with us for a free 15-min consultation

Expert advisors like Jacqueline, who have helped 1,000+ companies, can find the right software for your needs.

- All Software

- Software Advice FrontRunners

- Popular Comparisons

- Buyer's Guide

- Frequently Asked Questions

Payment processing software helps businesses securely accept and manage digital payments across cards, wallets, ACH, and mobile channels. With over 550 tools covering varied operational models, integration needs, or regulatory contexts, choosing the right system can be daunting. To help you narrow it down, I worked with our payment processing software advisors to curate a list of recommended productsi and a list of the payment processing software Frontrunners based on user reviews. For further information, read my payment processing software buyer's guide.

Payment Processing Software

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Average Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

Alphabetically (A-Z): Sorts listings by product name from A to Z.

Acuity Scheduling is a cloud-based appointment scheduling solution that enables business owners to manage appointments online. ...Read more about Acuity Scheduling

Acuity Scheduling's Best Rated Features

See All

Acuity Scheduling's Worst Rated Features

See All

Send payment links on WhatsApp and get paid fast, or accept payments in person using just your phone. Give your customers more w...Read more about Nomod

Nomod's Best Rated Features

See All

Nomod's Worst Rated Features

See All

Stampli provides the structure for any procure-to-pay (P2P) workflow, from purchase requests and approvals to invoicing and paym...Read more about Stampli

Stampli's Best Rated Features

See All

Stampli's Worst Rated Features

See All

WeTravel is the leading all-in-one business management platform for multi-day travel businesses, providing integrated, travel-sp...Read more about WeTravel

WeTravel's Best Rated Features

See All

WeTravel's Worst Rated Features

See All

ePayPolicy is a payment processing solution designed to help businesses in the insurance sector collect credit card and ACH paym...Read more about ePayPolicy

ePayPolicy's Best Rated Features

See All

ePayPolicy's Worst Rated Features

See All

Software Advice FrontRunners 2026

(2653)

(247)

(3276)

(904)

(81)

(151)

(330)

(214)

(42)

(521)

