General Ledger Software Buyers Guide

This detailed guide will help you find and buy the right general ledger software for you and your business.

Last Updated on November 09, 2023The general ledger is a core financial tool for any business, as it contains all accounts for a company’s assets, revenue, equity and expenses. The importance of a well-kept general ledger cannot be overstated.

Because of this, a general ledger is a key feature of any accounting software solution. However, due to regulations and standards placed on company’s financial practices and the large and ever-evolving landscape of software, it can be challenging to find the accounting suite that delivers the results you need.

This buyer’s guide is designed to help alleviate any potential frustration and aid you in your search for a system that will help keep your general ledger balanced and organized.

We’ll cover the following topics:

What is general ledger software?

A general ledger is a core feature of most accounting software, and serves as a repository for all financial data from other subledgers and modules, such as:

Accounts receivable

Accounts payable

Project accounting

Cash management

Purchasing

Fixed assets

Organizations, such as law firms or nonprofits, must keep separate ledgers for each client or account to comply with regulations. These will have to be reconciled monthly to ensure accounts match between the bank and the organization.

The general ledger is also the place where users can derive important reports, such as income statements and reports on overall financial health.

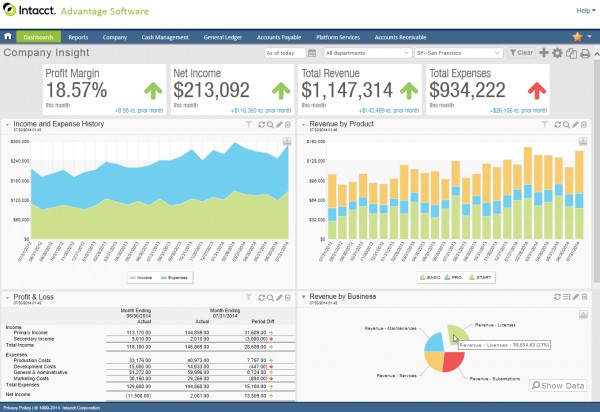

In many modern accounting systems, the general ledger contains the data that fuels a graphical dashboard, showing users the top key performance indicators (KPIs), such as profits, total revenue and expenses and revenues for individual business units, in charts and graphs. This is all the more reason the software you choose should have easy-to-use and accurate general ledger functionality.

The customized dashboard view of Intacct

What are common features of general ledger solutions?

The general ledger is a functional area of a larger accounting suite, and many features assist with the daily tasks associated with the ledger. Here are some common ones:

Bank reconciliation | Allows companies to match the balances of records in the general ledger to bank accounts to identify any discrepancies. Some accounting systems can automatically import and export changes to the numbers, such as credit card transactions, to save time. |

Tax preparation | Depending on the state and federal regulations you are subject to, accounting software vendors stay up-to-date and ensure compliance by updating tax law details in the system. |

Customizations | Accounting software vendors serve a wide range of industries, so most offer highly customizable systems to ensure each client has the functionality they need. In addition, most systems can integrate with other software, so all your company’s financial data can flow seamlessly from module to module. |

Reporting and dashboards | Any data used to generate reports or populate KPI dashboards will pull from the general ledger. It’s important to keep the ledger accurate and up to date so that the information you use in reports and dashboards reflect the true financial standing. |

When emergency situations occur, mobile apps give users the ability to perform most tasks with a smartphone or tablet anywhere. Mobile users can send invoices, reconcile accounts, log expenses and more. Many apps also take advantage of native mobile device hardware, such as a camera, to capture paper receipts, for example. |

What are the trends among small business accounting software buyers?

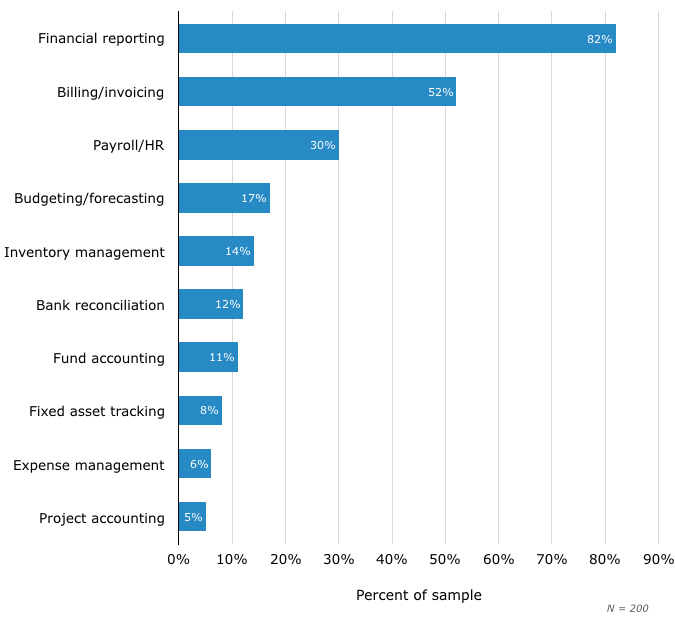

Software Advice is in contact with hundreds of small business software buyers each day, so we gain unique insight into their preferences. In a 2016 survey about accounting software, buyers revealed the most important features to them:

Ninety-seven percent of buyers request a system with accounts payable, accounts receivable and general ledger

Three percent request a system with accounts payable and general ledger

Therefore, we can say that 100 percent of accounting software buyers want the functionality of a general ledger system.

This highlights the importance of choosing a system with the ledger capabilities you need. The survey went on to uncover the other top accounting features:

Top-Requested Accounting Software Functionality

Financial reporting led the results for features that aren’t included in core accounting capabilities with 82 percent; this is a leap from 56 percent in 2015, and a sign that the general ledger is critical to several other functions in an accounting system.

How are general ledger systems priced and deployed? General Ledger Systems Pricing and Deployment

Accounting software, like many other types of systems, is commonly offered in two ways:

As a perpetual license. Users pay an upfront cost for the right to use the software forever. Usually, buyers will also pay fees for ongoing support and software updates.

As a monthly subscription. Users pay a monthly subscription fee based on the number of users, features included or other factors. This may also include an additional upfront, one-time cost.

Costs for software will increase as features or add-on modules are integrated into the system, and vendors are often able to customize a set of features into a package that works for a specific industry or business.

Secondly, the system can be deployed in a of couple ways:

Hosted or on-premise means the software is downloaded to the computers at your business, and all the data on that system is local. Some users prefer this model to keep their data close by.

Cloud or web-based typically means the software is accessible via a web browser, anywhere the user needs it. In the overall software industry, there is a movement toward cloud-based systems, as their flexibility is a significant benefit for many types of companies.

In a recent survey, Software Advice asked small businesses about their confidence in cloud-based accounting systems. The results showed that while about 43 percent used on-premise software in 2014, the following year, the number of cloud software users nearly doubled, with an increase from 16 to 30 percent.

The notion that cloud-based software is less secure than on-premise is changing, and 28 percent of respondents from the same survey cite increased safety and security as a top benefit.