A Contingency Plan Will Help Your Business Avoid the Worst Outcomes of the Next Supply Chain Crisis

The past three years have thrown one supply chain crisis after another at U.S. retailers, from a global pandemic to a series of national labor strikes. Software Advice research shows it’s more important than ever for businesses to formally plan for the next disruption—in fact, 90% of leaders at small to midsize retail companies say preparing for potential crises is a top business priority.*

And it’s a good thing too, because contingency planning for tomorrow’s crises can help your business avoid the worst outcomes of a serious disruption.

Key insights:

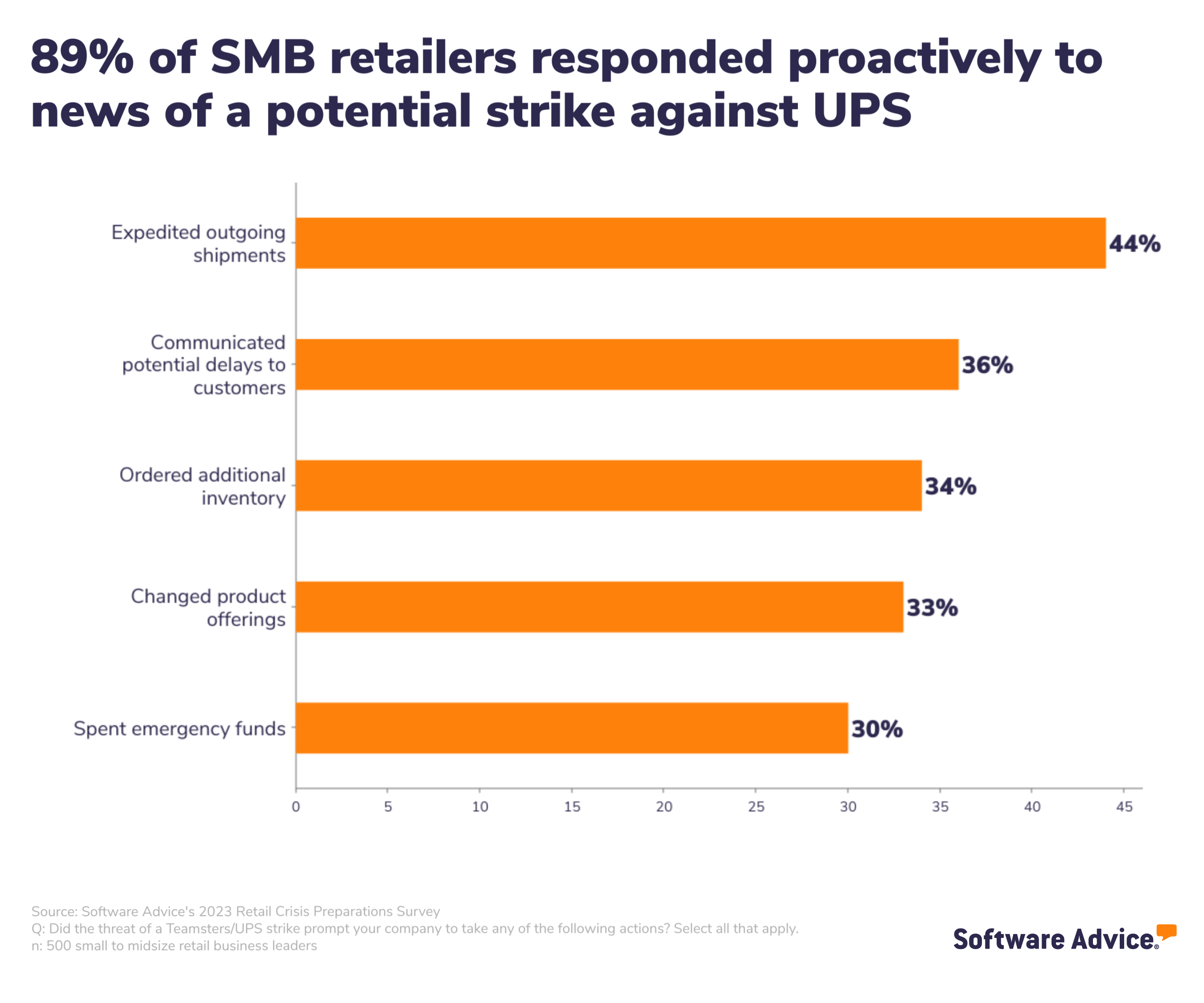

89% of small to midsize retailers recently took one or more proactive steps to prepare for a potential strike against UPS.

