IT Project Management Tools – Buyer Report 2016

Every year, thousands of project management (PM) professionals contact Software Advice for recommendations and guidance on selecting PM software.

These consultations produce a wealth of knowledge about PM market trends, including the challenges driving buyers’ software searches and the functionality they seek in new solutions.

Additionally, these interactions give us unique insight into trends and demographics among specific buyer segments.

For example, we know that the largest percentage of PM software buyers that contact Software Advice are from information technology (IT) services and related industries—21 percent in 2014 and 18 percent in 2015.

With this in mind, we analyzed a random sample of interactions over the past year with buyers from IT services and software and technology fields. This report, which highlights our findings, can be used as a reference by other buyers in these industries as they evaluate PM software.

Key Findings

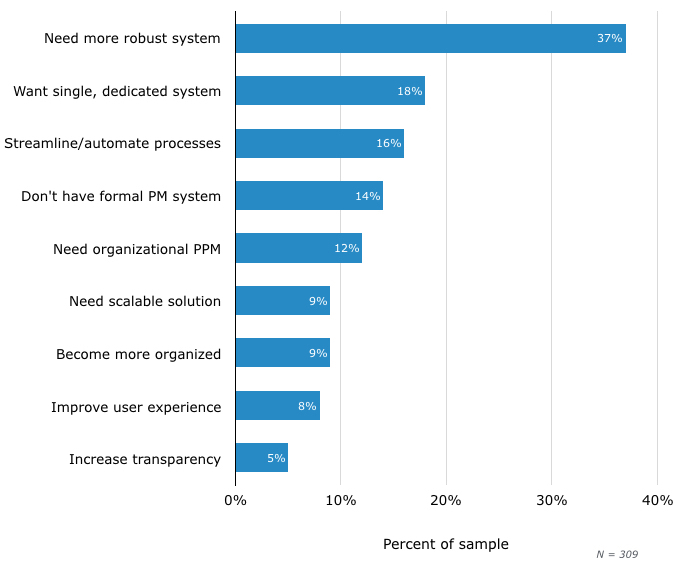

The majority of IT professionals (56 percent, combined) are looking to replace existing PM software.

Incentives driving buyers’ software purchases include needing a more robust system (37 percent) and wanting to institute a dedicated PM solution (18 percent).

Top-requested features include task management (62 percent) and time tracking (56 percent).

Introduction

PM software buyers within IT and software and technology industries (referred to collectively as “IT” for the remainder of the report) have specialized needs when it comes to project management software.

For example, there is a high tendency within these fields to follow an agile PM methodology, rather than a traditional waterfall approach.

Additionally, as we’ll discuss below, we see a greater need for software solutions that support multiple concurrent projects within an IT portfolio.

To gain further insight into the unique needs of these buyers, we interviewed Jeffrey Palermo, managing partner and CEO of Clear Measure, a custom software engineering and consulting firm based in Austin, Texas. His expertise sheds light on the following IT buyer trends.

Majority of IT Professionals Looking to Replace Current System

When looking at buyer trends within the larger PM market, we see the majority of buyers are currently using manual methods, and they contact Software Advice for recommendations for their first PM system.

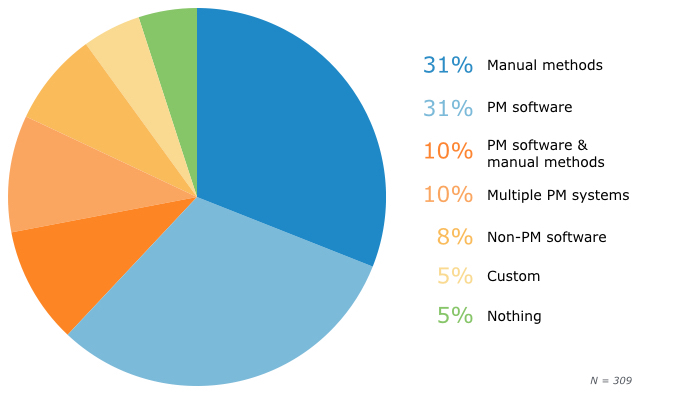

But this is not the case when we narrow our search to only include IT professionals:

Nearly 60 percent, combined, are currently using PM software to manage projects, either alone or in combination with manual methods or other tools.

36 percent are managing projects with manual methods (pen and paper, spreadsheets or email) or do not have formal PM processes in place.

An additional eight percent are using non-PM software (e.g., office management suites, CRM software etc.)

