$47,476: How to Prepare Your SMB for the Overtime Rule Change

[UPDATE: November 28, 2016. On November 22, a Texas federal judge issued a preliminary injunction on the overtime rule change, which was set to go into effect on December 1. While the case is being reviewed, the current rules regarding overtime pay will remain the same until further notice. As changes occur, we’ll keep you posted.]

Here’s the quick-and-dirty summary of the big overtime rule change that the Department of Labor (DOL) announced on May 18:

The annual salary level under which employees must be paid overtime nearly doubled, from $23,660 to $47,476.

All businesses have until December 1, 2016 to comply.

Unfortunately, the difficult decisions that small businesses must make with their workers’ compensation to comply with this new law in the coming months are anything but quick and dirty.

This guide includes everything you need to know as a small business about the overtime rule change, the options you have for compliance and tips for how to communicate drastic compensation changes to your employees.

(Click on a link below to jump to that section.)

Answers to Frequently Asked Questions

9 Ways Small Businesses Can Comply (With Examples)

How to Communicate Changes to Your Employees

Downloadable Checklist and Next Steps

Answers to Frequently Asked Questions

If you’re not quite sure what the new overtime rule entails, or even how it applies to you, this FAQ section presented as a Q&A should provide clarity.

Q: In simple terms, what’s changing?

A: More salaried workers must be paid overtime for any hours worked over 40 a week.

The Fair Labor Standards Act (FLSA)—the law that covers minimum employment requirements for businesses—has a nationwide salary threshold. Outside of a few exceptions, any salaried employee who makes under that amount annually is owed time and a half for any hours worked over 40 a week, while any salaried employee who makes over that amount is not.

Since 2004, the specified salary level has been $23,660 a year (or $455 a week). With the new rule, it has now doubled to $47,476 a year (or $913 a week). In short, any salaried employee who makes between $23,660 and $47,476 a year is now eligible for overtime pay, outside of a few exceptions.

Q: Who are the exceptions to the new rule?

A: Computer programmers, teachers, lawyers and businesses whose annual sales are less than $500,000, to name a few.

At a business level, if your organization makes less than $500,000 in gross sales annually, you do not need to worry about the new rule. The exceptions to this exception are hospitals, nursing facilities, schools and anyone in government or the public sector. These entities must comply regardless of revenue.

If your entire business isn’t an exception to the new rule, there may still be individual employees in your organization that are. At an individual level, you don’t need to pay overtime to salaried, white collar workers that make less than $47,476 if they fall into one of these categories:

Business owners

Executive employees (e.g., CEO)

Administrative employees (e.g., administrative assistants, HR directors)

Learned professional employees (e.g., lawyers and teachers)

Creative professional employees (e.g., graphic designers)

Computer employees (e.g., software engineers, systems analysts)

Outside sales employees (e.g., door-to-door salespeople)

There are strict guidelines for how these employees are defined, which you can learn more about on the DOL website.

Q: Is $47,476 always going to be the salary threshold?

A: No, it will change every three years.

$47,476 isn’t just a random number drawn from a hat. It’s the 40th percentile of earnings for full-time salaried workers in the census region with the lowest wage (in this case, the South). Starting January 1, 2020, the DOL will increase this salary level to reflect that 40th percentile, and will continue to do so every three years for the rest of time.

However, since this rule is set at the regulatory level, the next round of DOL leadership could change the language whenever they want, or get rid of the new rule entirely.

Q: How much is this change going to cost me?

A: Potentially a lot, in increased overtime pay, increased salaries and otherwise.

According to the DOL, affected businesses will need to collectively spend $1.2 billion a year to comply with the new overtime rule, and even that number may be conservative. The government’s cost figure is based on research that the change will impact 4.2 million workers, but the Economic Policy Institute puts that number as high as 12.5 million workers.

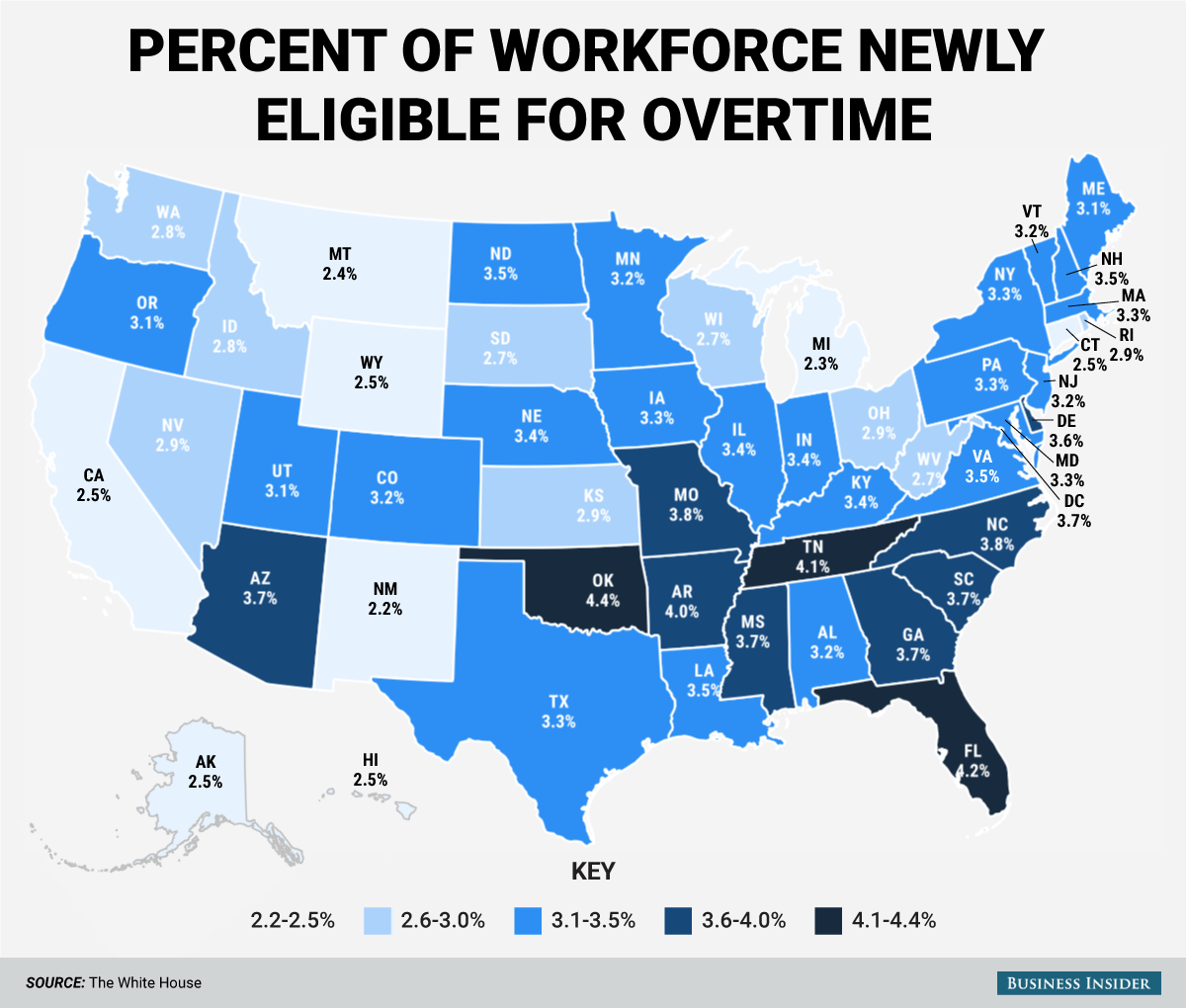

Q: Who will be impacted the most by this new rule?

A: Low-income areas, low-margin businesses and nonprofits.