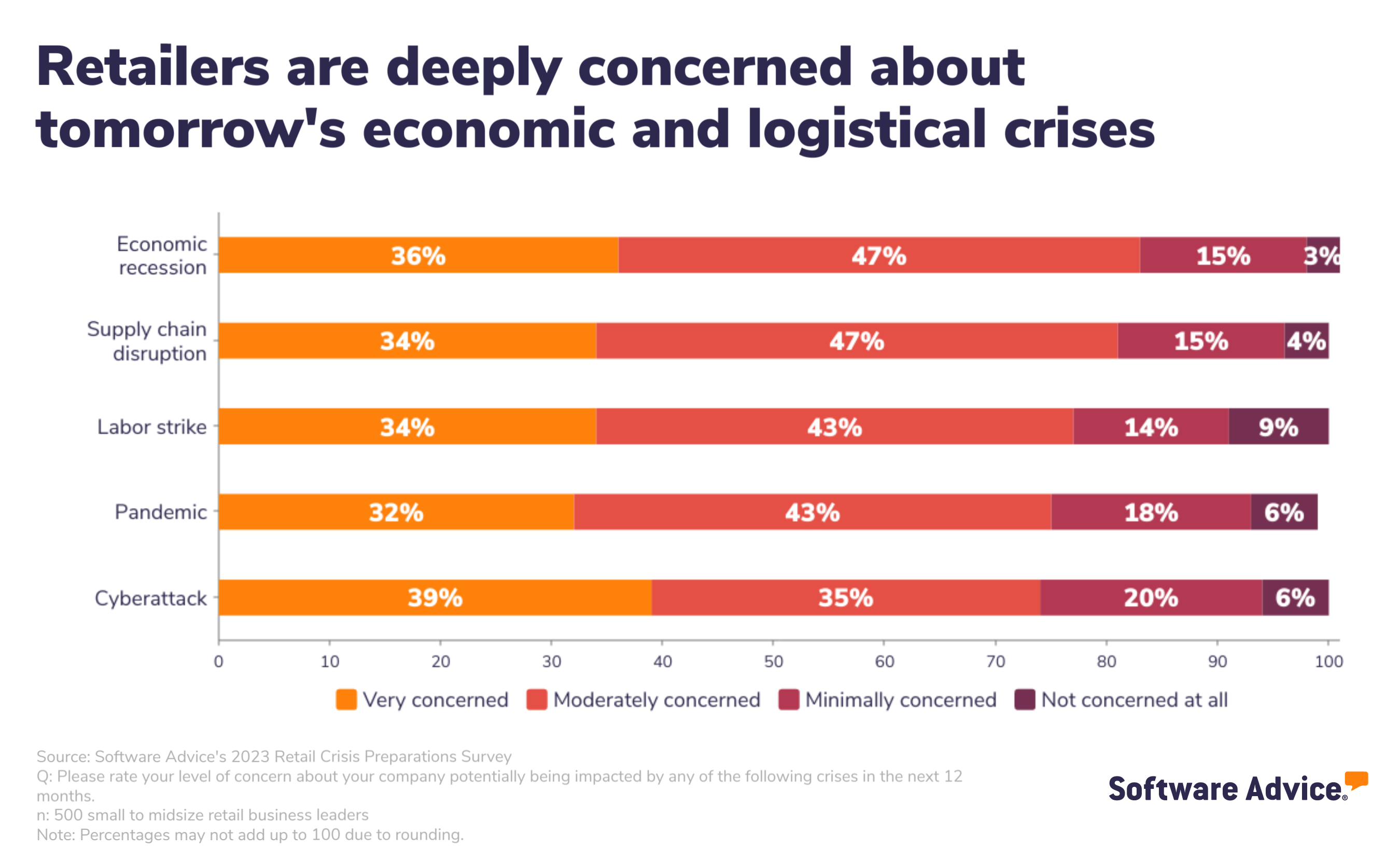

SMB retailers are most concerned about being impacted by an economic recession, a global supply chain disruption, or a labor strike in the near future.

