Human Resources Software Buyer Report – 2014

Software Advice helps organizations narrow down human resources (HR) software options to find a system that best meets their needs. This provides us with unparalleled insight into the biggest pain points buyers have with their current methods, as well as what they’re looking for in a new solution.

We recently analyzed a sample of 385 of these interactions with potential HR software buyers. This report outlines the top HR buyer trends we uncovered.

Key Findings

The majority of buyers were evaluating HR software for the first time (40 percent).

The most requested HR application was applicant tracking (40 percent).

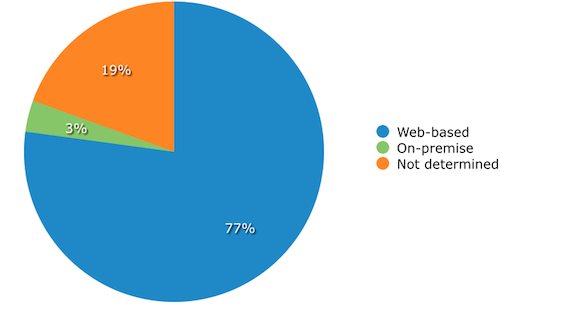

77 percent of HR software buyers requested a web-based deployment model.

Most Buyers Evaluating HR Software for the First Time

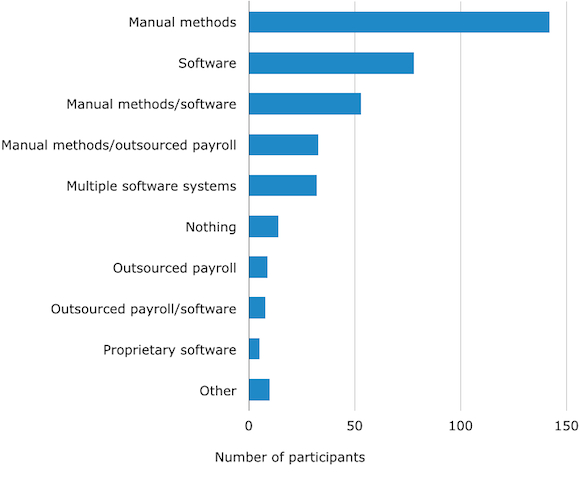

Almost 40 percent of the software buyers we spoke with were using manual methods (e.g. some combination of pen and paper, Excel and email) to track and store their HR data. In other words, they were evaluating software for the first time.

Meanwhile, 22 percent reported using manual methods in combination with either some form of HR software, or an outsourced payroll provider.

Buyers’ Current HR Methods

Given that 40 percent of HR software buyers were purchasing a solution for the first time in 2014, it’s clear the HR function has been slow to adopt new technology—especially in small to midsize businesses (SMBs).

However, it seems HR technology is finally pervading the SMB space as HR professionals increasingly realize the benefits of adopting an HR software system. In a recent survey, for example, companies that adopted HR software realized a 33 percent higher operating income growth, primarily through the time saving effects of software.

Over Half of Buyers Seeking Best-of-Breed Solutions

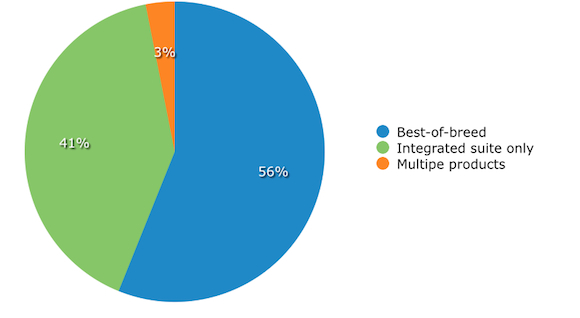

HR software encompasses many different types of applications, from applicant tracking to employee scheduling. Some vendors offer a set of applications together, called an integrated suite, while others offer them as stand-alone options, or best-of-breed applications.

Of the buyers in our sample, 56 percent sought a best-of-breed application, while 41 percent preferred an integrated suite from a single vendor. The remainder sought solutions from multiple vendors to meet their application, or functional, requirements.

