How Automation Is Transforming Account Reconciliation for Small Businesses

In a recent Software Advice survey*, nearly 45% of small businesses said they entrust all their accounting duties to a single individual. As new businesses prioritize growth, they may sideline the importance of rigorous reconciliation.

Reconciliation, a critical yet tedious process in accounting, involves an accountant sifting through a business’s entire financial records (of a week, month, or year), matching transactions from accounting to banking records one by one. Manual reconciliation, a recourse for many small businesses, increases the risk of errors and diverts skilled personnel from important tasks, such as analyzing discrepancies in records, that demand their adeptness.

Automation transforms this admin-heavy task by automatically matching transactions with precision and speed. In this article, we explore how automated reconciliation transforms this fundamental accounting process, drawing insights from Gartner research [1], a US-based eCommerce business’s case study [2], and Isaac Routh, accounting advisor manager at Software Advice who interacts with hundreds of small business buyers every day to help them find the right software solution for their needs. Routh has unique insights into the challenges that lead accounting professionals to seek out software (read more about our advisors here).

Isaac Routh

Accounting advisor manager, Software Advice

What is automated reconciliation?

Gartner identifies automated reconciliation as a game-changer for accounting. [1] Normally, an accountant would go through the company’s transactions, making sure accounting records match with what’s in the bank account or cash receipts.

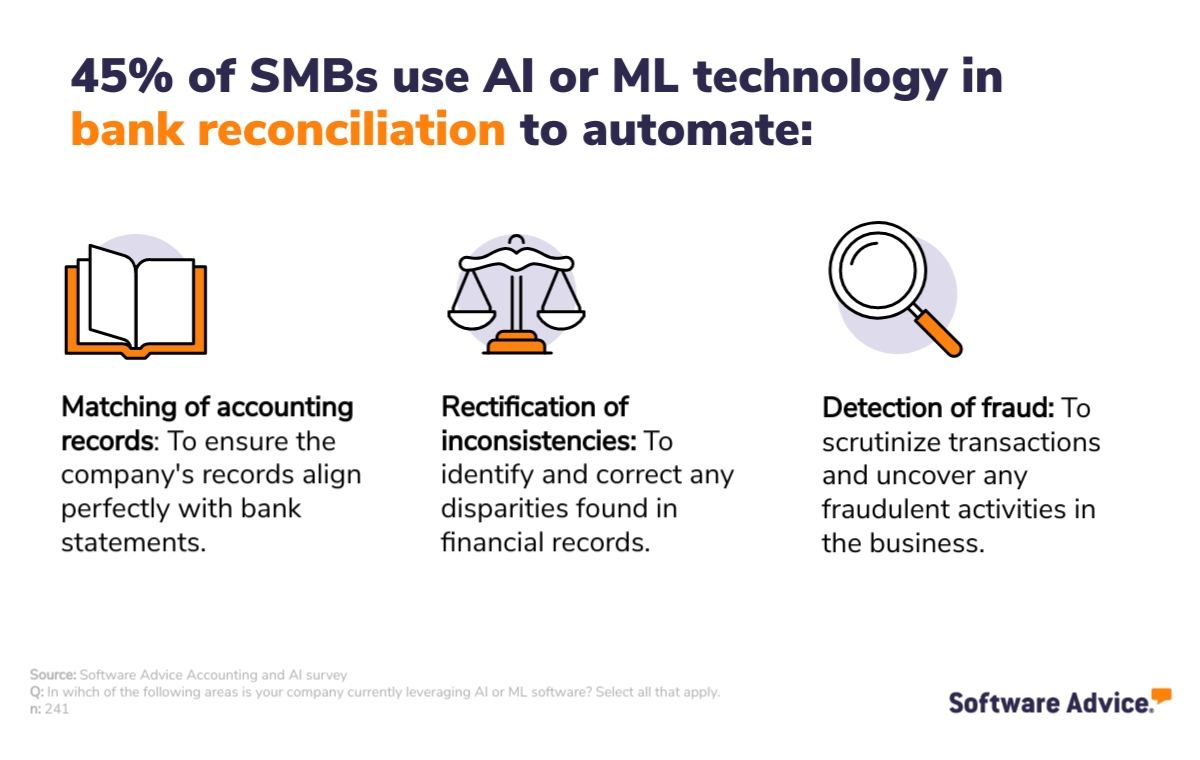

Automated reconciliation introduces a smart system that automatically double-checks records and executes this vital function. If something doesn’t add up, it sends alerts, so a human can investigate those transactions. A recent Software Advice survey shows that 45% of small and midsize businesses (SMBs) are reaping the benefits of advanced technologies in reconciliation.**

How does automated reconciliation work?

