How Automated Expense Management Simplifies Your Financial Workflow

Travel and entertainment are typically the biggest portion of a company’s spend, after employee compensation. Handling these costs with outdated methods such as paper record-keeping often leads to inefficiencies. A recent Software Advice survey shows 92% of employees face challenges when reporting travel expenses, and a near equal, 90%, admit to making mistakes in the process.*

In your line of business, if you find your teams often on the move, investing company resources during their journeys, then automating the tracking and recording of these expenses using technology can save valuable time and costs for both the business and employees.

We explore how expense management automation can transform your operations, with insights from Tracy Kennedy [1], chief operations officer for a travel company, and Sophia Tang [2], founder of a private label cosmetic manufacturing business. These insights are bolstered by Isaac Routh, accounting advisor manager at Software Advice. Routh talks to hundreds of business owners every day and brings first-hand knowledge of their challenges and pain points.

Isaac Routh

Accounting advisor manager, Software Advice

What is automated expense management?

Expense management automation refers to streamlining the tracking and processing of business expenses without the need for manual intervention. Often, it's associated with digitizing the receipt collection process so employees can easily upload receipts through a mobile app or email, thus eliminating the need for physical storage and manual data entry.

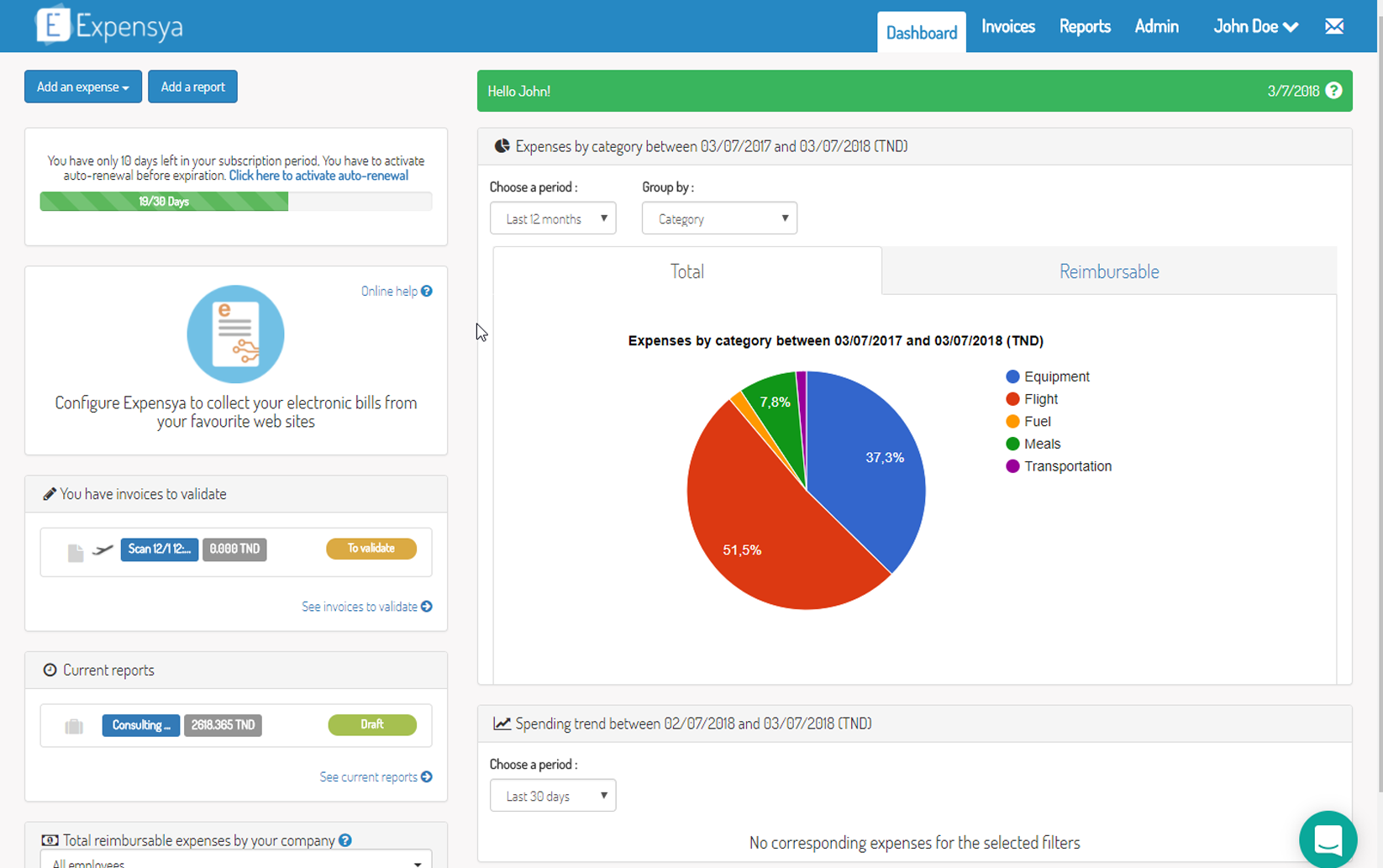

But the automation goes beyond just receipt collection. It also extends to policy compliance checks, expense approval workflows, and reimbursement processing. The image below shows an example of one of these platforms.

Dashboard view of spending by category in an expense tracking tool (Source)

An expense management tool benefits everyone involved in the process—by eliminating the tedious task of sorting through paper receipts and manual record-keeping for accounting professionals, automating review and approval workflow for managers, and making it easy for employees to file expense claims and get timely reimbursement.

What are the benefits and use cases of automated expense management?