Since the income level is directly tied to earnings from the lowest wage census region, businesses in low income areas are going to be more impacted by this new rule than others. (Average salaries in San Francisco are well above $47,476 so less change is needed, for example.)

Source: Business Insider, using data from The White House

Historically low-margin industries such as retail, food, construction, hospitality and especially nonprofits may also not have enough wiggle room in compensation budgets to make needed adjustments right away.

Q: If I don’t comply, what happens?

A: It could end up costing you more money than if you do comply.

Philip Miles, employment attorney for law firm McQuaide Blasko, explains:

“If you don’t comply with the overtime provisions, you could be subject to a DOL investigation. An investigator will open up your books and identify any overtime violations. If they find intentional violations, they can go back three years and collect back pay for all of the overtime you should have paid but didn’t. Then they can assess a civil penalty on top of that which could be thousands of dollars per violation.” Tweet this quote

Philip Miles, employment attorney for McQuaide Blasko

Miles adds that it’s unlikely the DOL will go out and start investigating small businesses on December 2, but warns that there are no “get out of jail free cards” for those that get caught.

9 Ways Small Businesses Can Comply (With Examples)

There’s no way around it: This new rule will cost you. But with careful planning and knowing all your options, you can certainly soften the blow.

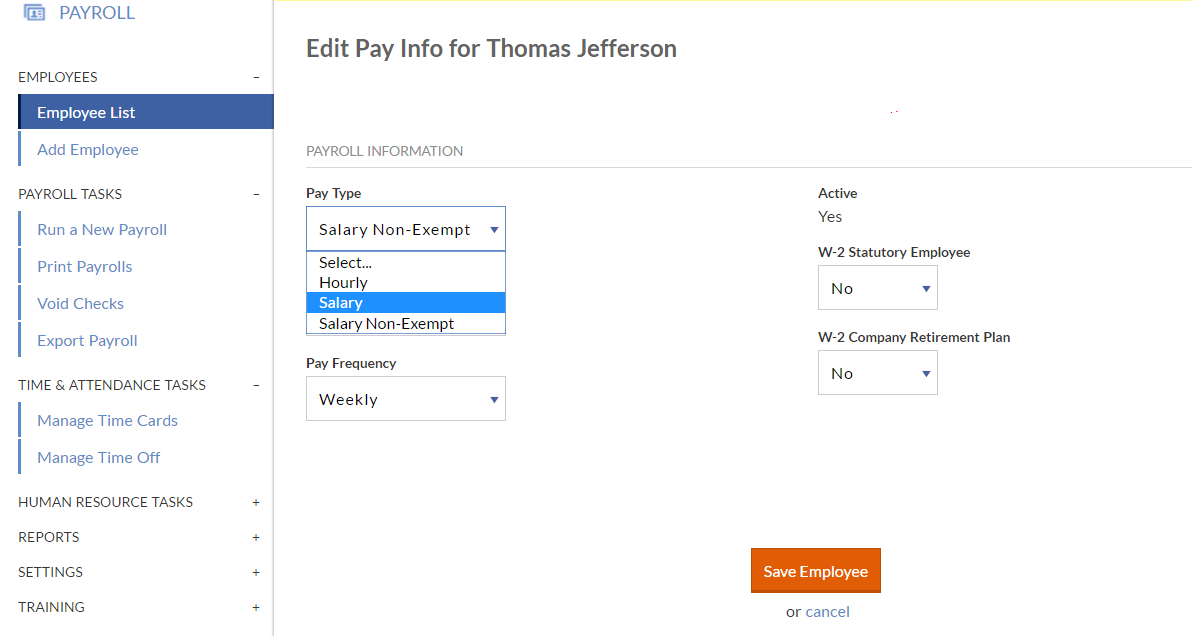

The first thing you need to do is identify every salaried employee that falls between the old salary level ($23,660) and the new salary level ($47,476). Most payroll solutions allow you to label exempt and nonexempt workers to make things easier.