Automated reconciliation is a software-driven process that compares two sets of records to make sure they match. These records are usually your company’s accounting records and your bank statements. Here’s how it works in simple steps:

Input: Data for performing bank reconciliations is segregated across the general ledger, bank statements, accounts receivables, purchase orders, and other records. The system receives information from these various sources, including details of what you’ve spent, what you’ve earned, and so on.

Comparison: Next, the system cross-verifies your internal financial records against bank statements, ensuring agreement between transaction data. The aim is to spot the difference between two records of similar transactions, say a cash receipt and a corresponding entry in the bank account.

Alerts: For transactions that don’t find an exact match, the system will suggest the closest ones, so you can approve them. It’ll raise other red flags, such as duplicate or missing transactions, for accountants to review and reconcile. They are also called reconciliation exceptions. These are typically marked in different colors to be easily identified.

Resolution: Accountants then investigate flagged items, figure out what’s wrong, and fix it. Over time, you can create rules (without any need for programming expertise) for the software to handle common exceptions, so they no longer need manual intervention.

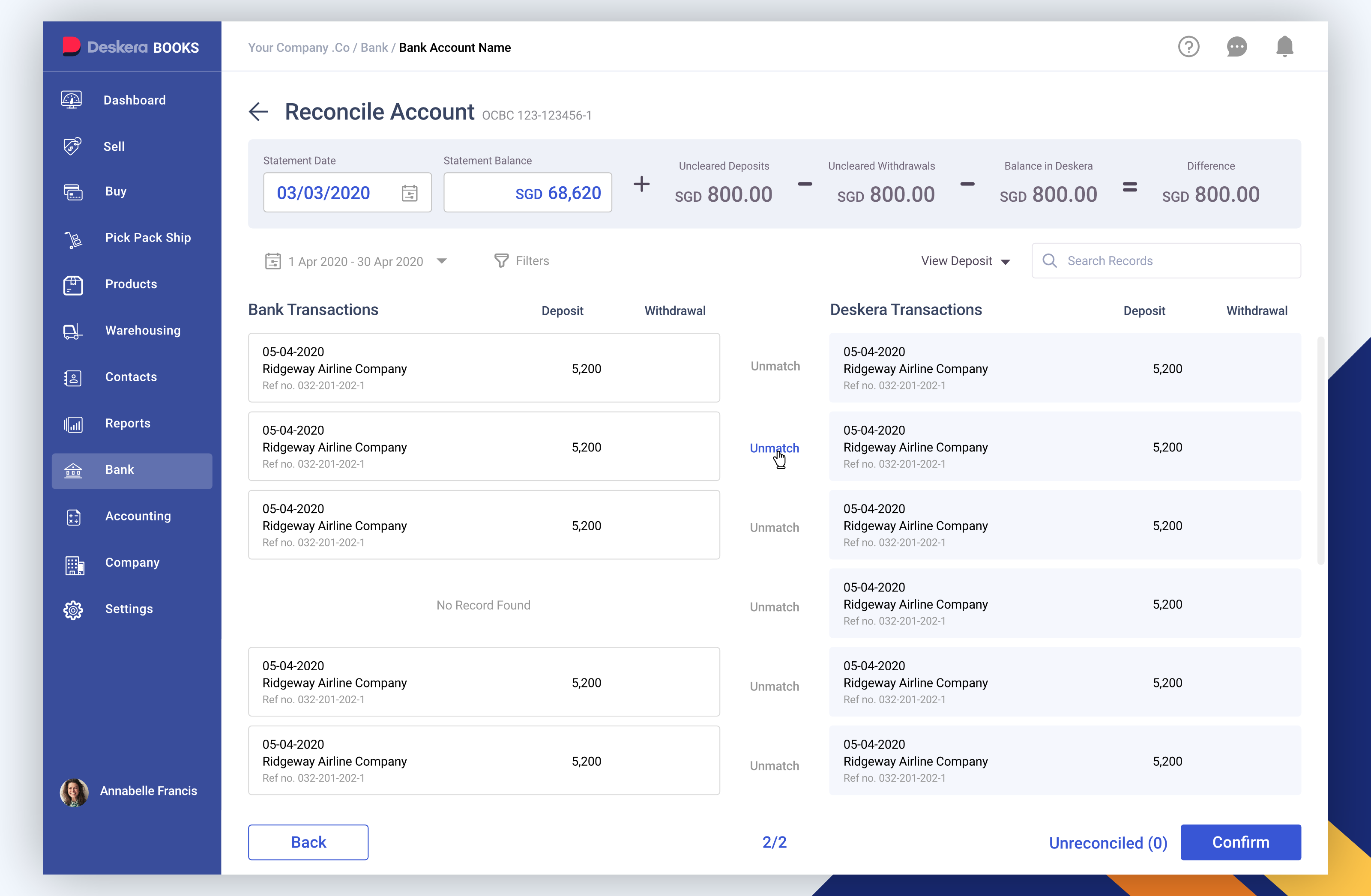

Example of reconciling accounting records with bank statements (Source)

Pro tip for choosing the right technology

When it comes to the choice of software for reconciliation automation, you have options. You can opt for specialized reconciliation software equipped with high-end artificial intelligence (AI)- or machine learning (ML)-driven capabilities or leverage the bank reconciliation features that come standard in accounting suites.

Specialized solutions are more appropriate for businesses with complex needs, says Routh. “It's really going to be for businesses that have a higher possibility of balance sheet errors, larger volumes of transactions, foreign currency accounts, and multiple entities/subsidiaries owned by the parent company managing all finances and balances of vendors and suppliers.”

Most small businesses can attain the benefits of automation with effective accounting software, and centralize all financial processes, including reconciliation, budgeting, forecasting, billing, invoicing, and payroll. Plus, many software providers are increasingly adding intelligent capabilities within a single accounting solution.

