Find the best Construction Management Software

Compare Products

Showing 1 - 20 of 507 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

Houzz Pro

Houzz Pro

Houzz Pro is a lead and project management solution that streamlines processes for businesses of all sizes by centralizing all needs into one place. Key features include project management, lead management with client dashboards, ...Read more about Houzz Pro

Jobber

Jobber

Jobber is a cloud-based field service management software solution that allows small and midsize service businesses to manage field staff, provide customer support, and expand business operations either through a mobile app or a d...Read more about Jobber

Knowify

Knowify

Knowify helps contractors Budget, manage, and invoice every construction project and service job with precision, and get insights to grow their business along the way. All work happens in one intuitive platform that integrates sea...Read more about Knowify

BuildBook

BuildBook

BuildBook is construction management software that enables residential home builders and remodelers to streamline projects, improve team collaboration, simplify scheduling, elevate the client experience, create better estimates & ...Read more about BuildBook

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Meet Eric, a software expert who has helped 1,534 companies select the right product for their needs.

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Tell us more about your business and an advisor will reach out with a list of software recommendations customized for your specific needs.

STEP 1 OF 4

How many are in your organization?

Buildxact

Buildxact

Is estimating taking weeks when it should only take hours? Optimize your residential construction estimating, quoting and project management with Buildxact. Buildxact is a Software Advice Front Runner, noted by users for its eas...Read more about Buildxact

ConstructionOnline

ConstructionOnline

UDA Technologies’ ConstructionOnline offers a web-based, integrated approach to project management, project scheduling, and customer management. Designed for emerging construction businesses in the homebuilding and remodeling indu...Read more about ConstructionOnline

JobTread

JobTread

JobTread provides end-to-end construction management software that helps jobs-based businesses manage all of their processes, from pre-construction to project completion. The software serves as a central location to manage jobs, t...Read more about JobTread

TimeSuite

TimeSuite

Designed for construction businesses, TimeSuite is a cloud-based platform that helps manage job costing, inventory transactions, resource scheduling and more. The solution offers various features such as task management, approval ...Read more about TimeSuite

ComputerEase

ComputerEase

Deltek ComputerEase provides powerful job cost accounting and construction management software to help contractors outpace their competition. This innovative, user-friendly software not only improves the way contractors run their ...Read more about ComputerEase

SmartBuild

SmartBuild

SMARTBUILD is your ultimate answer to efficient Construction and Contract Management. Crafted from industry expertise, this cloud-based Construction Management Software suite revolutionizes your approach, ensuring seamless operati...Read more about SmartBuild

Builder Prime

Builder Prime

Builder Prime is revolutionizing the home improvement industry. Our all-in-one business management solution seamlessly integrates CRM, estimating, production management, invoicing, payments, and more. Businesses can now operate m...Read more about Builder Prime

Simpro

Simpro

Simpro is a powerful job management software solution created by trade contractors, for trade contractors. If your business struggles with quoting multi-stage projects, managing inventory, communicating with technicians, or any ot...Read more about Simpro

RedTeam Go

RedTeam Go

RedTeam Go is a simple, end-to-end construction project management software designed to optimize your business for a better day, every day. Minimize Stress - All Your Data in One Place - Automatic Reminders - Bids Convert Into Co...Read more about RedTeam Go

ROOFLINK

ROOFLINK

ROOFLINK is a roofing business management software. It caters to roofing contractors and companies in the construction industry. ROOFLINK provides a customizable dashboard to manage all areas of a roofing business. Users can c...Read more about ROOFLINK

JobNimbus

JobNimbus

JobNimbus is a CRM and project management software wrapped up in one application. The platform is an end-to-end solution designed to help contractors (roofing and construction professionals) streamline their communication and bett...Read more about JobNimbus

Projul

Projul

Projul is everything you need in a construction management tool. Built by construction pros. With honest pricing. • Consolidate your systems into one spot • Save 7+ hours a week per employee • Close 15% more jobs • Instead of pa...Read more about Projul

