Tech Answers: What’s a Good NPS Score?

In our Tech Answers series, we pore through search engines, social media and online communities to find three burning software questions that need definitive answers.

If a business has ever asked for your opinion, there’s a good chance they asked for it like this:

That is the classic Net Promoter Score (NPS) question and it’s one of the most popular and powerful ways of measuring customer satisfaction. Introduced by Frederick Reichheld in a 2003 article titled The One Number You Need to Grow, NPS has gained great popularity for both its simplicity and its predictive power.

The article was the culmination of a multi-year study in which Reichheld’s team looked for correlations between old customer satisfaction survey results and company growth.

What they learned is that of the immense variety of satisfaction metrics, surveys and question types, NPS is the strongest predictor of a company’s future success. If you want to know which company in XYZ industry will be growing fastest next quarter, just see which company has the highest NPS this quarter.

Despite its simplicity, questions about NPS abound.

In this Tech Answers, we highlight three common questions about NPS and provide actionable answers any small to midsize business (SMB) can follow.

Here’s what we’ll cover:

Q3: What Are Good Sources for NPS Benchmarks?

How to Leverage NPS at Your SMB

Q1: How Do You Calculate NPS?

ANSWER:

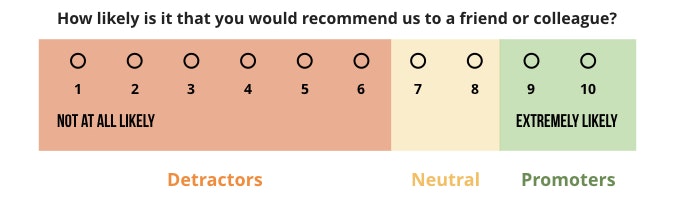

NPS scores are calculated by subtracting the total number of “detractors” from the total number of “promoters.”

Calculating NPS is simple. The 1 to 10 scale is broken into three sections and each response is categorized as either a detractor, a promoter or a neutral party depending on where it falls:

To arrive at the final score, simply subtract the percentage of detractors—those who marked 1 to 6 on the survey— from the percentage of promoters—those who marked 9 or 10. (The neutral scores are ignored.)

Here’s the formula:

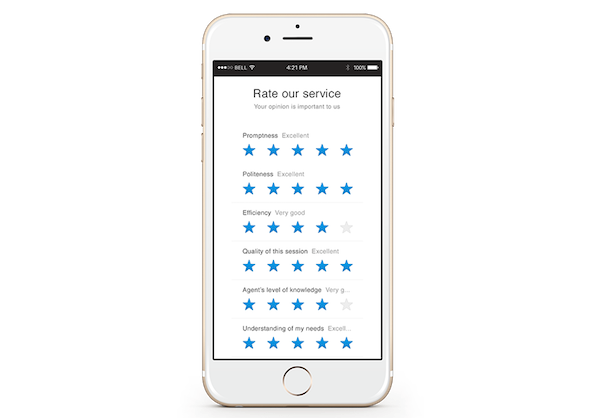

Now that you know how the score is calculated from the data, you might be asking: So how do we actually collect the data? That, too, is easy! Many SMB customer service platforms include survey tools for exactly this purpose.

There are also tools for adding NPS and other surveys to your website. Some live chat applications can be set to offer an NPS survey to customers at the conclusion of the chat.

Simple survey tool in Whisbi’s service and support platform could easily be adapted to measure NPS

It’s important to remember that survey results can be greatly influenced by the timing of the survey question. While it’s difficult to give advice that will work in all cases, you should keep these guidelines in mind:

The value of NPS scores comes from an SMB’s ability to compare them over time, so it’s best to avoid frequent changes to the wording or timing of the question. For the most accurate analysis, you want to eliminate variables, not create new ones.

The timing of the NPS survey question can be very important. First, it should be timed carefully to the customer journey. Don’t solicit NPS responses from customers who don’t have much experience with the company.

The timing should also be considered with regards to the company’s product roadmap. Don’t try to gather responses immediately after rolling out a new product or service, especially if the roll-out could be a little bumpy.

Depending on the nature of your small or midsize business, you might find that NPS information can only be gathered by integrating a third-party solution into software you already use.

Q2: What’s a Good NPS Score?

ANSWER:

NPS scores vary widely by industry and business model and should be considered good or bad only relative to direct market competitors.

While we can’t say exactly what a good NPS score for your company is, we can help motivate you to determine one by sharing the following stat, from the creators of the NPS methodology:

“Though the scores themselves varied widely by industry, Net Promoter leaders on average grew at more than twice the rate of competitors.”

So there’s no such thing as a universal “good score.” Instead, businesses should seek to become NPS leaders within their market and among their competitors.

With that in mind, there are certain qualities that can help a company derive the most benefit from its NPS initiative. NPS scores should be:

Accurate

A good NPS score is an accurate NPS score. It’s one that represents the opinion of the average customer at multiple points along the customer journey.

Generally, companies expect their NPS to improve over time. But this is complicated by the fact that, from the customer’s perspective, any particular company’s NPS score is relative to its competition. Your company’s NPS could go down as newer better competitors enter the market. Without accurate historical NPS scores, your business could miss out on this important indicator.

Reliable

A good NPS score is one your company can rely on, and that’s why the methodological points in Q1 are so important. Flaws with survey design (like those related to timing, discussed above) or inconsistent deployment will yield erratic, unreliable results.

When the results are unreliable then two things might happen. Best case scenario is the company scraps its existing survey method in favor of one that yields consistent, reliable results. The worst case scenario happens when SMBs make changes to address a failing NPS despite having reservations about its accuracy. These companies are essentially rolling the dice.

Reasonable

Lastly, it pays to have staff gut check any NPS surprises. Scores should be generally in-line with what the company knows about its typical customer interactions or customer journeys. When used internally, NPS should be in the same ballpark as the buzz around the office watercooler.

Hang on … NPS can be used internally? That’s right! Thanks to its success in customer-facing scenarios, some companies have begun using NPS to measure employee satisfaction as well. For example, some IT service departments now use NPS to gauge the quality of service provided to other departments.

One member of the Gartner Connect community shared his experience (available to Gartner clients) after implementing NPS in in an internal context:

“Initial results (based on early data) show a very low NPS Score near -50. Instead of being disappointed I am very satisfied with the qualified comments which accompany the survey, by the shift of responses from hardcore fans to hardcore naysayers, and by the establishment of a baseline which better reflects ‘coffee machine talk.’

By aligning survey results to buzz we have a better basis for dialogue with the larger mass of less than perfectly satisfied users and influencers.”

Q3: What Are Good Sources for NPS Benchmarks?

ANSWER:

Companies can benchmark to their own historical NPS data, use an NPS benchmarking survey addendum or pay for third-party benchmarks.

If you read the answers to the first two questions, then you already know the value of using historical NPS data to gauge how good or bad a current NPS is. Historical NPS data is the most readily available and cheapest NPS benchmark for most companies.

Historical benchmarks aside, there’s another category called competitive benchmarking and this is what most businesses have in mind when looking for benchmarks. Competitive benchmarking is used to gauge performance within a specific market segment ot relative to a company’s competitors.

A handful of companies provide detailed industry-specific NPS benchmark reports:

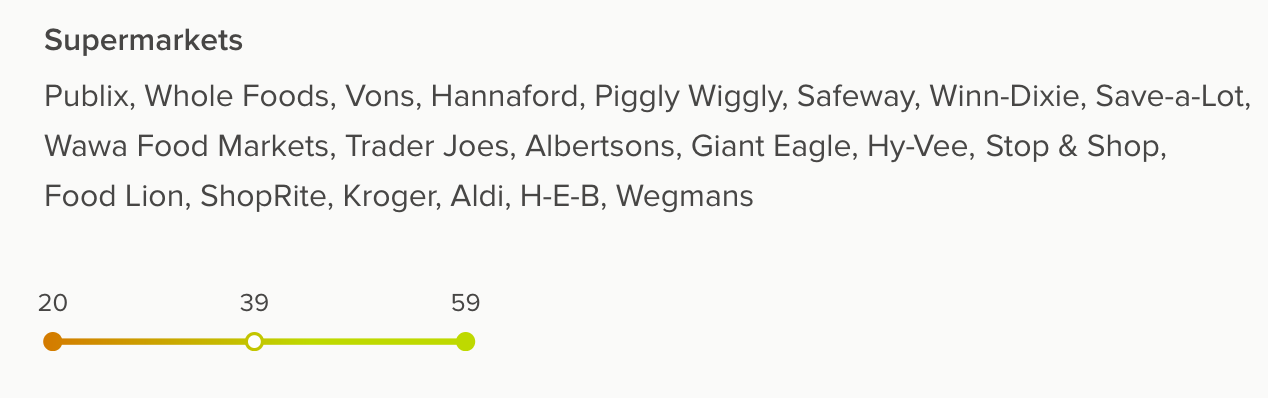

Delighted.com has a basic free online tool for quickly checking your company’s score against an industry benchmark. The example below shows an NPS benchmark for supermarkets. Twenty is considered a low score, 39 average and 59 high.

An industry benchmark for supermarkets, provided by Delighted.com

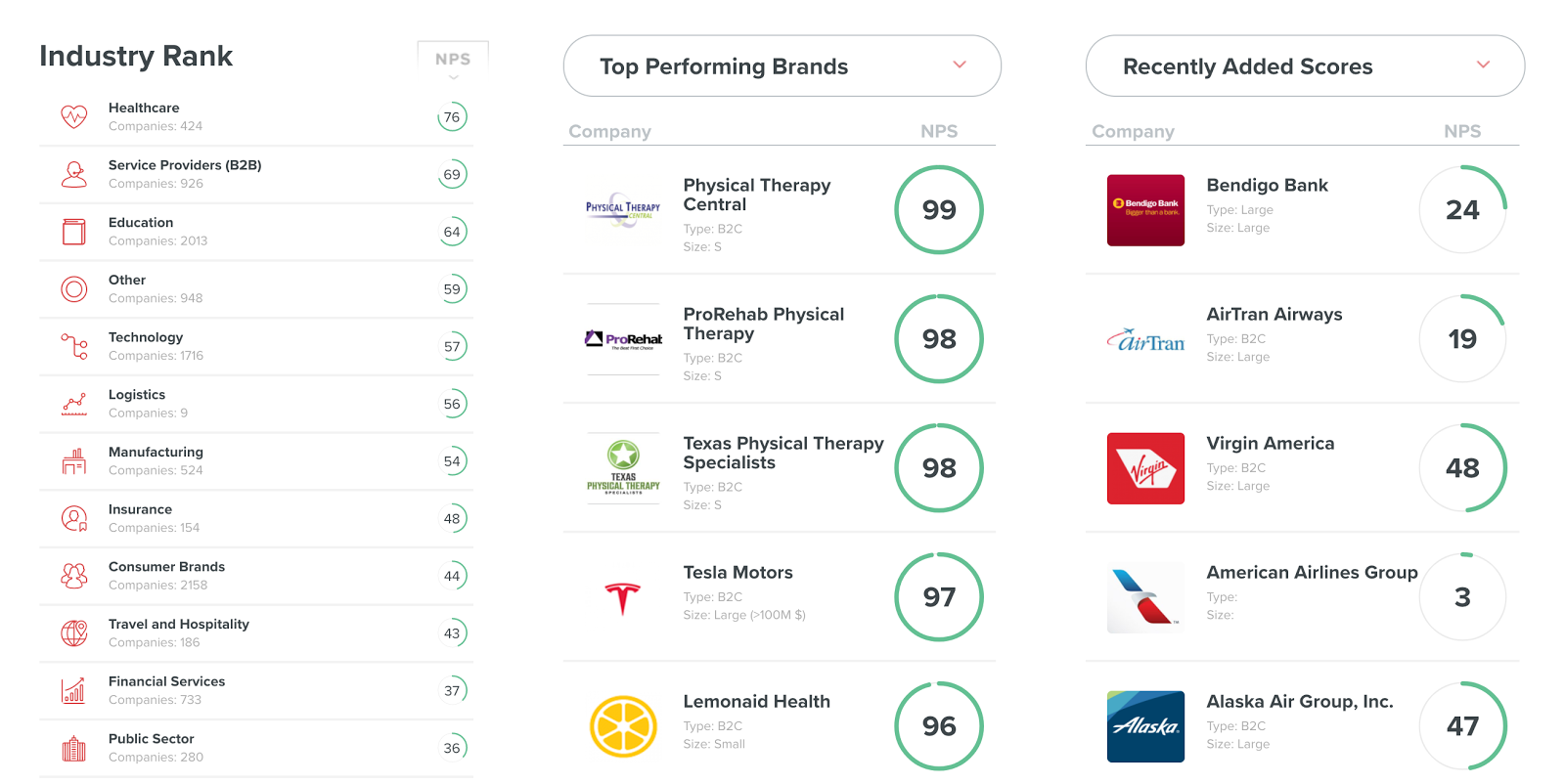

NPSbenchmarks.com shows average benchmarks per industry and includes recently added scores and scores for individual brands:

Example NPS benchmark data from NPSbenchmarks.com

Remember, NPS surveys are designed to be simple and fast for customers to complete. In other words, they’re not much of a burden. Your SMB can use this fact to its advantage by occasionally doubling the length of the survey with a benchmarking NPS survey addendum.

To do this, simply add a second question to the NPS survey, something along the lines of:

“If we are not your favorite or primary business (or partner, supplier etc.) then who is? Why would you recommend them over us?”

This free-form question can help provide valuable context for evaluating your company’s NPS relative to its competition.

How to Leverage NPS at Your SMB

NPS is one of the most popular and powerful metrics around. It greatly simplifies the process of collecting feedback (by asking only a single question)—yet research has shown it’s also one of the most highly instructive and reliable of KPIs. Consider these best practices when implementing or improving your company’s NPS initiative:

Carefully select the touchpoint at which the NPS survey will be given, as this can greatly impact results.

Consider adding a follow-up to the NPS question that’s given selectively to respondents who give low scores.

Don’t set a fixed NPS target or goal. Instead, aim for continuous improvement over time.

Historical comparisons aside, your company’s NPS score is only good or bad relative to your competitors scores, so pay attention to those whenever possible.