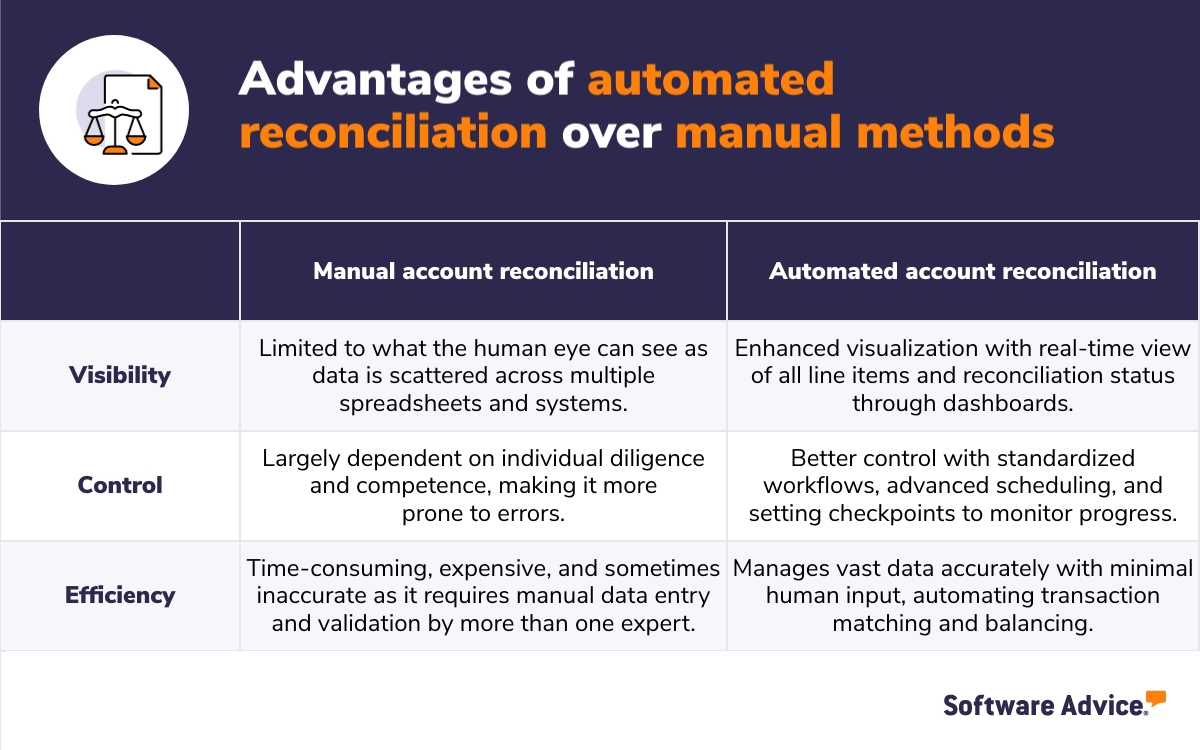

Why is automated reconciliation better than manual?

Matching accounting records with bank statements manually is not only time-consuming but the monotony of the process makes it highly probable for careless mistakes to creep in. You’ll need a high tolerance for deviations and risk higher write-offs. Say, an outstanding invoice goes unnoticed leading to uncollected revenue due to late realization or inability of a customer to pay back.

While legacy tools like spreadsheets can work initially, as your business grows and the volume of transactions increases, it becomes tough to verify transactions and track errors. Here’s what Gartner says about automating reconciliation:

Gartner [1]

Take a look at three reasons why auto bank reconciliation is better than manual.

Case study

Why a US-based eCommerce business transitioned to automated reconciliation

The challenge

Four years ago, New York-based eCommerce company, ShipTheDeal was dealing with growing pains. As their daily transaction volume swelled to approximately 150-200 transactions, the manual reconciliation process became increasingly time-consuming and expensive. It required both CEO Cyrus Partow[2] and an accounts executive for dual verification to minimize errors.

“It was costing the company over $600 per month in employee compensation just for manual accounting,” shares Partow. The process involved collating all sales data from their online platforms and POS system, then cross-referencing it with bank statements and invoices.

The solution

Recognizing it was not possible to grow without software, Patrow decided to incorporate automation into their reconciliation process. Brand trust, ease of use of the reconciliation feature, and seamless integration with existing tools were key considerations while selecting their preferred software. They utilized automation for:

Auto-matching: To automatically match their bank transactions with sales records and reduce manual input.

Reconciliation reports: To get comprehensive reconciliation reports, providing clear insights into discrepancies, allowing quick identification and rectification of issues.

Detecting discrepancies: To fetch data in real time with minimized lags or mismatches and get consistent and accurate visibility into accounts receivables with oversight of where sales are coming from and where the clients are late in payments.

Cyrus Partow [2]

