9 Accounting Features Proven to Optimize Your Business

There’s no one right way to do accounting; in fact, there are many.

It’s why the accounting software market varies so greatly in scope, with options ranging from “so easy your three-year-old could do it” to “what am I even looking at?” Without an accounting software features list, businesses can’t identify the right system to fulfill its needs—lest they overspend on a system with unnecessary functionality.

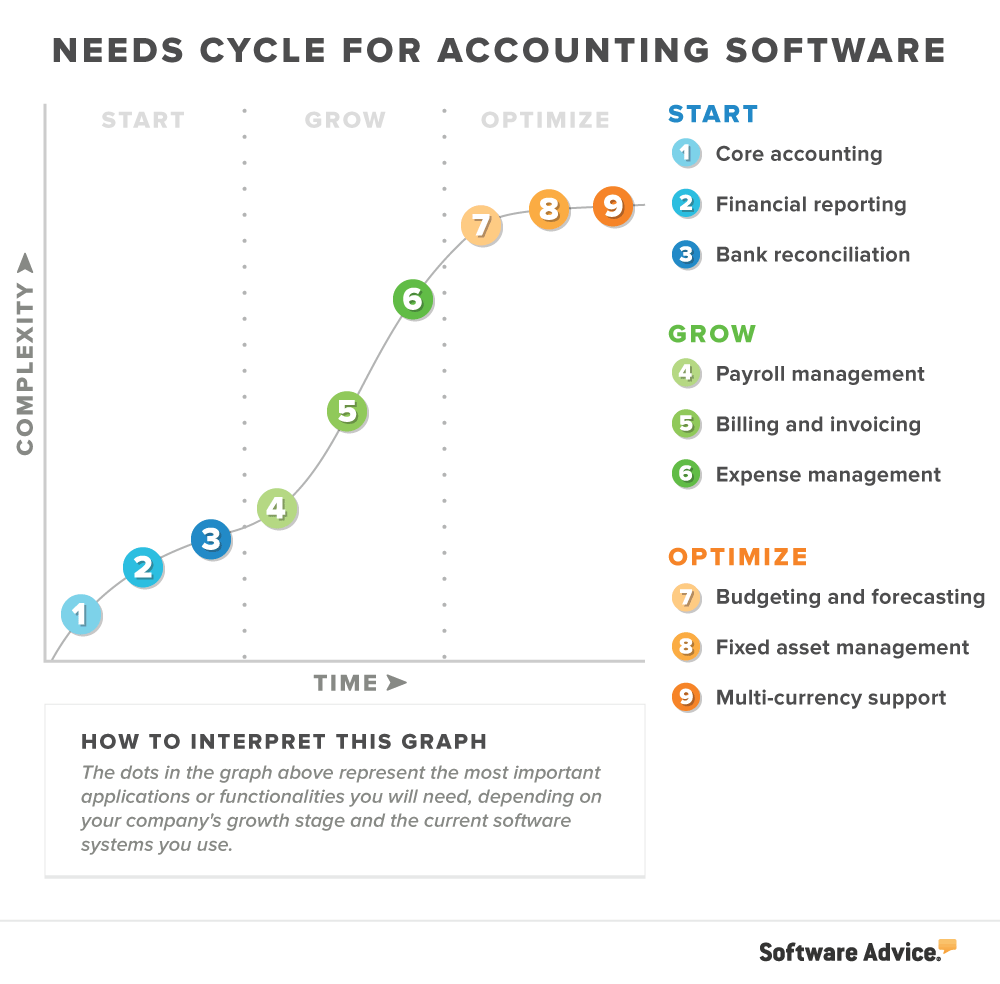

In general, it’s better to start small and add features as you go.

By adopting only essential features during implementation, and adding more desired functionality as you grow, your business can more adequately manage integration and allocate resources more effectively.

By adopting only essential features during implementation, and adding more desired functionality as you grow, your business can more adequately manage integration and allocate resources more effectively.

After analyzing data from hundreds of accounting software buyers from the past year, we identified the most important set of features for each stage of your business.

Here’s what we’ll cover:

3 accounting software features you need to START

3 accounting software features you need to GROW

3 accounting software features you need to OPTIMIZE

3 accounting software features you need to START

These features are for small teams (two to 10 software users) just getting started with accounting software.

