Ramp

About Ramp

Awards and Recognition

Ramp Pricing

Ramp is free to use. Reach out to get started today!

Free trial:

Available

Free version:

Available

Other Top Recommended Accounting Software

Most Helpful Reviews for Ramp

1 - 5 of 176 Reviews

Kenny

11 - 50 employees

Used unspecified

OVERALL RATING:

5

Reviewed December 2023

Ramp Review: Ramp Has Been a Game-Changer

Zach

Verified reviewer

Banking, 11-50 employees

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed September 2020

Smooth onboarding and great reporting

We've been really happy with the ease of use and the reporting features, our employees seem to like using it and the cashback is a nice overall win for the team

PROSI love the reporting features and the ability to easily generate cards for employees or vendors. Breaking them down into how the money is spent is really nice

CONSThe physical cards could definitely be a bit nicer ... you'll gain no extra street cred throwing this baby down at a meal with a candidate

Reason for choosing Ramp

See above

Reasons for switching to Ramp

Mostly the accounting integrations and reporting features that Ramp had / Brex lacked

Amanda

Wine and Spirits, 51-200 employees

Used monthly for more than 2 years

OVERALL RATING:

5

EASE OF USE

4

FUNCTIONALITY

5

Reviewed November 2023

Ramp is fun and easy to use!

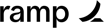

I like how approachable and user-friendly Ramp is. It has a really simple interface and straightforward features. I love Ramp's receipt matching integration with my work Gmail, and I also like how easy it is to text a receipt to Ramp and have it matched. The previous software my company used didn't provide a physical card which was really inconvenient, so I'm glad I can have a physical and/or virtual work card through Ramp.

CONSFrom the perspective of an employee who just uses Ramp for monthly expenses and reimbursements, I don't have much negative feedback.

Reasons for switching to Ramp

I'm not fully aware of the reasons why my company switched from Expensify to Ramp, but I imagine it had to do with the cost of the product and Ramp's ability to supply physical work debit cards.

Abraham

Business Supplies and Equipment, 51-200 employees

Used daily for less than 12 months

OVERALL RATING:

1

EASE OF USE

5

VALUE FOR MONEY

1

CUSTOMER SUPPORT

1

FUNCTIONALITY

5

Reviewed May 2023

Deceptive product representation

Our company was looking to replace our corporate credit card program with a platform that would also offer expense management tracking, and the Ramp sales team presented their product as the prefect solution for that. Nevertheless, what they didn't disclose during the process is that they do not offer credit and you are required to maintain a bank account with 2x cash or else their card will be declines. So if they give you a limit of $500k because your initial bank statement shows a million dollars in cash, they will suddenly slash your limit to $300k if your next bank statement shows only $600 in cash. So the card may stop working at any given time according to the fluctuations of cash flow in your bank account. They have a very good expense management system but it's deceptive for them to represent it as a replacement for a corporate credit card program.

PROSRamp offers a very good expense management software.

CONSRamp does not offer credit, and should not be used to replace your corporate credit cards.

Jason

Logistics and Supply Chain, 51-200 employees

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed November 2023

Game changer!

Ability to audit and approve expenses on the go. Bill pay integration with Xero for fast, easy reconciliation.

CONSNothing so far. Once we set up our internal processes for workflow and auditing it has been smooth sailing.

Reason for choosing Ramp

Price - Ramp's monetization platform to collect off the banking side instead of the consumer side is the best I have seen.