Accounting Process Automation: How to Get Started and What to Consider

Accounting leaders ready to introduce automation into their business operations may be hesitant to do so because of the overwhelming thought of overhauling their usual processes.

We've taken on some of that burden for you with this automation guide that breaks down the automation of accounting processes into six simple steps. This guide is backed by Gartner research [1] and expert advice from Michelle Kvello [2], an Australia-based finance officer who helps small and midsize businesses (SMBs) scale their operations.

What is accounting automation?

Automation is when tasks, say posting a journal entry for depreciation or sending a monthly performance report, happen without your involvement. These tasks are programmed, so they continue even when you’re sleeping.

It can be as simple as using accounting software or as elaborate as leveraging automation tools, such as robotic process automation, business process management, low-code/no-code platforms, and AI software, to streamline processes involving multiple software systems or people.

A lot of tasks go into accounting, and for all, accuracy and accountability are paramount. This leads to a cycle of highly repetitive chores that follow a clear set of steps and defined rules. refers to programming these daily, repeatable tasks to make the workflow more efficient. A study reveals that 89% of accounting operations are highly automatable [3].

Automation not only saves time and costs by eliminating repetitive tasks but consolidates disconnected tools, such as invoicing and accounting software, to make it easier to move data around, giving greater control and visibility over the facts that really matter for business. Let’s learn by an example.

Say you want to automate payroll processing. You could adopt payroll software that automatically calculates tax deductions, contributions, and net pay for each employee. This is a simple way to use technology to make your processes faster and more accurate.

But, there may still remain some manual processes that take up your time, such as reimbursing employees for business expenses or calculating overtime. Automation tools can be used here to extract expense data from digital receipts or pull in hours from time-tracking software to feed everything into your payroll system, all without you having to lift a finger.

6 steps to automate accounting

Step #1. Document the “why” and “how” behind your accounting practices

Start by studying your current workflow thoroughly. It’s critical in improving your processes.

Kvello points out that a common challenge businesses face in accounting is outdated processes, which have been followed for so long that no one questions their need or validity anymore. That worsens when workflows aren’t documented and rely on verbal directions from one person.

Michelle Kvello

Founder and CFO at Lantern Partners

Pro tip

Trace everything when documenting workflows: from a single task, such as pulling data from an invoice that landed in your email and recording it in your accounting system, to an entire organizational process that covers different systems and business domains and requires rules for routing decisions, say invoice processing for payment.

Step #2: Identify opportunities for automation

Now that you understand your current accounting workflow, pick out the processes that are prime candidates for automation. Look for tasks that take up a lot of your time and don’t need much of a human touch. Some cues to spot them:

Repetitive tasks: You do these tasks repeatedly, such as entering financial data into a spreadsheet or sending out invoices. If you find yourself thinking, “I’ve done this a thousand times before,” there’s a good chance it can be automated.

Time-consuming tasks: If a task is rule-based and takes a long time to complete, it may be an ideal candidate for automation. For instance, matching your financial records and bank statements to spot discrepancies or monthly closing process leading up to financial report generation.

Tasks with high error rates: Accountants dread errors, often double- and triple-checking their work. Hand over tasks with high error rates to a computer for consistent, accurate results. These could include calculating taxes or payroll deductions.

Tasks that require multiple approvals: If a task requires thumbs up from multiple people before it can move forward, automation can be a game-changer. Say, purchase orders that need to be approved by different departments or expense reports requiring multiple signatures. Plus, it’ll free your financial brains to focus more on analytical than administrative tasks.

