4 Steps to Create a Compensation Plan That Makes Dollars and Sense

There are few business concerns that require as much careful consideration as the compensation plan.

If your mix of pay and benefits comes in too low, good luck hiring skilled candidates and keeping important employees. Come in too high, and you risk blowing your budget if your company doesn’t perform as expected, forcing you to make cutbacks. It’s a balancing act like no other.

To help, here is a guide to creating a compensation plan that effectively attracts, motivates and retains employees, along with tips on how compensation management software can help.

(Click on a link below to jump to that step.)

Step 1: Invest Heavily in Job Analysis

Step 2: Decide Where to Go Above and Below the Market

Step 3: Mix in Short-Term and Long-Term Benefits

Step 4: Have Multiple Plans Based on Company Performance

Step 1: Invest Heavily in Job Analysis

In a broad sense, you compensate your project managers to manage projects and your accountants to account. But when every dollar matters in your compensation budget, it pays to be specific about what every position at your company entails, from the CEO to the front desk receptionist.

That’s where job analysis comes in, and it’s absolutely vital to laying a solid foundation for your recruiting, performance management and compensation planning processes. Job analysis generally involves three steps: research, job description and job specification.

The Three Steps of Job Analysis

The research phase involves identifying all the roles in your organization and detailing general information about their responsibilities, necessary competencies, day-to-day tasks and even the personality traits needed to thrive.

Do certain positions carry a safety risk? Is it vital that a person in this role have a college degree?

This research phase will help answer both role-specific and candidate-specific questions at a broad level, and provide general compensation ranges to work with.

Resources for Job Analysis Research

Here are a few resources you can use to help with job analysis:

O – A free online database managed by the U.S. Department of Labor which details hundreds of jobs.

PayScale – The largest salary database in the world, with user-submitted pay information for a variety of industries, skills, certifications and locations.

Compensation software – Some platforms have functionality built-in to market price roles based on a variety of factors.

Job boards – Look through job listings posted by other organizations to see what they’re looking for in a similar role.

Ask your employees – Get employee feedback through either an interview, observation or survey. This is especially important in roles that lack an equivalent outside your organization.

Hire a job analyst – In-house or consulting job analysts can perform all of this research for you.

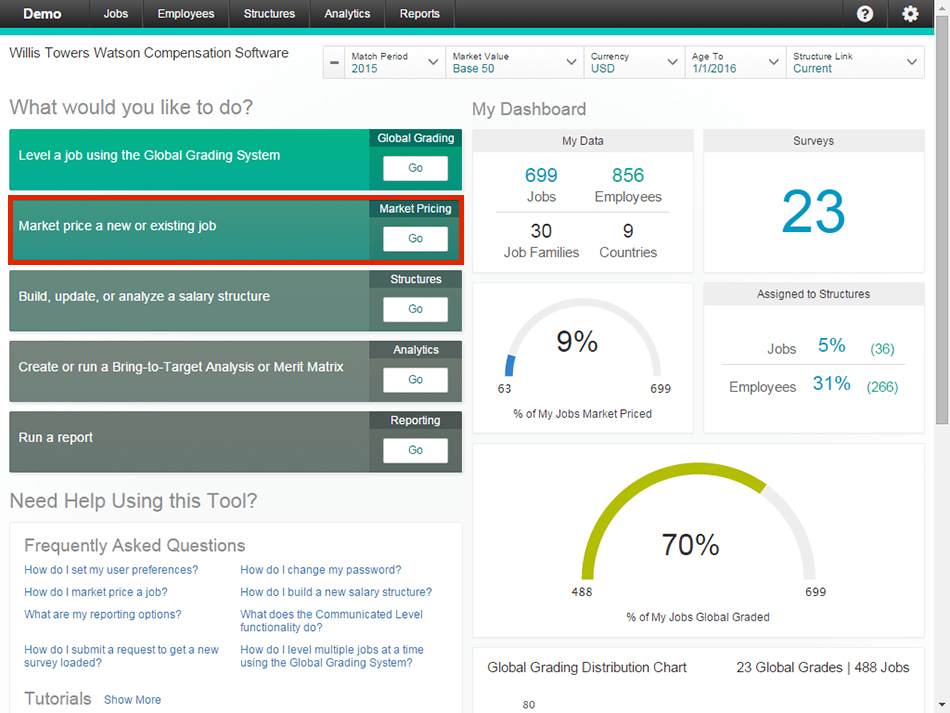

Job market pricing in Willis Towers Watson Compensation Software

From this vast amount of information, you can then boil each role down to two statements—the job description and the job specification. These will be specific to your organization’s unique requirements and expectations.