1. Core accounting

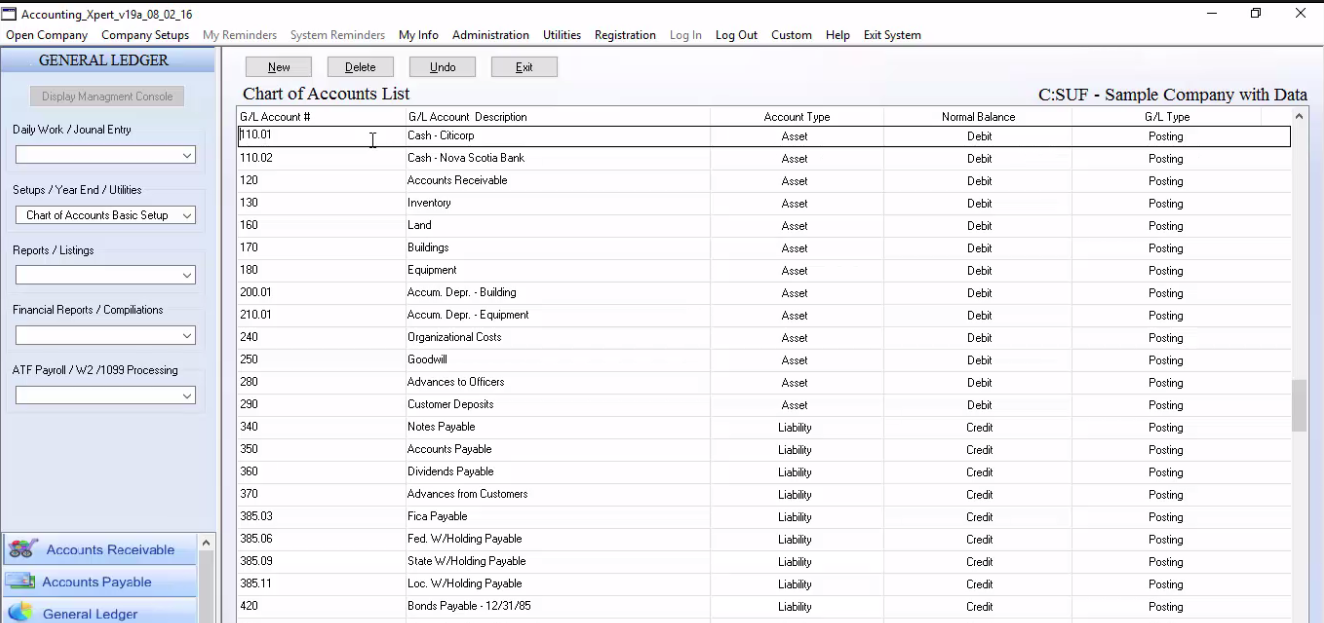

What it does: Core accounting includes the bare-bones basics: accounts payable, accounts receivable, and a company’s general ledger. These are the fundamental financial records designed to keep tabs on all your business transactions.

General ledger in Accounting Xpert (Source)

Why you need it to start: Though critical for every business, core accounting is especially pertinent to budding organizations, which typically have less income and more debt. But there’s more to it than keeping the books tidy; with artificial intelligence, small businesses can automate core accounting processes to more efficiently collect and submit payments.