Prospective IT Buyers’ Current Methods

While it’s interesting to note that these segments do not follow the same pattern as the market as a whole, it’s not surprising.

According to Palermo, the nature of IT professionals work makes them more open to using new technology.

“Out of all the different project management fields, IT is the producer of software, so those people are going to be more comfortable adopting software automation and software record keeping of any kind.”

Jeffrey Palermo, CEO of Clear Measure

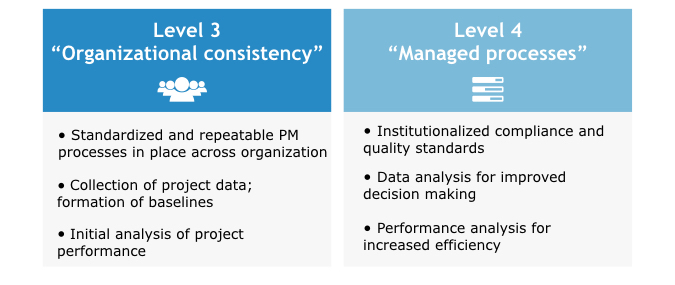

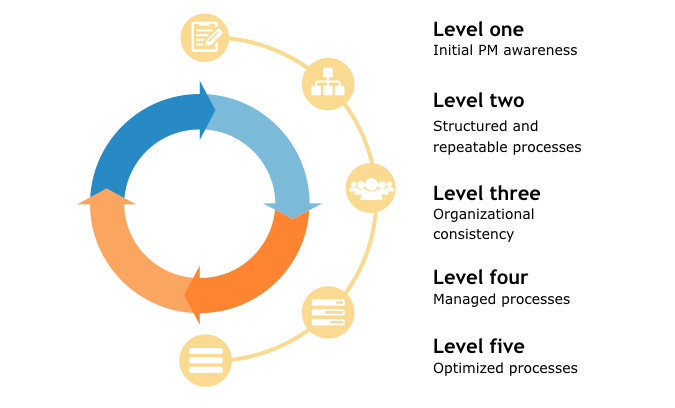

PM Solutions, a research and consulting firm, states that as organizations gradually move away from manual methods and institute standardized and repeatable PM processes, the more they advance in PM maturity. PM maturity is strongly related to an organization’s rate of project success.

IT teams’ interest in more advanced solutions indicates a higher level of PM maturity than other fields, which are often investing in software for the first time.

It’s likely that these IT organizations are at a “level three” (organizational consistency) and ready to advance to “level four” (managed processes).

Breakdown of PM Maturity Levels 3 and 4

Project Management Maturity

Source: Project Management SMB Buyer Report – 2015

IT Buyers Replacing Existing PM System Want More Functionality

The top reasons IT buyers cite for replacing existing PM software include:

Needing a more robust system (37 percent)

Wanting a single, dedicated PM solution (18 percent)

Trying to streamline/automate processes (16 percent)

Top Purchase Drivers

These pain points relate directly to IT buyers’ current methods.

Buyers replacing their existing system typically want to upgrade to something more advanced that can keep pace with their demands. Most are using basic (or sometimes open source) software that has limited functionality.

“System is server-based and [employees] cannot access the system remotely. [It] doesn’t offer resource management, and its time tracking is difficult to use.”

Anonymous IT PM software buyer

Twenty percent of buyers note they are managing projects using either multiple PM systems or PM software coupled with manual methods. These buyers report wanting to consolidate their efforts and invest in a single, dedicated PM software.

“Tracking projects across multiple systems is cumbersome and results in data loss/errors.”

Anonymous IT PM software buyer

The 31 percent managing projects using manual methods are looking to streamline and automate processes by instituting a formal PM solution.

“Managing projects in Excel is virtually impossible and [project managers] have to constantly update employees when project schedules change. This is incredibly time consuming and inefficient.”

Anonymous IT PM software buyer

Palermo says there are several basic PM tools that focus on task management, allowing a project manager to assign individual workers to individual tasks. However, as projects scale in size and complexity, there is a greater emphasis on user workflows. This requires a higher level of sophistication in both PM methodology and software.

“Different methodologies in project management are necessary for projects of different sizes … Unless you understand the size of the software project you’re undertaking, you can’t select the appropriate project management methodology for that size, and of course the tool is roped up in the methodology decision.”

Jeffrey Palermo, CEO of Clear Measure

Palermo goes on to explain that popular agile PM methodologies, Scrum and Kanban, are suited for projects of varying size and complexity.

