Avoid a Failed Field Service Software Implementation by Learning From Buyers With Experience

When managing a mobile workforce, field service managers often schedule work orders, track equipment details, and manage inventory levels, ensuring technicians have the necessary tools to complete their work orders. Such tasks, when done manually or using software that isn't built specifically for field service, can get tedious and time-consuming.

Investing in a dedicated field service software solution can help curb such issues. However, finding the right software requires knowing your unique requirements, understanding what budget to set, and discovering the most sought-after features in any software.

Each year, Software Advice's advisors speak with thousands of software purchase decision-makers evaluating new field service software for their businesses. We've mined those conversations for insights on other small businesses' budgets, feature needs, and pain points to aid your software search. Our key insights will help you understand buyer pain points and challenges with existing setups, why third-party solutions are insufficient, and finally, find the right software for your business.

Key insights

Software buyers from the field service industry prioritize work order management feature during purchase, while actual users consider scheduling as the top priority in field service software.

Most businesses rely on third-party software or manual methods for their day-to-day field service operations, such as managing and tracking work orders, accounting, and creating and sending invoices.

Switching to field service software is driven by inefficiency, limited functionality, and the lack of user-friendliness.

Heating, ventilation, and air conditioning (HVAC), cleaning, electrical, plumbing, and lawncare are among the top five industries investing in field service software, allocating $93-$126 per user, per month, with an overall buyer average of $97 per user, per month.

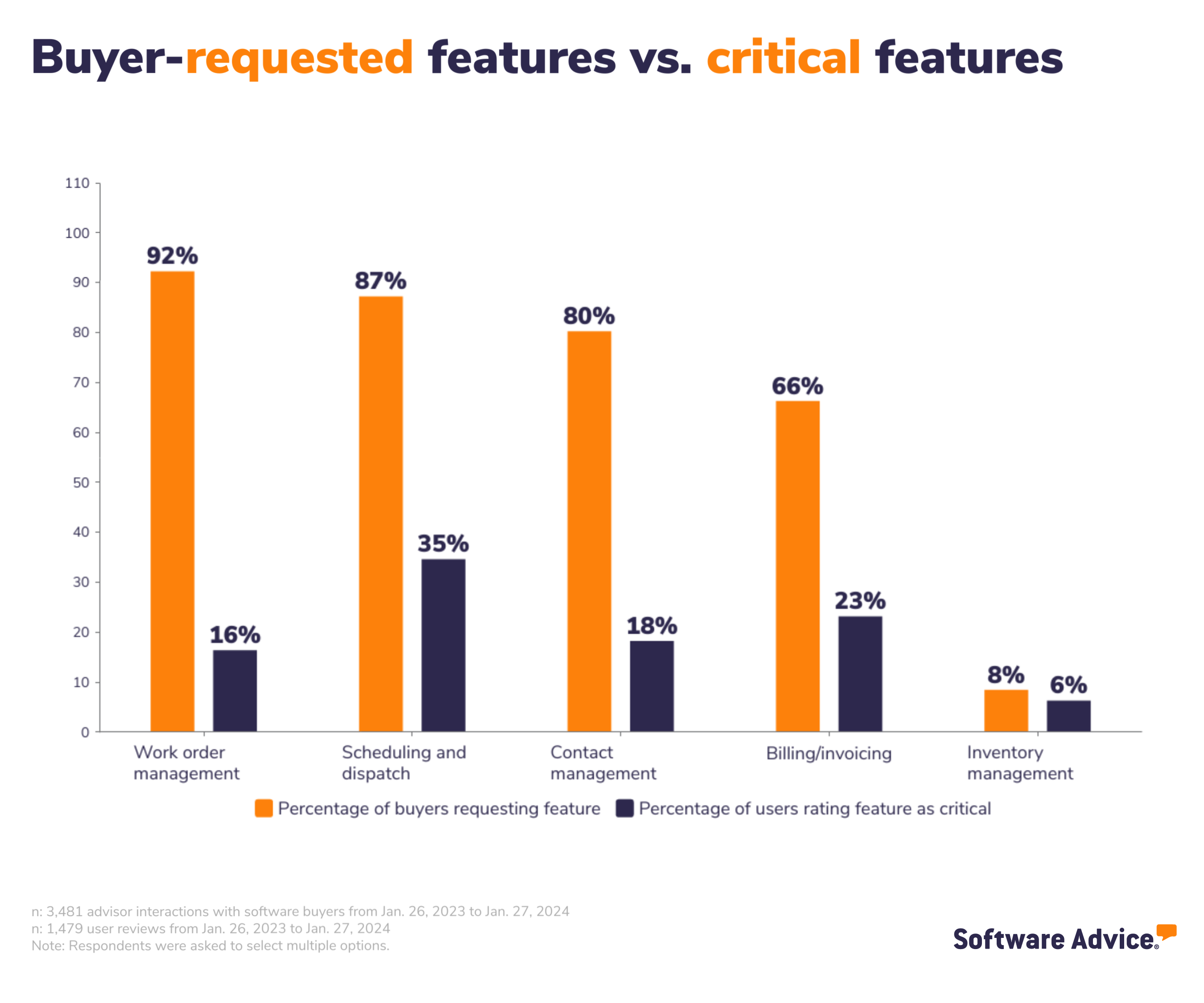

Buyers seek work order management functionality, while users rate scheduling as a critical feature

To gain insights into user preferences, we analyzed thousands of field service software reviews available on Software Advice to identify the features that field service software users consider the most critical for their daily work. Interestingly, our findings revealed a discrepancy between the priorities of field service software buyers and users.

Thirty-five percent of actual field service software users rate scheduling and dispatch as a critical feature. On the other hand, ninety-two percent of field service software buyers prioritize the work order management feature during software purchase.

These findings indicate that businesses already using field service software find immense value in scheduling and dispatch since the feature helps to dynamically schedule appointments based on technician availability and optimizes technician routes to the job site for efficiency. The feature also takes into account factors such as travel time and customer time preferences. This minimizes delays and improves response times.

On the other hand, buyers seeking field service software focus more on work order management functionality during software selection. Work order management allows users to create work orders quickly and efficiently and automate them through a scheduling module. The feature also enables work order customization with relevant details such as customer information, job requirements, and service specifications. It specifies which field service technician is assigned, clarifying responsibilities and accountability.

Pro tip

Look for software with integrated billing and invoicing that automates the generation of invoices based on completed work orders and supports multiple billing methods.

Most businesses rely on third-party software or manual methods for their day-to-day field service operations

When our advisors asked buyers what methods they were currently using to handle their day-to-day field service operations, here's what they found:

Sixty percent of buyers use third-party software such as Google Drive, Samsara GPS tracking, and QuickBooks Online across functions such as scheduling work orders, tracking job locations, and accounting.

Thirty-two percent of buyers use manual methods such as spreadsheets to manage a client database and a pen-and-paper method to create client invoices.

Knowing how complicated and time-consuming field service processes can be, having a dedicated field service platform can help businesses be more efficient with tracking the location and activities of field service technicians, optimizing route planning and scheduling, and facilitating communication between field operators and the head office.

Consolidating functions within a single field service platform eliminates the need to invest in multiple third-party software and manage their licenses, subscriptions, and integrations.

Pro tip

Consider whether the software includes features to optimize travel routes based on GPS data, minimizing travel time and reducing fuel costs.

