Find the best Insurance Software

Compare Products

Showing 1 - 20 of 172 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

AdInsure

AdInsure

AdInsure is a standard insurance platform that provides insurance companies with future-proof technology for streamlining their business processes and operations. AdInsure serves as a foundation of award-winning solutions: AdInsur...Read more about AdInsure

AgencyPro

AgencyPro

AgencyPro is agency software designed for insurance companies, intermediaries and underwriting agencies. It is suitable for organizations with multiple insurance products, including auto, home, health, accident, causality and life...Read more about AgencyPro

Guidewire

Guidewire

InsuranceSuite is an insurance management solution that helps agencies streamline operations and manage claims, bills and receivables, as well as underwriting and policy administration. The solution can be deployed in the cloud an...Read more about Guidewire

Insly

Insly

Insly has provided full-cycle low/no-code insurance software for MGAs and insurance companies since 2014. Insly delivers a scalable solution for C-Suite employees and underwriters looking to launch and distribute new products. Add...Read more about Insly

Vertafore Agency Platform

Vertafore Agency Platform

Vertafore Agency Platform is a cloud-based insurance management solution designed for insurance companies of all sizes. It offers accounting, customer management, document management, policy management and reporting within a suite...Read more about Vertafore Agency Platform

Stream Suite

Stream Suite

Stream Suite is an insurance management solution designed for insurance companies of all sizes. It offers claims management, customer management, billing, policy administration and distribution management within a suite. The produ...Read more about Stream Suite

Applied TAM

Applied TAM

Applied TAM is a cloud-based insurance management solution designed for small and midsize businesses. It offers business process management, risk management, insurance renewals, marketing management and reporting functionalities w...Read more about Applied TAM

Agency Suites

Agency Suites

With EZLynx®’s software for new and growing insurance agencies, we provide your business with an all-in-one platform that integrates your comparative rater, agency management system, reporting, customer portal, and more to make ma...Read more about Agency Suites

HawkSoft CMS

HawkSoft CMS

HawkSoft is an insurance management solution designed for independent agencies. HawkSoft offers workflows for commercial and personal lines and an auto-documentation process that builds a trail of every client interaction. Ha...Read more about HawkSoft CMS

Partner XE

Partner XE

Partner Platform’s agency management system (Partner XE) is praised by clients for its ease of use, breadth of capabilities, and long-term affordability. Built for the agency that cares about community values and is tired of the s...Read more about Partner XE

Velocity

Velocity

Velocity is a cloud-based agency management system for property and casualty insurance carriers. It helps users handle the needs of general agents, program administrators, wholesalers, carriers, reinsurers and retailers. The core ...Read more about Velocity

1insurer Suite

1insurer Suite

1insurer Suite is a cloud-based and on-premise insurance solution that combines software modules such as policy management, billing, claims management, agent/customer/repairer portals and insurer analytics. Businesses can choose t...Read more about 1insurer Suite

InsuranceEnterprise

InsuranceEnterprise

InsuranceEnterprise by CodeObjects is an integrated insurance solution that can be deployed on-premise or in the cloud. The solution offers four modules, which include policy administration, claims management, ratings and billing....Read more about InsuranceEnterprise

SEI CRM

SEI CRM

SEI CRM is an accounting and insurance system for agents and brokers to manage sales and customer relations. It allows agents to manage their customer base, add and edit client data and maintain client history. The applicatio...Read more about SEI CRM

NetClaim

NetClaim

NetClaim by Navex Global is an online claims management and incident reporting solution for insurance carriers and third-party administrators (TPAs). It allows clients to handle various types of claims, such as workers' compensati...Read more about NetClaim

VCA Software

VCA Software

With a claims engine as its core, VCA Software (formerly known as Virtual Claims Adjuster) is a global SaaS platform focused on improving policyholder satisfaction and retention, while providing a next-generation ecosystem to impr...Read more about VCA Software

FINEOS Claims

FINEOS Claims

FINEOS Claims is a cloud-based solution designed to help businesses of all sizes streamline and manage accident, health and life insurance claims. The centralized dashboard enables employees to automate and optimize the entire cla...Read more about FINEOS Claims

Surefyre

Surefyre

Surefyre is a cloud-based customer relationship management (CRM) solution designed for the needs of insurance agents. It is suitable for multiple types of carriers, including property, casualty, life and health care insurance prov...Read more about Surefyre

BriteCore

BriteCore

BriteCore is a cloud-based insurance solution for personal, commercial, auto and specialty insurance providers. Designed for the needs of small and midsize insurance service providers, it provides support for multi-line, multi-sta...Read more about BriteCore

Applied Epic

Applied Epic

Applied Epic® is an agency management platform that allows agents to manage their business across all roles and locations for both their P&C and Benefits books of business via a single view of the customer with automated capabilit...Read more about Applied Epic

Popular Comparisons

Buyers Guide

Last Updated: November 07, 2023Despite a slew of challenges in recent years—government regulations being constantly in flux, homeownership rates declining—insurance companies continue to survive in an increasingly competitive and complex industry. In some cases, they're even thriving: The global insurance industry is expected to grow 4.5 percent in 2017 and 2018.

Does that mean it's time to be complacent if you're an insurance carrier, agency or brokerage? No way.

Your business won't last long in this day and age without being able to manage a growing policy volume, while still meeting the increasing demands of digital-savvy customers. In a recent report, global consultancy Ernst & Young said having the right technology in place is vital to gaining a competitive advantage in the insurance industry moving forward:

"To meet changing expectations, insurers need to digitize interactions with customers, employees and suppliers. Building new distribution channels and working closely with existing distribution partners to enhance the customer experience is a strategic imperative."

This is why you should consider investing in insurance software—systems designed with the specific needs of insurance carriers, agencies and brokerages in mind.

In this Buyer's Guide, we'll explain what insurance software is, what common functionality to look out for, how much it costs and everything else your insurance business needs to know before making a purchase decision.

Here's what we'll cover:

Benefits of Insurance Software

Common Insurance Software Functionality

How Much Does Insurance Software Cost?

Key Considerations When Purchasing Insurance Software

What Is Insurance Software?

Insurance software is designed to help insurance carriers, agencies or brokerages manage their day-to-day operations. On the administrative side, these systems can help you keep track of policy and claims information, manage your teams and more. There's a client side to this software as well, which allows your customers to log in and do things such as check their policy information, fill out forms and make online payments.

Combining business process management (BPM) and customer relationship management (CRM) functionality, insurance software can act as the digital hub to facilitate all of your company's primary insurance processes.

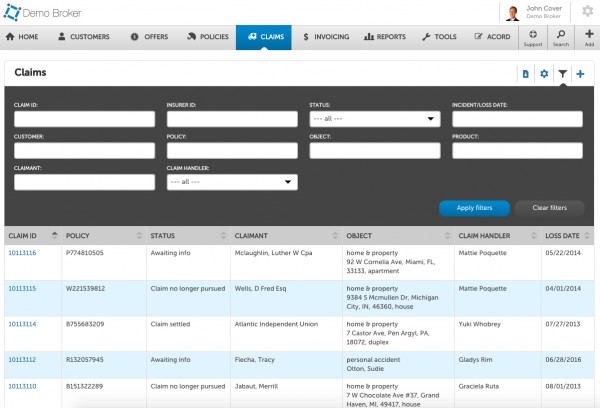

Claims management in Insly

Benefits of Insurance Software

Dedicated insurance software can provide numerous benefits to your insurance company over more manual methods such pen and paper or spreadsheets. With an insurance software system in place, you can expect:

Improved operational efficiency. Being able to house all of your information in one easily searchable database and automate tedious processes related to billing or reporting can save your business a ton of time.

Increased data security. Sensitive customer or carrier information shouldn't be held in easily crackable spreadsheets. Encryption and user authentication capabilities found in insurance software can keep your data safe.

Better regulatory compliance. Staying on top of ever-shifting regulations through manual methods can be an incredible time suck and result in costly errors. Insurance software can automatically highlight any areas that need your attention.

Fewer breakdowns in communication. Features such as task management, automatic notifications and communication tracking can ensure that nothing falls through the cracks working with customers, carriers or otherwise.

The ability to provide superior customer service. Insurance buyers rely on you to provide quick, accurate assessments of their situations, and the ability to perform self-service requests on their own time. Insurance software can allow for this.

Common Insurance Software Functionality

When researching different insurance software systems, you'll find a lot of variance in functionality. Some systems focus on breadth of functionality, acting as comprehensive software suites that can do everything your insurance business needs, while others focus on depth of functionality and being able to do one thing really well.

With that in mind, here is some of the most common functionality you can expect to find:

Create, administer and manage insurance policies for various customers and insurance lines. | |

Manage customer claims information and track the status of claims that are being processed. | |

Billing | Create and send invoices, process insurance payments and manage customer billing information. |

Enter customer information and receive quotes from partnered insurance carriers in real time. | |

Underwriting | Define formal rules for insurance coverage company-wide. Enter prospective client information to determine risk of insuring. |

Analytics and reporting | Analyze trends to discover instances of fraud, risk prevention or revenue opportunity. Generate standardized reports. |

How Much Does Insurance Software Cost?

Another trend you'll notice when researching insurance software is that many vendors aren't completely transparent about pricing on their websites. This happens for a number of reasons—the vendor might be trying to get you on the phone to sell you on their product, or their system might have so many customizable options that the cost varies wildly from customer to customer—but it's frustrating nonetheless.

Most insurance software vendors charge a per-user subscription fee. This means you pay a recurring fee (usually monthly) that changes depending on how many people in your company are using the system. The monthly fee can range from around $30 on the low end to $150+ for more advanced systems.

The license cost isn't the only one to consider either. Vendors may also have recurring support costs or one-time upfront fees for services such as implementation, data migration or training. Be sure to understand all of the various costs, pricing models and payment schedules associated with a specific insurance software system before finalizing the purchase.

Key Considerations When Purchasing Insurance Software

Here are some final key factors you should consider when deciding on the right insurance software system for your carrier, agency or brokerage:

Cloud-based or on-premise? Insurance software deployments are either on-premise (where the software is maintained on company servers) or cloud-based (where the software is maintained on vendor servers and accessed by companies via the internet). There are benefits to each option—on-premise software is more customizable to your needs, while cloud-based software requires fewer IT resources—so weigh your options carefully.

Do you need to integrate? It's likely that your business already has other vital software systems in place, be it CRM software, accounting software or otherwise. Let vendors know which systems you're currently using to ensure a seamless integration between different business processes (e.g., migrating invoice information into the company ledger).

Do you need segment-specific software? Most insurance software vendors can tailor their system to work with multiple insurance segments, be it health, life and annuities (L&A), property and casualty (P&C) or otherwise. That's great news if you want to evaluate a wide variety of options, or if you're a multiline insurance business. If you desire a vendor that specializes in your segment though, they definitely exist. Silvervine, for example, only serves P&C insurance businesses.