RedTeam Flex

RedTeam Flex

RedTeam is a project management, construction financials and document control solution suited for midsize commercial general contractors. It is a cloud-based application developed by contractors to manage pre-construction, constru...Read more about RedTeam Flex

eSUB

eSUB

eSUB is a mobile application and cloud-based project management solution that helps commercial subcontractors across various trades to manage day-to-day operations. eSUB offers tools to connect field workers with office managers a...Read more about eSUB

Briq

Briq

Briq is a financial automation platform that enables construction companies to be more efficient and profitable. Briq automates financial workflows by connecting the people, processes, and systems that contractors use to run their...Read more about Briq

Smartsheet

Smartsheet

Smartsheet is a work execution platform and collaboration tool with a familiar spreadsheet-like interface that helps teams plan, track, and manage projects in real-time. Smartsheet features include a range of project management to...Read more about Smartsheet

Popular Comparisons

Buyers Guide

Last Updated: November 07, 2023Here’s what we’ll cover:

What is construction management software?

Benefits of construction PM software

Competitive advantages of using construction PM software

Business sizes using construction PM software

Software related to construction PM

Popular construction software product comparisons

What is construction management software?

Construction management software is a tool to help schedule and track worker to-dos, punch lists, and client billing. These systems provide firms with the appropriate oversight and document control required to monitor requests for information (RFIs), change orders and purchase orders so they can adhere to project budgets and timelines.

Benefits of construction PM software

Adopting construction project management (PM) software can benefit your firm in several ways, including:

Improved accountability. Document control capabilities help minimize liability by creating a virtual paper trail for plans, RFIs, change orders, submittals etc. All documentation is stored in a centralized repository with tracking and version control, so all parties know when something is added or updated.

Financial visibility. With a budgeting and cost control module in place, managers can track actual costs relative to estimates, and set up notifications to alert them if a project is in danger of exceeding the budget. If the system is integrated to accounting and job costing systems, the data will be even more accurate and offer increasingly valuable financial insights over time.

Improved collaboration. Because most construction PM systems are online, team members can collaborate even when not at the job site. Parties can review and markup plans, submit RFIs and receive responses and execute a change order—on the web and all in real-time.

Competitive advantages of using construction PM software

Firms that implement and make use of these systems can gain the following competitive advantages:

Scale your business. Most firms start out using manual methods—pen and paper or spreadsheets—to track projects, but eventually reach a breaking point. Either they take on more jobs, hire more people or they suffer a claim or a lawsuit from a mistake that could have been prevented. Construction PM software offers a more disciplined approach to managing projects and people.

Operate more efficiently. If you had a way to standardize processes on job sites, reduce confusion around change orders and track purchase orders and job costs, why wouldn't you use it? Construction PM software can offer this and more, helping your firm adhere to regulations and streamline communications among workers and clients. With access to a centralized repository of pictures, blueprints, punch lists and other job documentation, you can make operations more efficient and cut down on costly mistakes.

Increase the number of jobs completed on time and on budget. One of the greatest advantages these systems offer is increased visibility into estimated versus actual project costs. This transparency can help you adhere to budgets and schedules and alert managers and executives when projects are in danger of exceeding those benchmarks. Ultimately, these tools help firms complete more projects on time and on budget.

Business sizes using construction PM software

Your construction PM software purchase will be heavily influenced by your size of business, your tech maturity and availability of IT resources, as well as your demographic segment (i.e., job title and responsibility).

Business size and IT resources generally break down as follows:

Single user: Less than $1 million in annual revenue. This is likely a small, family firm with no IT department and a single software user.

Small business buyer: $50 million or less in annual revenue; 2-100 employees; likely no IT department; requiring 2-10 software user licenses.

Midsize buyer: $100 million or less in annual revenue, 2-100 employees; IT department; 11-100 user licenses.

Midsize - enterprise buyer: $100 million+ in annual revenue, 100+ employees, IT department; 100+ user licenses.

Most construction PM software buyers fall into one of the following groups:

General contractors. These buyers are looking for robust functionality that will help them track costs, manage documents and in many cases, schedule projects. Project managers at these GCs will seek best-of-breed solutions, while C-level executives may push for integrated construction management and accounting suites.

Building owners. These buyers manage a portfolio of capital projects, and keep tabs on the timing and costs of all projects in in aggregate. They seek best-of-breed and portfolio management systems that enforce accountability for all parties, while encouraging collaboration over the web.