Best for Mobile app

- Key FeaturesSquare Payments's scoreCategory average

Data Security

4.674.57 category average

Online Payments

4.644.59 category average

- Screenshots

Best for Customer Satisfaction

ePayPolicy

- Key FeaturesePayPolicy's scoreCategory average

Data Security

5.04.57 category average

Online Payments

4.884.59 category average

Transaction Monitoring

4.784.40 category average

- Screenshots

Best for Quick Implementation

Stripe

- Key FeaturesStripe's scoreCategory average

Data Security

4.584.57 category average

Online Payments

4.664.59 category average

Transaction Monitoring

4.104.40 category average

- Screenshots

Highly Rated for Security and Access Control

Google Pay

- Key FeaturesGoogle Pay's scoreCategory average

Data Security

4.634.57 category average

Transaction Monitoring

4.624.40 category average

- Screenshots

Most Used By Non-Profit Organization Management

Cheddar Up

- Key FeaturesCheddar Up's scoreCategory average

Data Security

4.974.57 category average

Online Payments

4.974.59 category average

Transaction Monitoring

4.504.40 category average

- Screenshots

Most Rated for SMBs

Amazon Pay

- Key FeaturesAmazon Pay's scoreCategory average

Data Security

4.674.57 category average

Online Payments

4.694.59 category average

- Screenshots

Best for Usability

Nomod

- Key FeaturesNomod's scoreCategory average

Data Security

4.734.57 category average

Online Payments

4.794.59 category average

Transaction Monitoring

4.444.40 category average

- Screenshots

Most Used By Health, Wellness and Fitness

- Key Featuresauthorize.net's scoreCategory average

- Screenshots

Most Used By Information Technology and Services

Finix

- Key FeaturesFinix's scoreCategory average

Data Security

4.874.57 category average

Online Payments

5.04.59 category average

Transaction Monitoring

4.604.40 category average

- Screenshots

Most Used By Computer & Network Security

Podium

- Key FeaturesPodium's scoreCategory average

Data Security

4.674.57 category average

Online Payments

5.04.59 category average

- Screenshots

Melio

- Key FeaturesMelio's scoreCategory average

Data Security

4.364.57 category average

Online Payments

4.314.59 category average

- Screenshots

360 Payments

- Key Features360 Payments's scoreCategory average

Data Security

4.404.57 category average

Online Payments

4.504.59 category average

- Screenshots

Paystand

- Key FeaturesPaystand's scoreCategory average

Online Payments

4.134.59 category average

Transaction Monitoring

4.04.40 category average

- Screenshots

GoCardless

- Key FeaturesGoCardless's scoreCategory average

Data Security

4.544.57 category average

Online Payments

4.114.59 category average

- Screenshots

Caxton

- Key FeaturesCaxton's scoreCategory average

Data Security

5.04.57 category average

Online Payments

4.334.59 category average

Transaction Monitoring

4.504.40 category average

- Screenshots

Payarc

- Key FeaturesPayarc's scoreCategory average

Data Security

4.764.57 category average

Online Payments

4.714.59 category average

Transaction Monitoring

2.754.40 category average

- Screenshots

- Key FeaturesPayPal Commerce Platform's scoreCategory average

Data Security

4.444.57 category average

Online Payments

4.504.59 category average

- Screenshots

- Key FeaturesCoinbase Commerce's scoreCategory average

Data Security

4.294.57 category average

Online Payments

4.504.59 category average

Transaction Monitoring

4.104.40 category average

- Screenshots

Chargebee

- Key FeaturesChargebee's scoreCategory average

Data Security

4.684.57 category average

Online Payments

4.104.59 category average

- Screenshots

- Key FeaturesMaestro Payment's scoreCategory average

Data Security

4.604.57 category average

Online Payments

5.04.59 category average

- Screenshots

- Key FeaturesRevolut Business's scoreCategory average

Online Payments

4.04.59 category average

Transaction Monitoring

4.04.40 category average

- Screenshots

- Key FeaturesPayPal Enterprise Payments's scoreCategory average

Data Security

4.684.57 category average

Online Payments

4.384.59 category average

- Screenshots

Methodology

The research for the best Payment Processing software list was conducted in October 2025. We evaluated data (user reviews and demand signals) from the past 24 months as of the research date. Read the complete methodology.

Popular Payment Processing Comparisons

Buyer's Guide

This detailed guide will help you find and buy the right online payment software for you and your business.

Last Updated on June 30, 2025Here's what we'll cover:

Benefits and competitive advantages of using payment processing software

How to choose the best payment processing software for your business

What you need to know about payment processing software

Payment processing software is an essential tool for any business accepting electronic or online payments. As opposed to broader financial systems like accounting software or enterprise resource planning (ERP) solutions, payment processing tools focus specifically on capturing payments securely and efficiently rather than focusing on bookkeeping, tax compliance, or inventory tasks.

How we can help: With over 550 different payment processing software products on our site, this guide will help you choose the right fit.

Because payment processing involves multiple parties (merchants, payment processors, card networks, banks), various components (gateways, terminals, security protocols) and varying fee structures, it can be tricky for newcomers to understand how these elements interact and which solutions would best fit their specific business model.

Why you can trust us: In the past year, we've spoken to 2,700+ buyers and anaylzed over 7,800 reviews. [1] [2]

Pricing at a glance: The cost for these entry-level systems can average around $39 per month and high-end suites can go up to $115 to $181 per month, depending on the number of transactions, processing fee, and the level of functionality offered. [3]

Understanding how much to budget should be a top priority. While most payment processing systems on the market are free to use, they typically charge a processing fee per transaction. Some providers also offer subscription-style plans with a lower transaction fee.

Selection prep: You should meet with stakeholders in your organization to figure out answers to critical questions about your payment processing needs, like:

Which sales channels do we need to support? (e.g., online, in-store, mobile)

What payment methods do our customers prefer? (credit or debit cards, ACH bank transfers, or digital wallets like Apply Pay or Google Pay)

What integrations do we require? (e.g., eCommerce websites, POS systems, and accounting software)

What security and compliance measures are necessary for our business?

How much support or hardware do we need from the vendor? (e.g., card readers, customer-facing portal, payment gateways)

With help from our experienced payment processing software advisors, McKenzie Anderson and Cameron Pugh, this buyers guide can help you make the right payment processing software purchase decision with confidence.

What is payment processing software?

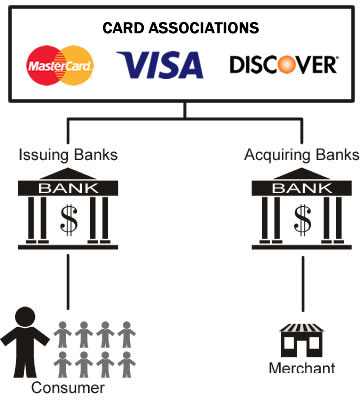

Payment processing software helps businesses accept electronic payments across methods like cards, ACH, and digital wallets. It acts as a financial bridge—authenticating transactions, settling funds, and connecting with networks like Visa and MasterCard behind the scenes.

Parties involved in a payment processing workflow Source: Fidelity Payments

Online payments go through four main stages, which make up the processing fees charged by software providers.

Authorization: Customer initiates the sale and the merchant requests authorization from the customer's issuing bank via a payment processor. The issuing bank then approves or declines the transaction and relays that response back through the card network and processor to the merchant.

Batching: The software helps merchants compile all approved daily transactions into a batch and submit them to the acquirer (merchant service provider or MSP) for settlement. Batching transactions allows for time to review orders (to catch any fraud or errors) before finalizing them.

Clearing: The acquirer accepts batched transactions from the payment processor and forwards them to the card networks, which then distribute each transaction to the correct issuing bank. The issuer then debits the funds from the cardholder's bank account, routing the funds back to the acquirer through the card network.

Funding: The acquirer (your MSP) deposits the processed funds from the batch into the merchant’s bank account. This is when you actually receive the money for the sales, minus any fees for this processing.

Throughout this process, various fees (like interchange fee by issuing bank for facilitating transaction, assessment fee by the card network, and processing fee by the payment processor) are incurred and taken out of the transaction amount before it reaches the merchant’s account.

Our advisor, McKenzie Anderson, points out that many business owners assume that processing fees are included in the flat monthly subscription charge of payment processing software. “One misconception we hear often is that the software only costs a set monthly fee,” she says. However, in reality, “Buyers often overlook the transaction charges, typically ranging from 2% to 4% (depending on the software provider and your volume), that apply on top of that.”

Essential features of payment processing software

You can expect to find core features like online payment processing and data security compliance in virtually all payment processing systems. Beyond this, the feature sets can vary as different vendors may focus on specific areas, such as fraud prevention or in-person point-of-sale transactions.