The primary advantage of any automation tool is the time it saves for your teams from manual application and processing of expense claims. Automating expense management also offers the added benefit of providing detailed reports and spend history to maximize financial efficiency in your business.

Here's what you can expect from expense management tools, along with ways to leverage its benefits.

1. Enhanced employee experience

Nearly 50% employees spend two to four hours on expense reporting tasks after each trip, as per our survey.* Automated tools drastically reduce this time with easy mobile receipt capture, allowing your team to focus on other important tasks. Tang, shares, “Before automation, it wasn’t just the 60-hour monthly commitment that was taxing, but the irregularities such as missing receipts or misclassified expenses. In 2019, due to these discrepancies, a key marketing team member had to delay their core job responsibilities to reconcile travel expenses.”

As an added bonus, these tools ensure quick turnaround for reimbursement by automating approvals, further enhancing employee experience.

2. Improved policy compliance

Around 20% of employees admit to submitting reports that don’t align with company policies in our survey.* Automated systems counter this by flagging non-compliant expenses proactively. Routh explains, "You can set thresholds. Say, if you're spending less than X amount of dollars, you need not submit a formal expense receipt. On the contrary, if an expense hits a certain dollar amount threshold then it’ll need an additional level of approval." This ensures consistent policy enforcement and reduces non-compliant claims.

3. Swift reconciliation of records

Manual expense management methods often involve a tedious process of going through a stack of physical receipts at the end of the month, which often delays the finalization of accounting records. Automated systems streamline this process by digitizing the data from paper receipts and invoices, and automatically putting it in a format that’s easy to peruse.

Tracy Kennedy

COO, Tasmania.com

4. Reduced taxable income

Expenses such as office supplies, travel costs, or professional service fees are often tax-deductible. Accurate and well-organized expense records can help you claim tax deductions on business spending. These potential savings could be missed without proper documentation.

Automation ensures these records are maintained systematically and can be retrieved for easy tax filing.

