Bloomberg Tax Fixed Assets

About Bloomberg Tax Fixed Assets

Bloomberg Tax Fixed Assets Pricing

Contact Bloomberg Tax & Accounting for pricing information or a quote.

Free trial:

Available

Free version:

Not Available

Other Top Recommended Accounting Software

Most Helpful Reviews for Bloomberg Tax Fixed Assets

1 - 5 of 31 Reviews

Heidi

Real Estate, 51-200 employees

Used weekly for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed September 2023

Accurate and Efficient

Bloomberg Fixed Assets is fast, easy to navigate, and most importantly, correct. Upgrading to the online program has been a huge timesaver for us, and has saved us large amounts of time, especially in tax season.

PROSThe ability to consolidate companies and change reporting structures and report organization using even basic reports is a huge timesaver, and is appreciated by management, who can request ad hoc reports organized as they like.

CONSIn some areas such as "Switch View" the date selection could be larger to make it easier to quickly switch between months and years.

Reason for choosing Bloomberg Tax Fixed Assets

Easy of use and timely updates to tax changes.

Tara

51-200 employees

Used monthly for more than 2 years

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

3

CUSTOMER SUPPORT

4

FUNCTIONALITY

2

Reviewed March 2017

BNA Fixed Assets Review

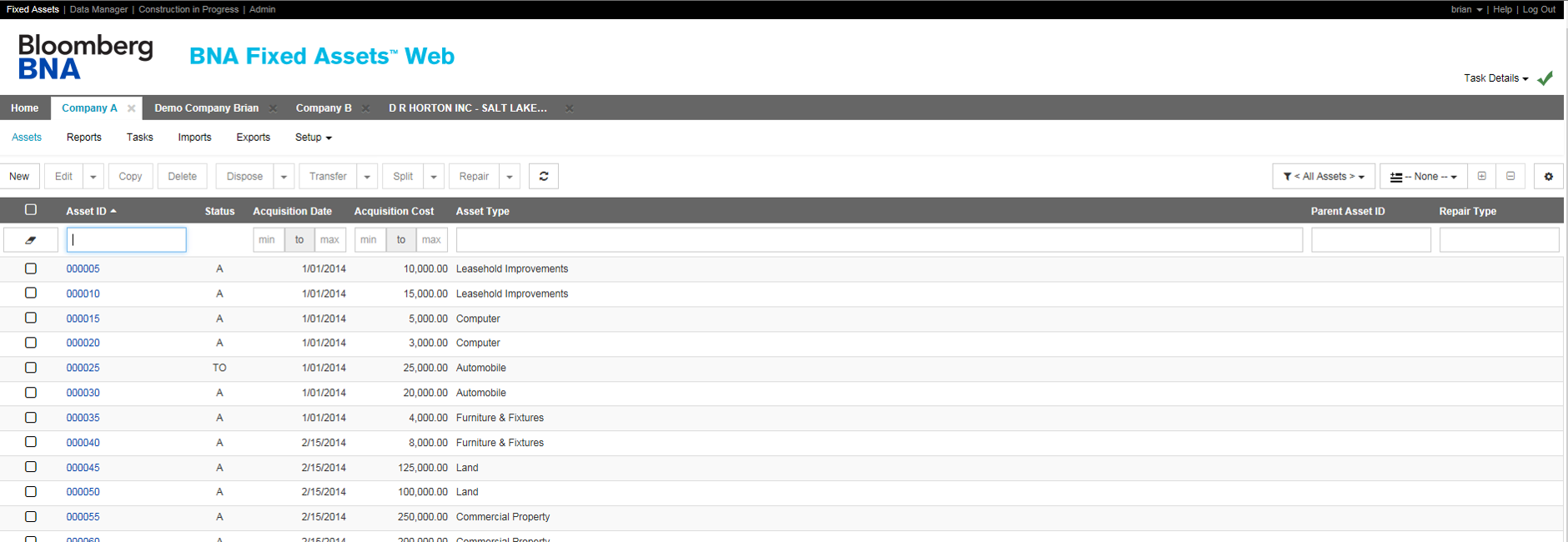

We have recently upgraded from the desktop version to the web version of BNA Fixed assets. There were many difficulties with the move, but received customer service to slowly complete the transaction. After we accomplished the transfer and customized the system to our specific use, one thing I would say that is extremely helpful is the ability to search within each field. There has been a lot to learn with the system compared to the old with specifics as report creating, defaults, and asset view. In the future I look to learn more about the software and the possible capabilities. We have found a few items that are desired enhancements as listed below: Order of fields in Add Asset windows to be customizable Add option to upload document within the Add Asset window when asset is created rather than editing the asset and then uploading the document Option to add an additional asset after one is complete Default within Add Asset windows: Override Additional First-Year Depreciation - Default next screen to choose No AFYD Setup- Fields Asset Field List larger box to view all data at once Similar: Edit within asset when selecting from PickList - larger selection area Have All Favorites (reports and batches) as a filter in the reports section Asset Viewer ability to go to next asset without exiting asset viewer Assets View add more headers be able to scroll over (left and right) Thank You.

PROSAbility to search within each field on the asset view.

CONSListed below are a few desired enhancements: Order of fields in Add Asset windows to be customizable Add option to upload document within the Add Asset window when asset is created rather than editing the asset and then uploading the document Option to add an additional asset after one is complete Default within Add Asset windows: Override Additional First-Year Depreciation - Default next screen to choose No AFYD Setup- Fields Asset Field List larger box to view all data at once Similar: Edit within asset when selecting from PickList - larger selection area Have All Favorites (reports and batches) as a filter in the reports section Asset Viewer ability to go to next asset without exiting asset viewer Assets View add more headers be able to scroll over (left and right)

Greg

Hospitality, 10,000+ employees

Used daily for less than 2 years

OVERALL RATING:

3

EASE OF USE

5

VALUE FOR MONEY

3

CUSTOMER SUPPORT

4

FUNCTIONALITY

3

Reviewed October 2016

Very Easy to use; good service, expensive pricing model; weak reporting

The software makes it very easy to upload and mass modify assets. If you buy it, you must get the dataview add-on that lets you integrate the reporting into excel. The base crystal reporting is hard to use and also only allows you to report on one book at a time. The database is very flexible, allowing multiple placed into service dates (one for each book) but the reporting becomes erroneous if you have to input assets placed into service in prior periods or modify the basis of an asset (say, due to an impairment). Instead you need to create new component assets for the modifications. This becomes a problem because BNA charges you based on the number of assets, and the price escalates very quickly. We have only 5 users but are forced to pay for a pricey 100 user license because we have 100,000 assets. In other words, BNA is bad for capital-intensive businesses who need detailed, accurate records. By using easy to understand asset types you can quickly populate all of your books (GAAP, Fed, AMT, etc) because lives and methods are programmed automatically by type. You get great efficiency and simply your tax reporting. If you have unusual assets you can also modify each book separately after you populate the asset type, so you retain flexibility when needed. For a smaller business, this software would be superb. The BNA team was very responsive during our implementation, and did the project management for us. All we had to do was export our old database into CSV or excel and give it to them. The job was very well done.

PROSThe asset type method makes training users very easy

CONSThe price model is unfair to companies with a large number of assets but few transactions. The reporting is basic and prone to error. An upgrade is required to get a good reporting capability.

Steven

Chemicals, 201-500 employees

Used monthly for less than 2 years

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

2

CUSTOMER SUPPORT

4

FUNCTIONALITY

5

Reviewed September 2023

Good Software But Pricey

My overall experience has been positive. The software is easy to use, fairly easy to import into and easy to fix asset depreciation histories when needed to keep aligned with that was booked, when what was booked was wrong. Not every program provides the granular level of control Bloomberg does. If only their pricing model wasn't so punitive and they supported external reporting tools, it would be outstanding.

PROSGood user interface and strong functionality. The reporting tools provide easy export to Excel, but lack in connectivity to other tools, such as PowerBI. The ability to manage multiple companies in a single web application is great, as is the ability to manage multiple capital projects and convert compelted projects into assets. Asset disposal is similarly easy, and they give you plenty of ability to tailor asset depreciation to accomodate any mistakes you may have in your asset history.

CONSThe biggest issue with Bloomberg is pricing based on number of assets. In an age when storage is dirt cheap, there's no excuse for arbitrary levels of pricing based on number of assets. If you have existing assets, expect to have to lose history or pay through the nose to store fully depreciated assets just to bring their records over. The other major limitation is that while reporting to Excel is terrific, reporting to other tools such as BI is non-existent. Bloomberg really needs to add support for connections to other reporting tools.

Joy

Verified reviewer

Transportation/Trucking/Railroad, 5,001-10,000 employees

Used daily for less than 12 months

OVERALL RATING:

4

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed December 2018

Accounting for Fixed Assets

The ability to report fixed assets in multiple currencies is the best thing with this software, its so useful for a company that has branches in different countries as it automatically calculates exchange rates .

PROSThis software makes the process of accounting for fixed assets so simple. One is able to record, calculate depreciation, calculate gain or loss on disposal and asset and track all fixed assets owned by a company.

CONSIt is complicated and it is difficult for users to adjust the depreciation rates or add anything to it.