Scrum works well for small projects, where teams consist of a few users who possess similar skill sets.

Kanban, on the other hand, can scale to larger, more complex projects that require specialists.

“Kanban is the agile strain that does scale higher in project size because of the higher level of sophistication. In Scrum, users are grouped together and work as a cross-functional team. But in Kanban there is specialization because the flow of the work is mapped out and different stages will require a different specialist,” says Palermo.

Prospective IT buyers looking to invest in software that supports these agile methods should note these differences and invest in a solution that aligns with the size and complexity of the projects they are carrying out.

For a detailed analysis of the similarities and differences between Scrum and Kanban software, check out our e-book comparing the two methodologies.

IT Buyers Want Both Basic and Advanced Features

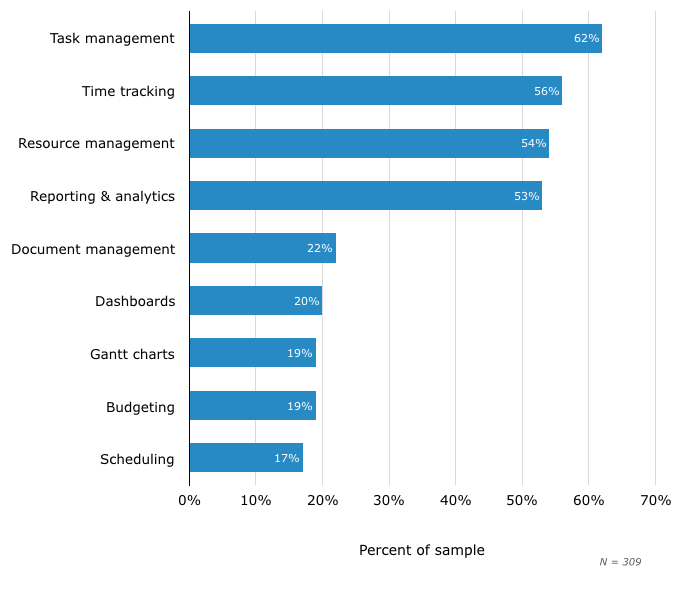

The top features requested by IT professionals include:

Task management (62 percent)

Time tracking (56 percent)

Resource management (54 percent)

Reporting and analytics (53 percent)

Top Four PM Features Requested By IT Buyers

Most Requested PM Software Features

Basic versus advanced PM features are often distinguished by their ability to handle day-to-day operations versus long-term project planning and analysis. As teams refine their PM processes, they gradually require functionality beyond time and task tracking to continue advancing in PM maturity.

At this stage, they often add more advanced features to their PM platform, including:

Project tracking tools. Reports (53 percent) and dashboards (20 percent) allow for data visualizations and monitoring of project progress and performance.

Project planning tools. Gantt charts (19 percent) and scheduling tools (17 percent) allow managers to forecast resources and plan projects into the future.

At this stage, Palermo says teams start to focus more on improving quality and productivity. This often requires more advanced resource management that will allow managers to assign staff to projects based on their specialized skill sets.

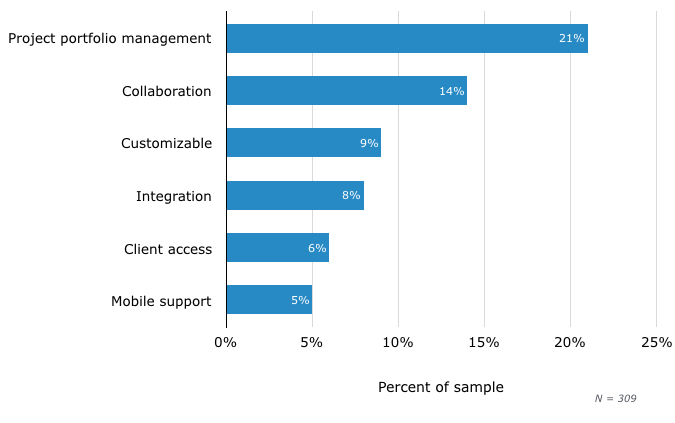

IT Buyers Want PM Software With PPM Capabilities

We also looked at the critical PM software capabilities IT buyers want. What stands out is the high number of buyers requesting a solution to assist with managing their project portfolio (PPM).

Most Requested PM Software Capabilities

This finding aligns with the high PM maturity of the group and is another trend that distinguishes the IT segment from the PM market as a whole.

PM software with portfolio management capabilities allows managers to classify similar projects together and manage them collectively. The immediate advantage of centralizing projects in this way is that managers can assign staff to current and future projects more effectively.

In the long-term, PPM allows organizations to better determine the risk versus reward for prospective projects and ensure each project they undertake aligns with and helps drives business goals.

Conclusions

Based on the results of our research, prospective IT buyers should consider well-rounded PM solutions that support a range of activities, from task tracking to project portfolio management.

Additionally, buyers should evaluate their current level of PM maturity. This can help them decide if there is a business case for purchasing a more comprehensive platform that could help advance their organization to the next level.

If your team is ready to invest in a PM solution, here are a few next steps to help start your search:

Check out our PM Software Buyer’s Guide for reviews and product information for leading systems. See how your peers have rated top systems for qualities such as ease of use and customer support.

Take our online PM software questionnaire, which will help guide you through a short assessment of your business and industry requirements and help us match you with several products that fit your needs. After answering a few questions, we can provide you with a FREE custom price quote.

Demographics

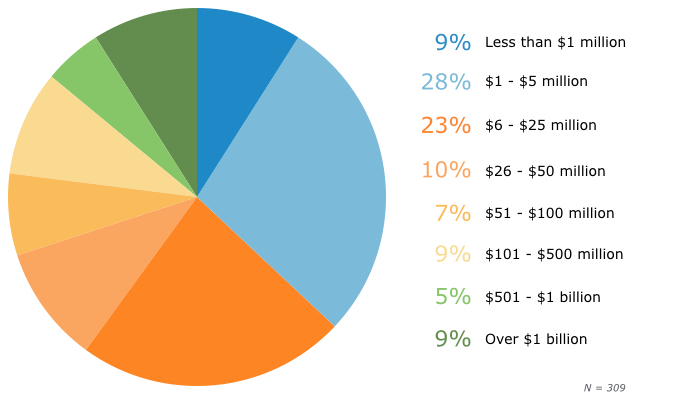

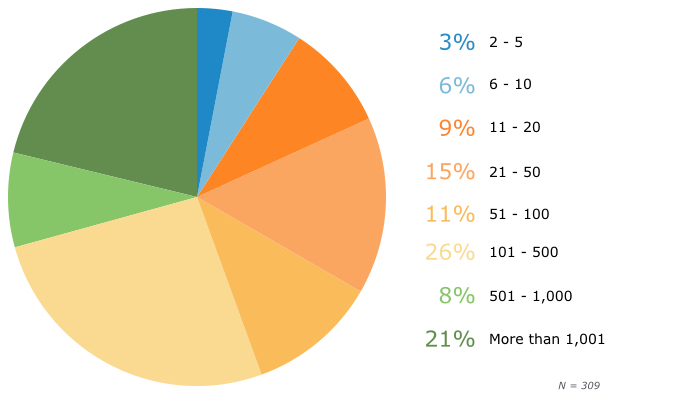

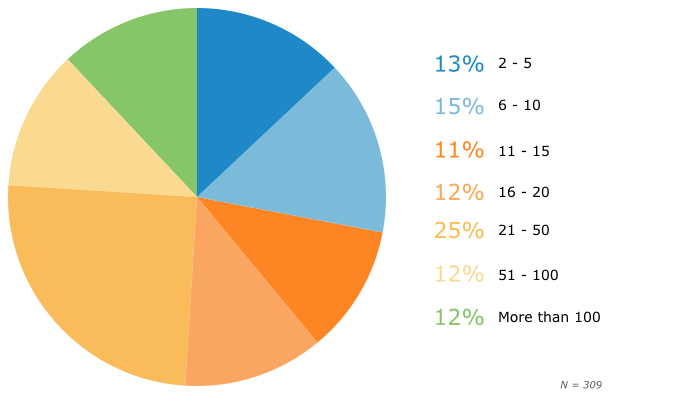

The demographics for the IT buyers in our sample are as follows:

The majority of buyers are from small businesses with $50 million or less in annual revenue (61 percent, combined).

The greatest percentage of businesses employ between 101 and 500 employees (26 percent).

The largest percentage of IT organizations are interested in PM software for between 21 and 50 users (25 percent).

By Annual Revenue: Prospective Buyer Size

By Number of Employees: Prospective Buyer Size

By Number of Users: Prospective Buyer Size

If you have comments or would like to obtain access to any of the charts above, please contact eileen@softwareadvice.com.