Choosing pay types in Patriot Payroll

From there, you must decide how you’re going to become compliant for each employee. Here are nine options:

Option #1: Simply Pay the Overtime

The first option is the most obvious, but potentially the most costly: Calculate your salaried worker’s hourly rate and pay them time-and-a-half for any hours worked over 40 a week. The best candidates for this option would be those on the lower end of the salary range or those who only work overtime occasionally.

Example: Say an employee makes $30,000 a year, which amounts to $577 a week ($30,000/52 weeks). Divided by 40 non-overtime hours a week, that comes out to $14.43 an hour. If that employee works 45 hours one week, they would be owed $108.23 in overtime pay for that period ($14.43 x 1.5 x 5 overtime hours).

Option #2: Increase Salaries Over the New Threshold

The other obvious option is to increase your worker’s salary over the $47,476 threshold, making them exempt from the new rule. Depending how much overtime an employee works, and how close their salary is to the threshold, this could be the most cost-effective option in a lot of cases. A salary boost can also provide added benefits in employee engagement and retention.

Example: Say you have an employee who makes $40,000 a year and consistently works 60 hours a week. Keeping their salary the same and paying for their overtime will cost you nearly $30,000 a year, while boosting their salary above the threshold will only cost you $7,476 a year.

Option #3: Push Workers Above the Threshold With Bonuses and Commissions

A lesser known part of the new rule is that companies can add bonuses and commissions up to 10 percent of a worker’s annual pay rate to get them above the salary threshold. So, if you have an employee who is close to the $47,476 mark, you may choose to simply increase the amount of their bonuses or commissions to push them over the top.

Example: If a worker makes $45,000 a year, you can award them up to $4,500 in bonuses and commissions annually to push them over the $47,476 salary level.

Option #4: Lower Salaries and Pay Overtime to Keep Compensation the Same

If an employee’s overtime pay is going up, you can also lower their base salary to keep their total compensation consistent. Are you technically paying your employee the same as before? Sure. But don’t expect them to be happy when their salary decreases.

To see what an employee’s new lowered salary would be, enter their current salary and an estimate of their weekly overtime hours into the calculator below:

Example: Say you have an employee who makes $35,000 a year and consistently works 45 hours a week. When the new rule kicks in, their total compensation will become $41,562 ($35,000 base salary + $6,562 in overtime pay). To combat this, you can lower that employee’s base salary to $29,474 to keep costs the same ($29,474 base salary + $5,526 in overtime pay = $35,000 in total compensation).

Option #5: Convert Salaried Workers to Hourly Ones

Depending on their role, some salaried employees can be turned into hourly employees to better control their hours and overtime pay, and allow you to only pay for time that a worker is, well, working. If you have a salaried worker slacking on their guaranteed pay rate, a switch to hourly can also provide a necessary push for them to earn their earnings.

Though this option may be cost-effective financially, it can have a devastating impact to worker self-esteem. Susan Heathfield, small business owner and HR expert for About.com, has instituted this change in her own company and warns of the negative effects.

“Hourly employees are always looked down on by salaried employees. Hourly employees are more like factory workers. Salaried employees function from the whole job concept—they do what [is necessary] to do the whole job. I have 260 employees that have all always been salaried, and this law is causing me to have to have a two-tiered system.” Tweet this quote

Susan Heathfield, small business owner and HR expert for About.com

Example: Say you have a salaried worker who makes $45,000 a year, but rarely works more than 30 hours a week. Moving them to hourly can keep you compliant, lower compensation costs and potentially push this employee to work more hours to earn more pay.

Option #6: Cut Hours, Hire More Workers and Enforce a No-Overtime Policy

Another way to avoid paying for overtime is to not have any overtime at all. You can enforce a no-overtime policy and hire more part-time and contract workers to pick up the lost hours.

The pro of this option is that your salaried employees will enjoy more work-life balance. The con is that they may resent that they can’t do their whole job (because part of it is being handed off to someone else), or feel that you’re withholding money.