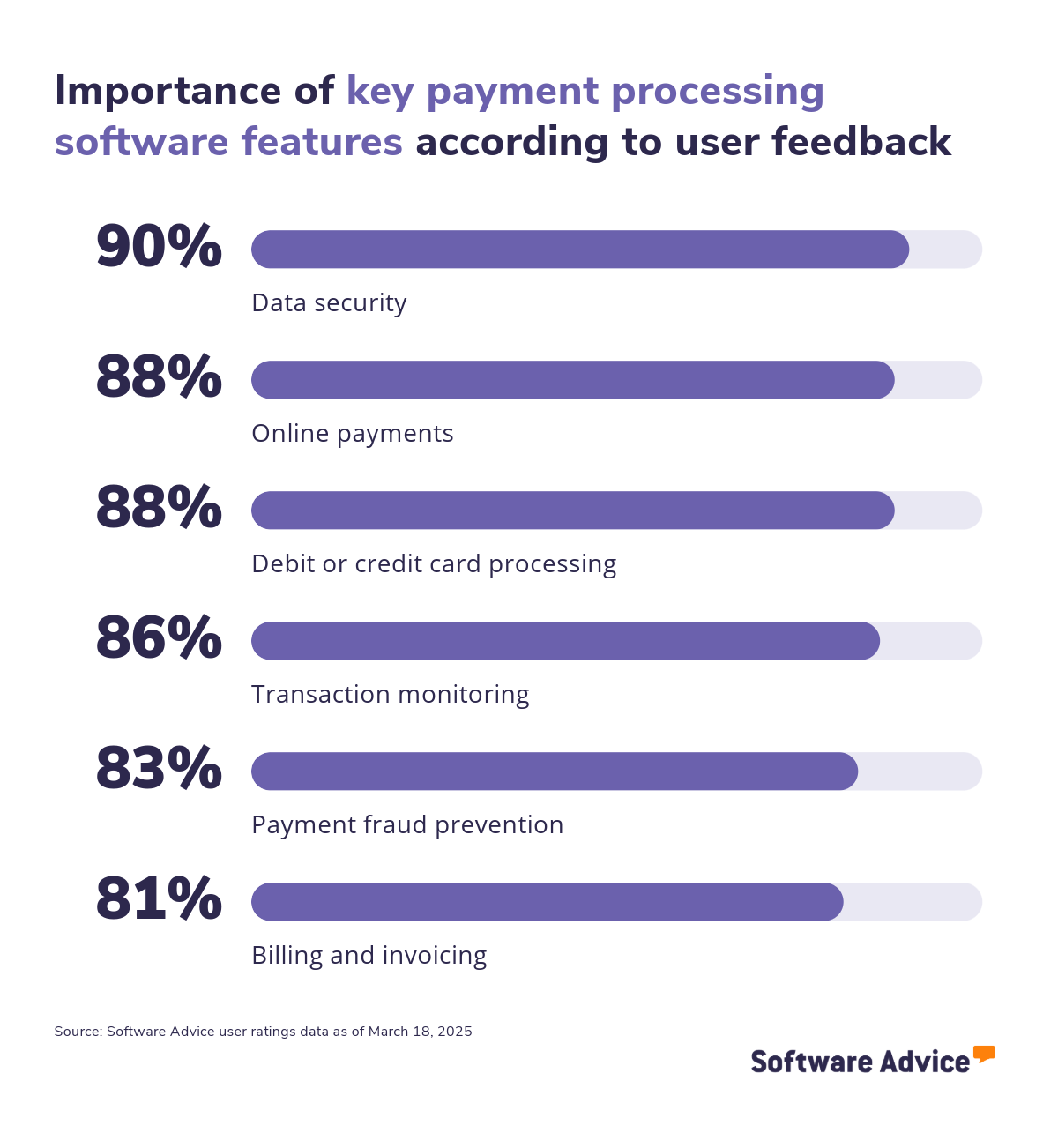

To help you hone in on the most essential payment processing features, here are the ones that reviewers rate as the most important. [1]

Core payment processing software features

Data security | Protect sensitive customer information through encryption and compliance protocols. 90% of reviewers rate this feature as critical or highly important. |

Online payments | Accept and process transactions through websites and digital platforms. 88% rate this feature as critical or highly important. |

Common payment processing software features

Debit or credit card processing | Captures and processes card transactions across multiple payment environments. 88% rate this feature as critical or highly important. |

Transaction monitoring | Monitor or audit historical and current transactions to ensure accuracy and detect suspicious patterns. 86% rate this feature as critical or highly important. |

Payment fraud prevention | Implement security measures, including identity authentication, risk analysis, seller protection, and payment protocols. 83% rate this feature as critical or highly important. |

Billing and invoicing | Create, manage, and distribute invoices or bills to customers with integrated payment options. 81% rate this feature as critical or highly important. |

Multiple payment options | Accept and offer various payment methods through a single integrated platform. 76% rate this feature as critical or highly important. |

Mobile payments | Enable transaction processing through smartphones and other mobile devices. 75% rate this feature as critical or highly important. |

Reporting or analytics | View actionable insights through data visualization and customizable reports. 74% rate this feature as critical or highly important. |

In-person payments | Allow transactions that typically involve face-to-face interactions between the payer and the payee. 71% rate this feature as critical or highly important. |

Recurring or subscription billing | Automate scheduled charges for membership, enabling customers to be billed at consistent intervals for continued access to products or services. 69% rate this feature as critical or highly important. |

ACH payment processing | Handle electronic bank-to-bank transfers using ACH. 62% rate this feature as critical or highly important. |

Trend alert: Many payment processing platforms are increasingly offering omnichannel capabilities, meaning the same system can process transactions in a retail store, on a website, or on a mobile app, all unified under one tool.

In addition, Anderson points out that many solutions are incorporating AI for fraud prevention. “I think it's exciting, especially for small and midsize businesses as they don’t usually have access to advanced security systems that larger enterprises do,” she says.

Benefits and competitive advantages of using payment processing software

One of the biggest advantages of adopting payment processing software is increased efficiency.

By digitizing payments, businesses eliminate slow, manual workflows involved in handling cash or paper cheques. In fact, many companies search for a payment solution specifically to “get away from manual checks, and the delays they cause,” says Anderson.

Here’s a breakdown of the benefits you can expect:

Improved customer experience: Buyers are more likely to complete a purchase when their preferred payment option is accepted. Features like credit or debit card processing and mobile payments provide customers an easy way to check out and make transactions smooth for them by reducing wait times.

Faster payments and better cash flow: Reviewers say card and digital transactions help get money in their hands sooner than waiting for invoices or cheques to clear. This boosts cash flow and keeps the revenue stream steady.

Reduced manual work and errors: Payment processing software automates many tasks like data entry, calculations, and payment authorization that would be tedious or error-prone when done manually. This frees up staff from chasing down declined cards, allowing them to focus on other value-adding tasks.

How to choose the best payment processing software for your business

Step 1. Define your requirements

We surveyed 3,500 software buyers and found that buyers who often ended up unhappy with a software purchase wished they had defined their goals and requirements more clearly from the start. [4]

To avoid regret, meet with key stakeholders (owners, finance team, IT, sales managers, etc.) and document the specifics of what your business requires from a payment processing system. Consider questions such as: What types of payments do we need to accept and where? Approximately how many transactions do we process in a day or month? Being as specific as possible in your feature requirements will ensure you only look at products that truly fit your business scenario.

Here are some other things to keep in mind as you define your requirements.

Know which type of buyer you are

Different businesses have different payment processing needs. Consider what category your business falls into as this can influence which software will be the best for you:

If you run a brick-and-mortar business along with an online store, you’ll need a system that supports both in-person and online payments. You’ll likely use a POS system for in-store payments and an online payment gateway for your online sales channel. Many providers offer unified solutions that connect the POS and eCommerce experience. Ensure the system you choose can handle website orders, online returns, etc., and that it integrates with your offline store systems.

If your business is fully online with no physical storefront, you’ll be focussed entirely on online payment processing. You’ll need a payment solution that connects with your website and mobile app. Instead of POS devices, you’ll place a premium on things like a smooth checkout user experience (UX), high authorization success rates, and the ability to accept multiple digital payment methods like Apple Pay to maximize conversions.

If you operate a subscription-based business, your needs will center around recurring billing and customer retention. Make sure your payment processing system can manage memberships and automatically charge customers on a set schedule.

If you run a nonprofit or charity organization, your system should be able to handle donations and preferably charge a low transaction fee to maximize the share of donations received. Many payment processing software providers offer discounts for nonprofits or charity organizations, so keep an eye out for them.

Ensure compatibility with your current tech stack

You can choose between dedicated payment processors that offer flexibility and integration with existing systems, or platforms with built-in payment processing for a more streamlined setup.