2. Financial reporting

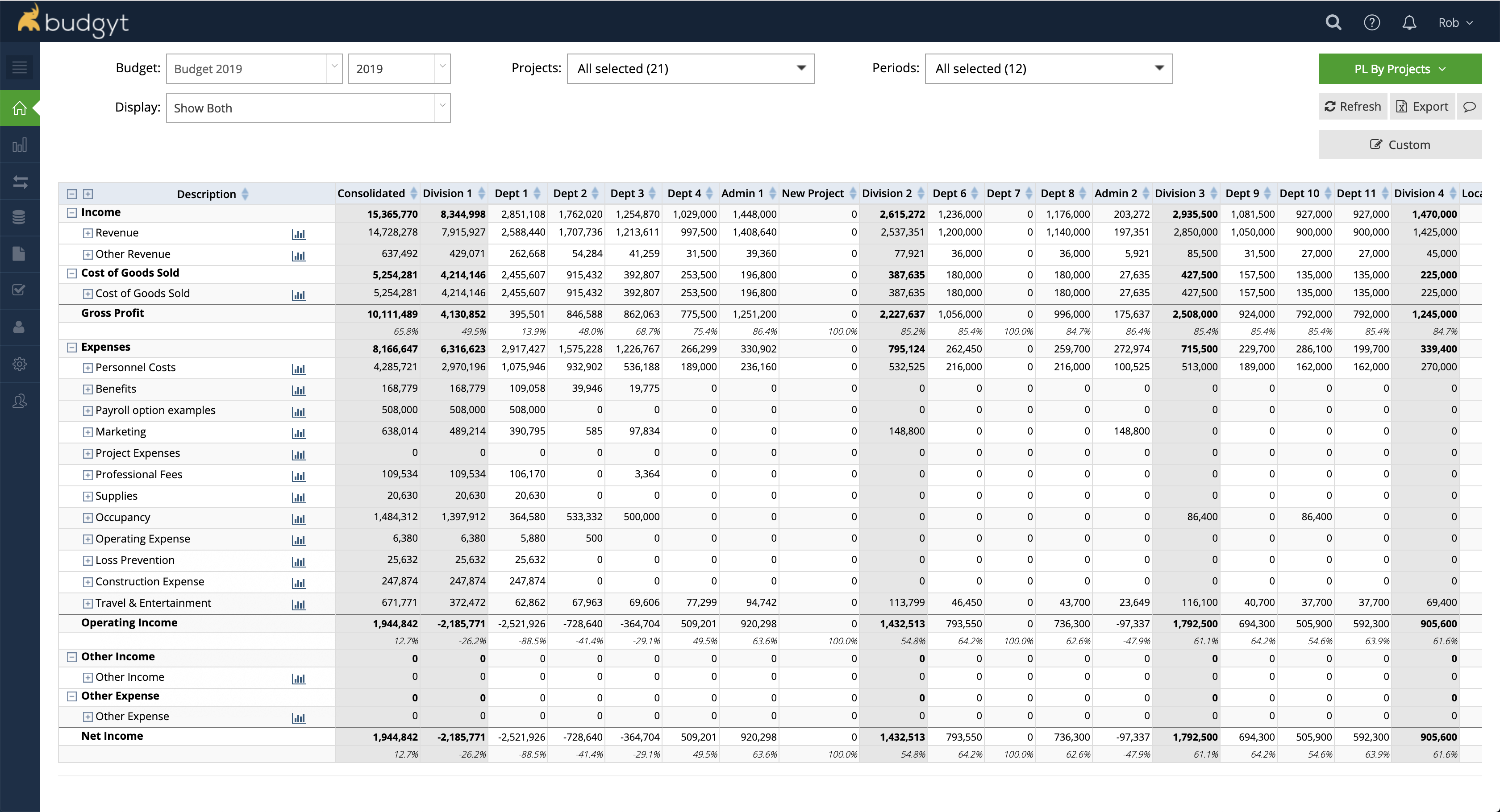

What it does: Accounting software’s financial reporting component helps businesses track and visualize key performance metrics. This includes things like balance sheets, profit and loss (P&L) statements, and expense reports.

Balance sheet in Budgyt (Source)

Why you need it to start: With accounting software’s in-depth, AI-driven reporting functionality, organizations can more easily identify trends that inform the decision-making process and make the business more profitable. Such insights offer nascent businesses a sturdy, fact-based foundation to build upon, arming them with the tools they need for sustained success.

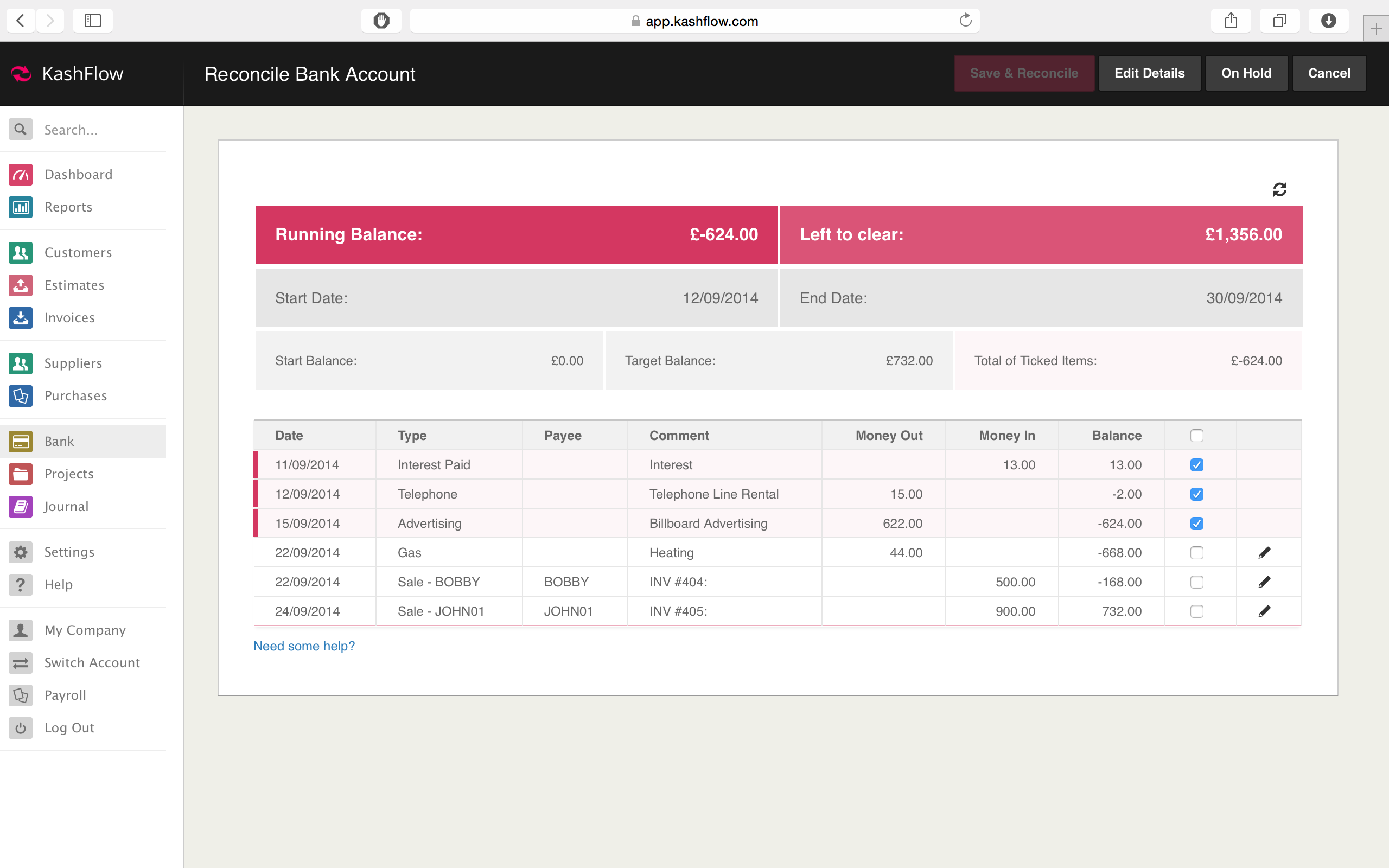

3. Bank reconciliation

What it does: Bank reconciliation is the process of comparing bank statements to the records of the account holder. In other words, it guarantees a business’s financial data is accurate. Accounting software’s automation simplifies the importation of electronic bank statements, compressing an otherwise painstaking process down to mere minutes.

