Cash Burn Rate: Are You Burning Money Faster Than You Earn?

Starting a business can burn funds quickly, especially for young companies. Careful planning and smart choices are key in these early, spending-heavy years. A recent survey by Software Advice reveals that 30% of small businesses expect their current funding to sustain them for the next three to six months, while over a third see their resources stretching up to a year.*

Keeping a close eye on cash consumption (or cash burn) allows young businesses to maintain steady growth without running out of capital in the process. Compared with the various financial metrics small businesses track, burn rate helps understand the impact of the money they spend today on their future survival.

With insights from Gartner research [1] and Craig Suyeishi [2], a California-based investor turned entrepreneur, we delve deeper into this critical business health indicator and explore how it supports long-term growth for new businesses.

Craig Suyeishi

Founder, Live Locl

What is burn rate?

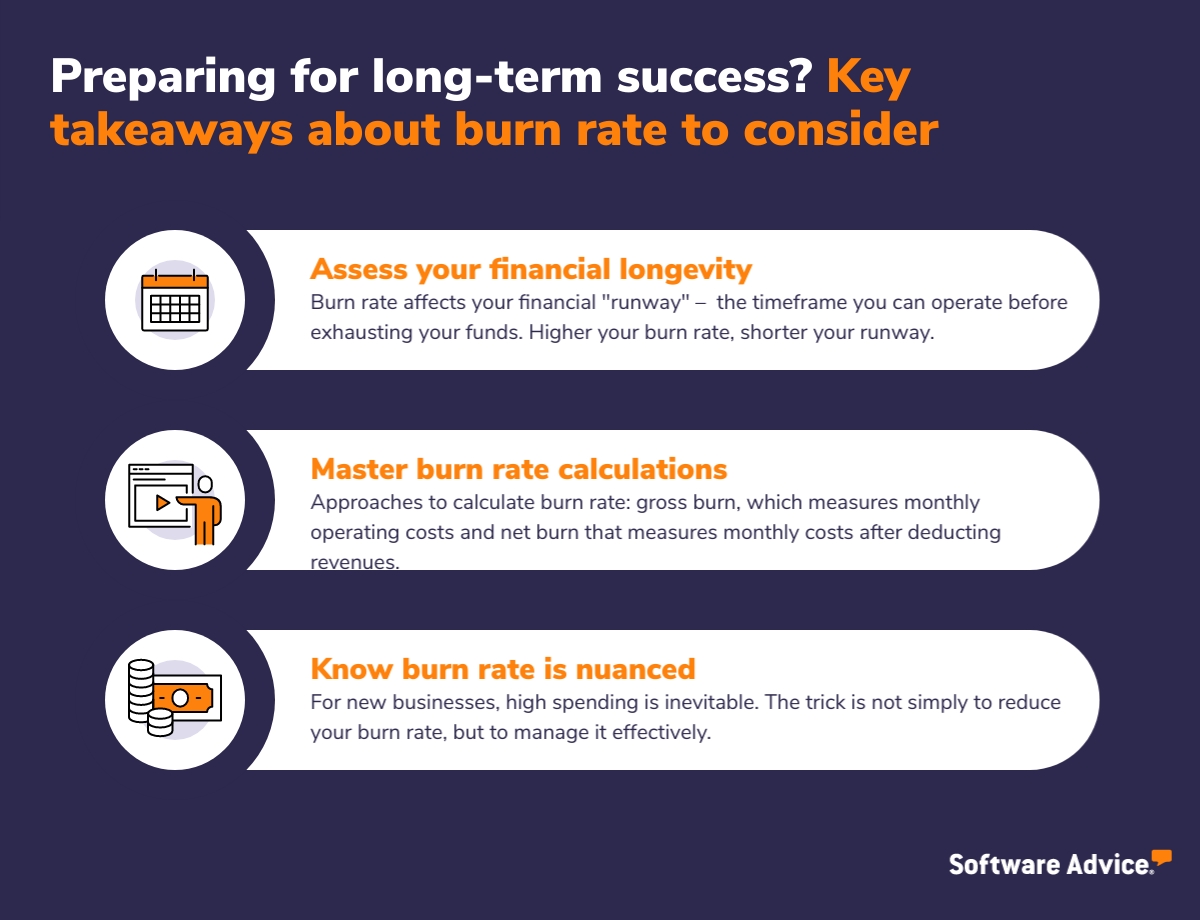

Burn rate is the speed at which your startup spends money to finance operations and growth—such as salaries, rent, and tech subscriptions—usually measured monthly. Combined with your cash reserves (including investment from venture capital firms), it gives your business's runway (also called "zero cash date")—i.e., the length of time you'll be able to operate on your current burn rate without running out of money.

Monthly cash burn rate (%) = Monthly spending ÷ Total cash reserve x 100

In Suyeishi's experience, burn rate is much more than a metric—it's a way to instill trust in financial backers and potential investors. "An unexplained increase in burn rate signals a lack of financial savviness. It shows investors that owners don't understand the costs and expenses that go into building out a business," he says.

Example of burn rate calculation

Company A spends an average of $80,000 every month from its $200,000 cash reserves, while its competitor, company B, spends $50,000 from its $100,000 cash reserves.

In absolute terms, company A is spending more than company B ($80,000 vs. $50,000), but relative to their cash reserves, company A has a lower burn rate and more cash runway than company B.

Cash burn rate (%) = Monthly spending ÷ Total cash reserve x 100

For company A, burn rate = 40%

For company B, burn rate = 50%

Runway = Total cash reserve ÷ Cash burned every month

For company A, runway = 2.5 months

For company B, runway = 2 months

This means company A spends less (40% of its reserves) than its competitor company B (50% of its reserves) and has more time to continue operating.

Why is it important to measure burn rate?

Understanding how much money your business spends affects when and how much profit you can make. It also influences how long your company can last without bringing in new investments or income.

Suyeishi explains why that's particularly important for new businesses: "Larger companies might not worry about burn rate, as they aren't cash flow negative (spending more than they earn). However, small businesses and startups typically consume from their cash reserves before becoming profitable. Therefore, keeping tabs on how much you spend each month helps avoid major problems."

Here are other reasons to monitor burn rate:

Understand your business's lifespan: Burn rate provides visibility into your company's financial runway, helping you understand how long your current funds will last. This number serves as a forcing reminder to set and achieve specific goals, such as profit margin and customer acquisition, within a given timeframe.

Attract potential investors: Burn rate is one of the most basic metrics investors check to decide whether they should provide funds. A healthy burn rate makes your business more attractive to venture capitalists and angel investors.

Maximize usage of current funds: Regularly tracking your burn rate provides more flexibility and strategic options to plan operations based on current funding. It helps you be proactive rather than reactive in resource allocation, allowing you to sustain operations during lean periods and capitalize on opportunities when they arise.

Secure new funding: Monitoring burn rate lets you identify when it's time to seek additional funding and prepare for the process. Suyeishi advises starting this process ideally at least six months before your cash reserves are projected to run out.

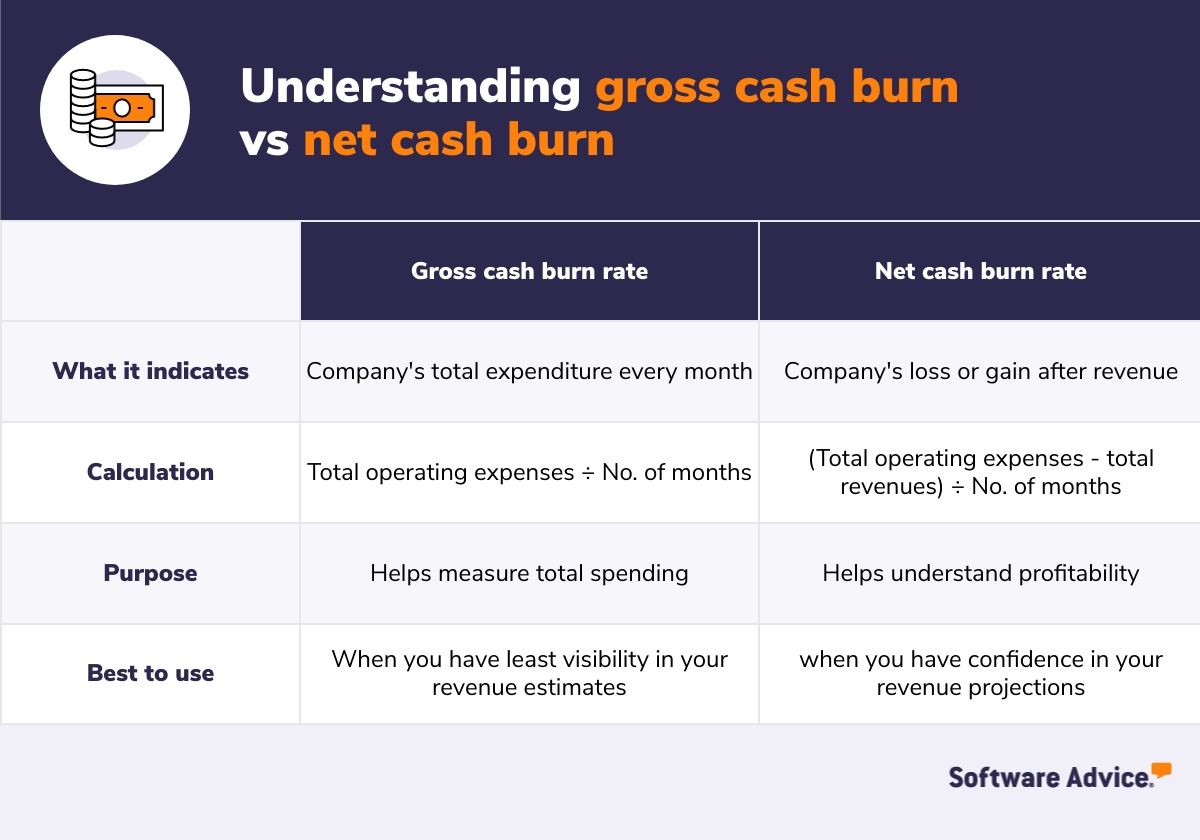

What are the types of cash burn rate?

We can further understand cash burn rate by classifying it into two types:

Gross burn rate

Gross burn rate measures the total amount of money you spend every month without considering the revenue you generate. It's best used when you have little visibility or confidence in your revenue estimates [1], as it doesn't consider the income generated from sales.

Gross burn rate = Total annual operating expenses ÷ No. of months

Runway without revenue = Cash reserve ÷ Gross burn rate per month

For example, if your company has $100,000 in cash reserve, spends $10,000 per month, and earns $14,000 per month in revenue, your monthly gross burn is $10,000, and you can operate without running out of money for 10 months.

When to use?

Use gross burn rate if you're an early-stage company that has not yet achieved product-market fit* and are still figuring out your main product or service. This metric helps account for delayed payments from customers or slow sales that may otherwise increase your net burn rate.

*Product-market fit involves knowing whether your product or service is something your target market wants. If you're selling a product and no one's buying it, even after adjusting the price, you don't have a marketable product or product-market fit.

Net burn rate

Net burn rate measures the total amount of money you spend each month after you've added your revenue. It's best used when you've confidence in your revenue projections, [1] as sales income is a major part of net burn rate calculation.

Net burn = (Total annual revenue ‐ Total annual operating expenses) ÷ No. of months

Runway with revenue = Cash reserve ÷ Net burn rate per month

For example, if your company has $100,000 in cash, spends $10,000 per month, and earns $14,000 per month in revenue, your monthly net burn is $4,000 and you can operate without running out of money for 25 months.

When to use?

Use net burn rate if you've found the right market for your product or service (product-market fit) and are in the expansion stage of your business. At this point, you'll have a clear idea of your income from sales, which will help you make a more precise estimate of your cash burn.

Software highlight

Forecasting is crucial to calculate your burn rate accurately. It provides visibility into how money is expected to flow in and out of your business in the future. Forecasting tools make it easier to calculate your estimated revenue and expenses by pulling data from across business operations and laying out a comprehensive picture of your financial trajectory. These tools also offer scenario planning functionality to check the impact of different expense or income situations on your burn rate.

Is a low burn rate always a positive indicator?

Keeping burn rate low is a good idea for young businesses, as it gives them the freedom to explore new strategic directions without worrying about going out of business. But whether you're starting out or planning for growth, it's almost inevitable to not dip into your cash reserves.

We asked Suyeishi if there's ever a scenario where spending more money faster (increasing your burn rate) could be beneficial. He says there's just one exception: when you've achieved product-market fit and figured out the perfect way to acquire new customers. "If you can get more customers quicker than you thought, then throwing more fuel on that fire to increase customer acquisition makes sense."

On the flip side, spending less money isn't always a positive sign either. "It could indicate to investors that your business is sandbagging its expenses," warns Suyeishi. "But if you've reduced your cash burn because you're making more money—say by raising your product prices—then, it's indeed a good sign."

In a nutshell, it's okay to increase your burn rate and spend more money as long as your sales are also going up and you're meeting your financial goals. The key is to find the right balance between ample and excessive cash burn.

Setting benchmarks: What's a good burn rate?

According to Gartner, companies should have enough funds to support at least 18 months of runway, while a 36-month cash runway is ideal. [1] So, if you've $100,000 in cash reserves, a good burn rate would fall approximately between $5,555 per month (18 months) and $2,777 per month (36 months).

That said, an optimal burn rate can be higher or lower depending on your business type and long-term goals. For example, if you sell to a large consumer market and want to go public in the near future, you'll have to spend significantly on recruiting talented professionals across the board, including marketing, to build a recognizable brand. Conversely, if your goal is to develop an app with the expectation of an acquisition in a few years, you could spend less capital on marketing and discretionary spending such as business travel.

Suyeishi adds that investors typically feel more comfortable investing over a 12 to 18 month window rather than providing the entire amount you may need to establish your business.

Craig Suyeishi

Pro tip: You can reduce burn rate in two ways: by getting more revenue through investments or sales and by cutting spending, such as reducing staff or seeking cheaper means of production.

Tools and resources to track burn rate

These tools and resources can help you better track your burn rate and other key performance metrics vital to running smooth business operations:

Accounting system: Understand your financial status better by using an to generate your balance sheet and cash flow statement. The cash flow statement informs how much money you have on hand to spend, and the balance sheet helps you deduct any liabilities or pending customer payments from your in-hand cash.

Forecasting tools: Leverage cloud-based to see how multiple spending scenarios impact your burn rate and ensure company-wide adherence to financial plans. Sueyishi says, "If a small business doesn't have the resources to create financial models, they can create a simple forecast looking at historical revenues and expenses."

KPI dashboards or BI platforms: Get a to visualize key performance indicators (KPIs) in one place. If you're an advanced analytical user, explore to look deeper into your data and understand the factors influencing your cash burn rate.

Financial advisors: If your burn rate is excessively high, seek professional guidance to manage it and to introduce this metric into your spending culture.

Survey methodology

*Software Advice's Financing Survey was conducted in April 2023 among 458 business leaders at U.S.-based small-to-midsize businesses who have role(s) in obtaining financing within their organization. The purpose of this survey was to learn about the challenges they face attaining traditional financing options and explore if they're turning to alternative funding to finance operations, investments, etc.