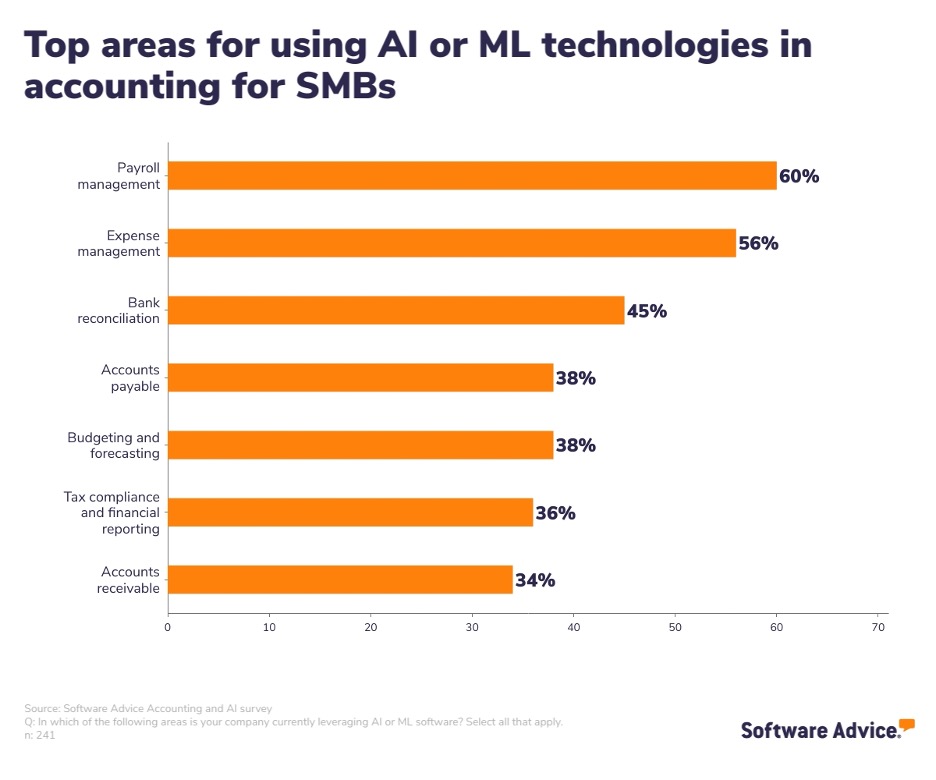

According to Software Advice’s survey, payroll is usually the first accounting function businesses automate*.

Pro tip

When choosing what to automate, Gartner suggests opting for a task that is highly manual and closely scrutinized, such as creating journal entries. It’ll build your team’s confidence in automation. Once they see the benefits in action, they’ll be more open to adopting automation in other areas of accounting [4].

Step #3: Select the right automation tools

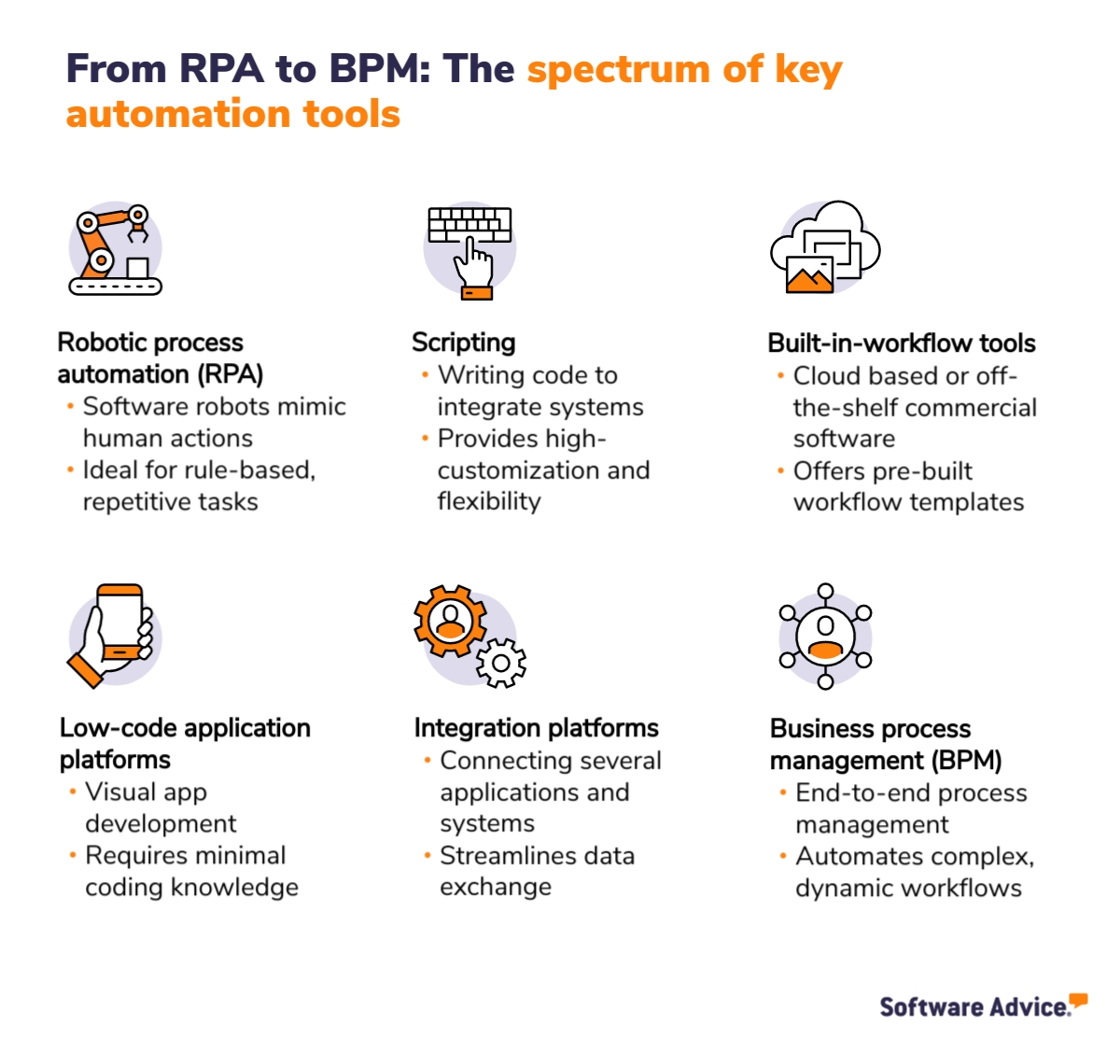

Different automation technologies cater to different needs, and often a mix of them is required [1]. Your goal is to identify the best fit for your use case.

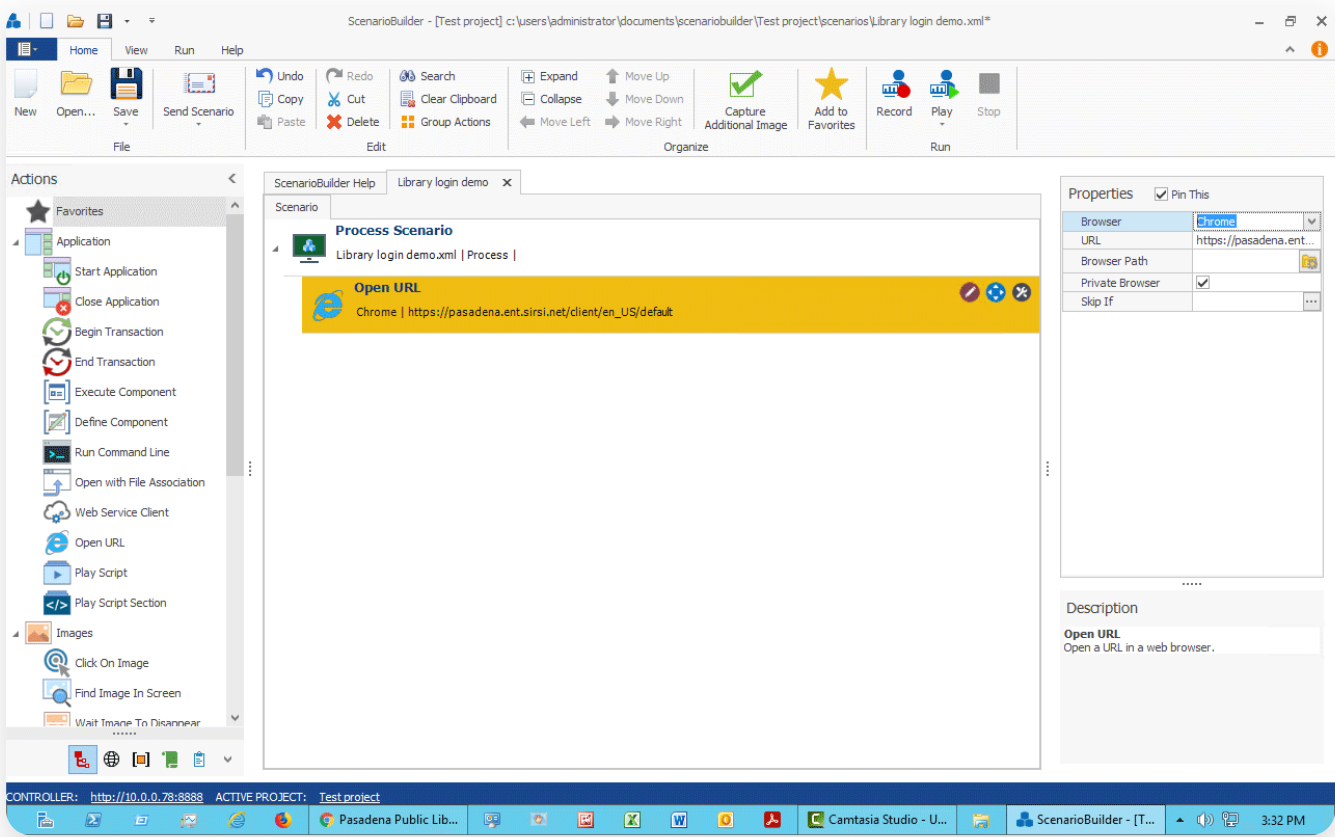

RPA: RPA platforms are best used to automate repetitive tasks with clear steps, such as inputting invoice details to your accounting system, requiring little to no decision-making. RPA doesn’t alter the process but mechanizes it for accuracy and speed. Did you know one-third of accounting tasks are suitable for RPA [3]?

Example of process automation with scenario builder (Source)

Scripting: Scripting is a decades-old and more prolific method of automation that requires programming languages such as Python or JavaScript. It’s best used when you have a coder on your team and need to integrate two widely used systems, such as accounting and payroll, seamlessly while retaining flexibility.

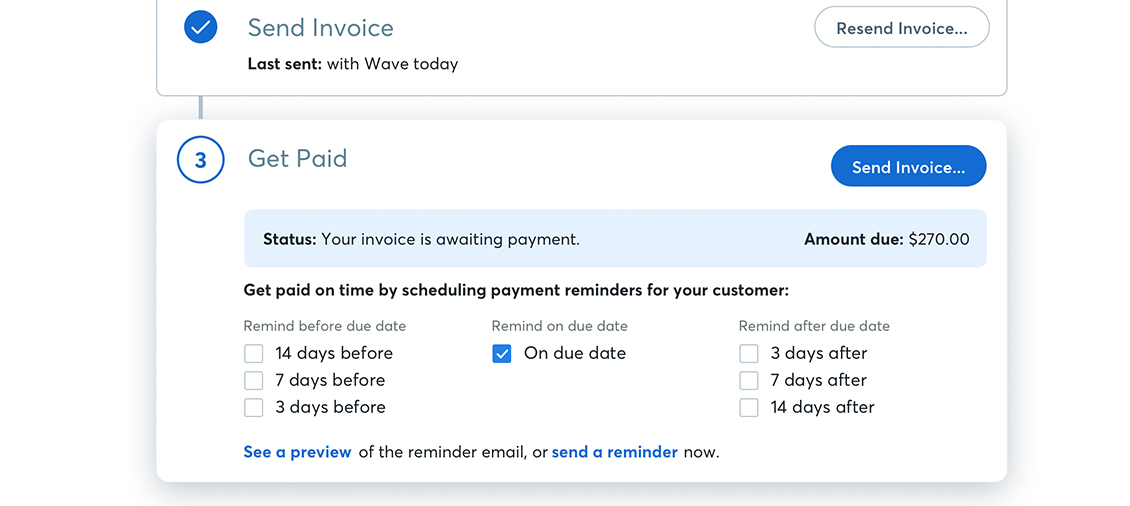

Built-in-workflow: These are features available in your software to create custom process flows. This type of automation is highly reliable as it’s done within the software. For instance, using a built-in workflow in an invoicing solution to automatically send reminders for overdue payments.

Example of software to schedule an auto-reminder for invoice payment (Source)

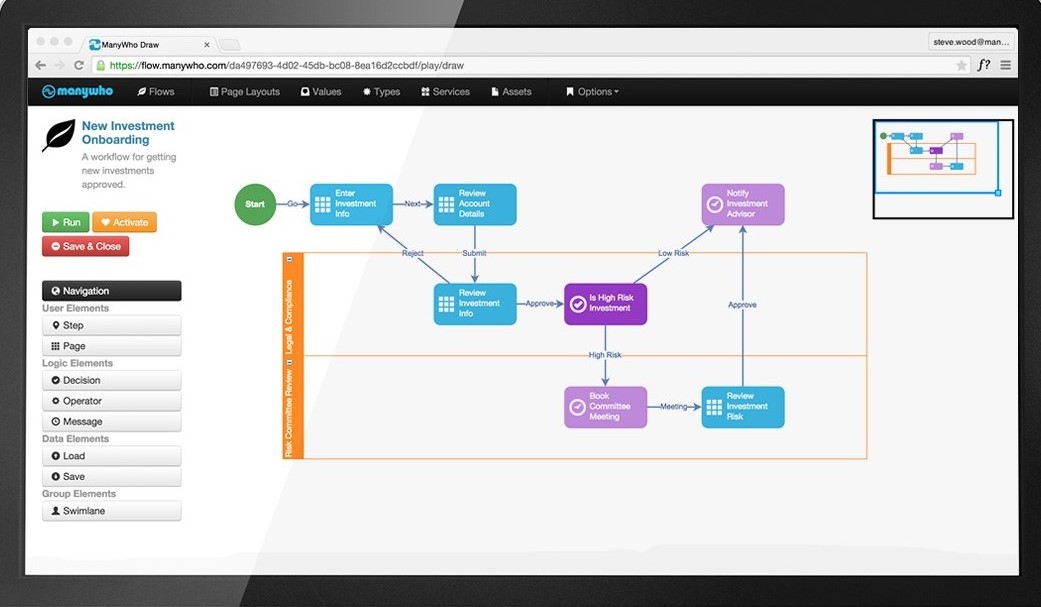

Low-code application platforms (LCAPs): Low-code or platforms are best when you need to automate new processes that require “new,” user-friendly, and attractive user interfaces (UIs). A simple example is creating a custom dashboard for financial reporting that populates data from different places.

Low-code accounting automation tool example to edit and automate workflow (Source)

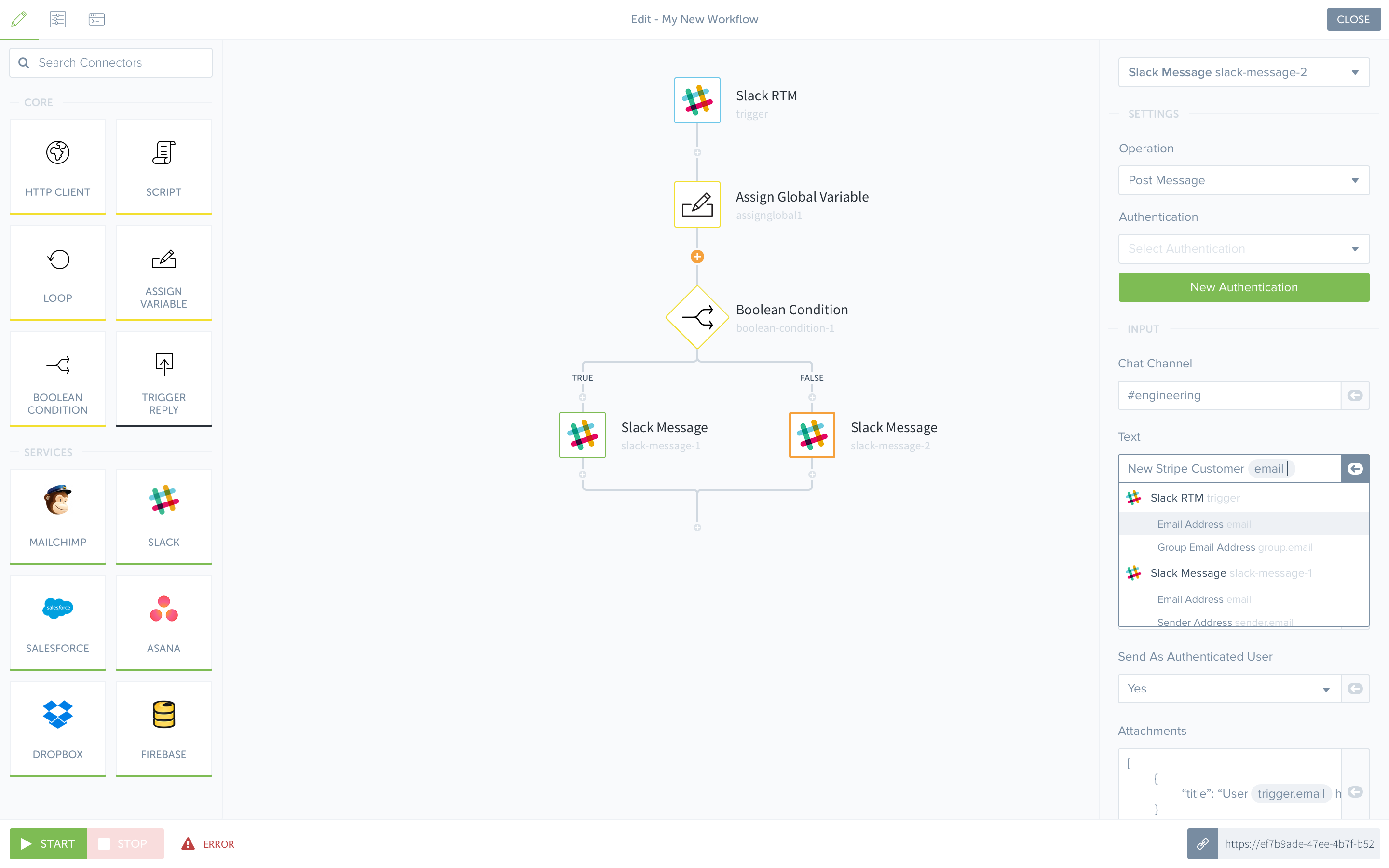

Integration platforms: Integration-Platform-as-a-Service (IPaaS) tools simplify integration by linking multiple systems through API abstractions, flow-control logic, and data mapping tools. They are useful when automating a process that requires little to no human input across applications. For example, integrating CRM software data with accounting software to input sales transactions.

Example of integrating applications in an automatic workflow (Source)