CEO, ShipTheDeal

Consider these factors when automating the reconciliation process

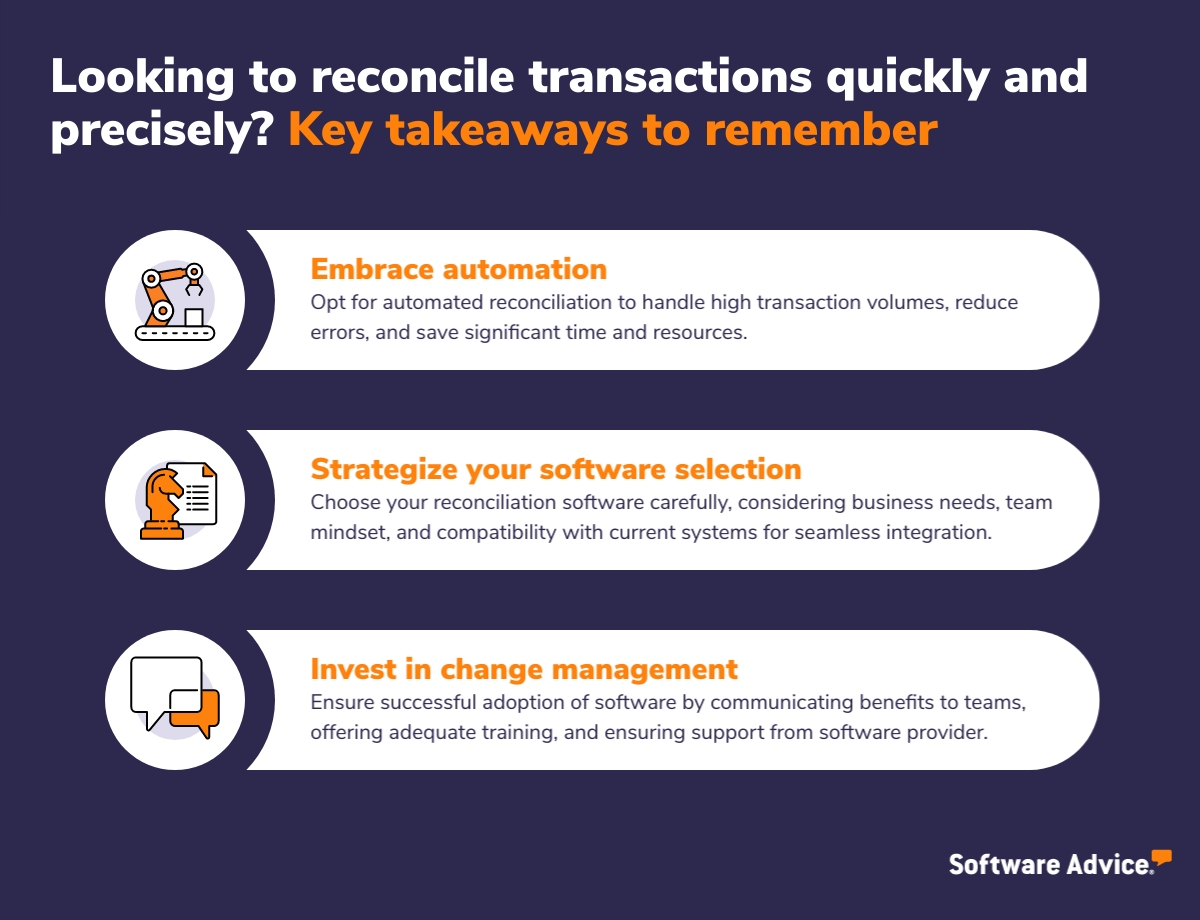

Adapting to new technology can be challenging even if it’s a welcome change. While it brings considerable advantages, it also demands efforts to learn and integrate into existing workflows. Keep these things in mind to select a solution that best fits your needs:

Make sure your accounting team approaches the new software with a positive mindset. Communicate the benefits, offer training, and set clear expectations. Ask if your software provider can assist with this transition.

Many providers now bundle advanced features, including reconciliation management, within accounting solutions. Check the reconciliation capabilities offered by your current accounting system before investing in specialized software. Many small businesses find that larger accounting suites with integrated reconciliation features best meet their needs.

If your focus is solely on upgrading account reconciliation, you can opt for specialized reconciliation software. Make sure it integrates well with your existing accounting and related software architecture. Unlike generic accounting suites, specialized software often offers more advanced features that cater to complex reconciliation needs and provide a more tailored solution.

To learn more about what to consider before purchasing an automated reconciliation solution, check out Software Advice’s reconciliation software buyer’s guide.

Survey methodology

*Software Advice’s 2023 Small Business Attributes Survey was conducted in October 2023 among 400 respondents to learn more about the characteristics that epitomize U.S. small businesses. All respondents were screened for leadership positions of Vice President or above at companies with 1 to 250 employees.

**Software Advice's Accounting and AI survey was conducted in April of 2023 among 317 business leaders within the U.S. to learn more about how they harness artificial intelligence (AI) or machine learning (ML) to assist with financial operations. Respondents were screened to ensure that they have relevant roles related to AI or ML functions within their organization.