For instance, POS systems built for retail or restaurant point of sales software that come with their own payment processing module. Similarly, eCommerce platforms may bundle a payment gateway or processor so you can start accepting payments instantly.

Which approach is right for you will depend on your existing software ecosystem.

If you already have a POS or accounting system, check what payment processing options can work with it. An independent merchant service can be integrated via an API or plugin. If you want tighter integration (at the cost of lesser choices), an all-in-one solution can offer simplicity and eliminate the need to juggle multiple vendors. However, you should be comfortable with their fee structure, as you may not have the option to shop around for competitive rates if it’s built-in.

Budget for how much payment processing software really costs

The primary cost to budget for in payment processing software is the fee per transaction. The software itself may be advertised as free, but you’ll want to understand the true cost per sale after all the charges.

As our advisor, Anderson, points out, “It’s usually not just a flat rate per month cost for payment processing software. Providers take two to four percent of each transaction as a processing fee.” In other words, for every credit card sale you make, a small percentage (typically 2% to 4%) goes toward a software vendor or payment processor.

Additionally, the exact fee structure will vary by provider. Some charge a fixed percentage plus a small flat fee, while others offer a monthly subscription in return of a lower per-transaction rate.

What should you do? Ask vendors for a clear breakdown of their fees, including any monthly subscription fee, chargeback fees, or fees for processing certain cards.

One strategy businesses use to manage payment processing costs is to pass those fees on to customers. In some industries it’s common to add a surcharge or convenience fee. Our advisor, Cameron Pugh, notes that some buyers looking for payment processors specifically want the ability to “Pass the charges on to the customers.” Whether that is a good idea will depend on your situation; it may not be customer-friendly in a competitive market, but this is still an option to be aware of when considering your budget.

Finally, note whether the provider requires a contract or long-term commitment. Some merchant services might lock you into a year or multi-year agreement (sometimes with cancellation fees), whereas others offer pay-as-you-go with no long-term contract.

Other common criticisms for payment processing software include issues with processing refunds, fraudulent transactions, and high transaction fees. Keep these in mind when researching different systems, reading reviews, and talking to vendors.

Step 2. Make your payment processing software shortlist

Once you’ve figured out your requirements, it’s time to research your options and come up with a shortlist of two or three systems to evaluate further.

Here are some ways you can pare down your payment processing software options and create a reliable shortlist with ease.

Get qualified help from our advisors

At Software Advice, advisors like McKenzie Anderson and Cameron Pugh have experience helping organizations identify payment processing systems that match their needs and budgets.

If you need help, you can either schedule a phone call with an advisor or chat online with one right now. In just a few minutes, your advisor will help you identify a shortlist of payment processing software options that best align with your requirements.

Explore our list of payment processing FrontRunners

If you’d rather do the research yourself, a good place to start is our 2025 Payment Processing FrontRunners report. Using reviews data, we map the top products in the category based on customer satisfaction and usability.

Step 3. Pick the best option

Once you have your shortlist, it’s time to investigate your final options further. This means arranging for a product demo and taking a free trial, if available. During the demo, have the vendor walk you through the workings of the system.

Be ready with the right questions during demos

To get the most out of your demo experience, come prepared with scenario-based questions, such as:

Show me how I would send an invoice to a client and how they pay it online

What happens if a card is declined?

How will the system process refunds?

How exactly will the system integrate with our website or POS?

What kind of customer support or dedicated account rep do you provide for businesses of our size located in [your country]?

Take advantage of our ultimate software vendor comparison chart to keep track of the answers and how your team is scoring different products.

Take advantage of free trials

Free trials are your chance to test the user interface yourself and maybe even run a couple of test transactions before purchasing a software product. This is critical, as you may discover bugs or bad UX that didn’t come up during the demo. If it’s confusing in the trial, chances are it might be a headache down the road or at least will have a steep learning curve.