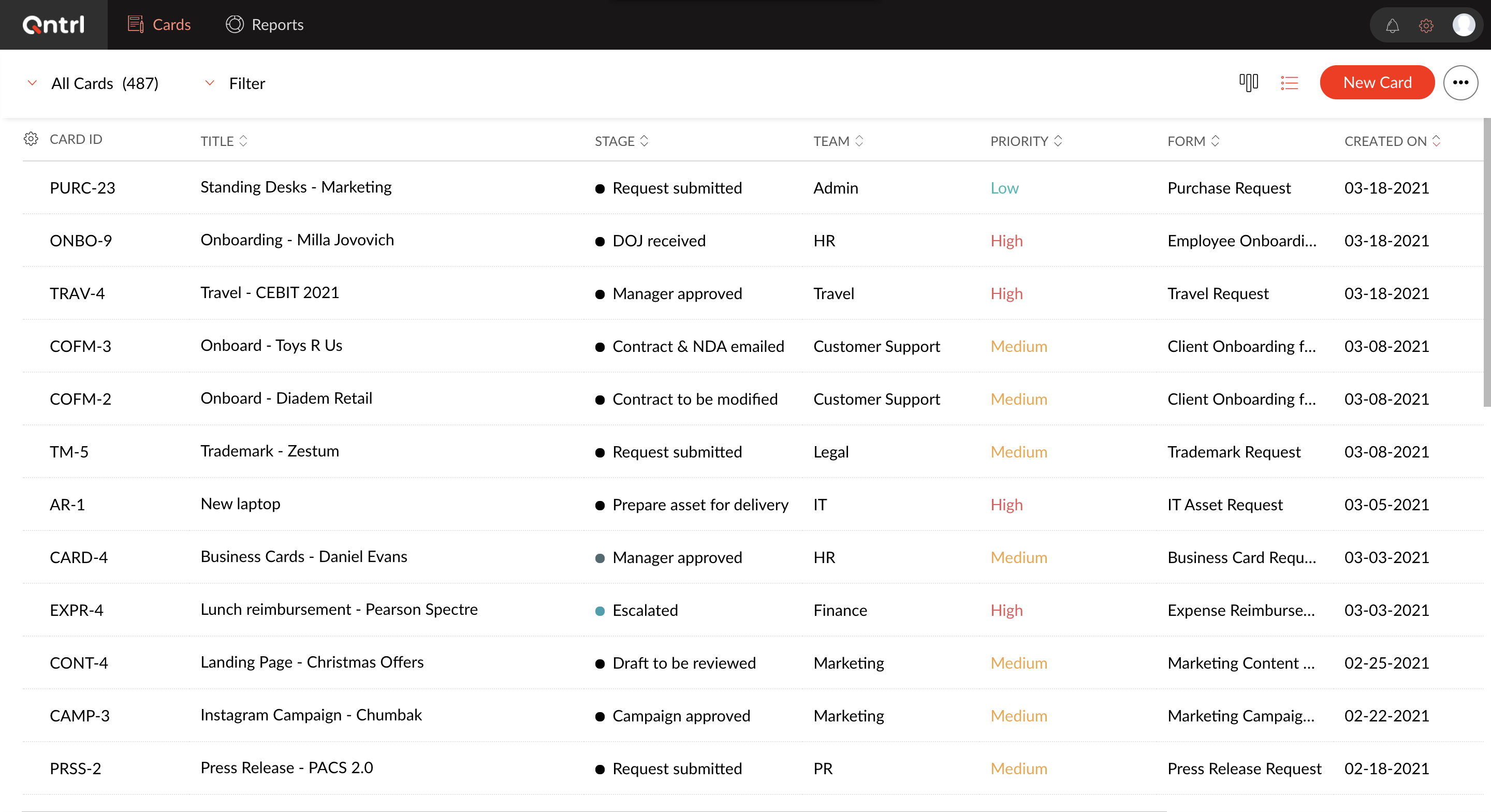

Business process management (BPM): BPM solutions digitize processes across the business. It uses IT to automate end-to-end processes involving multiple systems and people. For example, automating accounts payable (AP) processes, from generating PO to making the payment and adding it to your books. Though the demand for AP automation has led to robust solutions in the domain, BPM solutions can also be used to integrate such processes.

Example of automatic routing of requests throughout a company (Source)

Kvello emphasizes that choosing an automation tool often requires some adjustment to your current processes to best utilize the technology.

Michelle Kvello

Pro tip

Switch to cloud-based software. That will make automating your business processes much easier. Cloud systems are built to make it convenient to work and collaborate with teams and clients anytime, from anywhere, without compromising on data safety.

Step #4: Evaluate your team’s skills and capacity

Now that you know what and how to automate, ask yourself what can feasibly be automated given your team’s skills, platform capabilities, and intended outcomes [1]. Kvello also advises considering the management of the system post-implementation. “Evaluate: Who will be the go-to expert for any troubles? How will an automated system evolve with the business?”