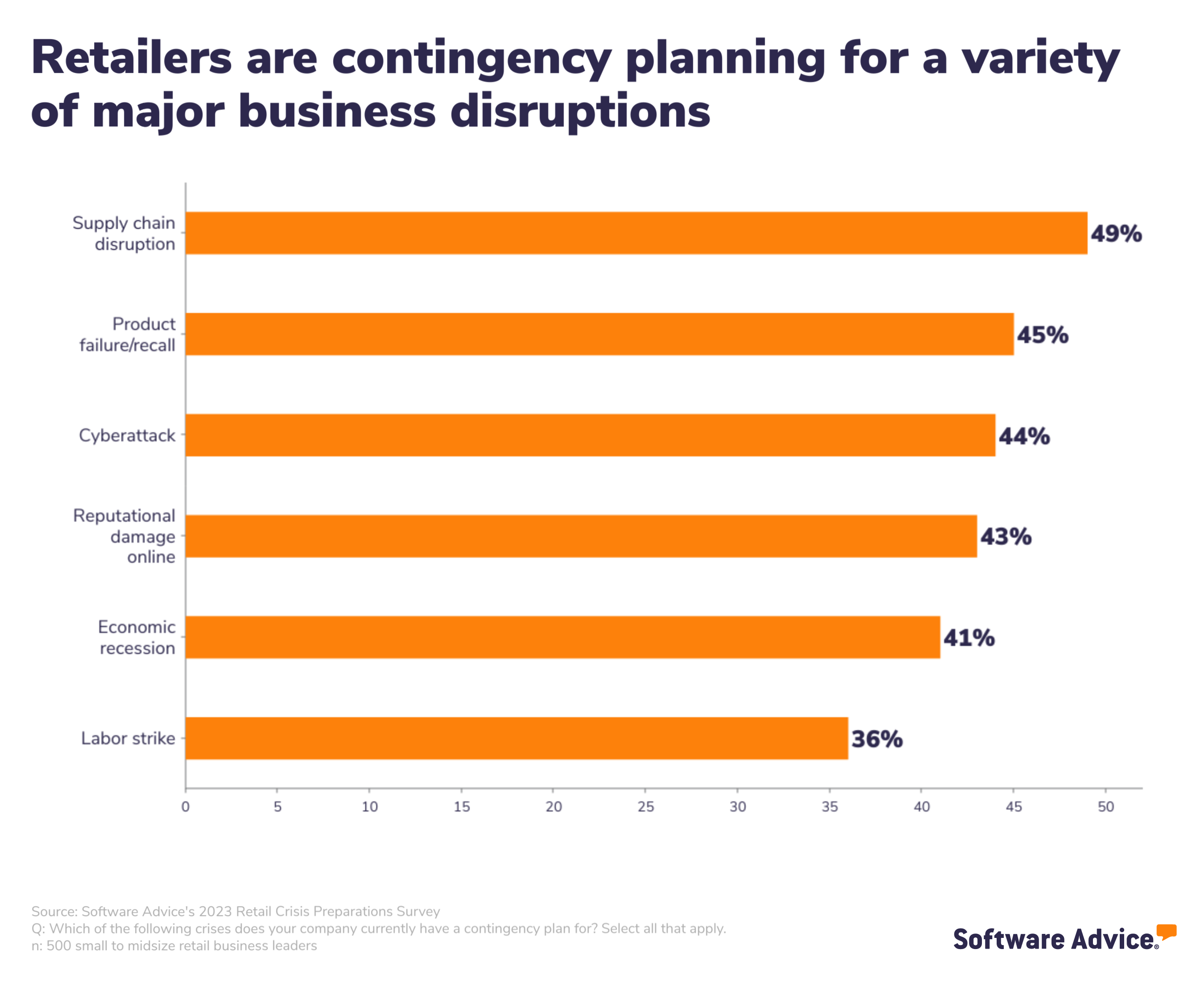

93% of SMB retailers currently have a formal contingency plan for one or more of the top crises of concern.

72% of SMB retailers have activated a crisis contingency plan at least once in the past.

Retailers are taking quick action to avert potential crises

Retailers are taking potential crises seriously and moving quickly to minimize damage to their businesses. For example, in June 2023, the Teamsters Union voted to authorize a strike against the United Parcel Service (UPS) over contract disagreements—news that sent a shockwave through the retail industry, which relies critically on UPS to function at both ends of its supply chain.

Though the strike was narrowly avoided after months of negotiation, even a few days without UPS delivery would have spelled disaster for smaller retailers. [1] The majority described the likely business impact of a week-long strike as significant to severe, estimating the cost to have exceeded $25,000.

With that in mind, 89% of SMB retailers took steps to mitigate the fallout from the potential strike, primarily by expediting outgoing orders, activating crisis contingency plans, and launching recruitment efforts for in-house logistics staff to handle fulfillment. Over one-third of SMB retailers also communicated to customers about how the strike could affect shipping times—an important step in building trust in their brand and retaining customer loyalty during tumultuous times.

Retailers’ quick actions reflect the resilience they’ve built up since the COVID-19 pandemic ground the global supply chain to a crawl. Their multi-pronged approach to crisis prevention—assembling task forces, addressing hiring needs, and preparing external communications—shows they understand that even a small disruption can affect multiple business functions, magnifying its impact.

Key takeaway

Taking quick preventive action at the first signs of a serious disruption can help your business combat crises before they hit. Consider how a coming crisis could affect your company’s day-to-day operations and build flexibility into your supply chain so you can quickly pivot to alternative shippers and workflows should you need to. Having the right supply chain management software can smooth the process. Don’t forget to communicate proactively with customers about potential delays while you’re putting out fires internally, whether it’s through social media, email, or your online customer service desk.