Check references and additional reviews

Ask vendors for references, ideally from those in a similar industry as you. If direct references aren’t available, do a quick search for additional reviews from fellow business owners on third-party ratings and recommendation websites like Software Advice. Make sure you understand the red flags raised by others and discuss any apprehensions with the vendor.

Step 4. Make the most of your payment processing software

Here are some important considerations to keep in mind as you implement your new payment processing software:

Data migration: Work closely with your vendor to plan the migration of any existing payment data and the integration with your business systems. Establish a clear timeline and testing process to ensure everything works as expected before going live.

Staff training: Take advantage of all the training resources your vendor offers. Also, encourage your managers to explore the system, as their hands-on experience will help you develop customized training materials specific to your business workflow.

Our 5 Critical Steps to a Successful Software Implementation Plan guide can help you through this process.

Software related to payment processing

As our advisors note in their discussions, payment processing is often incorporated with other types of software. Depending on your specific needs, you might consider these related software categories:

Point of sale (POS) software: Manage in-store transactions, inventory, and customer interactions for retail and restaurant environments. Payment processing is frequently paired with POS systems for retail operations to handle in-person card payments and cash handling.

eCommerce platforms: Helps you build and manage an online store. They typically include shopping cart functionality that is integrated with a payment processor or gateways to accept online payments.

Billing and invoicing software: Such software helps generate bills or invoices and includes features to accept payments against those invoices.

Subscription management software: These tools help businesses with recurring revenue models.

Accounting software: These systems aren’t for processing customer payments per se, but are closely related as they record all financial transactions happening in a business. Many accounting systems are integrated with payment processing and POS systems to automatically record sales and customer payments data.

More resources for your payment processing journey

About our contributors

Author

Amita Jain is a senior writer for Software Advice, covering finance technology with a focus on expense management and accounting solutions for small-to-midsize businesses. After completing her master’s in policy studies from King’s College London, she began her career as a journalist in New Delhi, India, where she garnered first-hand knowledge of the startup space and the education sector. She spent nearly half a decade covering high-level events hosted by the United Nations and the Government of India. Her work has been featured in Careers360, among other publications.

Amita’s research and writing for Software Advice is informed by more than 130,000 authentic user reviews and over 30,000 interactions between Software Advice software advisors and software buyers. Amita also regularly speaks to leaders in the finance and accounting space so she can provide the most up-to-date and helpful information to small and midsize businesses purchasing software or services.

When she’s not contemplating tech solutions for SMBs, Amita finds her zen in swimming, doodling, and indulging in animated sitcoms and science fiction.

Editor

Mehar Luthra is a team lead at Software Advice and specializes in editing reports that cover the latest trends affecting small businesses. With nearly a decade of experience, she has edited a multitude of research articles, top-rated software reports, and thought leadership articles for diverse markets such as Brazil, Japan, Canada, France, Australia, and India. She finds it particularly rewarding to produce content that provides small-business owners with practical tips and helpful advice on topics such as the digitalisation of small businesses, eCommerce trends, and HR developments.

Armed with a double bachelor’s in law (LL.B.) and business economics from Delhi University, she won a full scholarship to study for a master’s in creative writing at the National University of Ireland, Galway. In addition, she has written blog articles spanning a variety of topics such as fiction and non-fiction books, mental health and anxiety, the latest restaurants, and more. Her articles have been featured in Ireland’s national magazine The Village, among other publications. A die-hard journaling fan, she enjoys watching psychological thrillers, reading fiction books, and drinking iced coffee (even in the winter).

Advisors

Cameron Pugh is a senior advisor. He joined Software Advice in 2022, and he is based in Austin, TX.

Cameron works directly with small business leaders to connect them with best fit software providers. He assesses the technology needs of small businesses seeking tools such as CMMS, inventory management, call center, and facilities software through one-to-one conversations and provides a short list of potential matches.

His favorite part of being a software advisor is experiencing the buyer’s gratitude and relief when he finds the best software solution for their needs.