Bank reconciliation in KashFlow (Source)

Why you need it to start: Small upstarts might not have the resources of larger organizations, but bank discrepancies can be just as costly. Small businesses have more important things to worry about than the accuracy of their financial records (getting their business of the ground, for starters), and accounting software’s automated bank reconciliation function ensures they don’t have to.

Key considerations to START:

Your first order of business—as soon as you finish reading this accounting software features list—is establishing whether your financial transactions will be cash- or accrual-based. In cash-based accounting, income isn’t recorded until the money is paid to your business. Accrual-based accounting, on the other hand, includes agreed-upon purchases such as credit-based transactions.

When constructing your financial reports, it’s important to remember to start small and add data points as you go (a recurring theme in this article). This will ensure that your analysis isn’t bogged down with unnecessary information, which can be overwhelming for small businesses with limited expertise.

Most modern accounting software options include some sort of mobile integration, whether through a browser or an app that you download to your device. Mobile access is essential for businesses that value real-time, on-the-go access to their financial data—something to keep in mind when evaluating vendors.

3 accounting software features you need to GROW

This section is for teams that need to manage increasing workloads associated with a growing customer base.

4. Payroll management

What it does: Payroll management includes the calculation, processing, and distribution of pay to employees. Accounting software can automate these tasks in the amount of time it takes to say “It’s payday, woooooooo!”

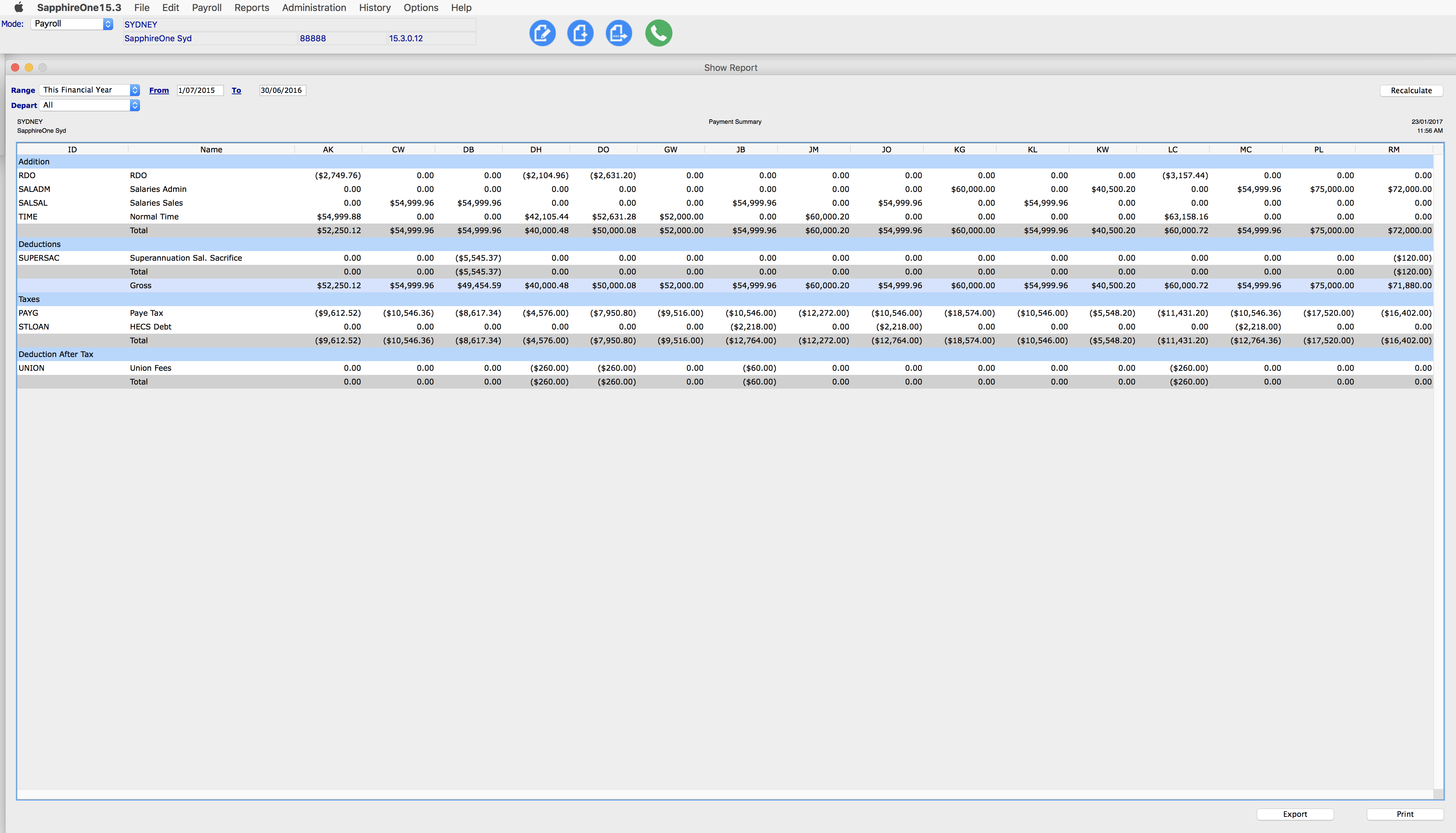

Payroll payment summary in SapphireOne (Source)

Why you need it to grow: Between calculating taxes, writing checks, and scheduling deposits, accounting software’s payroll functionality is designed to save your business precious time and money. Growing businesses will find this especially useful as their employee base increases.

5. Billing and invoicing

What it does: Modern accounting software allows for not only the creation and distribution of invoices, but more advanced sales processes as well. This includes a wide variety of recurring transaction types, such as contract- and subscription-based services.

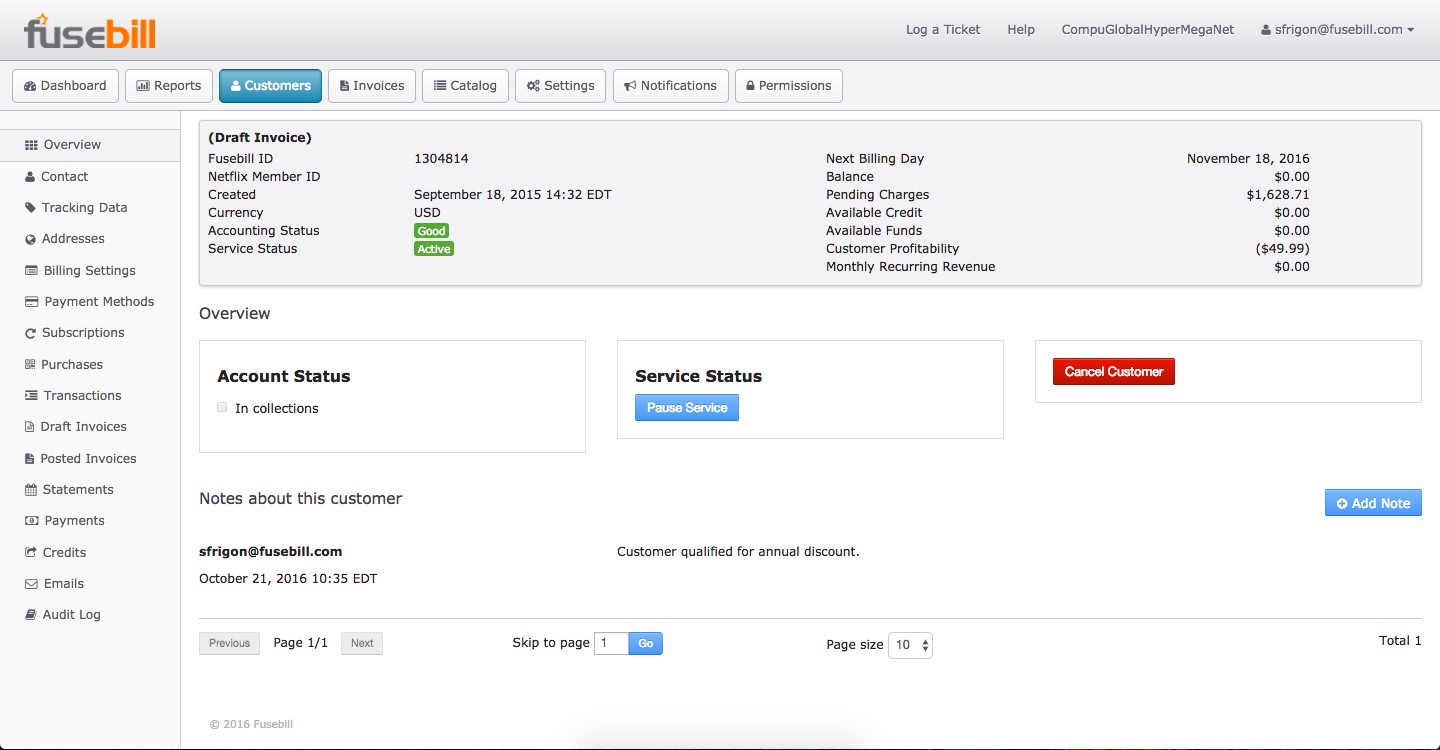

Invoice creation in Fusebill (Source)

Why you need it to grow: As your business’s customer base grows, so will the volume and variety of sales—and the time it takes to process them. Accounting software’s billing and invoicing component automates these procedures accurately and efficiently.

6. Expense management

What it does: Expense management includes the submission, processing, and tracking of work-related expenses. Through accounting software, businesses can customize expense reports to get a holistic view of how their money is being spent.

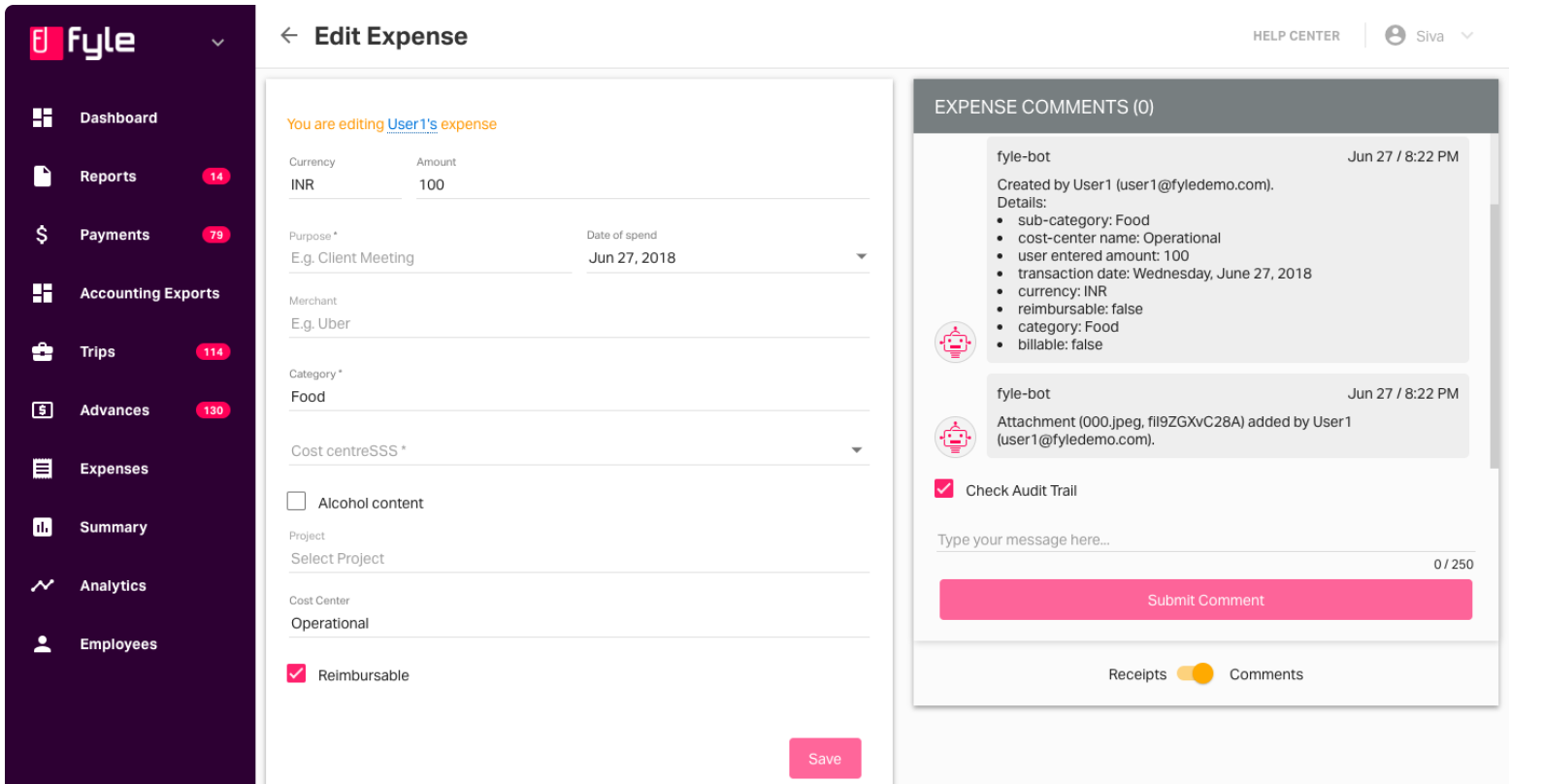

Expense management in Fyle (Source)

Why you need it to grow: Between all the booked flights, capital investments, and client dinners, growing organizations need a way to track their ever-increasing expenses. Through accounting software’s detailed expense analysis, business leaders can confidently identify potential cost savings and investment opportunities.

Key considerations to GROW:

It seems obvious, but growing organizations should remember to track all business expenses, no matter how small. You’ll thank us come tax season.

With great power comes great responsibility—especially when it comes to protecting your financial data. Businesses transitioning from small to midsize should place greater emphasis on data security and identify any potential vulnerabilities to would-be hackers.

If you haven’t by this point, consider hiring an in-house accountant or bookkeeper to oversee financial operations. Mismanagement of your accounting data is a surefire way to lose the trust of your growing customer base, and growing businesses are under increased pressure to process the increasing number of transactions in a timely and accurate fashion.

3 accounting software features you need to OPTIMIZE

This section is for companies with multiple sites and assets that require large-scale optimization strategies to reduce costs.

