Find the best Insurance Policy Software

Compare Products

Showing 1 - 20 of 69 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

Ventiv Policy

Ventiv Policy

Meet the demands of an ever-changing world. Beat the competition with quicker-to-market products that support policyholders’ needs. Ventiv Policy, a flexible tool built for the modern insurance landscape, sets the standard for pol...Read more about Ventiv Policy

AdInsure

AdInsure

AdInsure is a standard insurance platform that provides insurance companies with future-proof technology for streamlining their business processes and operations. AdInsure serves as a foundation of award-winning solutions: AdInsur...Read more about AdInsure

equisoft/manage

equisoft/manage

The solution is built on the Oracle Insurance Policy Administration platform and includes a digital self-service portal for advisors, agents, plan administrators, participants and individual customers that provides a completely di...Read more about equisoft/manage

RiskPartner COI

RiskPartner COI

RiskPartner COI is a cloud-based software designed to streamline the management of insurance certificates. With automated notifications for expiration tracking and customizable rules, it helps handle communication with subcontract...Read more about RiskPartner COI

Insly

Insly

Insly has provided full-cycle low/no-code insurance software for MGAs and insurance companies since 2014. Insly delivers a scalable solution for C-Suite employees and underwriters looking to launch and distribute new products. Add...Read more about Insly

Partner XE

Partner XE

Partner Platform’s agency management system (Partner XE) is praised by clients for its ease of use, breadth of capabilities, and long-term affordability. Built for the agency that cares about community values and is tired of the s...Read more about Partner XE

Velocity

Velocity

Velocity is a cloud-based agency management system for property and casualty insurance carriers. It helps users handle the needs of general agents, program administrators, wholesalers, carriers, reinsurers and retailers. The core ...Read more about Velocity

1insurer Suite

1insurer Suite

1insurer Suite is a cloud-based and on-premise insurance solution that combines software modules such as policy management, billing, claims management, agent/customer/repairer portals and insurer analytics. Businesses can choose t...Read more about 1insurer Suite

InsuranceEnterprise

InsuranceEnterprise

InsuranceEnterprise by CodeObjects is an integrated insurance solution that can be deployed on-premise or in the cloud. The solution offers four modules, which include policy administration, claims management, ratings and billing....Read more about InsuranceEnterprise

Surefyre

Surefyre

Surefyre is a cloud-based customer relationship management (CRM) solution designed for the needs of insurance agents. It is suitable for multiple types of carriers, including property, casualty, life and health care insurance prov...Read more about Surefyre

BriteCore

BriteCore

BriteCore is a cloud-based insurance solution for personal, commercial, auto and specialty insurance providers. Designed for the needs of small and midsize insurance service providers, it provides support for multi-line, multi-sta...Read more about BriteCore

DRC Insurance Platform

DRC Insurance Platform

DRC's insurance system is a cloud-based insurance solution that enables property and casualty insurance businesses to manage their policy quotes, ratings, billing and claims. The solution offers features for brokers, carriers and ...Read more about DRC Insurance Platform

tigerlab

tigerlab

tigerlab offers a cloud-based Insurance Platform as a Service (IPaaS), designed for insurers, MGAs, insurance startups and digital businesses. The software automates the whole insurance policy lifecycle, from policy issuance to ca...Read more about tigerlab

ISI Enterprise

ISI Enterprise

ISI Enterprise is a cloud-based insurance solution that assists businesses in policy administration, billing, claims and other related services. Key features include reinsurance management, a policy rating engine, document managem...Read more about ISI Enterprise

Jenesis Software

Jenesis Software

Jenesis is designed specifically for the independent insurance agency, offering a seamless platform to manage various aspects of insurance agency operations efficiently. Jenesis offers a robust agency management system with a wide...Read more about Jenesis Software

Proformex

Proformex

Proformex stands as the unrivaled leader in inforce management platforms, providing unparalleled data aggregation, advanced analytics, and comprehensive portfolio monitoring for life insurance and annuities. Specifically designed ...Read more about Proformex

NowCerts

NowCerts

NowCerts is a cloud-based insurance solution designed for insurance agencies of all sizes. Key functionalities include commission tracking, task management, claims management, reporting, self-service certificates, reminders, calen...Read more about NowCerts

SchemeServe

SchemeServe

SchemeServe is a cloud-based insurance solution designed for insurance organizations, managing general agents (MGAs) and brokers. Features include cancellation tracking, claims tracking, policy generation, a rating engine, reinsur...Read more about SchemeServe

WaterStreet

WaterStreet

WaterStreet is a cloud-based insurance solution designed primarily for sectors such as property and casualty insurance. WaterStreet provides tools to manage quote-to-claim policy lifecycle support, a configurable rule-based ...Read more about WaterStreet

TopSail

TopSail

TopSail is an insurance rating management software designed to help businesses with policy issuance, forms management and endorsement processing operations. The platform enables managers to organize documents and configure role-ba...Read more about TopSail

Popular Comparisons

Buyers Guide

Last Updated: March 16, 2023If there's one thing that everyone can agree on about insurance, it's that the industry is complicated. From the most basic, stripped-down health insurance policy to the most expensive corporate liability package, every policy has a multitude of details that need to be worked out by agencies, pored over by policy holders and regulated by the government.

