Financial Reporting Software Buyers Guide

This detailed guide will help you find and buy the right financial reporting software for you and your business.

Last Updated on November 08, 2023Financial reporting software helps businesses automate the collection of financial data and more accurately track trends that impact business goals. Financial reports provide business owners greater visibility and insight into the workings of their business, including:

Financial history

Adherence to tax laws

Compliance with SEC standards (e.g., Form 10-K and Form 10-Q)

Employee and department productivity

Return on investment (ROI) for business ventures

Despite these advantages, roughly 30 percent of the accounting software buyers that contact Software Advice are not using a financial reporting system. This puts them at a greater risk for bad investments and possible violations of various federal and state tax laws.

Whether you’re looking to invest in financial reporting software for the first time or looking to upgrade your current system to better align with your business or industry needs, this guide can help you make a more informed purchase decision.

Here’s what we’ll cover:

What is financial reporting software?

What are some features to look for in a financial reporting system?

What are the key purchase considerations of financial reporting software?

What is financial reporting software?

Financial reporting is a critical function of business accounting. Reports provide decision makers with a snapshot of current financial standing and given enough time, can offer insights into trends that affect profitability.

Reports also play an integral role in tax planning and preparation. Due to various federal, state and local tax laws, accurate financial reporting is key to remaining compliant and fiscally responsible. As such, financial reports help business owners reduce tax liability and make smart investment decisions.

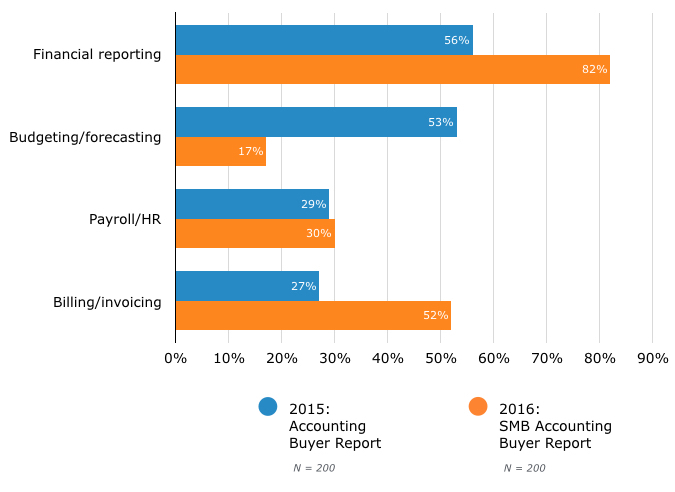

Given the impact that financial reports have on the success or failure of a business, it’s no surprise that financial reporting is the number one capability requested by accounting software buyers who contacted Software Advice in 2015 and 2016:

Top-Requested Accounting Software Capabilities: 2015 and 2016

The following are three financial reports common across industries that you should make sure your financial reporting system supports:

Balance sheet. Also called the statement of financial position, the balance sheet represents the exact financial standing of an entity on any given date. It contains information on a business’s assets, liabilities and equity.

Profit and loss (P&L). Also known as the income statement, the P&L shows the company’s financial performance (net profit or loss) over a specified period of time. It contains information on a business’s revenues, costs and expenses.

Cash flow statement. The cash flow statement indicates the movement in cash and cash equivalents (bank accounts, government bonds etc.) entering and leaving a company during a specified period of time. The movement in cash flows is broken down into three categories: operating activities, investing activities and financing activities.

Additional financial reports that you may or may not require based on your business or industry needs include sales tax return, fixed asset depreciation, accounts aging and expense reporting.

What are some features to look for in a financial reporting system?

Of course, the single most important function of a financial reporting tool will be to report on important financial and performance metrics, i.e., balance sheet, P&L and cash flows. However, there are several other features you should consider as you evaluate systems. These include:

Dashboards | Capture data on business and financial health and collate that information in an easy-to-scan display. Configure dashboards to summarize information for a specific audience, e.g., business owner or accountant. |

Data export | Financial reports help track business performance and increase transparency with decision makers, investors and regulatory agencies. As such, it’s important that data from dashboards and reports can be exported to CSV or PDF files to be easily shared with these parties. |

Customization | Create custom fields, views and formatting to track the information most important to your business. Look for the ability to drag-and-drop to change formatting and layout options, group data together in different ways and drill down into data for a detailed analysis. |

Integration with other tools | Ensure seamless transfer of data between applications. This is especially important if your business outsources payroll or has industry-specific requirements, such as inventory tracking or fixed asset depreciation. |

Multi-user access | Shared reports with accountants/bookkeepers can streamline tax preparation and filing. Ensure systems have tracked changes for accountability and accuracy. |

What are the key purchase considerations of financial reporting software?

Depending on your business and industry needs, you may require additional report options not listed above. As such, when evaluating financial reporting software, keep the following criteria in mind:

Industry needs. For example, nonprofits and government agencies often require a fund accounting module to keep track of funds and report on spending associated with each grant and/or donation they’ve received. Whereas, a manufacturing company might require reporting on the depreciation of fixed assets.

It’s also important to verify whether your industry has specific tax laws or SEC requirements that dictate financial reporting compliance.

Deployment options. Financial reporting software is available in both on-premise and cloud-based systems. Typically, the up-front costs associated with cloud-based software are much lower than with on-premise; however, costs for these deployment options eventually converge, for the most part. You can use our Total Cost of Ownership calculator to analyze the short-term versus long-term cost differences between on-premise and cloud-based systems.

Don’t let security concerns bar you from choosing a cloud-based option, either. In a 2015 report on consumer confidence with cloud-based accounting, 28 percent of users surveyed reported that moving their accounting to the cloud actually increased the security of their financial data.

What type of buyer are you?

Small business. Most small businesses are well-served by purchasing financial reporting software in-suite, as one application included in a larger accounting platform. This helps ensure that financial reporting is fully integrated with other key accounting processes, such as budgeting and forecasting, payroll and billing and invoicing. Examples of this type of system include Xero and QuickBooks Online.

Company snapshot in QuickBooks Online

Midsize and growing businesses. In our recent investigation into accounting software buyer trends, we found that nearly 60 percent of buyers are looking to replace their existing accounting platform for a more advanced solution. We also found that financial reporting was the top-requested feature, leading us to believe that some buyers may be looking to upgrade this specific functionality.

As such, organizations that outgrow the reporting capabilities offered by basic accounting solutions might consider supplementing their existing system with a stand-alone financial reporting software, such as Adaptive Insights. This could help curb the costs of an entire accounting system upgrade while meeting more advanced reporting needs.

However, buyers that require a greater depth of functionality and accounting regulations across the entire platform would be better suited investing in a financial reporting system rooted in a larger financial management platform, such as NetSuite or Intacct.