5. Visibility into cost-saving opportunities

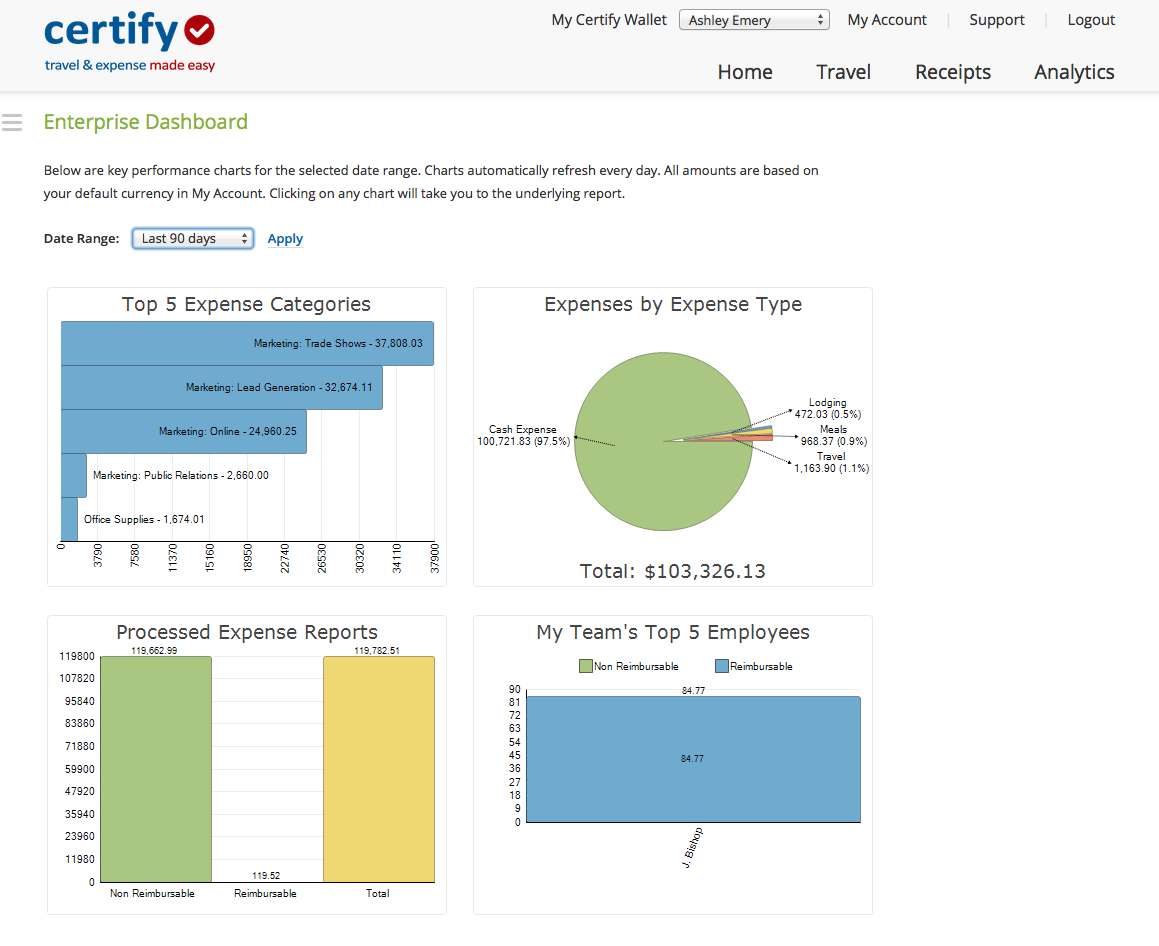

Expense management automation helps you stay on top of your spending and prevent budget overruns by providing real-time insights. Detailed analysis provided by these systems allows business leaders to identify potential cost savings and investment opportunities.

Sophia Tang

Founder, Nako Cosmetics

Integrating an expense management system isn’t just about efficiency; it’s also about empowering your team to make informed decisions.

Dashboard view of expense analytics (Source)

Expense management tools reduce the potential for error while helping you track your spending metrics. This way, you can report your expense data to stakeholders more confidently.

What are some common features of expense management software?

Expense tracking tools come with a range of features to streamline and automate the management of business expenses. Here are some of the key features you can expect to find in an expense management tool:

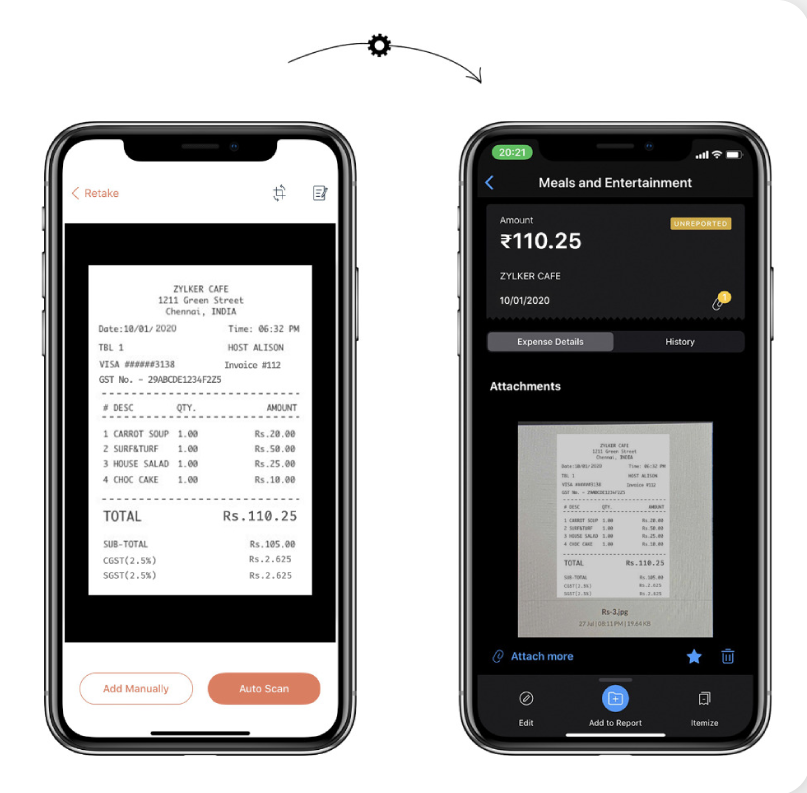

Receipt management or electronic receipt capture: This feature allows for easy uploading and tracking of all business expenses in a central database. It enables accountants to categorize and store receipts digitally, making them easily accessible for future reference.

Food receipt capture in an expense reporting tool (Source)

Expense reports: The ability to generate detailed expense reports that provide insights into spending patterns and help identify areas for cost savings.

Compliance management: Track and manage non-adherence to expense policies in a service, product, process, or employee or supplier behavior by setting thresholds.

Audit trail: This feature provides a chronological sequence of all the actions that have been undertaken in a business transaction for transparency and accountability during internal or external audits.

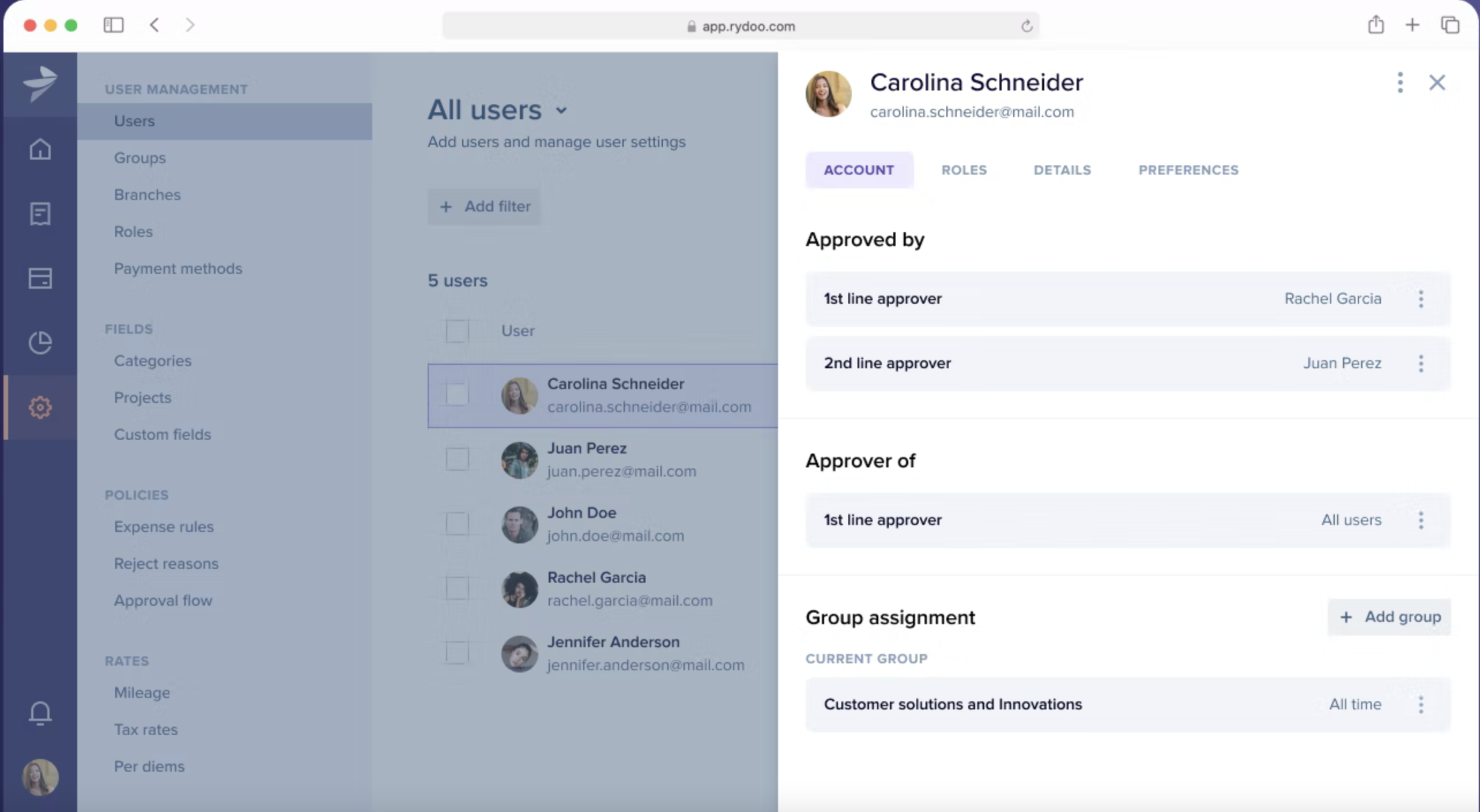

Approval process control: This gives managers the ability to approve or reject expense claims. It orchestrates the process of getting permission from relevant parties automatically throughout the task progression.