The level of skills you will need will change with the automation software you use. Some tools are designed for “citizen developers,” i.e., business users with basic technical knowledge and minimal to no coding experience but good process know-how.

Citizen developers: If your team consists of citizen developers, your tool options will narrow down to RPA, LCAPs, and built-in workflows. Integration platforms may also be manageable for slightly advanced citizen developers.

Experienced developers: If you have moderate to advanced developers or coders, you can explore any automation tool, which will give you more customization and functionalities.

External expertise: If your team lacks the necessary skills, consider outsourcing or hiring an experienced professional who specializes in automating accounting processes. But despite that, consider training or hiring someone in-house to maintain your systems after project completion.

Pro tips to nurture citizen developers on your accounting team

Start with low-code or no-code platforms (LCAPs). These platforms are excellent starting points for aspiring citizen developers as they enable creating applications through intuitive drag-and-drop interfaces, sparking creativity.

Organize workshops and training sessions. Conduct learning and development sessions on the use of LCAPs and RPA tools to provide support and encourage members to create their own solutions.

Designate an IT point of contact. Assign an IT professional to assist your accounting team. This creates a supportive community within your business where questions can be asked, and experiences can be shared to empower your citizen developers.

Step #5: Evaluate the costs and ROI

Many businesses (39%) struggle to find value in automation due to a lack of automation culture and adherence to old methods*. Combat this by projecting the potential returns on investment (ROI) from automation. Kvello recommends a simple formula to quantify value derived from automation: divide the savings or value gained by the cost of tools and talent used.

While costs are often evident, she suggests calculating your savings by considering:

Headcount savings: Automating repetitive tasks frees up staff for more value-added, complex work, saving on potential hiring costs for mundane data entry jobs.

Error reduction: Automation minimizes manual accounting errors that otherwise require detailed scrutiny by accountants. Save man hours and effort spent in rework.

Legal cost savings: Automated systems accurately handle tasks such as payroll, reducing legal costs that may be caused due to inaccuracies.

Improved cash flow: Automation aids in accounts receivable and payable, keeping your cash flow and supplier relationships healthy.

Focus on value-added activities: With automation handling routine tasks, your team can focus on growth-oriented activities.

Time savings for leaders: For small business owners juggling multiple roles, automating accounting frees up valuable time.

Remember, the goal isn’t just to save on costs but also to improve efficiency, accuracy, and strategic focus.

Pro tip

Expand your focus beyond traditional metrics. Consider non-traditional metrics that may not be easily quantifiable but are vital to achieving your business’s short-term and long-term objectives.

Step #6: Appoint a project manager

To prevent your automation projects from stalling, designate a project manager. This person will create a roadmap, manage the project, and ensure smooth execution, serving as the main point of contact and coordinator for tasks, resources, and timelines.

Ideally, they’ll have full knowledge of accounting workflows alongside project management expertise. You can start by hiring internally, especially from the accounting or IT team. If necessary, consider an external consultant specializing in accounting automation.

Pro tip

No project goes exactly as planned. Allow your project manager the flexibility to adjust plans, hire or train staff, and manage the budget as needed.

Kickstart your automation journey now!

Automation isn’t about replacing accountants. It makes their workload easier and workflows more efficient, allowing them to focus on what they do best: offering strategic advice, building relationships, and contributing to business growth.

So, are you ready to take on an automation journey of your own? It may seem daunting at first, but with careful planning, you’ll reap its benefits. Let’s quickly recap what we’ve learned.

For more guidance on what processes to automate and the tools to select, schedule a call or click here to chat with a software advisor. Or browse our software buyer’s guides for , , and other automation technologies.

Note: Specific software products referenced in this article are examples to show a feature in context and are not intended as endorsements or recommendations.

Survey methodology

*Software Advice’s Accounting and AI survey was conducted in April of 2023 among 317 business leaders within the U.S. to learn more about how they harness artificial intelligence (AI) or machine learning (ML) to assist with financial operations. Respondents were screened to ensure that they have relevant roles related to AI or ML functions within their organization.