Independent construction managers. Construction managers require advanced construction project software functionality that includes budgeting, costing and document control. However, smaller managers may not have the resources to deploy enterprise class construction PM systems. These buyers will do well with Software-as-a-Service (SaaS) systems or independent desktop licenses.

Subcontractors. These buyers approach managing projects from the standpoint of maximizing their crew's performance while minimizing liability. This requires subcontractor project management software with scheduling functionality to make sure the right crew is on the right job at the right time. Document control is critical for tracking change orders, transmittals, RFIs and other documents.

Software related to construction PM

"Construction software" refers to a class of applications that help firms manage the entire project lifecycle, from pre-sale through the actual build process and onto final billing. Increasingly, firms are looking to purchase an integrated software suite to help them manage this entire process.

However, if you choose to use a best-of-breed construction PM system, you'll need to know about the software related to this process to ensure each system can integrate and transfer data between applications.

Takeoff: Takeoff is a pre-sale process in which the estimator measures construction plans (blueprints and drawings) to determine the amount of materials and labor required for a job. Takeoff software is commonly sold as a standalone application or grouped together with estimating. It is less common to find takeoff within a construction PM tool.

Estimating: Another pre-sale process, estimating software is used to calculate the costs for the material and labor takeoff, and then produce detailed bid proposals from those estimates. Sold either as a standalone system or grouped with takeoff, it's less common for estimating to be included within a construction PM system. Unless, of course, each application is included as part of a comprehensive, integrated suite.

Bid management: Bid management, wherein a contractor solicits bids from subcontractors and suppliers before submitting a job quote to a building owner, is a process that in part bridges the gap between pre-sale and project management. As such, bidding can be found as an application within many construction PM systems or can be purchased as a standalone software.

Accounting: Construction accounting software helps firms manage their job costing, core accounting, fixed asset accounting and payroll. It's common to find some job costing and budgeting in construction PM software; however, if the PM systems you're evaluating don't offer core accounting, you should look for integrations with general accounting systems, such as QuickBooks or Xero.

Features Guide

A list of common construction PM features

Look for the following construction PM software capabilities as you compare solutions:

Project scheduling | Helps contractors and subcontractors assign people, resources and equipment to a project. |

Project tracking | Helps contractors and managers track progress on a job and ensure the project stays on track with budget and timeline constraints. |

Document management | Centralized repository for all project documentation that provides version control and keeps teams up-to-date and on the same page. |

Job costing/ project finances | Tracks estimated vs. actual job costs over the duration of a project to ensure accurate invoicing. |

Feature details and examples

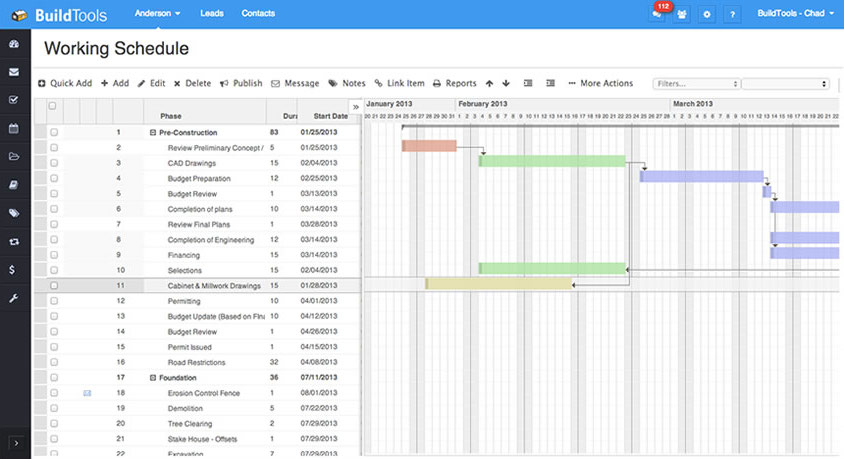

Project scheduling: Once a job has been awarded, the scheduling application helps contractors, subcontractors and project managers finalize the project schedule and assign workers, resources and equipment to projects. These tools help each party identify dependencies and constraints within the schedule so they can effectively manage multiple teams and/or projects.

Key features include the critical path method (CPM) and Gantt charts.

Scheduling in BuildTools

Scheduling in BuildTools

Project tracking: Helps firms track tasks and to-dos from start to finish and monitor the progress of projects. Automates the process by which executives and clients are notified when project thresholds are met and milestones achieved. Includes alerts for when projects are in danger of exceeding initial estimates for budget and/or timeline. Also provides notifications for users when changes are made to the schedule, when documents are updates or added or when new tasks are assigned.

Key features include dashboards, reporting, time tracking, task management, automatic notifications and mobile access.

![]() Project dashboard in RedTeam

Project dashboard in RedTeam

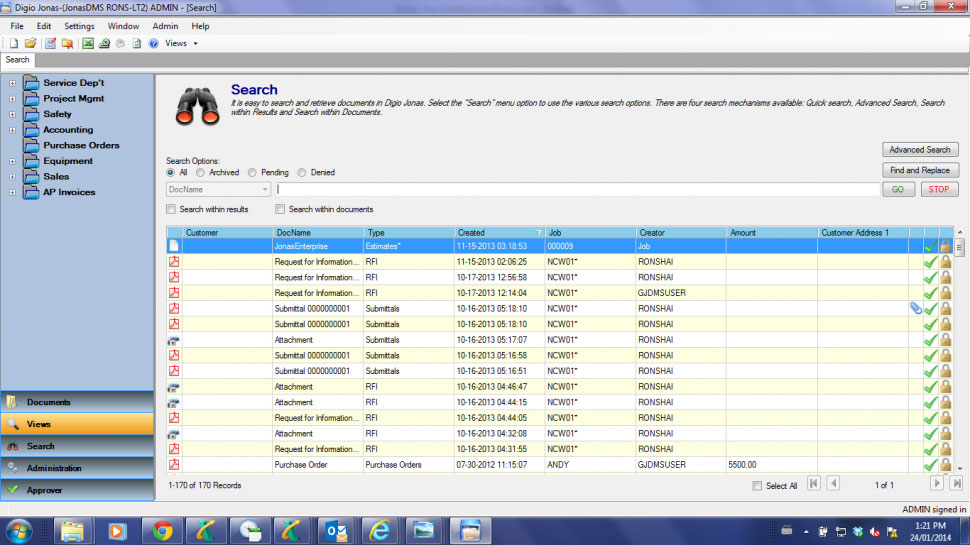

Document management: Archives all project documentation including blueprints, drawings, contracts, RFIs, change orders, photos etc., in a centralized, searchable database. This offers version control, increases organization, reduces errors, facilitates collaboration and provides firms and clients with a digital paper trail.

Key features include upload/download capabilities, plan markup, digital signature and mobile access.

Document search in Jonas Enterprise

Document search in Jonas Enterprise

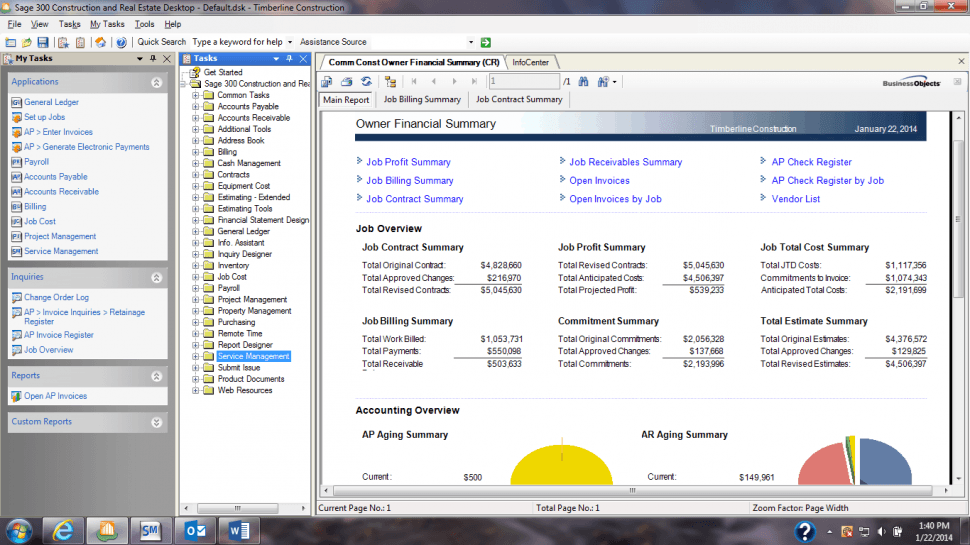

Job costing/project finances: Ability to track actual project costs compared to initial estimates, create and send purchase orders, execute change orders, schedule and track payments/invoices as well as submit and approve time sheets.