Retailers anticipate more supply chain disruptions in the near future

Retailers know that more crises are on the horizon, as climate change, cybersecurity weaknesses, and a growing consumer population add complexity to global supply chains and economies.

What’s more, previous Software Advice research shows that 91% of SMB retailers feel that larger companies have an advantage over them in their ability to procure inventory during crises.

Olivia Montgomery

Associate principal analyst of supply chain at Software Advice

SMBs’ less privileged position in the global supply chain means it’s even more important for them to plan against the worst outcomes of a crisis.

Retailers are primarily concerned about large-scale crises on a national or global level, such as an economic downturn, a global supply chain disruption, or a new pandemic. However, they’re also worried about crises that strike closer to home, such as cyberattacks, a negative post going viral on social media, and store break-ins.

That said, most retailers are confident they’ll survive most disasters they might encounter in the near future. That’s due in part to the fact that most have planned ahead to avoid the worst possible outcomes: 93% currently have a contingency plan for one or more of the top crises facing retailers in the near future.

Retailers’ confidence also stems from experience: 72% of surveyed retailers have had to activate a contingency plan in response to a crisis at least once before—most commonly cyberattacks and product recalls. Of that group, 67% said their contingency plan was moderately to very effective during the recovery period.

That’s not to say that contingency planning is an easy or quick process—it should involve a variety of stakeholders and careful consideration of your business’s vulnerabilities and the most pressing threats to its operations. It takes time and a diversity of input to make sure your business is adequately prepared for events to come.

Key takeaway

SMB retailers face a variety of potential crises. Most are confident they’ll survive those disruptions, thanks to diligent contingency planning that involves a variety of stakeholders. Bringing together a task force at your company to create action plans for potential crises is a crucial step in averting severe impact.

Contingency plans help retailers navigate disruptions effectively—here’s how to make your own

SMBs can take notes from their peers on how to prepare for the obstacles ahead.

Assemble a diverse set of stakeholders for your planning task force.

Any crisis has the potential to impact multiple functions across an organization. Most commonly, SMB’s contingency planning task force involves stakeholders from IT, logistics and supply chain, store operations, or facilities management departments.

It’s a good idea to also loop in marketing and communications, accounting, and HR leaders so your business can paint a full picture of how you’ll communicate about the crisis, how you’ll manage a recovery budget, and how quickly you can hire employees to assist the recovery effort, if need be.

It should go without saying that top-level leadership at the business should be aware and involved in contingency planning, and if your business has ecommerce operations, that team should be included as well.

2. Identify threats and vulnerabilities early.

Contingency planning is a year-round activity that starts with everyday awareness in your community—including your business, your locality, and world events. Your geographic region, the vendors and shippers you work with, the software your business runs on, and even the day-to-day treatment of your employees all determine your vulnerability to external and internal threats.

When a shift occurs that could indicate a coming crisis or a change to your company’s preparedness, revisit your contingency plan and convene stakeholders to review any necessary changes.

Some examples of external and internal threats on retailers’ radar include the following:

A worker’s union votes to authorize a strike, which could affect your logistics partners and lead to manufacturing and shipping delays.

A natural disaster hits overseas freight routes, which could result in your inventory being damaged or lost.

Your company experiences a sudden influx of negative product reviews, which could indicate a product failure or reputational attack.

3. Consider common tactics retailers use to mitigate disaster.

Your contingency planning task force should make a list of essential business functions it needs to both survive a crisis and continue serving its customers to the best of its ability, and prioritize tactics that ensure those functions can continue.

Some of the most important functions for retailers during a crisis include inventory management, order fulfillment, store operations, and customer service—these ensure your business can still make money and uphold customer expectations.

When faced with past crises, SMB retailers have acted quickly to secure inventory, establish a recovery fund, and draft communication to keep employees and customers in the know as events unfold.

Your retail business should be prepared for the next big disruption. By identifying threats and creating effective contingency plans with key stakeholders, you can meet challenges confidently, knowing you’re ready to pivot and avoid the worst outcomes of a crisis.

To learn more about software and strategies that can help your business in times of crisis, check out these articles:

Survey methodology

*Software Advice's 2023 Retail Crisis Preparations Survey was conducted in September and October 2023 among 500 professionals representing small to midsize retail businesses with management roles or above. They were asked about whether and how their company is prepared to meet crises in the near future, and what impact crises would likely have on their company. Crises including labor strikes, pandemics, natural disasters, and cyberattacks. Respondents were screened for companies with 1,000 or fewer employees. Businesses that sell vehicles or software were excluded.