These steps go beyond describing a salesperson to describe your salesperson. Then you can adjust compensation ranges depending on how your role differs from your researched norm.

The job description details each role at your organization (e.g., place of work, salary range, responsibilities, working hours and conditions, who they report to), while the job specification details the minimum requirements a person needs to fill each role (e.g., education level, years of experience, skills, abilities, certifications, personality traits).

Once you have these statements nailed down, you can save them in your compensation platform, recruiting system or HR suite to use in job postings and update them in the future as needed.

Step 2: Decide Where to Go Above and Below the Market

Having a researched job analysis—which is regularly updated to reflect economic changes and the supply and demand for different roles—provides the information needed to pay your employees the going market rate.

But as the saying goes, you get what you pay for: In a study of the manufacturing industry released last year based on 2012 economic census data, the U.S. Department of Commerce found a high correlation between compensation per employee and their value added to the firm.

Average wages produce average employees, so the next step in compensation planning is a strategic one: deciding which roles to compensate above-average to attract and keep better workers, and which ones you can afford to pay below-average to save money.

This ultimately comes down to your company’s competitive advantage. If it’s product quality, you may want to invest more in your line workers or developers; if it’s branding, you may shift more of the budget toward marketing.

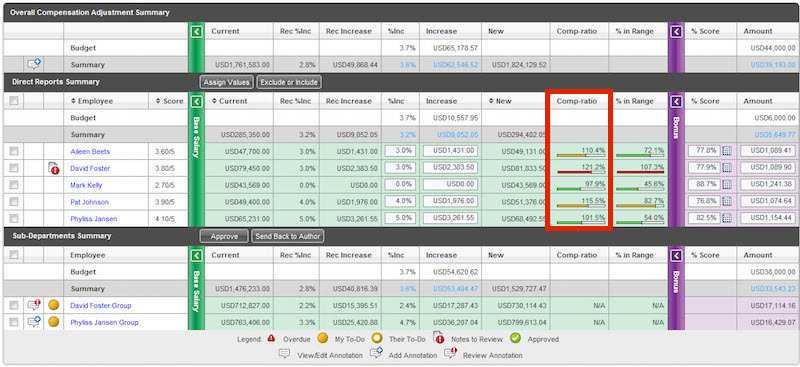

Adjust comp-ratios in Halogen TalentSpace

This determination seems somewhat arbitrary in the beginning (pay top dollar for top-dollar employees). But over time, using an integrated performance review process, you can actually see where your additional compensation is making an impact.

You might learn some roles don’t perform measurably better with higher wages or merit bonuses, while others may thrive when thrown a few extra bucks. This way you can truly tie your compensation plan to what will be effective in driving valuable performance and employee engagement.

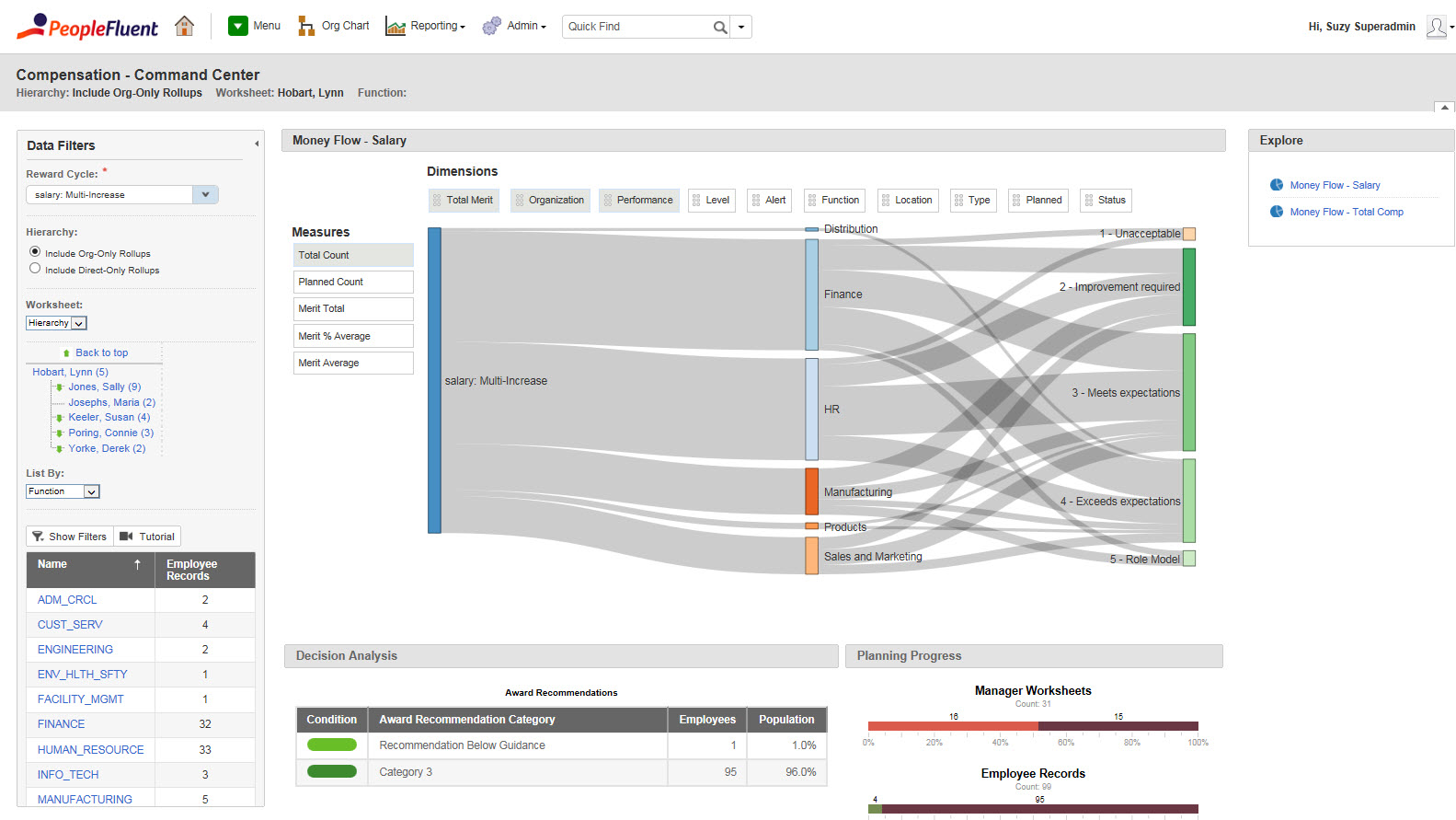

Pay vs. performance analysis in PeopleFluent

Step 3: Mix in Short-Term and Long-Term Benefits

Along with salaries, wages and potential bonuses, you also need to decide what benefits to offer your employees in the form of health insurance, retirement savings plans, stock options, paid vacation time and otherwise.

The importance of benefits can’t be denied—workers satisfied with their benefits are more than twice as likely to also be satisfied with their work, according to an annual study by MetLife. But the cost is a significant consideration as well, amounting to 30 to 40 percent of base pay on average, so it’s important to get your mix correct.

Factors ranging from employee preference and usage to broker negotiations play a role in choosing your benefits, but a general best practice during compensation planning is to offer a mix of short-term benefits (those settled financially less than a year after being used) and long-term benefits (those settled financially much later).

This way you can effectively recruit and retain top performers and smooth out expenses over time.

Short-Term Vs. Long-Term Benefits

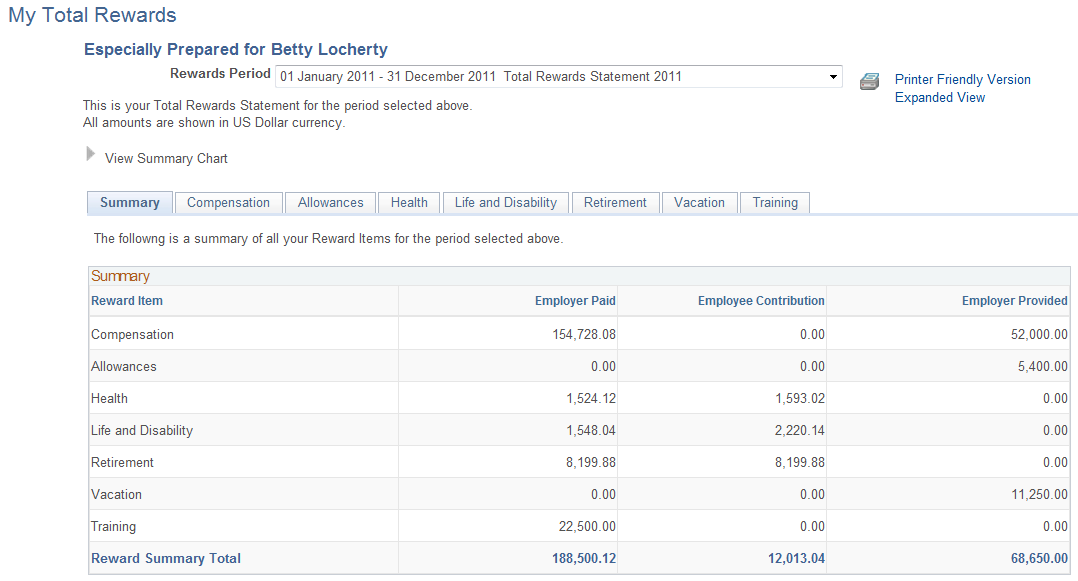

Tracking the cost of these benefits for compensation planning and reporting purposes can be tough, but benefits administration and compensation platforms help keep things straight on a line item and per-employee basis.