Key features include job costing, budgeting, financial tracking and integration with core accounting system.

Project finances in Sage 300

Project finances in Sage 300

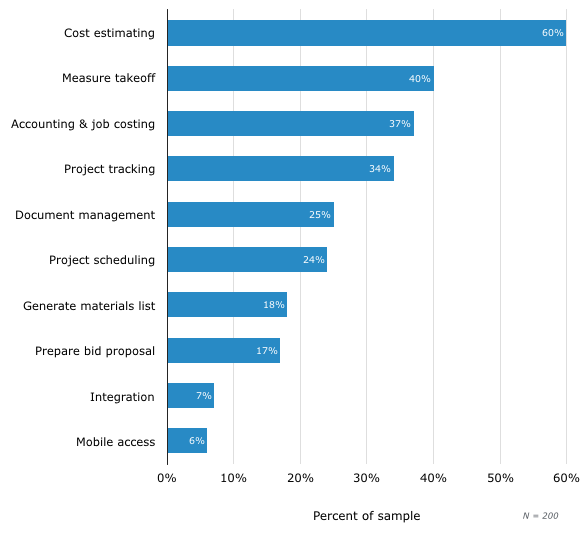

Construction PM software buyers' top requested features

The construction PM software capabilities most-often requested by buyers in our 2016 buyer report reflect the key functions highlighted above:

Job costing: 37%

Project tracking: 34%

Document management: 25%

Project scheduling: 24%

Combined, these applications make project management the number one business process construction firms sought to automate and streamline in 2016.

Top-Requested Construction Software Functionality

Source: Construction Industry Trends | SMB Buyer Report 2016

Source: Construction Industry Trends | SMB Buyer Report 2016

The construction PM software features you really need

Some construction PM software features are more critical than others, depending on your size of business. This table shows how construction PM software needs grow as businesses grow (please reference the section

Single user | • Document management: Manage and store all project documentation in a centralized repository. |

Small business | • Project scheduling: Assign workers, resources and equipment to projects with a specified start and end date. This is especially important if your firm runs concurrent and/or back-to-back jobs. • Project tracking: Monitor the progress of tasks, the completion of project phases and the achievement of milestones. • Job costing: Track project costs and any variation from initial estimates. Monitor KPIs and project profitability. |

Midsize business | • Core accounting: Manage your company's GL, AP and AR; track project costs and financials including payments, invoices, change orders and contracts. • Bid management: Receive job prospects, upload plans to an online plan room, solicit and procure bids from subcontractors and put the best bids together into a quote for the job. |

Midsize - enterprise business | • Program management: Manage your firm's portfolio of projects and optimize profitability; track budgets, schedules and resources across job sites. • Customer relationship management (CRM): Nurture leads and turn prospective customers into clients. Manage interactions over the entire customer life cycle. |

Pricing Guide

For an accurate snapshot of what Construction Project Management software costs, download our Pricing guide here.

FAQs

What are the key functions of construction PM software?

Construction project management (PM) software helps construction managers and general contractors oversee the actual build process. The key functions of these tools include:

Project scheduling: Evaluating the project's critical path and assigning workers and equipment to jobs.

Project tracking: Tracking the completion of tasks and the achievement of milestones.

Document management: Maintaining a centralized repository of all project documentation, e.g., change orders, submittals and transmittals, punch lists, purchase orders, invoices etc.

Job costing/project finances: Tracking actual project costs against initial estimates and monitoring the job's profitability.

What questions should I ask vendors when evaluating construction PM products?

When comparing construction PM software, be sure to ask vendors about the following:

What support and training services do you offer?

