Embrace Salary Transparency With These 3 Best Practices

How would you feel if every one of your coworkers could look up exactly how much you make in your current position? For most of us, the answer to that question involves mixed emotions — which is in line with the sentiment towards salary transparency in general.

While there is plenty of research out there about the advantages and disadvantages of pay transparency, stories of organizations that have successfully embraced it are much harder to find. But with conversations around pay transparency heating up due to new legislation, inaction is no longer an option.

If you’re an HR manager who’s taken on the difficult task of paving the way to pay transparency, know that not only has it been done before, but we’re here to guide you through how to do it the right way.

But first, let’s discuss why this is such an important task.

In some states, salary transparency is now the law

In January of this year, Colorado’s Equal Pay Transparency Rules went into effect. This legislation requires employers to include compensation in job postings, notify employees of promotional opportunities, and keep up with job description and wage rate records.

Soon after, Nevada, Washington, Connecticut, Maryland, Rhode Island, and California passed similar pay transparency and salary range disclosure laws.

Resisting salary transparency could result in turnover

Whether you live in one of these states or not, expectations surrounding transparency policies are changing, and organizations that choose not to take a proactive approach to the salary conversation are doing more harm to their company culture than good.

Your organization may be more prone to turnover without some level of pay transparency. According to a 2021 study from Beqom, when employees perceive a pay gap (regardless of if the pay gap actually exists) it results in a 16% decrease in intent to stay. Further, their report found more than half (58%) of employees would consider switching jobs for more pay transparency—for Gen Zers, that number jumps to 70%.

This means that embracing pay transparency will not only minimize the risk of turnover, it will also make your organization more attractive to job seekers, especially young talent.

Is salary transparency beneficial for everyone? The answer is yes… with stipulations.

It’s clear that employees benefit from salary transparency; by knowing how much their coworkers are being compensated, they can negotiate a fairer wage for themselves. And through that process, employers can make the adjustments necessary to get closer to pay equity at their organization.

However, the path to equitable pay is not a straightforward one. Tensions between coworkers, ambiguous salary policies, and budget constraints are all challenges that employers have to overcome as a part of rectifying pay discrepancies.

Overcoming these challenges requires a well-thought-out plan, which is why we’ve put together a list of best practices for embracing salary transparency below.

3 best practices for embracing salary transparency

Simply publishing your workforce’s compensation information on your company intranet probably isn’t a good idea. Put these three practices into action before making your payroll publicly available.

1. Identify pay discrepancies with a pay equity audit

One of the top reasons why employers choose not to offer salary transparency is that it would reveal inexplicable pay gaps between employees. The solution to this concern is to proactively find and fix pay discrepancies, and the way to do it is with a pay equity audit.

At small businesses, an HR professional will typically lead the pay equity audit, but larger companies can hire a consulting firm that specializes in compensation. Whatever route you choose, here are the basic steps of a pay equity audit:

First, collect relevant employee data. Gather your employees’ job titles, hire date, tenure, and compensation details, as well as demographic information such as their gender and age. The goal is to create a clean data set on which to conduct your audit. You can obtain most of this information from wherever you keep employee records, such as an HRIS platform.

Identify comparable roles. Next, you should group employees with similar jobs. According to HR Executive, comparable roles require substantially similar skills, responsibilities, and effort, and are performed under similar working conditions.

Conduct a regression analysis. Once your data set is cleaned and you’ve identified cohorts with comparable roles, it’s time to conduct a regression analysis. Regression analyses allow you to assess pay discrepancies while controlling for legitimate factors, such as work experience, education, and training. Check out this guide from Alteryx for a detailed breakdown of how to use regression analysis for a pay equity audit.

Tip: If you have a business intelligence tool (such as HR analytics software), you should be able conduct a regression analysis on employee data through that tool. If not, a spreadsheet-based reporting tool is a great alternative.

Find the outliers. Unless your compensation strategy is airtight, there are bound to be inexplicable pay discrepancies. Look into these cases; make sure that the individuals are appropriately grouped and that there are no clear reasons why the worker’s salary is noticeably different from that of their comparable coworkers.

Remediate pay disparities. Lastly, correct existing pay gaps by making adjustments to compensation. Most frequently, this will involve offering a slight salary increase to a handful of individuals. In the case that there’s an outlier who is paid more than their comparable coworkers, consider withholding merit or cost-of-living raises until they’re closer to the salary of their peers (rather than outright lowering their salary).

2. Use data to set salary ranges

In order to eliminate bias, every salary in your organization should be determined with data. This means that you’ll need to develop clear salary bands for different levels of roles. An employer can have as many or as few salary bands as they want; a small business may only have three or four salary bands, while a large corporation may have closer to 15 or 20.

Much like with a pay equity audit, group similar jobs in order to develop salary bands. These groups are called job grades, and your organization will have one for each tier of work, from entry level to C-suite.