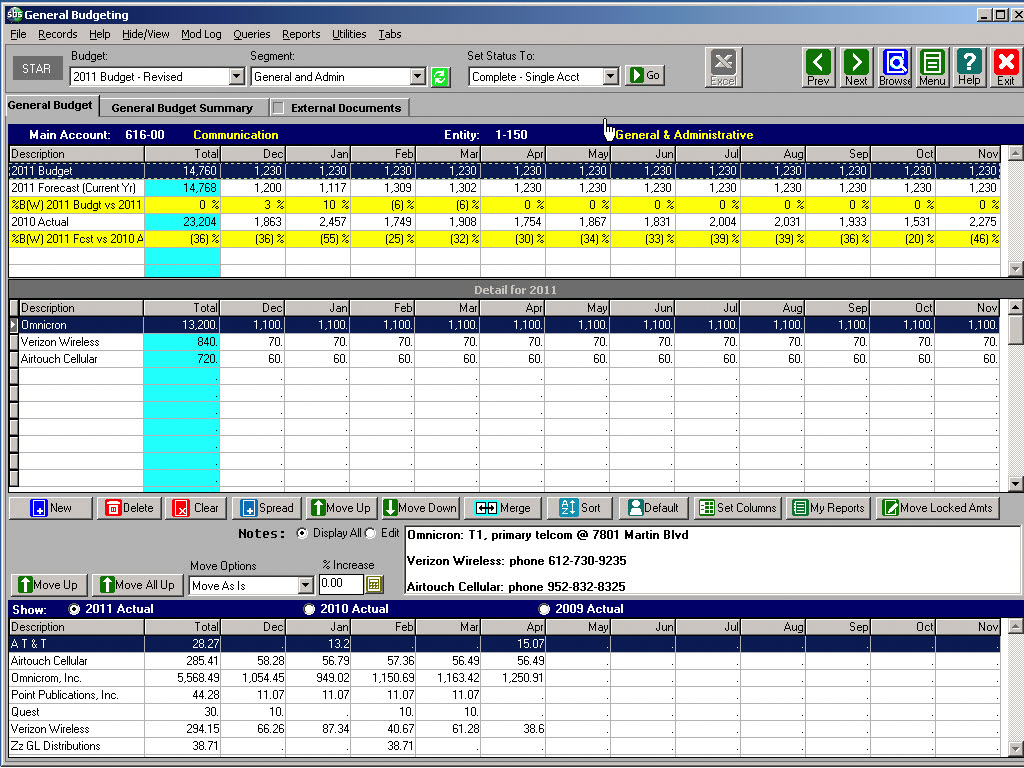

7. Budgeting and forecasting

What it does: Accounting software’s budgeting and forecasting capabilities help businesses plan their budgets in accordance with forecasting models. The software uses AI and historical data to identify trends and likely outcomes for things like revenue, expenses, and cash flow.

Budgeting in SBS Financials (Source)

Why you need it to optimize: As your business grows, so too do the financial stakes. Organizational leaders should build their budgets based on the most reliable data available, and modern forecasting technology empowers decision makers to invest in their business with confidence.

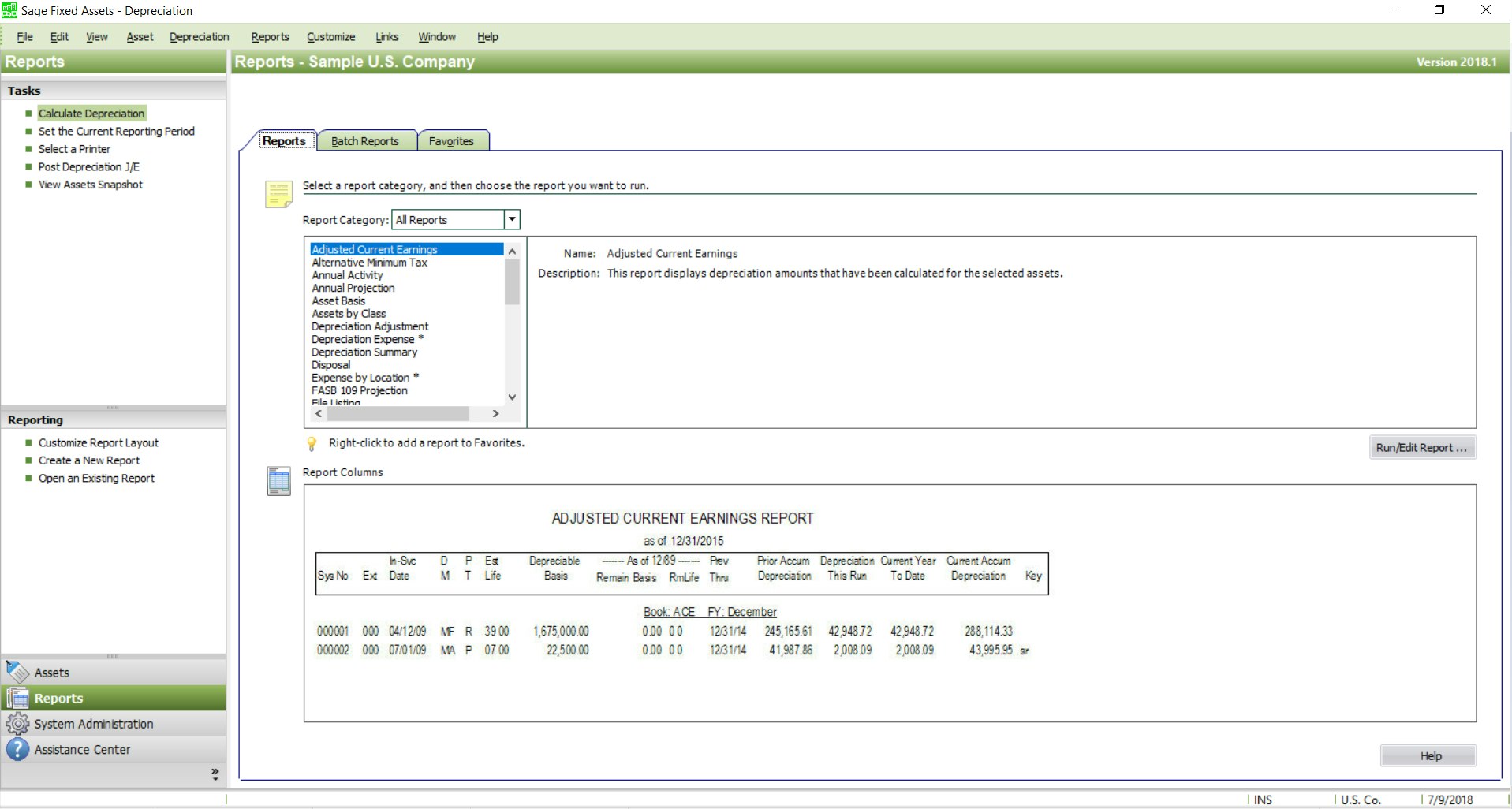

8. Fixed asset management

What it does: With fixed asset management, businesses have the ability to monitor capital assets and property such as office buildings, machinery, and company vehicles. They can also track the depreciation of tangible assets over time.