Sources

Software Advice reviews data: Software Advice reviews are collected from verified users for individual software products. For this report, we analyzed reviews from the past year as of the production date. Read the complete methodology.

Software Advice advisor call notes: Findings are based on data from telephonic conversations that Software Advice’s advisor team had with small-to-midsize businesses seeking payment processing software. For this report, we analyzed phone interactions from the past year as of the production date. Read the complete methodology.

Software Advice software pricing data: Only products with publicly available pricing information and qualified software products within the category, as of the production date, are included in the pricing analysis. Read the complete methodology.

Software Advice’s 2025 Tech Trends Survey was conducted online in August 2024 among 3,500 respondents in the U.S. (n=700), U.K. (n=350), Canada (n=350), Australia (n=350), France (n=350), India (n=350), Germany (n=350), Brazil (n=350), and Japan (n=350), at businesses across multiple industries and company sizes (five or more employees). The survey was designed to understand the timeline, organizational challenges, adoption & budget, vendor research behaviors, ROI expectations and satisfaction levels for software buyers. Respondents were screened to ensure their involvement in business software purchasing decisions.

Payment Processing FAQs

- What is payment processing software?

Payment processing software allows businesses to accept electronic payments from customers through various modes, such as credit card, debit card, digital wallet, and ACH. It acts as an intermediary that securely moves money from a customer’s bank to a merchant’s account. Many modern systems go beyond basic payment authorization and acceptance, offering features like subscription billing or even AI-powered fraud detection. At Software Advice, we have over 550 different payment processing solutions listed on our site with over 7,800 verified user reviews in the past year alone, and we found that 90% of reviewers rate data security as their top priority when choosing a payment processing software.

- What is a payment getaway and do I need one?

A payment gateway is like a digital cash register for online payments. It securely transmits payment details from a website or mobile app to the payment processor, which then contacts the banks to approve or decline the transaction. This interface enables customers to enter their card details on the checkout page. If you sell online, you definitely need a payment gateway. Most modern payment processing software includes built-in gateway functionality, so you may not need a separate service. However, if you want a separate third-party gateway for flexibility, be sure it can integrate with your payment processor. For in-person sales including a cash counter, you likely won’t need a gateway. A POS system or card reader will typically handle that for you.

- How much does payment processing software cost?

Most payment processing software are free to start using. The real cost comes from the transaction fees, typically ranging from 2% to 4% per transaction, which is deducted from each sale. However, there are some providers that charge by monthly subscription (ranging from $39 per month to $181 per month, depending on payment types, volume, and other features) in exchange for lower per-transaction fees. Many buyers who talked with our software advisors said they want payment processing systems with the ability to pass these processing costs onto customers. That said, be sure to check with your software provider and local regulations before implementing this strategy.

- How do you set up a payment processing system for your business?

Setting up a payment processing system for a business is fairly simple. The easiest route is to sign up with a payment processing service or provider. With most solutions, you can start accepting payments within a day. However, more complex setups like integrating with ERP systems may take a little longer. The steps to set up usually involve choosing a software provider that’s right for you, creating an account, integrating payments, testing transactions, and training your team to use it.

- How do I ensure my payment processing is secure?

Secure payment processing requires implementing multiple layers of protection. Choose PCI DSS compliant software with features like tokenization (replacing sensitive data with non-sensitive equivalents), point-to-point encryption (P2PE), and fraud detection tools. Plus, regularly update your security protocols, conduct vulnerability assessments, and train staff on security best practices. According to our analysis of verified user reviews, 83% of reviewers rate fraud detection as a key factor when selecting a payment processing software. If security is a major concern for you, prioritize a processor that offers built-in fraud protection and real-time monitoring.

- What is the difference between payment processing and merchant services?

In simple terms, payment processing is a tool that helps move money, while merchant services is a broader term encompassing a full range of financial services and tools that businesses may need to accept payment, including a payment processor plus extras like POS systems, invoicing, and customer analytics.