6 Types of Budgets Every Small-Business Owner Should Know

Creating a budget is an essential part of your small business's financial planning process. A budget offers a roadmap to identify and meet the larger strategic goals of your business. It also enables an ongoing comparison between actual allocations and the figures you forecasted at the beginning of the year.

Budgeting strategically allows small-business owners like you to set realistic financial goals and allocate funds and resources more effectively. In fact, developing a planning, budgeting, and forecasting strategy is the No. 1 priority for 85% of financial planning and analysis leaders for 2023, according to Gartner. [1]

If you're new to budgeting or have limited experience with creating detailed business budgets, we got you covered. We spoke with CharRon Smith, a production house owner with a background in accounting and finance, to explore the different types of small-business budgets and why you need them to enhance decision-making. [2]

6 types of budgets (and when to use them)

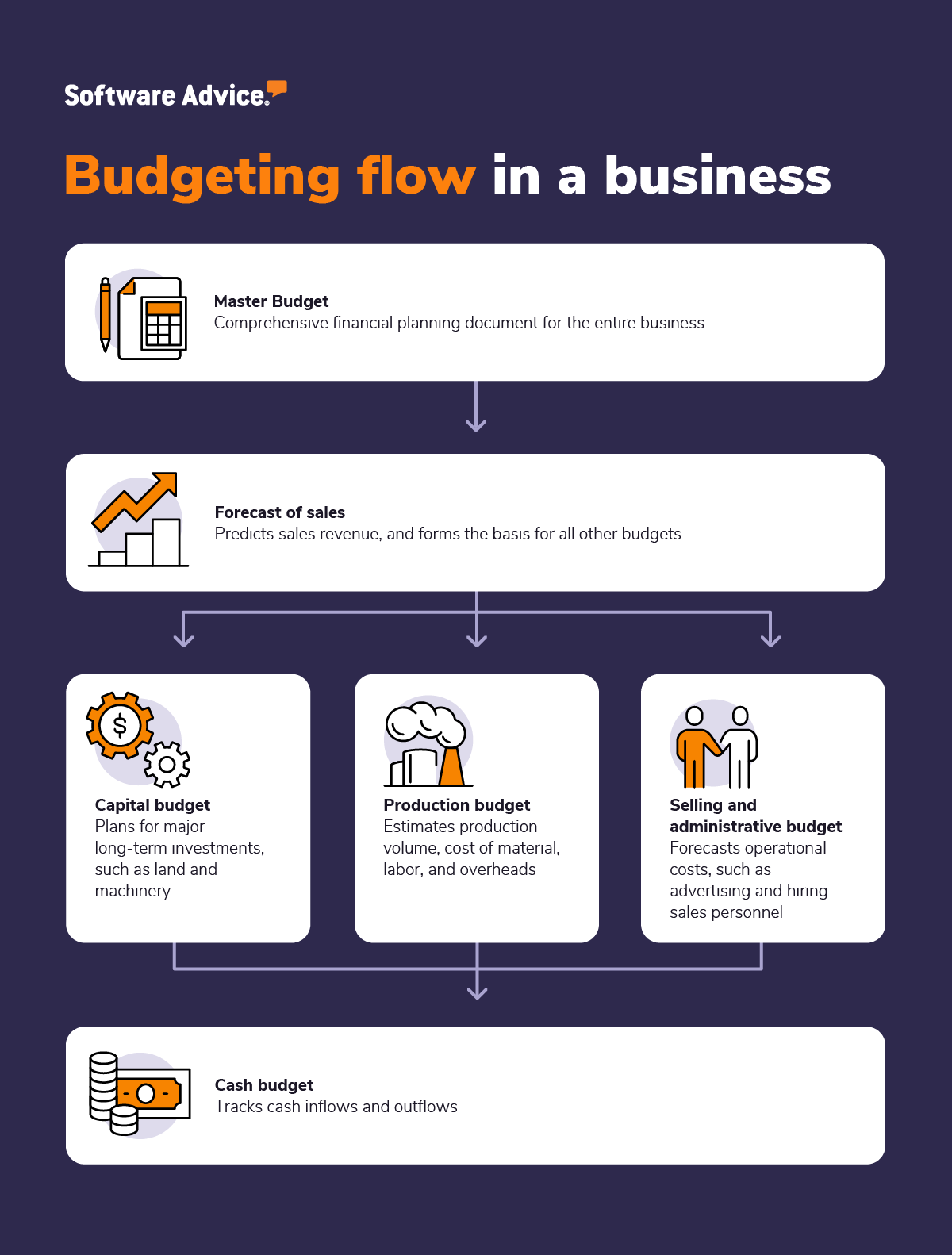

The types of budgets to create depends on whether you're planning finances for the long term or short term. Long-term planning involves your small business's broader strategic initiatives, comprising sales and capital expense budgets. On the other hand, short-term planning delves into your business's production and operational needs, covering production, selling and administrative, and cash budgets.

CharRon E. Smith

Founder, A Serious Production

1. Master budget

A master budget comprises all lower-level budgets within your organization. It's not just one budget; it's a series of detailed budgets that together show your business's overall production, operating, and financing plans for the budgeted period. This budget serves as a central planning tool.

To create the master budget, you can aggregate all the different budgets within your organization. You can also use specialized budgeting tools that automatically pull estimates from integrated accounting and financial systems to help create your master budget.

When to use?

Use the master budget to view the overall financial plan of your business, including projected income, expenses, and profits.

2. Sales budget

A sales budget estimates the revenue from selling your products over the budgeted period. It typically considers the forecasted sales volume and unit price to forecast revenue. But making accurate sales forecasts is tricky because it requires researching the impact of external variables such as customer tastes, market competition, and seasonal fluctuations, as well as internal variables such as selling price, sales effort, and advertising.

To create your sales budget, look at your previous fiscal year's growth trends and ask major customers about their purchase plans for the year. You can also use sales forecasting tools that analyze past and present data and trends to predict future sales accurately.

When to use?

Use the sales budget to set company goals, drive long-term strategy, and know how much money you can expect to make in the coming period.

Example of a sales budget

Grace Vintage Tables Company wants to create a sales budget for the last two quarters of 2023. (Regardless of the period you budget for, the method of creating a budget remains the same.) Based on historical trends, it forecasts selling a total of 200 tables in Q3 and Q4, with the sales price of each table being $100.

To estimate revenue for these two quarters, we'll first need to look at the actual sales figures of the previous quarter.* With that, the sales budget will look something like this:

Actual Q2 2023 | Forecast Q3 2023 | Forecast Q4 2023 | |

|---|---|---|---|

Sales number | 50 | 70 | 130 |

Price per table | $100 | $100 | $100 |

Revenue earned this quarter | $5,000 | $7,000 | %13,000 |

Cash received this quarter* (x 80%) | $4,000 | $5,600 | $10,400 |

Cash collected from previous quarter* (x 20%) | $700 | $1000 | $1,400 |

Total cash collected this quarter | $4,700 | $6,600 | $11,800 |

*Note: The revenue earned isn't equal to the cash made because in every quarter, some tables will be sold on credit. In this example, we assumed that Grace Vintage Tables is able to collect approximately 80% of revenue from customers in the same quarter, with the remaining 20% collected in the next quarter.

3. Capital budget

A capital budget is a long-term financial plan that outlines expenditures on major long-term assets, such as land, buildings, and equipment. Long-term projects, say acquisition plans, are also covered in this budget. Assets covered in the capital budget are typically high-cost investments that are acquired to be used over several years.

The capital budget is prepared by considering the sales forecast for the budgeted period and the strategic plans of the company. In our example above, Grace Vintage Tables Company may budget $10,000 for purchasing woodworking tools and machines to cater to an expected customer increase in the coming quarters.

When to use?

Use the capital budget to determine the need for and returns on a big investment before making it.

4. Production budget

A production budget details the number of products you'll need to manufacture to meet your sales forecast for the budgeted period while considering operational constraints.

Based on this "required production" quantity, the budget determines how much you'll have to spend on direct materials (raw materials), direct labor (labor for production), and overhead elements (all production costs besides direct materials and labor) during the budgeted period.

Remember, the required production quantity isn't the same as the estimated demand for your products. Every quarter, you'll produce some extra units—i.e., safety stock—to meet unexpected demand fluctuations. Also, you may have some leftover inventory from the previous quarter. The production budget includes both your safety stock and leftover inventory.

When to use?

Use the production or purchase budget to know how much it costs to make what you’re selling, schedule purchases from suppliers, control production costs, and determine how much labor to hire.

Example of a production budget

Step #1. Determining the required production quantity

If Grace Vintage Tables Company's management decides to create 50% of the inventory of the next quarter in advance, its production plan will look like this.

Finished goods | Actual Q2 2023 | Forecast Q3 2023 | Forecast Q4 2023 |

|---|---|---|---|

Sales number (tables) | 50 | 70 | 130 |

Desired ending inventory* | 35 | 65 | 80 |

Tables needed | 85 | 135 | 210 |

Inventory on hand | -25 | -35 | -65 |

Total tables to create | 60 | 100 | 145 |

*Pegged at 50% of next quarter's sales

Step #2: Determining direct material and labor required

Say Grace Vintage Tables Company can create one table from 30 board feet, and they purchase each board for $10. Based on these calculations, the direct materials budget required for Q3 2023 will look like this:

Wood | Q3 2023 |

|---|---|

Production volume | 100 tables |

Standard feet per board | 30 feet |

Wood needed for production | 3,000 feet |

Standard price per board | $10 |

Total cost for wood purchase | $30,000 |

Note: You can add desired ending inventory for wood and subtract the beginning inventory here as we did in the production estimates.

You can similarly create a direct labor budget if you have the hourly labor rate you pay and the number of labor hours each table needs.

Direct labor | Q3 2023 |

|---|---|

Production volume | 100 tables |

Labor hours per table | 15 hours |

Labor hours needed for production | 1,500 hours |

Standard labor price per hour | $20 |

Total direct labor cost | $30,000 |

Related reading: What Is Inventory Accounting, and Why Do You Need It for Your Small Business?

5. Selling, general, and administrative expenses budget

The selling, general, and administrative expenses (SG&A) budget includes planned expenditures in all areas other than production. The cost of supplies used by your office staff, the salaries of employees (other than staff directly involved in producing goods), and the depreciation of administrative office buildings (not the production facility) all belong to this category.

The SG&A budget is prepared using the sales budget, and because this budget covers several areas, it's usually quite large and may be supported by individual budgets for specific departments within the selling, general, and administrative function (e.g., research and development, product design, marketing, distribution, customer service).

When to use?

Use the SG&A budget to track the cost of activities happening outside your production facility, such as marketing, management, and office supplies.

6. Cash flow budget

A cash flow budget estimates the amount of cash coming into (inflow) and going out (outflow) of your business during the budgeted period. Unlike other budgets, it focuses solely on when "actual money" enters and leaves your company. The keyword here is "cash,"—i.e., readily available money you can spend right now.

For example, Grace Vintage Tables Company might forecast sales revenue of $13,000 in Q4, but if clients pay only 80% of that amount (and the rest in the next quarter), the company will receive cash worth $10,400 only from Q4 sales.

The cash budget is important because sales and purchases are often made on credit. It ensures you have enough money on hand to keep operations running and pay bills.

When to use?

Use the cash flow budget to determine how far along you can run business operations without requiring new financing, check the hard money available, and avoid cash problems.

Recommended reading:

Know more about how to predict the incoming and outgoing cash in your small businesses with our article on "Cash Flow Forecasting: The Key to Making Smart Business Decisions."

Budgeting for nonmanufacturing businesses

We used the example of Grace Vintage Tables Company, a manufacturing firm, to explain the different types of budgets. When asked if budgeting is different for other businesses, such as merchandising, retail, and wholesale firms, Smith says, "Budgeting is an exercise in logic. It involves thinking deeply about everything you'll need. Then, it doesn’t matter whether you're a manufacturer or a service provider."

Budgeting for a merchandising or retail firm

Merchandising and retail companies buy products rather than make them, so they prepare a purchase budget instead of a production budget. However, the budgeting format remains exactly the same as the direct material budget we discussed in the production budget example.

Let's say you're a retail company that sells antique tables. To arrive at the total number of tables you'll need to purchase, consider your sales forecasts (anticipated demand), beginning inventory (surplus tables from previous quarter), and desired ending inventory (extra tables to accommodate unexpected demand).

Budgeting for a service firm

Service companies differ from manufacturing or merchandising companies in the sense that they provide services instead of products to customers. Some common service businesses are law firms, accounting firms, engineering businesses, healthcare providers, hotels, and motels.

Budgeting in service firms also begins with a sales budget, and it's almost similar to the process for manufacturing firms, except for these parts:

Services firms don't need a production budget, as they sell intangible products, such as physician appointments, car repairs, room rentals, or internet services, that can't be inventoried. However, they may budget for supplies or materials required for service delivery, such as office supplies or specialized tools.

The cost of materials is low in service firms, and the focus is on labor and infrastructure support.

Smith suggests a project-based budgeting approach for service firms. "Each project should have its own budget, which should be factored into the overall operating budget. The project budget should consider all aspects, including production costs and potential revenue from advertisements."

Example sales budget for a service firm

Grace View Inn is a small motel, with January through March being a slow period. However, for the rest of the fiscal year, demand is at its peak. It has 10 rooms, and the average rent for each is $150 per night during peak periods and $100 during the slow period.

Based on historical data, occupancy rates are expected to be 30% for Q1, 90% for Q2 and Q3 each, and 60% for Q4. Using this data, we can construct the sales budget for the first quarter.

Forecast Q1 2023 | |

|---|---|

Number of rooms | 10 |

Number of days | 90 |

Potential rental volume | 900 |

Occupancy rate | 30% |

Actual rented volume/rooms | 270 |

Room rate | $100 |

Revenue earned | $2,700 |

Resources to simplify budgeting for your small business

Smith advises new businesses not to hesitate to seek advice or assistance. "There's always someone in the same business line. Also, there are various resources online. The only time I needed to call in professionals was when things started getting over my head. That's when I realized I needed to form a team. Before that, it was just me, my bookkeeper, and a budgeting tool."

Expanding your budgeting practices requires time and commitment. But with the right resources and budgeting method, you can gain confidence to make efficient resource allocation decisions. Here's a list of tools and resources to get you started:

Budgeting software: Specialized budgeting and forecasting software can create and maintain budgets with ease by integrating with your accounting, CRM, and other business applications. It can monitor resource usage, develop estimates, and measure budget performance by comparing actual spending with planned numbers.

Financial management tools: Tools such as invoicing software and inventory management software can make your budgeting process simple and reliable by maintaining accurate records and automatically pulling spend data from across business units.

Financial advisors: If you don't have a dedicated finance team, consult with a financial advisor to efficiently expand your budgeting practices and lay down the initial processes.

Upskill with online courses: Mastering budgeting requires consistent and diligent efforts. Hone your skills and knowledge with online courses and webinars.