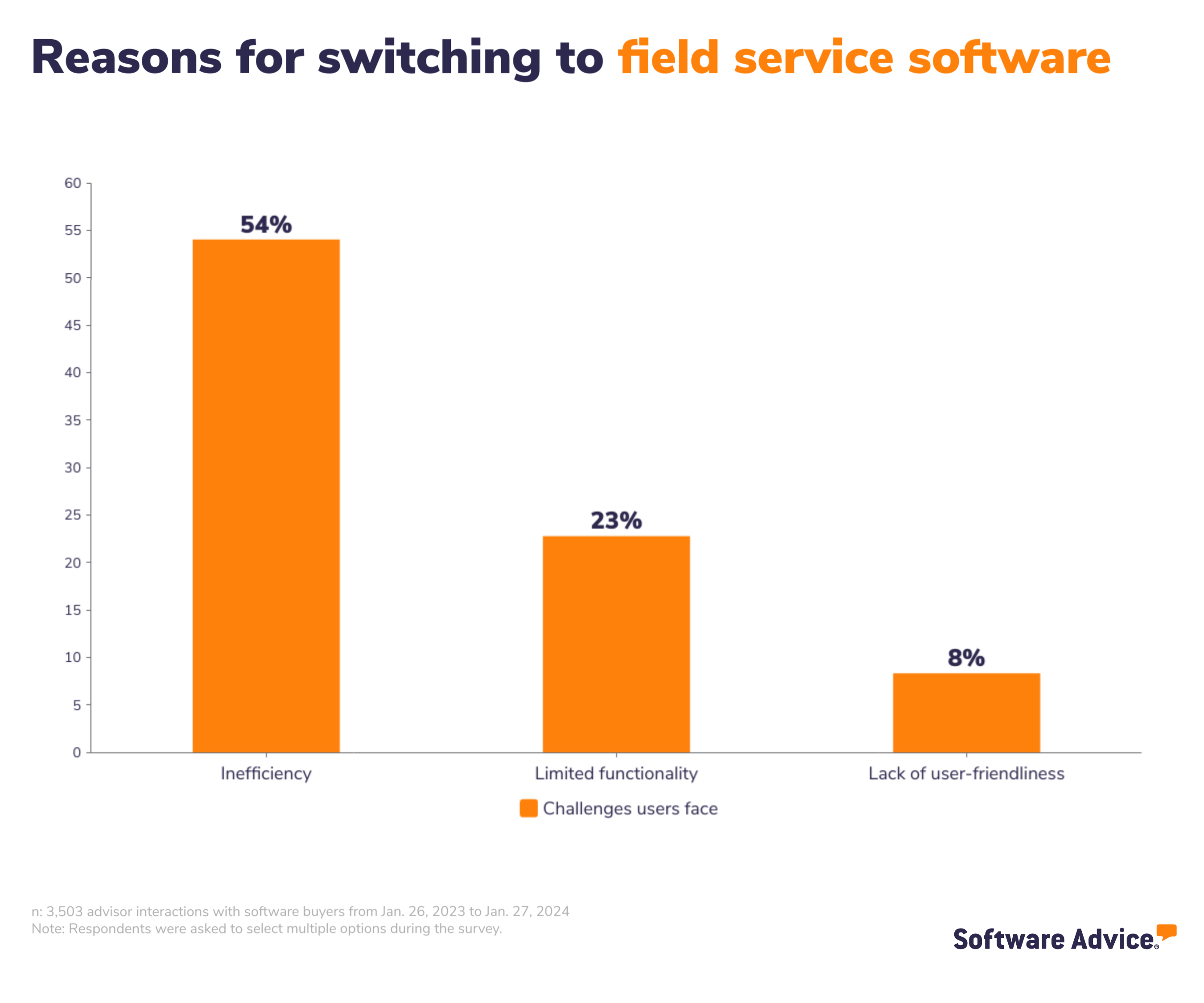

Inefficiencies, limited functionality, and lack of user-friendliness are key drivers of switching to field service software

Our advisors conversed with buyers currently using either manual methods or third-party software and seeking a switch to field service software. These discussions shed light on businesses' real-life challenges with their existing tools. These included inefficiency (54%), limited functionality (23%), and lack of user-friendliness (8%).

Inefficiency: Third-party software and manual methods often aren't efficient enough for various field service operations. For instance, scheduling conflicts are common when manually creating work orders for your team, especially if it's large. Similarly, when creating invoices for work orders, if done manually, can become exhausting for your workforce and provide them no time to optimize scheduling.

Limited functionality: Compatibility issues with third-party software due to limited functionality can also slow down operations. For instance, a third-party GPS tracking system not meant for field service operations won't be able to perform route optimization for technicians efficiently. Additionally, time and attendance tracking can be missing in such software.

Lack of user-friendliness: Most third-party tools lack a simplified dashboard to manage work orders. Additionally, some third-party tools don’t let you break things up into invoice portions with itemization for each job, making it necessary to create multiple invoices for the same customer.

Pro tip

Consider whether the software includes features specific to your industry, such as inventory tracking for HVAC and equipment and asset management modules for electrical, plumbing, or other field service niches.

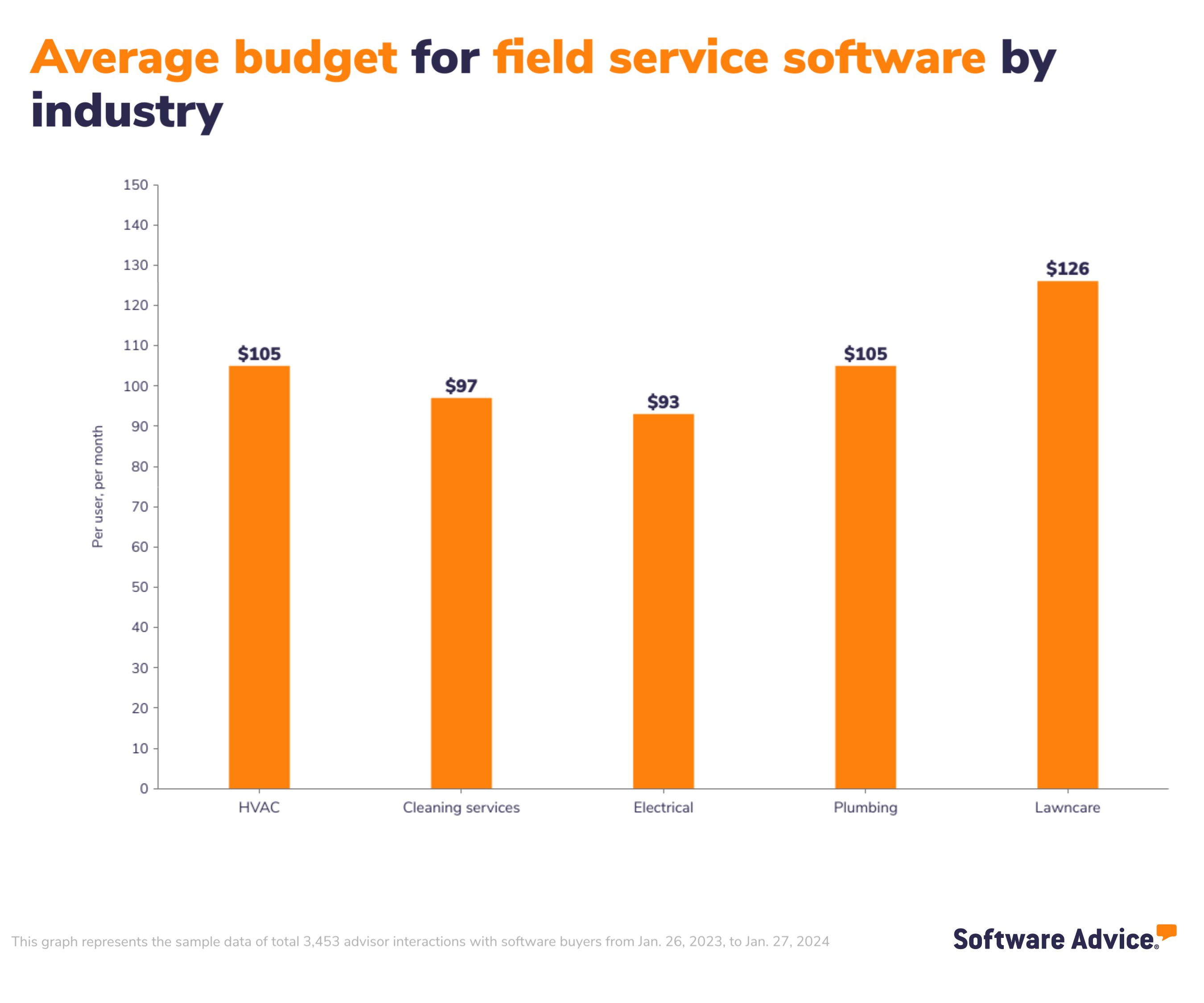

The average buyer’s budget ranges from $93 to $126 per user, per month

The budget for purchasing field service software varies from industry to industry based on factors such as organization size, the number of field technicians, and the required features and functionalities.

However, the average budget across industries for purchasing field service software was approximately $97 per user per month.

The chart below highlights the average buyer budget per user, per month for the top five industries interested in field service software.

Use cases for field service software

HVAC companies use field service software to schedule installations, maintenance, and repair appointments. Dynamic scheduling algorithms help optimize technician routes, reduce travel time, and maximize the number of appointments daily. Technicians receive work orders electronically through field service software’s mobile applications. Work order details include information about the job, required tasks, equipment specifications, and customer details.

Similarly, businesses use field service software to schedule appointments for various cleaning tasks, including regular cleaning for individual and commercial properties and special projects, such as performing extensive cleaning after construction or renovation projects to remove dust, debris, and construction-related materials.

