Expense Report Software Buyers Guide

This detailed guide will help you find and buy the right expense management software for you and your business.

Last Updated on November 08, 2023Expense report software helps companies simplify the management and tracking of “T&E,” or, “business travel and expenses.” By providing increased visibility of employee spending, expense management software can increase adherence to corporate spending policies and help organizations budget and forecast for future expenses.

With so many expense reporting systems on the market, it can be hard to decide which one is right for you. With that in mind, we created this buyer’s guide to help you narrow down your choices from the selection available.

Here's what we'll cover:

What is expense report software?

What are the key purchase drivers of expense report software?

What are the common features of expense management software?

What is expense report software?

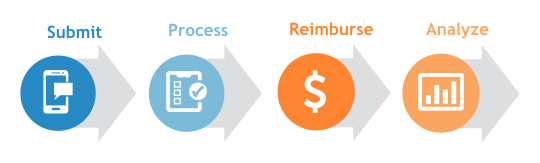

Tracking expenses is an essential task for every company. Expense report software automates the entire expense management process, from submitting a claim to analyzing business expenses. Not only does this save time, but it reduces errors caused by manual data entry.

While systems vary, the key steps in this process include:

Submit claim, i.e. employee expense report, to manager for approval. Employees can easily create and submit expense reports for work-related expenses like transportation, lodging and meal costs. Management reviews and approves, then sends the claim to accounting for processing and reimbursement.

The ability to automatically import expenses from personal and company credit cards and accounts streamlines the expense report process and ensures no expenditures are overlooked.

Additionally, organizations can customize approval workflows to help structure the approval process by setting limits or creating rules dictating spending overrides and adjustments.

Process expense report. Features such as automatic expense import and integration with popular accounting systems, such as Quickbooks Online andIntacct, eliminate the need for manual data entry and minimize the chance of errors.

Reimburse funds. Direct deposit allows for quick and easy funds transfer, so companies can reimburse employees more efficiently and the compensation is available for immediate use.

Analyze spending. The ability to track spending by expense category, unit or vendor provides insight into spending trends and identifies areas for cost savings. Organizations can improve their cash flow cycle and forecast for future expenditures.

Additionally, reviewing expense data helps ensure that employees are compliant with company policies and can even assist with fraud detection (see “Key Purchase Drivers” section below for more details).

What are the key purchase drivers of expense report software?

There are three main drivers that push a business to automate their expense management system:

Cost

Compliance

Productivity

Cost: Submitting and processing an expense report can be tedious and expensive. Automating this process saves time and cuts down on transaction costs.

For example, many systems offer mobile apps that allow employees to take a picture of receipts or scan and email the receipt, and the relevant data is extracted and autopopulates on the report. Approved expenses, such as car mileage, flights or hotel lodging, are pre-coded for streamlined processing.

Even more, systems that include integration with accounting platforms and offer direct deposit help reduce the time and costs associated with claim approval and reimbursement.

Compliance: Internal company policies as well as external government and tax regulations can cause non-compliance risks for an organization. Expense management systems help reduce risks by evaluating expense reports against internal and external regulations.

For example, managers and accounting can set up expense rules so they are automatically alerted when an expense is submitted that isn’t filed under an approved code. This can help catch innocent errors more quickly and alert management of situations involving possible fraud.

Productivity: Time and money lost due to misplaced receipts, forgotten expense approvals and error-prone manual data entry and expense calculations, can put a significant drain on employee productivity and satisfaction. Expense management software can curb these issues and increase efficiency.

For example, employees can use their mobile device to take a picture of receipts, rather than having to keep track of various paper receipts while traveling. Managers can set up email reminders for employees about submitting reports and for themselves about approving reports. Automating these processes can boost productivity tremendously.

What are the common features of expense management software?

Features of these systems can vary from vendor to vendor. Below are some of the most common functions:

Feature | Description |

Accounting integration | Many systems integrate with popular accounting systems such as Xero, Microsoft Dynamics and Sage 50 (formerly known as Peachtree), allowing for easy export of reports and eliminating the need for manual data entry. |

Expense compliance | Helps enforce corporate spending policies and assist with fraud detection flagging expense overages, duplicate expenses, missing documentation (e.g., receipts) and so forth. |

Approval workflow | Streamlines the review and approval process by enabling managers to configure workflows according to expense type and other variables. |

Analytics reporting | Customizable reports help forecast and budget for future expenses, identify spending trends and highlight cost savings opportunities. |

Automatic expense import | Connects to personal and corporate accounts and credit cards, allowing users to pick and choose charges to add to expense reports. |

Electronic receipt capture | Enables users to scan, email or take a picture of receipts for easy submission. |

Links directly to employee bank accounts for quick and easy expense reimbursement. | |

Mobile app | Allows employees to enter expenditures, snap and submit photos of receipts or edit existing expenses via their smartphone or tablet. |

What type of buyer are you?

Small businesses. Organizations with just a handful of employees need an easy, organized way to manage business and travel expenses without all the bells and whistles of a more complex system. These companies will benefit from business expense software that offers basic features, such as the ability to upload photos of receipts and accounting software integration.

Midsized and growing businesses. Midsize organizations must find a way to handle the increased accounting requirements that come with additional customers and employees. Systems best suited to these companies allow managers to set spending limits by category and approve expense reports for employees who are on-the-go.

Large corporations. Organizations with hundreds or thousands of employees need an automated approach to manage business and travel expenses. Systems that offer automatic expense report creation and integrate with pre-existing financial and/or enterprise resource planning (ERP) solutions can help companies quickly and efficiently process reimbursements to keep operations running smoothly.