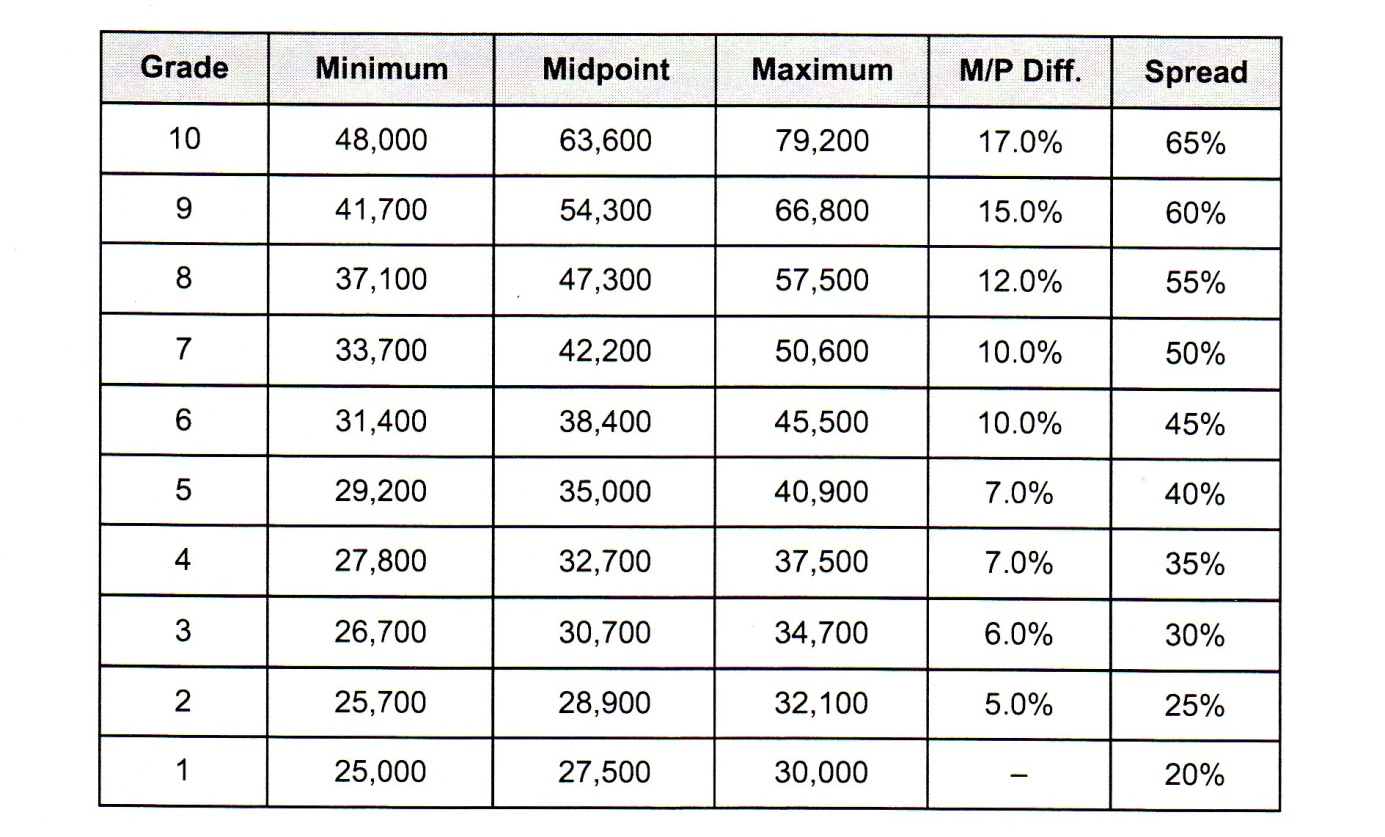

A chart showing the minimum, midpoint, and maximum salaries for different job grades (Source)

Tip: A simple way to determine the midpoint of a salary band is to collect market data on compensation for different positions in a grade and calculate the average. You can find this information on sites such as Glassdoor or Payscale.

It’s worth mentioning that salary ranges typically have some overlap. Overlap makes career progression more cost-effective for employers; less overlap will call for a larger pay increase for internal promotions.

Having definitive salary ranges helps with transparency efforts because every worker will know where they fall on their spectrum of opportunity. Salary bands provide a clear range of compensation for each level of role; employees with more experience or tenure should fall on the high end, while new hires will land near the minimum. This makes it easier to identify when an employee is paid outside of the expected range.

3. Prepare managers for conversations about compensation

According to Gartner, nearly 70% of organizations rely on managers to deliver pay communication. This seems to be the right course of action, as employees respond 20% better to the same information when it’s delivered by their manager rather than by the HR function.

However, even with training, less than half of managers (46%) feel prepared to discuss pay (full content available to clients).

To address this, have the compensation specialist or HR employee who manages total rewards at your organization create a discussion guide that covers the following topics:

How salaries or hourly wages are determined, including incentive pay such as bonuses

Where an employee’s compensation falls within their salary band

How an employee can acquire the skills or experience needed for a pay raise

How to raise pay equity complaints and why some employees may receive adjustments

Who in the HR, total rewards, or legal teams can answer additional questions

We’ve talked about the importance of being proactive when it comes to salary transparency throughout this article. This step is no different; managers should proactively plan to have discussions with their reports about compensation at least twice a year. During these conversations, managers should explain any changes being made to their employees’ pay and encourage them to raise any questions or concerns they have about their compensation. For ease, we recommend scheduling these discussions on the same cadence as your performance reviews.

Next: Publish pay information internally

With these three best practices in place, your organization should be in the right position to fully embrace pay transparency. The Society for Human Resources Management (SHRM) suggests a three-pronged approach for compensation transparency:

Don’t discourage conversations about pay. First of all, restricting conversations about compensation may violate labor laws. Secondly, they also may cause increased suspicion or tension among employees.

Strike a balance between transparency and privacy. It may not be necessary (or helpful) to publish every employees’ exact compensation. Instead, you may decide to publish averages, or pay ranges for jobs in a group or pay grade.

Make pay process transparency the goal. Providing your employees with information about how their compensation is determined should be your primary goal. This includes sharing details about how their bonus is calculated or how they can earn a raise.

Prepare for the future of work today

Embracing salary transparency is one step towards future-proofing your organization. However, there’s a lot more you can do to improve the employee experience at your workplace.

For more enlightening HR content, visit our blog where we post our latest research and recommendations, including the following related articles: