From Check-In to Checkout: Understanding Financial Management in the 24/7 Hotel Industry

To keep a hotel afloat and growing, it's essential to have effective financial practices in place. But this can be overwhelming for new accountants and hotel managers as hotels manage a multitude of revenue streams and expenses that accumulate round the clock, all while operating on razor-thin profit margins.

In the US, the net profit margin for the hotel industry averages 10%. [1] That means for every dollar in revenue earned, only 10 cents goes toward profit. This leads hotels to adopt unique accounting practices such as night auditing, which involves tracking and tallying each day’s income and expenditure after office hours.

To understand the fundamentals of financial management in hotel operations, we talked to Annia Silva [2], front office manager at a full-service luxury hotel. With her insights and our research, we’ve put together this blog to help you grasp the financial side of this industry.

What makes hotel industry accounting different?

Hotels occupy a unique position in accounting compared to other industries for many reasons:

They operate 24/7, which means you need to design accounting practices that can accommodate a continuous flow of transactions.

They have to maintain separate expense and revenue accounts for each department in their chart of accounts (CoA).

The revenue in hotels is recorded upon check-in but is typically received during checkout, necessitating a robust credit management system.

The room prices in hotels are adjusted quite often in response to demand fluctuations and seasonality.

Annia Silva

Front office manager of The Ocean House, Rhode Island

What’s a chart of accounts for hotels?

A chart of accounts (CoA) is a list of clear and organized financial categories used in accounting to record business transactions.

For hotels and motels, the Uniform System of Accounts for Lodging Industry (also known as USALI) [3] sets the standard chart of hotel accounts. It details revenue and expense accounts separately for each department, such as housekeeping, food and beverage (F&B), and maintenance. So, let’s say a guest munches on a snack from the minibar—that revenue will be recorded in the room department’s account rather than F&B.

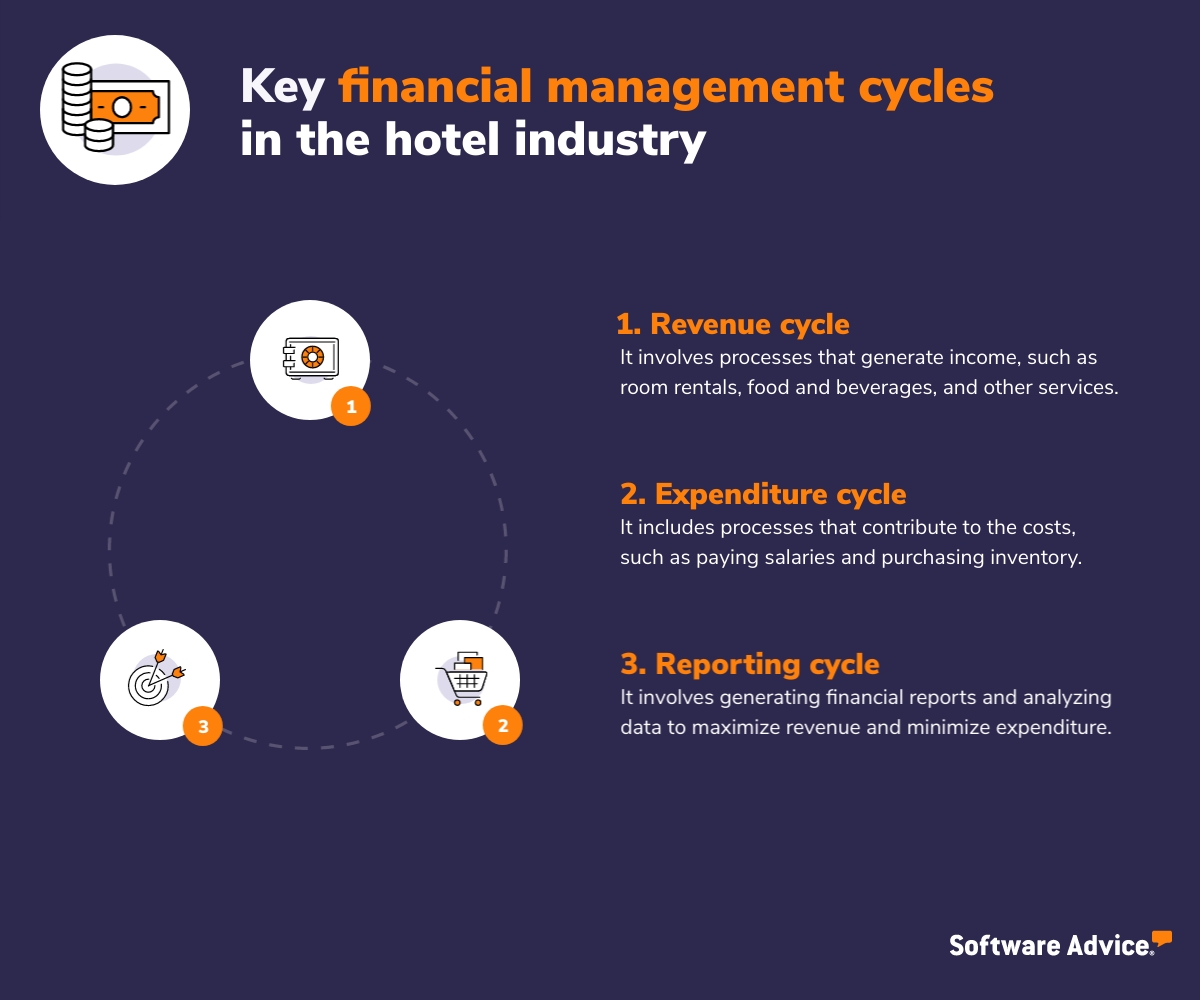

Key financial management cycles in hotels

When it comes to managing finances in a hotel, you can classify the processes into three main categories: revenue-related, expenditure-related, and reporting-related. Keep an eye on all of them to ensure your hotel is financially sound.

1. Revenue-related processes

These refer to all activities that bring money from the guests. It encompasses booking amounts taken during reservation to income earned in the till during checkout, including revenue from ancillary services such as spa treatments.

What’s the role of hoteliers and accountants in the revenue cycle?

Hotels heavily rely on revenue-generating activities to maximize their income. For hoteliers and accountants, it primarily entails increasing the occupancy rate of the hotel, i.e., the number of rooms taken relative to the total available, while setting competitive prices for the room. It also involves managing relationships with distribution channels, such as online travel agencies and direct booking platforms to broaden your reach among potential customers.

2. Expenditure-related processes

refer to all activities involving spending money to operate a hotel, from purchasing goods and services from vendors to processing payroll for employees.

What’s the role of hoteliers and accountants in the expenditure cycle?

The ultimate goal of these activities is to minimize hotel expenses while ensuring smooth operations. For hoteliers and accountants, it means controlling costs with sound staffing practices, wise purchase decisions, and proper procurement and inventory management that reduces waste and prevents stockouts.

3. Reporting

This involves analyzing hotel earning and spending data to assess the financial health of the business and create performance summaries, allowing managers to make informed business decisions.

What’s the role of hoteliers and accountants in the reporting cycle?

For hoteliers and accountants, reporting entails accurate bookkeeping and timely publishing of financial reports (balance sheet, income statement, and cash flow statement), by adhering to proper USALI accounting principles. They are used to ensure compliance with legal and tax requirements, observe department-wise performance and spending, and set goals for the future.

Common accounting challenges hotels face

Setting room prices

You don’t want to price your rooms too high and risk low occupancy, but you also don’t want to price them too low and miss out on prospective revenue. According to Annia, “Considerations should include demand patterns for different seasons, weekdays vs. weekends, festivals, local events, competitor rate, and guest preferences to price your room.”

You can use dynamic pricing tools that allow you to determine and adjust prices in real time based on multiple factors of demand and supply.

Handling accounts receivable

Accounts receivable is the money guests or third-party agencies owe to your hotel. If you’re a hotel manager, managing receivables would be one of your top priorities as that’s where the money comes from. Annia shares, “We monitor guests’ credit cards twice a day as a standard practice to ensure they have sufficient funds to cover their expenses and to avoid chargebacks.”

She suggests implementing a prepaid policy in your business if you’re just starting out in the industry. “Trust me, doing this will save you from dealing with nonpayment and delinquent accounts.”

Cost controls

Keeping costs under control is one of the major challenges for hotels as they need to maximize profits despite seasonality and vulnerability to market trends. Labor alone makes up 50% of a hotel’s operational expenses, with the rest going to costs of purchasing goods and services. Smart staffing and tracking departmental budgets are two ways you can control costs. Consider outsourcing non-core functions, such as laundry, and hiring seasonal staff, i.e., bellboys and pool concierges, only during the peak season.

Reconciling accounts daily

Given the volume of transactions in the hotel industry, reconciliation is a daily necessity. Accountants and auditors take on the task of night audits, i.e, reconciling transactions of the day during non-peak hours. It involves matching money in the bank account with accounting records.

Reconciliation is largely automated with accounting software and specialized tools. This feature matches your records and identifies discrepancies, which may require human intervention.

Preventing identity fraud

Dealing with sensitive guest information, hotels are susceptible to credit card theft and information hacking. They need to establish strong internal controls and security tools that help them detect fraudulent activities and prevent such events from happening.

Here are some key takeaways to help you sharpen your financial senses for running a hotel.

Key takeaways

Get started on the right foot by creating a customized chart of accounts. Base it on industry-recognized Uniform System of Accounts for Lodging Industry (USALI) recommendations. It’ll help you produce meaningful and detailed reports to analyze your operations.

Adopt best practices for each financial cycle: revenue, expenditure, and reporting. For the revenue cycle, focus on setting pricing strategies and finding distribution channels. Control costs and choose vendors wisely for a successful expenditure cycle. At the reporting stage, essential activities include bookkeeping, timely preparation of financial reports, and performance analysis.

Prepare yourself to tackle major challenges of hotel accounting: Develop necessary skills and strategies to set room prices effectively and maximize revenue, efficiently collect payments owed to you from guests and online travel agencies, control costs of operations, reconcile accounts daily, and prevent identity frauds.

Next steps: Some helpful tools to manage hotel finances

The right tools can make your complex hotel operations considerably easier. Whether you’re a new hotel business or an old one, here are three hotel financial management essentials.

Property or hotel management system: These are accommodation management systems that cover front desk operations, including reservations. Some even come with accounting modules to maintain financial records. Look for a tool that gives you continuous visibility into your top performance indicators with a dashboard.

Point of sales (POS) system integrated with front desk system: If you offer ancillary services such as restaurant or spa, integrate a POS system with your hotel or property management system (PMS) to easily transfer guest charges to their room bills.

Accounting software: Have a dedicated accounting tool for your back office to manage your books, invoices, financial reports, and payments in one place. Make sure it is in accordance with USALI standards and integrates with your front desk system. It would make all financial information flow back easily into your accounting system.

If you’re just beginning and don’t want multiple systems, explore the specialized hotel accounting category that covers tools catering to all your basic needs, from managing reservations to publishing financial reports. Check out the capabilities offered by these systems in our buyers guide for hotel accounting software.