Property Management Accounting Software Buyers Guide

This detailed guide will help you find and buy the right property management accounting software for you and your business.

Last Updated on November 24, 2023Property management accounting software offers a number of features that typical accounting systems do not. In addition to financial reporting and payroll, these programs will integrate industry-specific information about vacancies, units, tenants and property maintenance into the real estate software.

The more robust accounting tools also manage company information related to property listings, track referrals and link electronic documents to sales.

This guide was created to help property managers determine the best software to meet their needs. We’ll cover the following topics:

What is property management accounting software?

Common features of property management accounting software

What are the benefits of property management accounting software?

What are some deployment options for property management accounting software?

What are some business trends of property management accounting software?

What is property management accounting software?

Property managers are required to perform some specific types of accounting processes, such as holding and tracking security deposits and common area maintenance costs.

A property-management-specific accounting system is designed to assist managers with their unique responsibilities, such as:

Collecting rent on a monthly basis

Tracking expenses for maintenance, improvements and supplies

Budgeting and forecasting using real-time information

Reporting features also allow managers to review income by property so users have a bird’s-eye view of their financial health.

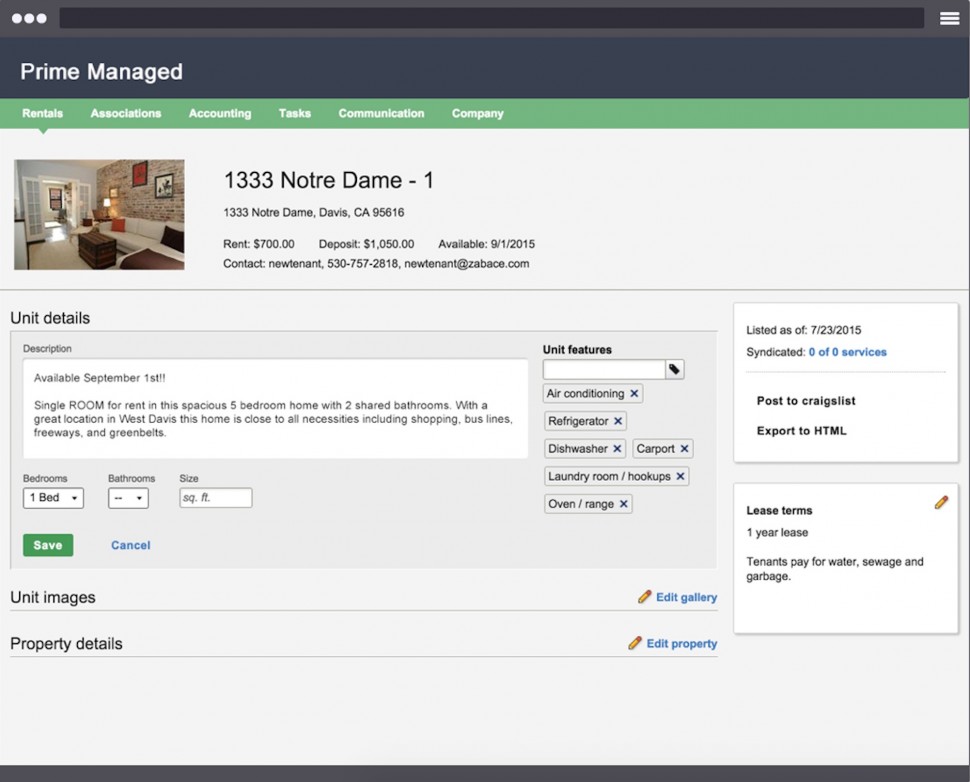

Screenshot of open vacancies in Buildium

Common features of property management accounting software

Track rents & payments | This software will categorize receipts based on the specific real estate category, such as rents, utilities, subleases or late fees. The software also calculates real estate taxes, property insurance, maintenance costs and payroll, and all of this information ties directly to the tenant or property record. |

Online payment portal | Some property accounting systems include an online portal for tenants to pay rent. This simplifies the payment process, as renters can pay online 24/7 using credit or debit cards. This feature is more common in full property management suites. |

Bank reconciliation | Many systems offer bank reconciliation assistance to ensure the figures match in both your’s and the bank’s accounts. Users can download bank statements to identify and correct discrepancies. |

Reporting | Accounting systems typically offer a variety of report and chart types to view income and expense data by month or year. These reports can be automatically generated at certain dates and shared with specific people. |

Business growth & development | Automatically calculate annual rent increases, property appreciation and depreciation, as well as manage the growth of your assets. Many of these programs also have built-in budgeting and forecasting capabilities and the ability to analyze rents based on current market rates. |

Common area management | Most solutions calculate charges and costs associated with common areas, tracking maintenance, policies and usage as desired. |

What are the benefits of property management accounting software?

The automation of accounting processes is an obvious benefit of property accounting software, and others increase convenience in common tasks.

Get paid faster. With an online payment portal, you don’t have to wait for mailed checks to arrive. Tenants can pay rent online anytime, with cards or cash, which goes directly into your account.

Calculate rent increases easier. Software can help analyze local housing market conditions to calculate how much you can charge for rent while staying competitive.

Stay on top of your accounting from anywhere. Most of the top property management software vendors offer a native mobile app or the ability to access the system through a mobile web browser. Even when traveling, you can view incoming payments or reports.

Devote more time to finding great tenants. After the software helps you handle complex accounting tasks, you can focus on screening out the bad tenants you don’t want to deal with.

What are some deployment options for property management accounting software?

Software can be implemented in various ways, but two options are most common today:

On-premise. An on-premise accounting system would be installed locally on the computer you use at your office. This type of deployment keeps your accounting data close-at-hand. These deployments typically require a larger upfront cost.

Cloud-based. Alternatively, a cloud-based system is installed on the software vendor’s servers and delivered to you via the Internet. This can be a more secure option, as your accounting data is saved “in the cloud” and won’t be lost should your local computer be destroyed or lost. Additionally, a cloud-based deployment is often a cheaper investment upfront, with fewer hardware requirements and a monthly subscription fee.

What type of buyer are you?

Portfolios can vary greatly from one property manager to the next. Software vendors know this and offer a range of features that can often be mixed and matched to meet a manager’s requirements.

Managers with a single, small apartment complex. For those who oversee a small apartment complex, basic accounting features, such as general ledgers for rent payments and expenses, should be enough functionality to handle your needs. Additional features can be added to increase convenience.

Managers with a large complex or mixed real estate portfolio. Maybe you manage a few apartment complexes, or you have a mixed portfolio, with hundreds of tenants to track. These managers can gain greater benefits from software by opting for more functionality, such as advanced reporting, budgeting and forecasting. An online portal can also greatly reduce the stress of collecting rent each month.

What are some business trends of property management accounting software?

The property management industry is always subject to new government regulations, renter behavior trends and the ever-changing real estate and housing markets. Here are some events that impact property managers:

Rent growth is strong despite increase in supply. The U.S. housing supply in 2016 isn’t able to meet demand, leading to high rent growth. Cities with booming rents include Austin, Seattle and Nashville. Some experts say these markets are tough to enter as developers are aggressively building new properties, but apartment managers in these locations have the opportunity to increase rates.

Are we due for another economic recession? U.S. economic indicators in mid-2016 are showing patterns that could lead to another recession within 12 months, according to J.P. Morgan economist estimates. This suggests that property managers should be conservative about plans for growth or expansion and more critical of applicant’s financial stability.