HR Software Buyers’ Integration Requirements

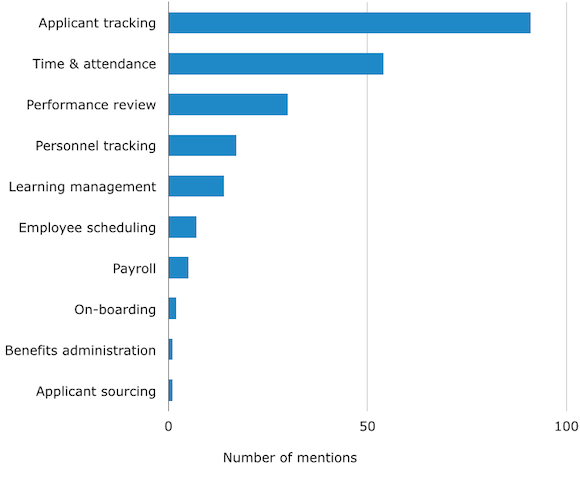

Digging slightly deeper into the data, we found that, of those buyers who specifically requested a best-of-breed application, over a third (34 percent) were looking for an applicant tracking system (ATS). Time and attendance was the second most popular best-of-breed application, with 20 percent of buyers requesting that functionality, while performance review software came in third, at 11 percent.

Most Commonly Requested Best-of-Breed Applications

40 Percent of Buyers Requested Applicant Tracking

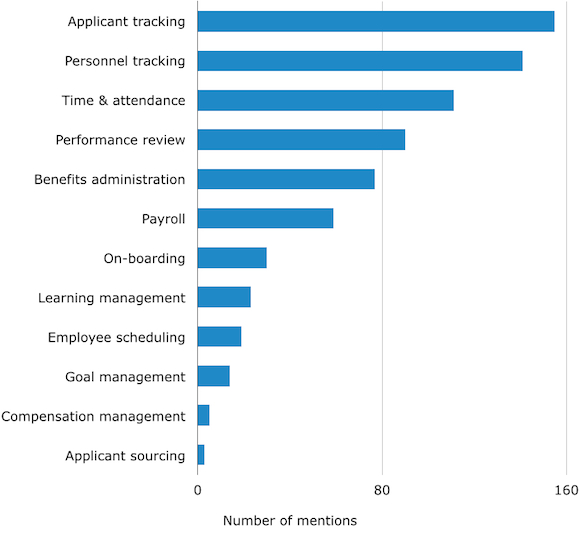

No matter whether buyers were seeking a best-of-breed, integrated solution or a combination of products from multiple vendors, an ATS was the most commonly requested application across the board. In fact, 40 percent of all potential HR software buyers requested ATS functionality to streamline their hiring process.

After applicant tracking, personnel tracking was the next most requested feature. This functionality allows users to create a centralized database of employee data, including social security numbers, contact information and past employment and demographic information.

HR Buyers’ Top-Requested Applications

This high demand for applicant tracking systems is likely a result of what Gartner calls, “The Hype Cycle,” which tracks the maturity and adoption of technology. According to recent Gartner research, ATSs are found in what is called “The Plateau of Productivity,” which Gartner defines as the period where “Mainstream adoption starts to take off. Criteria for assessing provider viability are more clearly defined. The technology’s broad market applicability and relevance are clearly paying off.”

Given that the first web-based ATSs began appearing around 1998, it’s safe to say the broad market applicability of an ATS has been proven. Add that to the fact that there are hundreds of ATSs on the market—many of them extremely affordable—and it’s no surprise that SMBs are demonstrating such a high demand for this particular kind of HR technology.

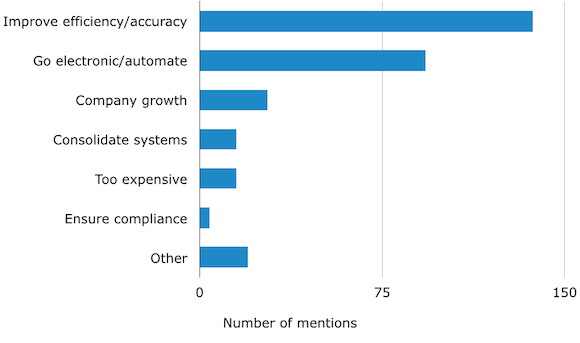

First-Time Buyers Want to Improve Efficiency

Buyers using manual methods cited the need to improve efficiency and decrease errors incurred through manual data entry as the primary reason for evaluating new software. Many said they were spending an inordinate amount of time tracking things via paper or in Excel spreadsheets, and were looking to streamline the process with specialized software.