Depreciation reporting in Sage Fixed Assets (Source)

Why you need it to optimize: As an organization grows, the number of assets to its name will grow alongside it. Accounting software’s fixed asset management component gives users a detailed glimpse into the health of a business’s property, including its valuation, condition, insurance status, and other tools designed to help prevent asset loss.

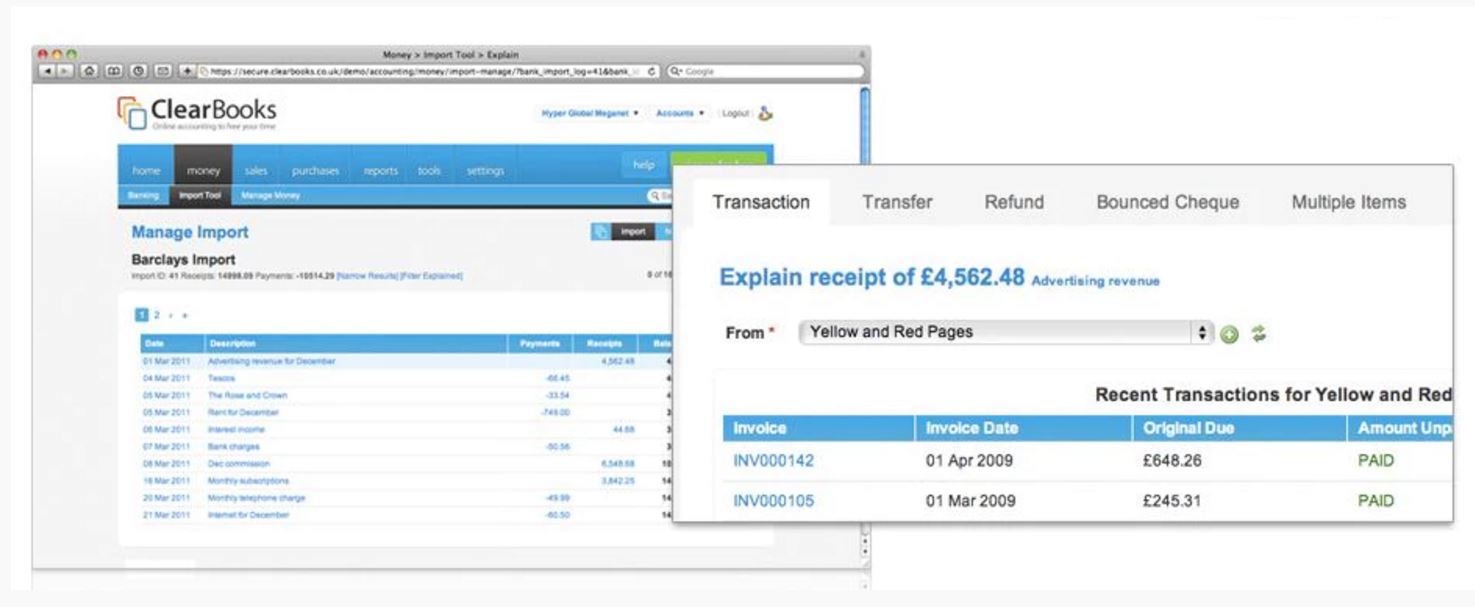

9. Multi-currency support

What it does: The multi-currency support function allows for automatic conversion between currencies, enabling businesses to accept payments, produce quotes, and send invoices in legal tender other than their own. Users can also designate the specific preferences of their customers, making international transactions seamless regardless of currency.

Multi-currency support in Clear Books (Source)

Why you need it to optimize: With support for multiple currencies, your business can confidently expand into international markets. Conversions and reporting are automatically revalued with the most up-to-date exchange rates, removing virtually all of the guesswork and uncertainty associated with foreign transactions.

Key considerations to OPTIMIZE:

Forecasting with accounting software will only take you so far. Because external market developments and economic swings are just as likely to impact your business, be diligent in researching trends and outlooks when drafting future budgets.

When filing your taxes, consider hiring a tax professional to help get all your financial ducks in a row. Enterprise organizations have more dollars at stake than smaller businesses, making it harder to identify all applicable tax breaks and exemptions.

The bigger the business, the more convoluted things can get. One way around this is through software integration, one of the best ways to optimize in this 21st-century economy. As much as you can, configure your system to allow for flexibility and the freedom to customize it to the needs of your organization.

What are my next steps?

Every business is different, and the recommendations in this accounting software features list are nothing more than a guide for your accounting software journey. The objectives of your organization—and only your organization—will ultimately determine the route you take.

That said, when it comes to vendor selection, the following resources will benefit businesses of all stripes:

These accounting software trends for 2019, which we tabulated from interactions with more than 300 small-business leaders, offer a glimpse into the top requested features, pain points, and demographic information comprising the buyer market.

This listing of more than 260 accounting software products will give you a comprehensive look at the vendor landscape. You can also read reviews from real, live buyers, and even filter products by industry, size, price, and user rating. The world is your oyster.

If you’re still on the fence, get expert advice from one of our friendly neighborhood software advisors, who are on the phones right now helping small businesses find the solutions that best fit their needs. For a free 15-minute consultation, give us a call at 855-998-8505.