Especially if you're moving from manual methods to software, it's likely that you'll need extensive training on the new tool. Forgoing training can jeopardize the success of the implementation (and your investment). Look for a vendor whose support services align with your needs and preferences; e.g., 24 hour support vs. regular office hours, phone or email services etc.

How long does implementation typically take?

Factors that impact implementation timelines include your IT resources, your comfort with software as well as the complexity of the tool. For example, it'll likely take less time to implement a standalone construction management system than an integrated business management suite.

What product updates/changes do you have in the pipeline?

Vendors typically plan product updates around current customer requests and complaints. Asking what product changes you can expect gives you insight into both the state of the current product as well how dedicated the vendor is to improving their customer experience.

What accounting integrations do you offer?

While many construction PM systems include a job costing and budgeting module for tracking project finances, not every system includes core accounting (GL, AP and AR). If not, you'll need to ensure that the PM system integrates with your accounting platform.

Does your product include a mobile app?

Mobility on the jobsite can not just save your workers time, but also help cut down on errors. Look for tools that allow your team to take and upload pictures to project folders and draw up change orders on the spot and have customers sign them in real-time.

Does your product offer or include support for building information modeling (BIM) technology?

BIM is a growing trend in the industry and increasingly available to small and large firms alike. Whether you're currently using BIM as a software application or considering adopting the process in the future, it's important to evaluate whether products offer or include BIM integration.

What are some drawbacks I should watch out for?

The best way to understand the common sources of dissatisfaction among construction PM software users is by reading user reviews. The following are some common complaints we've seen among reviewers on Software Advice:

High cost

Poor integration

High cost. There are several variables that impact the final cost of your software purchase, including:

License fee

Set up and/or installation

Customizations

Training

It's important to remember that you'll have to revisit these costs each time you add a new user to the system. Additionally, customization and integration costs are not one-time fees, so you'll pay for these each time you renew your contract.

Also, unless you have a fixed-rate contract, vendors can increase rates during your contract period so you'll have to pay more when you renew.

Poor integration. It's important for your construction PM software applications to "talk," i.e., transfer data to the other software you use, specifically your accounting tool. Accurately balancing the books depends on your ability to track project costs and subcontractor payroll.

When your construction PM tool doesn't integrate with your other business software, your administrative teams will have to rely on manual entry, which is time consuming and error prone. It's critical to find a PM system that integrates with the other tools in use at your organization.

Tips & Tools

Build a business case for construction PM software

When building a business case for new construction PM software, you'll need to consider both the benefits and costs stemming from your investment.

The following are three sources of ROI cited by reviewers on Software Advice:

Standardizes processes across teams and projects.

Helps facilitate greater collaboration and connectivity between field workers and office staff.

Increases efficiency by saving time otherwise spent on manual tasks.

Relevant articles

"Building A Case For New Construction Software: 4 Questions To Answer"

"Free & Open-Source vs. Proprietary: How Construction Software Licenses Stack Up"

Popular construction software product comparisons

Construction PM market trends

These market trends should be considered as you select a software product and vendor:

Software-as-a-Service (SaaS). SaaS, or cloud-based software, is prevalent in this market. There is a substantial need for improved collaboration between participants, and web-based construction tools make that possible. That, and the cost and ease-of-implementation benefits of SaaS have made web-based systems very popular. Most systems are now SaaS or web-enabled and we recommend that buyers seriously evaluate these systems.

Mobile applications. The nature of construction requires that managers spend time in the field, and those managers want to stay connected to their software applications. As a result, there is huge demand for construction apps. The booming popularity of smartphones and iPads is accelerating this trend. Pay close attention to the mobile apps available, and platforms supported, for each vendor.

LEED credit tracking. LEED certification is increasingly popular, but requires diligent LEED tracking during construction. More and more systems are offering LEED tracking applications. These automate detailed tracking of points required to achieve certification. Firms that will be building to LEED standards should carefully evaluate the LEED tracking capabilities of the software products they consider.

Improved offerings from full-suite vendors. Traditionally there has been a trade-off between the deep feature set available from best-of-breed vendors and the seamless integration that results from implementing an integrated suite. In the last few years, a number of full-suite vendors have released stronger applications that can hold their own against best-of-breed solutions.