Pro Forma vs. Commercial Invoice: An International Trade Guide for SMBs

Small-business owners new to global trade may use pro forma and commercial invoices interchangeably, but these documents don’t serve the same purpose. Misunderstanding the two invoices can lead to errors in customs paperwork, delays in shipment, delivery of incorrect goods, and unexpected costs in clearances.

We spoke with Jessica Thompson, [1] a trader with over a decade of experience in import and export; and Kevin Zimmermann, [2] a global sourcing and importing expert to understand the differences between pro forma and commercial invoices and the roles each plays.

Jessica Thompson

Founder and CEO, YOGO

Kevin Zimmermann

Owner, eBrandary

What is a pro forma invoice?

A pro forma invoice is a preliminary bill of sale issued by a seller to a buyer before the goods or services are produced or delivered. It declares the seller’s commitment to provide the goods or services as per agreed-upon terms. This type of invoice is typically issued after extensive negotiations on product specifications, delivery timelines, pricing, etc.

A pro forma invoice formally outlines the expectations between the buyer and supplier. It forms the basis for a commercial invoice by including a detailed description of the products, the agreed price, shipping details, and commercial terms such as payment methods and due dates.

We asked our guest experts if businesses should conduct international trade without a pro forma invoice, and the unanimous answer was no. Thompson emphasizes that businesses shouldn’t do an international transaction without a proforma invoice as later on, it becomes their export invoice.

Jessica Thompson

What is a commercial invoice?

In international trade, a commercial invoice is mainly used for clearing customs—i.e., the government department responsible for controlling the flow of goods in and out of the country. It’s necessary for any international shipment, be it import or export. Customs officials use it to assess applicable taxes and duties.

Once the goods are produced, packed, and ready to load, the seller issues a commercial invoice. This invoice is the final bill the seller gives, and it contains all details of the sale. Thompson says, “It should match the pro forma invoice with the exception of any quantity adjustments if a quantity tolerance is mentioned in the pro forma.”

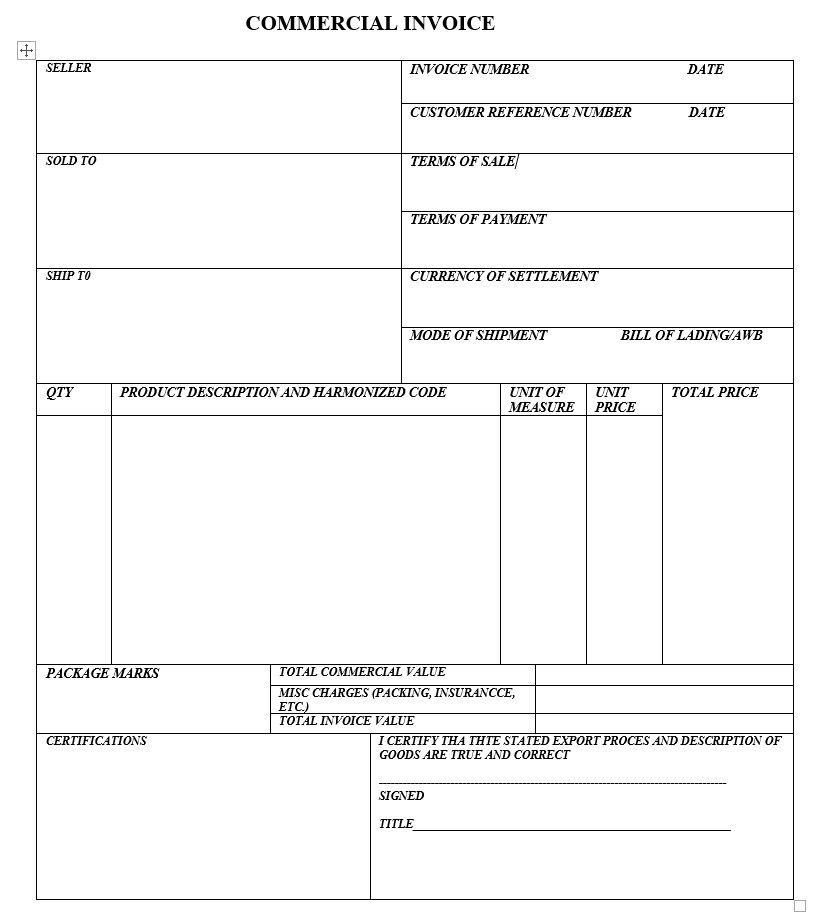

Zimmermann points out, “Commercial invoices may not be 100% identical from one factory to another, but they all generally contain the same information.” This information typically includes:

Exporter information: The name and address of the business or individual shipping the goods.

Importer or consignee information: Details of the business or individual receiving the goods.

Invoice number: The unique identifier of the invoice.

Invoice date: The date when the invoice was created.

Product description: A detailed description of the goods being shipped, including their quantity and weight.

Price: The cost of the goods, usually itemized per unit and with a total cost at the end.

Terms of sale: All agreed-upon terms related to the sale, including the payment terms and delivery date.

Shipping and handling costs: Any costs associated with transporting the goods.

Country of origin: The country where the goods were produced or manufactured.

Signature: The sign and stamp of the exporter is mandatory.

Harmonized System (HS) codes: Standardized international codes for different products that are used to calculate the duty to be paid.

A sample commercial invoice shared by Zimmermann [2]

What is a pro forma invoice used for?

These invoices are used for the following purposes:

Arranging finance: A pro forma invoice is useful when a buyer wants to open a letter of credit to purchase goods or arrange the transfer of substantial funds.

Applying for import licenses or permits: In countries where local industries are protected by import quotas on specific goods, buyers may use a pro forma invoice to get an import permit.

Preventing misunderstandings: A pro forma invoice ensures both parties are on the same page before production begins. Zimmermann experienced this firsthand when the price on his pro forma invoice was higher than the agreed-upon price due to a misunderstanding on the packaging material. Having the provision of a pro forma helped Zimmermann draw that discrepancy early.

Clearing shipments: Freight forwarders—intermediaries who manage the shipment of large quantities of goods—may use the proforma invoice to begin necessary paperwork and book transportation.

If, for some reason, the commercial invoice is delayed or unavailable, businesses can use a pro forma invoice to import a product legally, provided all the mandatory data elements are included in the invoice. That said, a commercial invoice will need to be produced upon the request of customs and border protection (CBP), if goods have been sold.

What is a commercial invoice used for?

Commercial invoices serve various purposes, including:

Sending and receiving goods: When shipping products to or from another country, local customs authorities need a commercial invoice to clear the shipment and calculate taxes or duties. The document also confirms who’s responsible for paying the taxes.

Maintaining accurate records: A commercial invoice is a formal record of what is sold, to whom, and for how much. It helps maintain accurate records for accounting and taxation purposes. This is important, says Thompson, because the final quantity manufactured may differ from what’s mentioned on the pro forma invoice.

Resolving disputes: If there’s a disagreement about a sale or shipment (with regulatory authorities or between the seller and buyer), a commercial invoice helps resolve the issue by serving as a legal document that confirms the details of the goods sold, their prices, and the parties involved.

Facilitating transportation: A commercial invoice is used to provide freight carriers with details about the shipment, which is required for transporting goods across borders.

Supporting insurance claims: In case of damage or loss of goods during transit, a commercial invoice can be used to file insurance claims and prove the value of items on board.

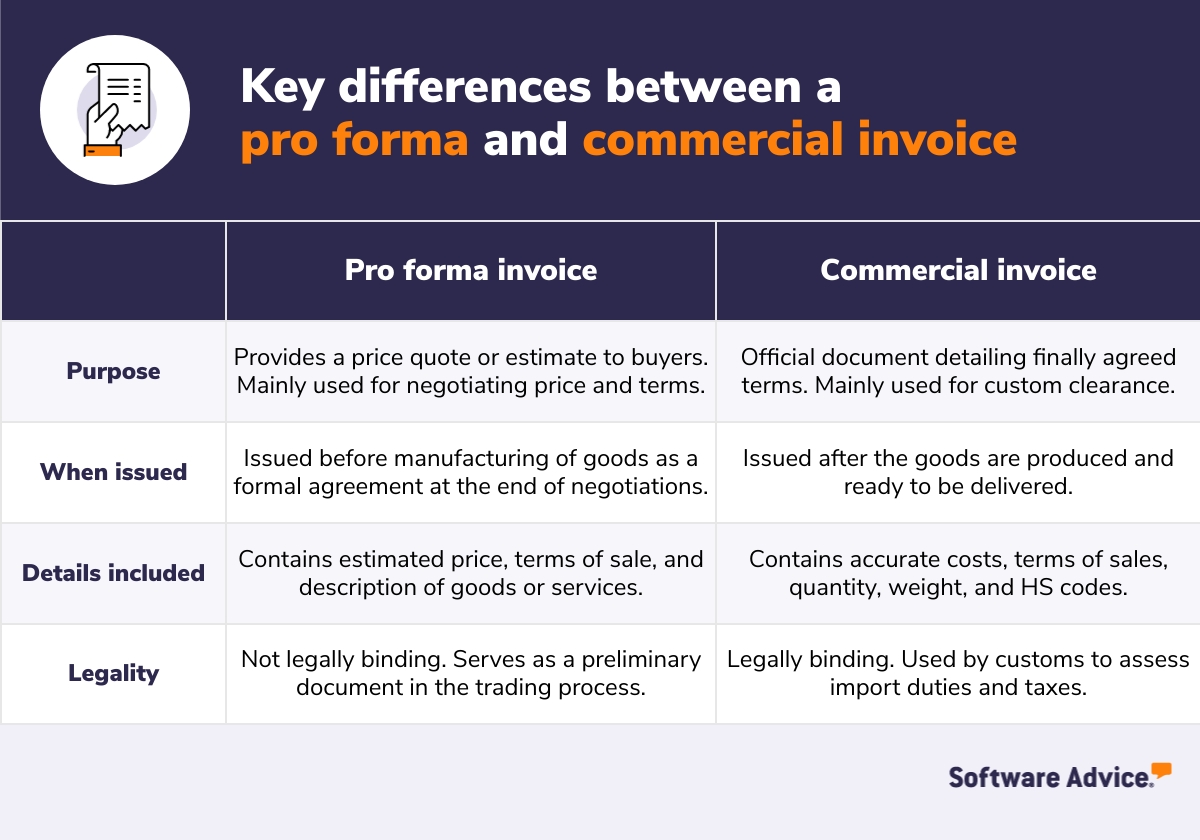

Pro forma invoice vs. commercial invoice: Similar, yet different

To summarize, while similar in appearance, proforma and commercial invoices play different roles in the international trading process.

Software spotlight

Use invoicing software to create proforma and commercial invoices for your international shipments. The software automates the invoice filling process, reducing manual data entry errors that could impact customs clearance. You can also customize the invoice template to include your company’s logo, client details, payment terms, and other key details. Most of these tools also integrate with your accounting and customer relationship management software to streamline these processes and centralize data for multiple tools into a single platform.

De-risk trade relations with pro forma and commercial invoices

Mastering international trade often comes down to managing risk and uncertainty. You could worry about various things: paying for goods that are yet to arrive, items getting stuck at customs, or products losing their quality during transit.

Preparing these invoices properly and maintaining a good relationship with the seller/buyer can help de-risk this process. As Thompson states, “The secret to doing well in international trade is getting to know and understand the people you're working with. Regularly talk to your supplier or buyer, and be sure to conduct detailed inspections, either by yourself or by a third-party inspector, to ensure everything is on track. In a good relationship, they are just as invested as you are in ensuring things go smoothly.”