Fortunately, just as insurance policies have grown more complicated over the years, the types of software created to help manage those policies have become more sophisticated. This makes keeping track of the various pieces of policies much easier for insurance agencies like yours, so that they can provide better service for their customers and policy holders.

This buyer's guide will explain how insurance policy software can help your insurance agency develop, administer and manage policies, so you can save time and simply focus on your agency's core processes.

This software exists either as stand-alone systems or as a part of a larger suite of insurance software.

Here's how we'll break down our discussion of this software:

What Is Insurance Policy Software?

Common Features of Insurance Policy Software

What Is Insurance Policy Software?

Insurance policy management software breaks down into two key processes—creating policies and administering/maintaining policies.

Although most insurance policy software will allow you to do both of these things, we've broken down our description of the software into these two key features, since they can look different in practice.

Policy Creation

Insurance policy software can provide you with the tools you need to develop new types and tiers of policies to present to buyers. The software will help you design different types of attractive insurance packages, calculate and weigh the costs and profit margins of those packages and keep careful records of all policies that get issues to clients. Some advanced systems even have databases of pre-existing policy templates that you can customize to create the right product for your agency.

Policy Administration

Keeping track of insurance policies can be as daunting a task as creating them, which is why the software will help you with this side of your business, too. Tools will help you to provide timely and accurate quotes, handle claims, track customer history and issue bills.

Additionally, this part of the software system can help ensure that your policies are in adherence with all applicable local, state and federal regulations.

Common Features of Insurance Policy Software

Policy creation | Provides a centralized database that houses all of your agency's policy types, along with a library of templates that you can use to create new policy packages. |

Policy issuance | Enables you to issue policies to customers more efficiently, making it quicker and easier to provide quotes, calculate rates, create contracts and get them signed; field customer inquiries; and track all policies once they've been issued. |

Compliance management | Helps ensure that all of your issued policies are compliant with all legal and industry regulations on the local, state and national level. |

Claims tracking | The key feature of insurance policies is how well they handle policy holder claims, and tools within the software will make this process easier for both you and your customers. Automated filing and cross-referencing will make filing claims and issuing payment quicker and more efficient. |

Customer portal | Provides an online portal that your customers can access to manage their policies and accounts. This can save you a lot of time and money in customer service phone calls, while also increasing your customers' satisfaction rate. |

Billing and accounting | Automates the billing of your customers so you can save time and money, while improving accuracy. You can also automate features of your accounting in order to track both overall profits and the profit margin of individual policies. |

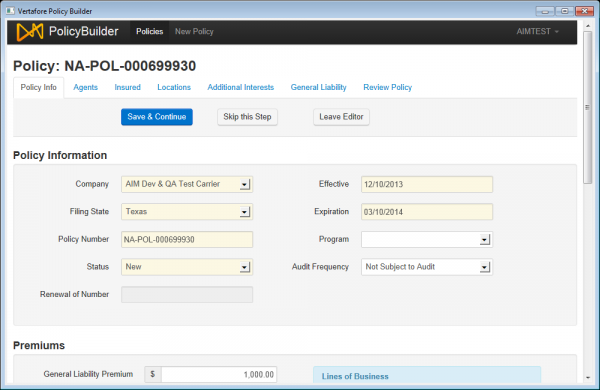

Vertafore Agency Platform's interactive policy builder page

What Type of Buyer Are You?

Insurance agencies, because they require so much capital to be on hand, tend to be medium to large sized companies. As such, few insurance policy software packages are designed for small businesses, and many only cater to enterprise-level agencies.

Your insurance agency may fall into one of the following categories with specific software needs:

Health insurance provider. Health insurance can be among the most complex type of policies, so you will likely want to get the most robust, feature-rich software suite possible. Given the immense body of law surrounding health insurance, you will especially want features that enable you to maintain compliance.

Life insurance provider. Because of the financial complexities often tied up in life insurance (including, and especially the high payout for those policies), you will want to make sure that you have a system that has strong accounting features.

Auto insurance provider. The ability to provide a quick quote and easy claims process will be of key importance in this market, since it is so highly competitive amongst consumers.

Homeowners insurance provider. Similar to auto insurance, you will want to be able to quickly and competitively provide a realistic quote to applicants.

Key Considerations

Other factors to take into consideration when picking the best policy management software for your business may include:

Integration with other systems. Your insurance policy software may be part of a larger, integrated insurance suite, but if it is a stand-alone package you need to be sure that the software you purchase can integrate with other systems you'll be using. You'll need to be able to check policies against your accounting or your customer relationship management (CRM) software, for example, and the two programs must be compatible in order to work together. Make sure you talk to vendors about how well their software will integrate with these other systems.

Cloud-based versus on-premise software. In the past, most software was hosted by businesses on their own premises. This meant that a business would purchase dedicated hardware along with their software so that they could run the software's programs. Such a process required businesses to have the space to host extra servers, as well as the IT resources and knowledge base to set up and maintain the system. Today, it is far more common (though not universal) to find vendors providing their software via the cloud. This means that businesses have no need to host the software themselves, and instead access it via the internet. This costs less up front and limits the amount of time and money that must be dedicated to IT upkeep. Be sure to check with vendors as to how their software will be hosted.