Setting up approval workflow in an expense reporting tool (Source)

Credit card reconciliation: Automatically pull credit card statements into the system each month to verify that all transactions on the statement match all expense receipts and expense reports.

Mobile app: Many expense management tools offer mobile apps, allowing employees to capture and submit expenses on the go. This increases convenience and ensures the timely submission of expense claims.

Accounting integration: This feature allows the expense management tool to integrate with existing accounting software, ensuring seamless data transfer and reducing manual data entry.

These features work together to make expense management processes more streamlined, efficient, and accurate.

Read more about expense tracking features in our buyers guide.

Pro tip for choosing the right expense management software: Specialized vs. integrated solutions

Software Advice buyers data reveals that 63% of buyers looking for expense management capability prefer specialized expense reporting tools over an integrated accounting suite.** Part of the reason could be attributed to many accounting solutions not offering expense tracking as part of their feature set.

According to Routh, small businesses with core accounting or enterprise resource planning (ERP) systems in place may only require a simple supplemental expense management system for employee reimbursement and tracking individual expenses. “Seek systems that offer receipt scanning applications, general expense reports, and company credit card invoicing,” says Routh.

“Alternatively, growing small and midsize businesses may look for accounts payable automation systems that also provide an expense management module. While these systems work harmoniously together, they tend to be more costly and are chosen by businesses who have budgets for such systems,” shares Routh. Advanced expense reporting tools have the ability to manage travel bookings as well, such as renting a car or purchasing an airplane ticket. The choice largely depends on your business needs.

Check out 3 Ways to Connect With An Advisor to Make the Right Software Choice.

What else should you look for in an expense management tool?

Before you adopt an expense management tool, make sure you consider these three factors:

It’s easy to use. Despite the software's user-friendly interface, your older demographic may face adoption challenges. Make sure the tool you choose is easy to use. Organize multiple sessions of hands-on training (for your finance team, sales team, and others on the ground), and at the end of each session ask attendees to rate their comfort level with the technology.

It’s scalable. If you have a lot of needs for business travel and client relationship management, you may need your software to be able to accommodate your growing needs. Consider if the software can scale as you grow. A good indicator of it is the number of users a software can support, followed by the types of features and integrations it offers.

It integrates with your current tech stack. Marrying the new software with your accounting, ERP, or payroll system can be a task. Make sure post-integration, the data flow will be seamless between systems.

Setting up your teams for successful expense automation

Expense automation is a powerful way to streamline your financial workflow, offering benefits such as improved transparency, reduced errors, and significant time savings. As you invest in an expense management tool, there are a few things you'll need to prepare:

Do budget for new technology. Most expense management tools are priced on a per-user, per-month basis. The base plans of these tools will cost less than premium versions that come with additional features.

Implementing a new system requires a structured training process that familiarizes your team with the new software and integrates well into your existing financial procedures. Onboard team members to the software in phases to minimize disruption to your workflow.

Investing time in these preparations will ensure that your transition to automated expense management is smooth and that your team can fully leverage the benefits of this technology.

Comparing expense tracking tools? Schedule a 15-minute call or click here to chat with our software advisors directly to save time with recommendations and gain insight on top technology trends and research.

Note: The screenshots of applications selected in this article are examples to show a feature in context and are not intended as endorsements or recommendations.

Survey methodology

*Software Advice’s Travel Survey was conducted in July 2023 among 398 business travelers in the U.S. to learn more about the changing travel economy, how their organization approaches recording and reporting travel expenses, and about business travelers' preference for leisure travel.

**Findings come from conversations that Software Advice’s advisor team has daily with software buyers seeking guidance on purchase decisions. The data used to create this report is based on interactions with businesses seeking accounting tools. We analyzed over 3,000 phone interactions from May 2022 to April 2023.

The findings represent buyers who contacted Software Advice and may not be indicative of the market as a whole. Data points are rounded to the nearest whole number.