Example: Say you have four salaried workers who do similar jobs and consistently work 45 hours a week. You could enforce a no overtime policy to limit them to 40 hours, and hire a part-time worker to pick up the 20 hours in lost productivity.

Option #7: Cut Workers and Give Their Hours to Employees Above the Threshold

The sad truth is that some businesses will have to let employees go to cut costs and comply with this new overtime rule. An option here is to let go of employees within the nonexempt salary range and spread their hours out between workers above the salary threshold. Hopefully, I don’t need to tell you what cutting employees can do to workplace morale.

Example: You could cut an employee who makes $30,000 a year and is due time-and-a-half for the 15 hours of overtime they work every week, then spread their 55 weekly hours among salaried workers above the $47,476 threshold.

Option #8: Reconfigure Roles to Fit Exceptions

Remember those exceptions to the new rule that I mentioned earlier? Though they have pretty specific criteria, it’s possible you may have workers in your company who could become an exception with a slight adjustment of their role and responsibilities. The administrative employee exception provides the loosest criteria, so start there.

Example: If you have an office assistant who has shown promise, you can give them more responsibilities and a final say in certain decisions to fulfill the criteria of the administrative employee exception.

Option #9: Award More PTO (for Government Workers Only)

Another loophole for public sector employers is that instead of paying workers time and a half for overtime, you can compensate them with time-and-a-half of PTO instead. There are a few limitations (which you can learn more about here), and the difference between paying for overtime and lost hours due to increased PTO may ultimately be pretty even. Nonetheless, it’s another option to consider.

Example: If a public sector employee works 45 hours a week, you can award them 7.5 hours of PTO (5 x 1.5) a week instead of paying overtime.

How to Communicate Changes to Your Employees

The financial impact of the new overtime rule on small businesses is substantial. But Heathfield points out that perhaps the most significant facet of this change is “what it’s doing to the psyche and morale of employees nationwide.” You’ll have to make tough decisions—cutting hours and pay or outright letting people go—that will not sit favorably.

Here are a few tips on how to communicate these drastic changes to your employees:

‘Thanks, Obama.’

You should probably phrase it more eloquently than that, but you get the gist: “If we could, we wouldn’t change anything, but the government has forced our hand.” This rule change has put small businesses in a tough spot, so the more you can communicate to workers that this is out of your control should help deflect blame away from the company.

“That’s what I did with my employees,” Heathfield says. “I told them that it was not our choice, and that we had to be in compliance with the law.”

The Benefits of Change

Due to needed compensation changes in your organization, some previously exempt workers may become nonexempt and vice versa. Focus conversations with your workers on the benefits of this change to not only help smooth things over, but also to help workers realize their new role may be a better fit than they realized.

The Benefits for Exempt and Nonexempt Employees

Exempt | Nonexempt |

More meaningful, impactful work | Ability to make more money through overtime |

Leadership opportunities | Greater work-life balance |

Potential to work remotely | More regular schedule |

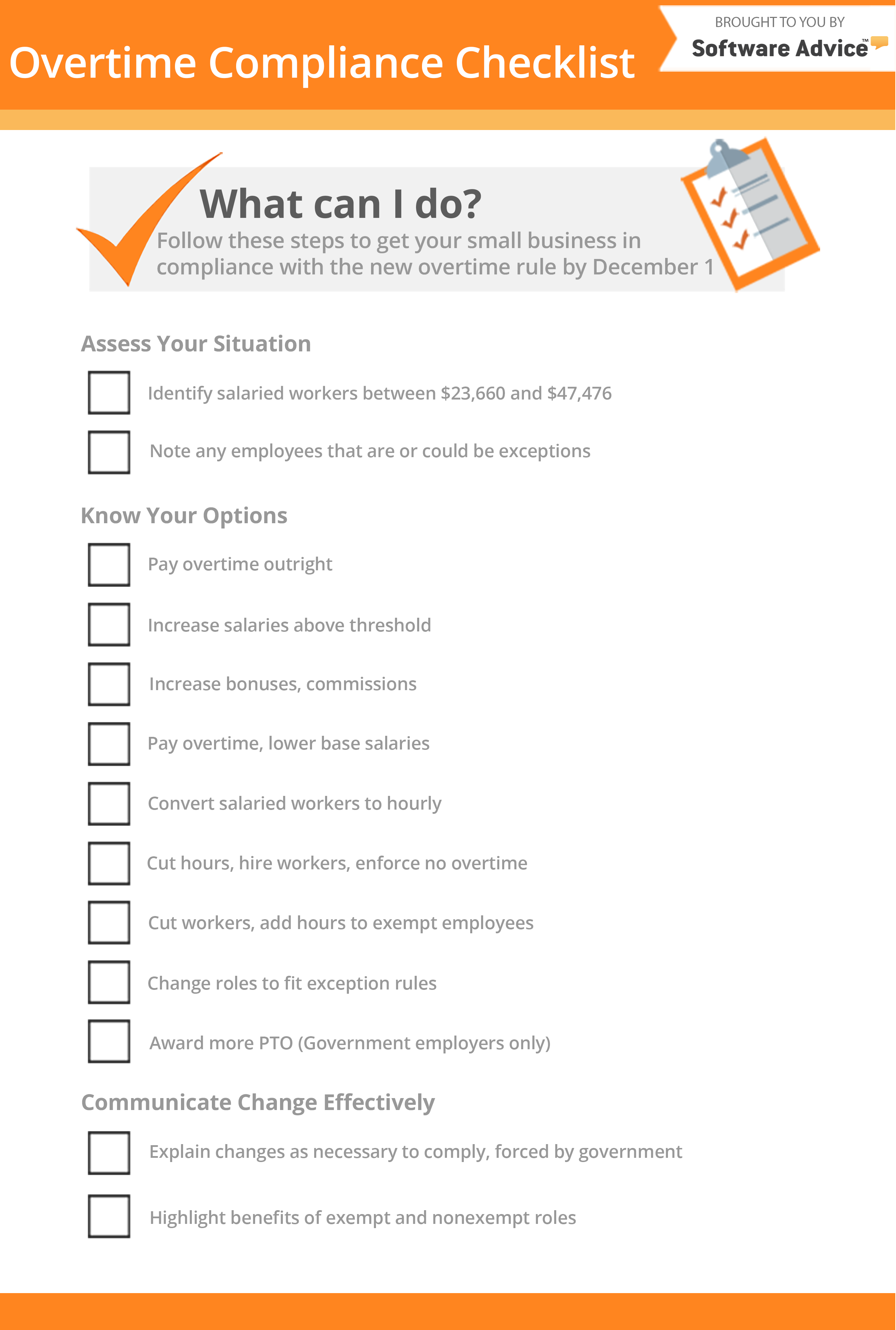

Downloadable Checklist and Next Steps

We’ve covered a lot, so to help keep things straight, here’s a downloadable checklist with everything your small business needs to do by December 1 to comply with the new overtime rule:

Employers have been dealt the short end of the stick, but proper planning and budgeting can help ease the pain. Here are some final next steps to start taking action:

Find extra resources. No, I don’t mean money (though that would be great, right?). Instead, seek out other articles and papers from lawyers, HR experts, consultants or governmental bodies in your region to better understand how the overtime rule change will impact your business locally. The DOL has also published webinars for businesses to better understand the change.

Check your payroll and time tracking solutions. If your current payroll system can’t help you easily identify exempt and nonexempt workers or see the total effect of compensation changes, it may be time for an upgrade.

Likewise, if you don’t have a solution in place for salaried workers to track their overtime hours, now is the time to invest in one. Our payroll and employee time tracking pages have over 100 different systems with user reviews and pricing information to help you find the right system.