These platforms also provide transparency by allowing employees to log in and see total rewards statements breaking down how much each party has contributed towards compensation.

Total rewards statement in PeopleSoft HCM

Step 4: Have Multiple Plans Based on Company Performance

Most companies determine their compensation budgets based on revenue. The only problem is there isn’t a hard-and-fast rule on what the ideal ratio is for every organization.

Service businesses who rely on their people may see compensation costs rise as high as 50 percent of their revenue and still be in solid standing, while manufacturers may see this figure dip into the low teens.

Second Wind Consultants says the general “safe zone” of compensation budgets is between 15 and 30 percent of gross revenue.

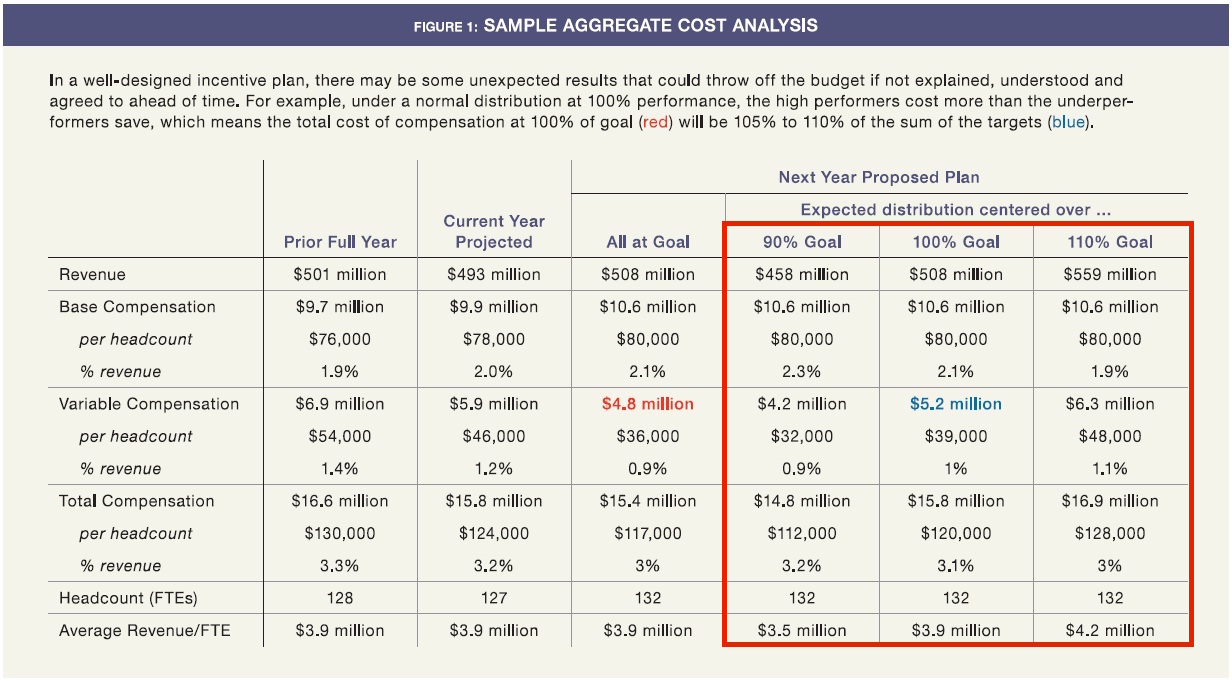

Whatever your ratio is, use that as your baseline to come up with contingency compensation budgets and variable payout scenarios should your revenue end up higher or lower than expected. It’s hoping for the best, but planning for the worst.

Example compensation plan with revenue contingencies. Source: DonyaRose.com

Final Considerations

Compensation planning is vital to the success of every company—how can you adequately pay your workers otherwise?

But balancing pay and benefits in a way that truly works for both employer and employee in the long-run requires research, flexibility, careful consideration and a little bit of data crunching.

You can learn more about what compensation management software can do for you by checking out our Buyer’s Guide. Then head over to our compensation management software page to compare systems, read reviews and find the right platform for your needs.