Electricians and plumbers use field service software to document compliance with industry regulations and safety standards. It helps track certifications, inspections, and adherence to safety protocols. Analytics tools within the software provide insights into key performance indicators (KPIs) such as job completion times, resource utilization, and customer satisfaction.

Field technicians in lawn care businesses use field service software to receive job details, update job statuses, and capture before-and-after photos. Supervisors can track the location of field teams in real time and monitor job progress.

Pro tip

Opt for field service software with built-in inventory management capabilities to track and manage stock levels of tools, equipment, and materials. Also, look for features that automate inventory replenishment and provide visibility into stock usage.

Looking for more resources?

Check out our field service software directory to compare hundreds of products, field service software Frontrunners report, and our buyers guide to better understand the market. Click here.

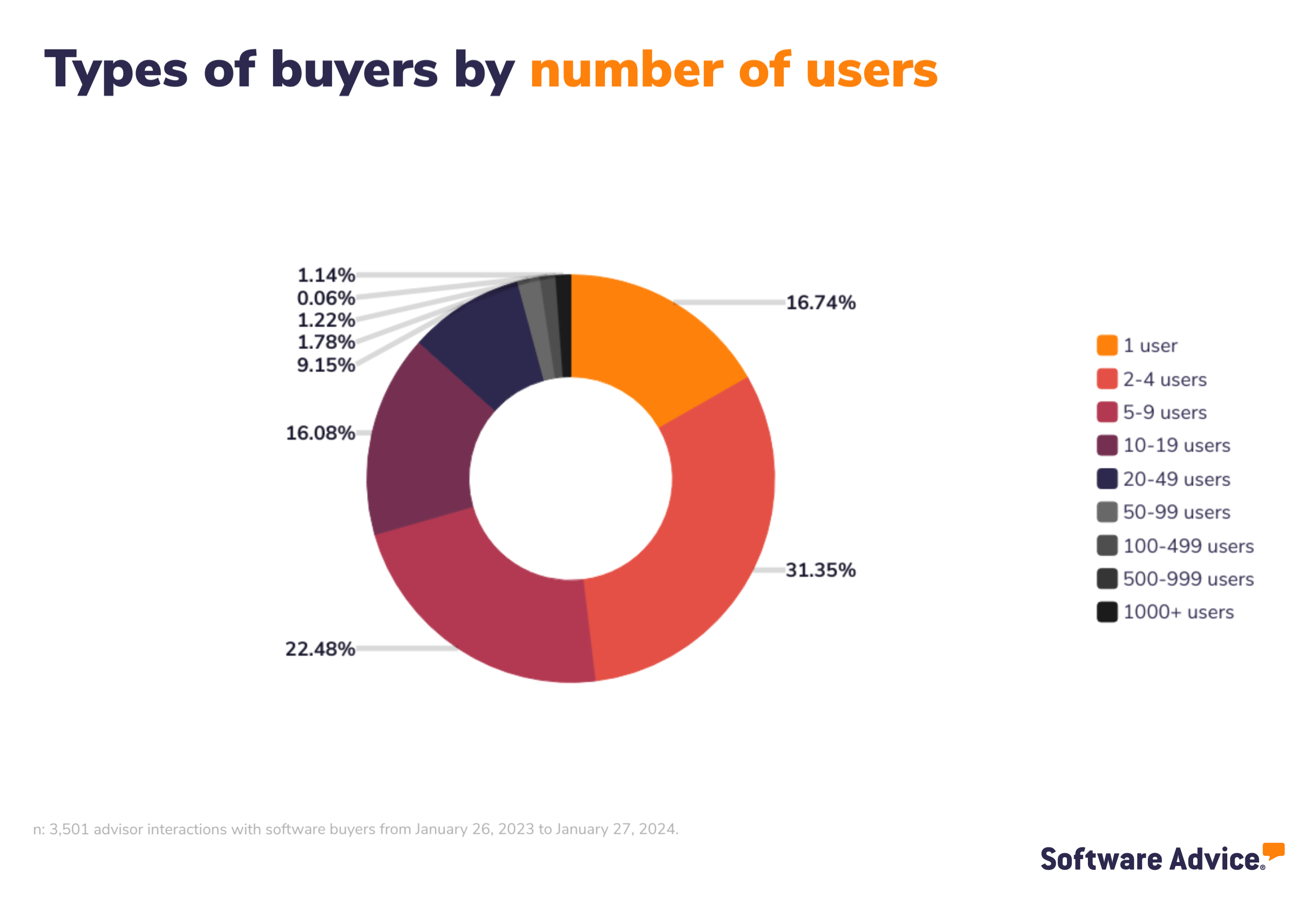

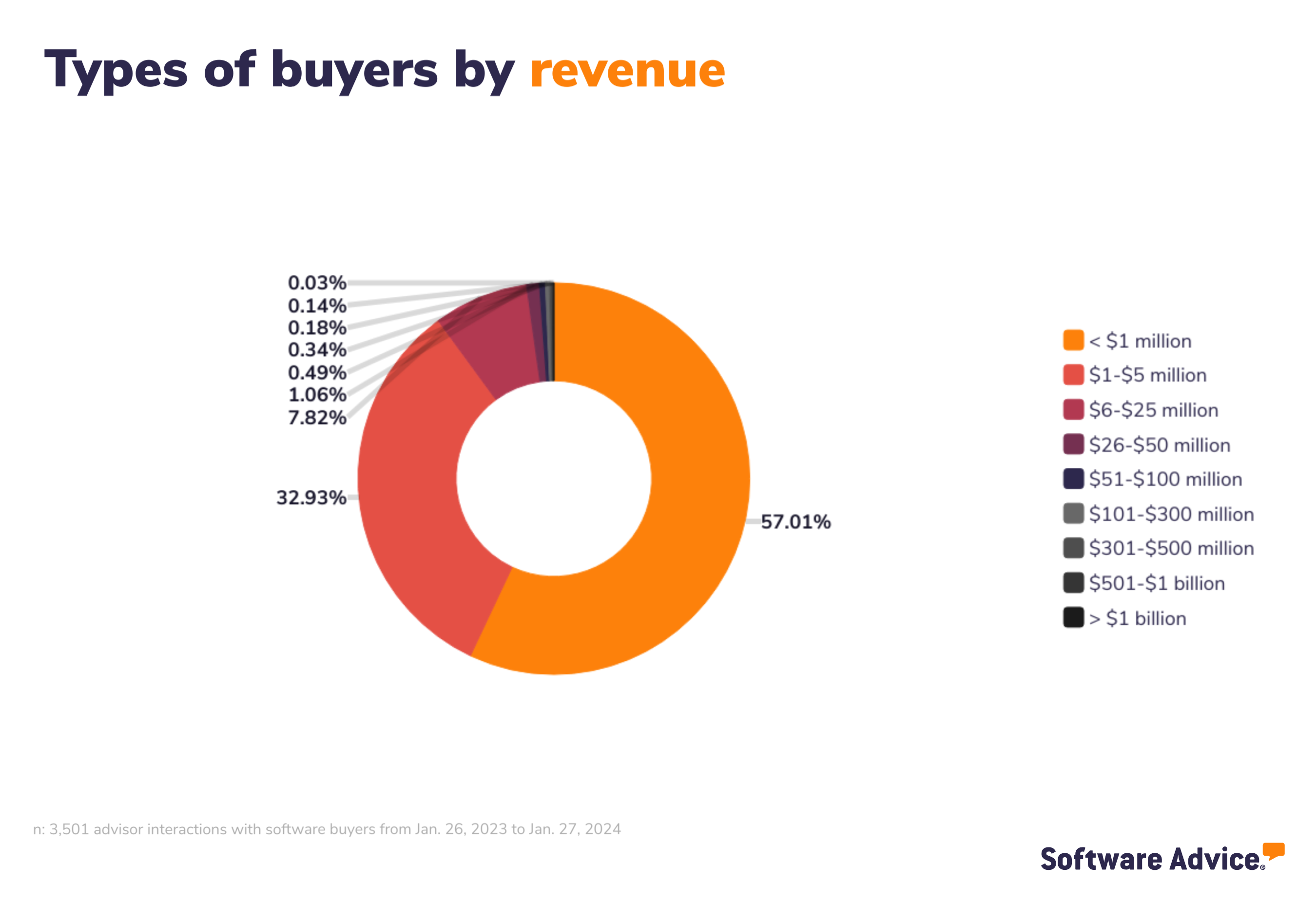

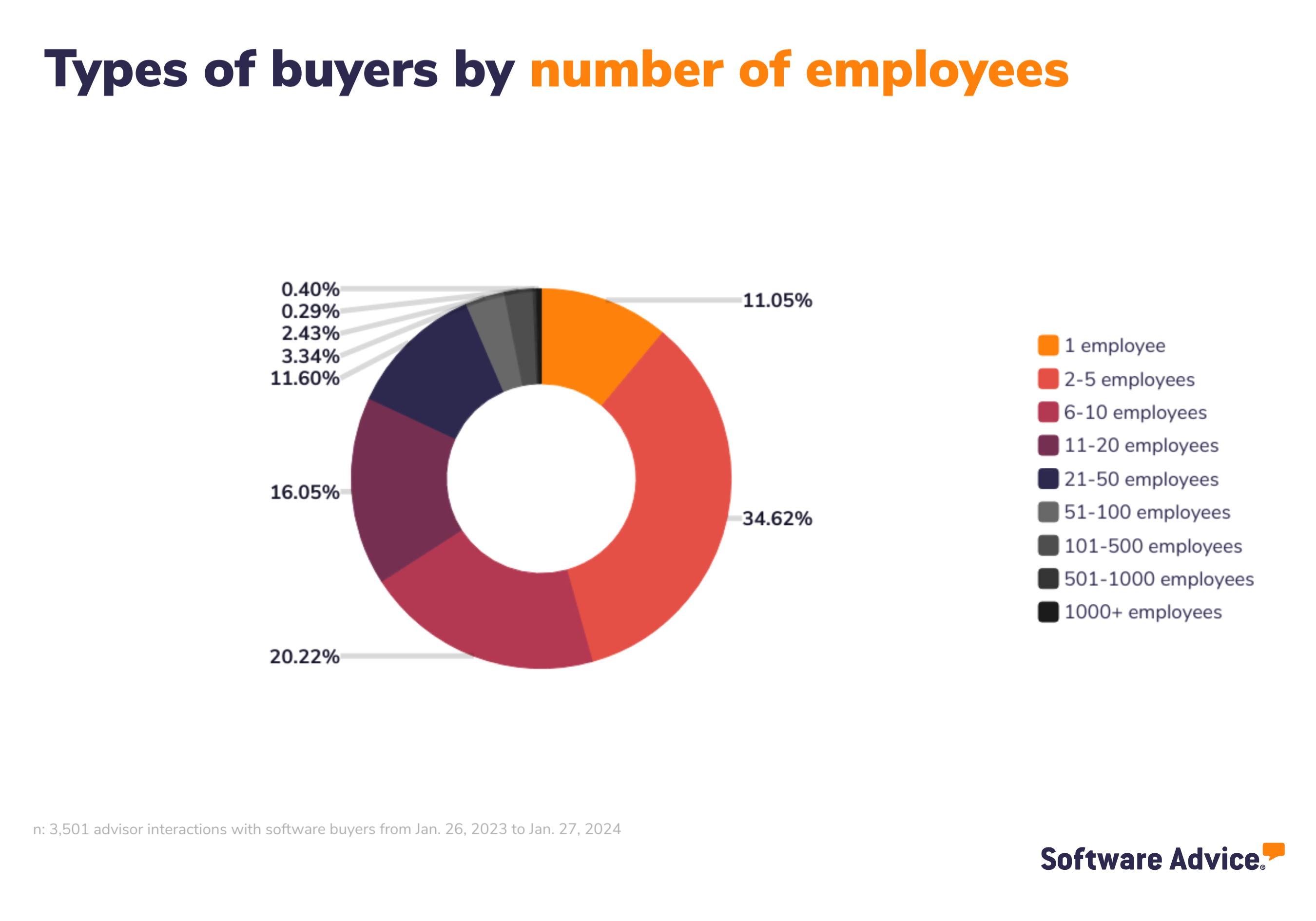

Buyer demographics

The buyers we interacted with are largely small businesses. You’ll find the demographics of the buyers below, so you can see the sizes and types of businesses, from annual revenue to industry.

Methodology

Software buyers analysis methodology

Findings are based on data from conversations that Software Advice’s advisor team has daily with software buyers seeking guidance on purchase decisions. The data used to create this report is based on interactions with small-to-midsize businesses seeking field service software. For this report, we analyzed approximately 3,500+ phone interactions from Jan. 26, 2023, to Jan. 27, 2024.

The findings of this report represent buyers who contacted Software Advice and may not be indicative of the market as a whole. Data points are rounded to the nearest whole number.