Top Reasons for Replacing Manual Methods

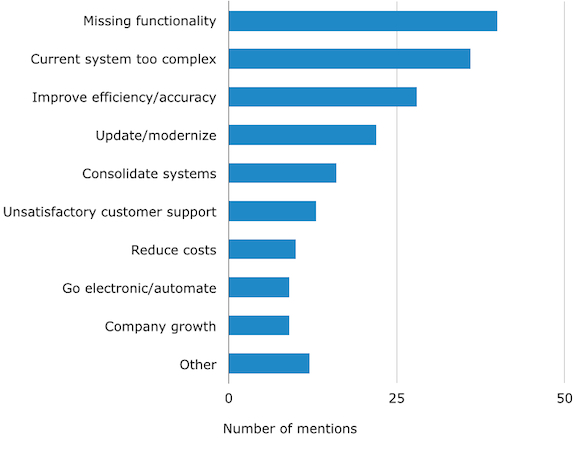

Current HR Software Users Seek Additional Functionality

Of those buyers looking to replace an existing HR system, 44 percent cited missing functionality as the reason for their research. The next most common reason was unhappiness with their existing software. These buyers often said their current system was too complex or confusing to use effectively.

Top Reasons for Replacing Current Software

Many buyers we spoke with mentioned they were shopping for new software because they needed capabilities to support HR processes that weren’t as common just a few years ago—like the ability to post jobs to social media networks.

77 Percent of Buyers Prefer Web-Based Deployment

When it came to deployment type, the vast majority of the buyers we spoke with (77 percent) expressed a preference for Web-based software, while only 3 percent specifically said they would prefer an on-premise system.

HR Software Buyers’ Deployment Preference

When compared with other software markets, the prevalence of buyers who prefer a Web-based deployment method is overwhelming, as many buyers we spoke with noted they needed their employees to be able to log in to the system from remote locations. Because Web-based software is accessible through any device with an Internet browser, this deployment method would be the obvious choice for these companies.

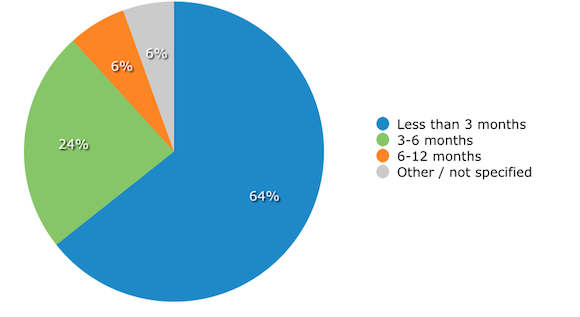

Most Buyers Want to Implement Software in 3 Months or Less

When asked about their timeframe for implementing a new system, 64 percent of buyers said they wanted to implement new software within less than three months. This reflects buyer behavior among small- to medium-sized businesses. Generally, these businesses don’t require a long evaluation and implementation process like that of their larger competitors.

Timeframe for Implementation

Most Buyers Are Small to Mid-Sized Businesses

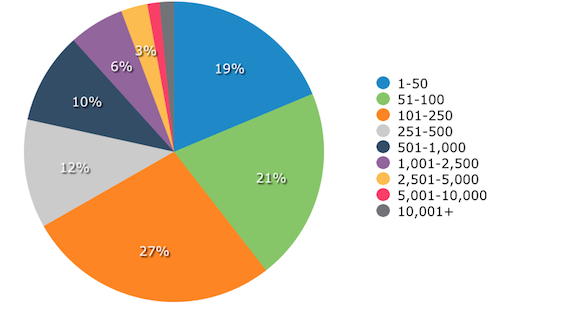

While our sample spanned a wide range of business sizes and revenues, the majority of HR software buyers were from companies that fell within the range of 1-250 employees.

Demographics: Buyer Size by Number of Employees

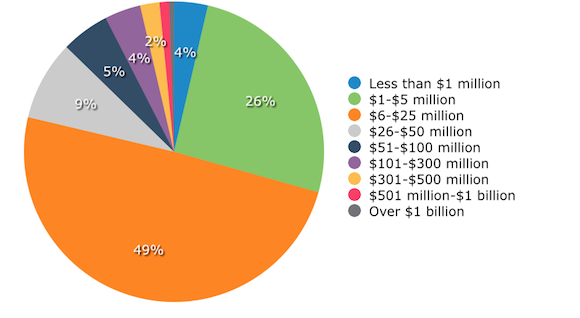

When we drilled deeper into the data to look at the annual revenue of these buyers, we again found that the majority fell on the lower end of the spectrum: 75 percent represented companies with annual revenue between $1 and $25 million.

Demographics: Buyer Size by Annual Revenue

Explore HR categories: