CPA Software Buyers Guide

This detailed guide will help you find and buy the right cpa accounting software for you and your business.

Last Updated on November 08, 2023Here’s what we’ll cover:

What is CPA accounting software?

What are the common features of CPA accounting software?

CPA accounting software pricing

What are the deployment options for CPA accounting software?

What are some other considerations when selecting a platform?

How to evaluate accounting software for Certified Public Accountants?

What is CPA accounting software?

Since Certified Public Accountants (CPAs) manage the finances for dozens, or even hundreds of corporations and individuals, they need software that can keep up. CPA-specific accounting programs will be designed for payroll, expense and reporting for multiple companies, and will also include useful tools like auditing, tax preparation and time-based billing.

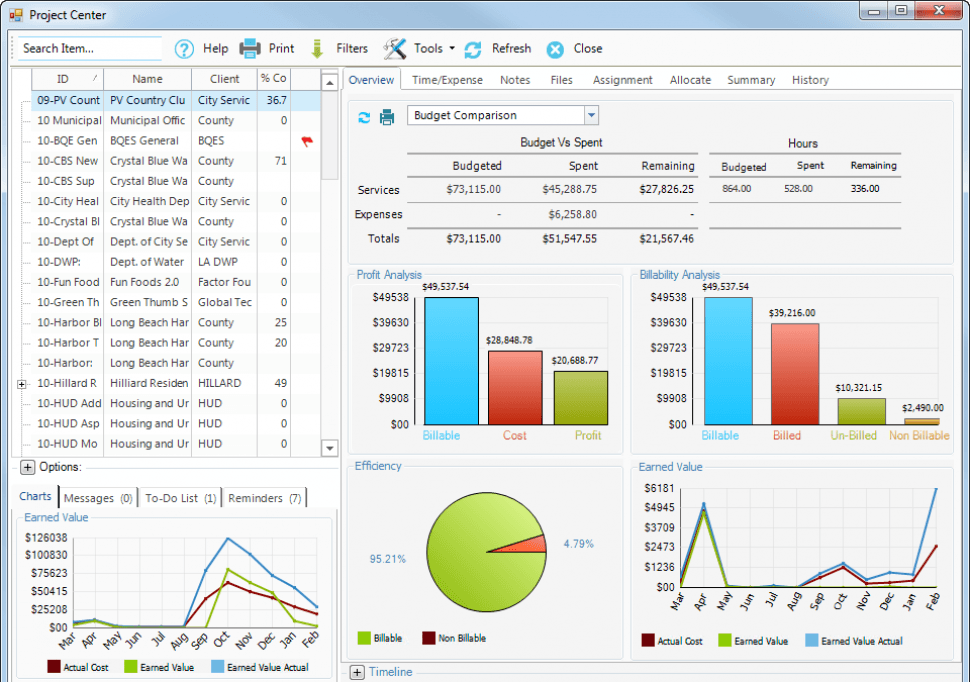

Screenshot of BillQuick user dashboard

Accounting software for CPAs isn’t just regular accounting software. CPAs typically need greater functionality and more features in order to handle multiple clients or otherwise ensure regulatory compliance.

In this guide, we'll cover:

The functionality CPAs should be looking for when considering software solutions; and

Best practices for evaluating CPA-specific systems.

What are the common features of CPA accounting software?

Accounting software for banks, mortgage companies and financial services institutions will include the following industry-specific features:

Multi-company accounting | Unlike other industries, professional accountants need to manage the accounting for multiple companies, so the software should allow you to categorize access all their data to keep it separated but easy to recall. Non-accountant-specific programs can sometimes become overloaded by all the records, so it’s critical that your software can handle large volumes of data. |

Tax preparation | The U.S. tax code is thousands of pages long, and it changes every year. Tax preparation is a major part of a CPA’s job, and CPA-specific systems will contain specialized data to support preparation for all your clients. These will include updated tax tables, automated calculations and electronic filing for individuals and corporations on a state, local and federal level. |

Time & billing | Time and billing refers to the ability to track the time spent on certain projects and then bill clients based on the number of hours spent. Accounting software for any service provider should include time and billing capabilities. |

Regulations compliance | The system needs to comply with federal, state and local regulations and statutes like FASB, GASB 34, IFRS and DCAA. Ensure the software you select complies with these regulations and updates it for any changes. |

Financial reports | Reporting is a critical component for freelance accountants. In addition to standard executive reports, charts and summary statements, the software should be able to build customized reports using an intuitive interface. |

CPA accounting software pricing

Accounting software used by CPAs is generally priced one of two ways: subscription and perpetual licensing.

Subscription. The software is priced as a monthly fee, typically based on the number of users. While no upfront fee is paid, an organization might have to pay annual fees for support and maintenance.

Perpetual license. With a perpetual license, an organization pays an upfront fee and then in turn owns the software in perpetuity. The upfront fee is also typically based on the number of users or the relative size of the organization based on its annual revenue. However, organizations will still generally have to pay annual fees for support, maintenance and updates. A general rule of thumb is that an organization can expect to pay 20 percent of the perpetual license fee annually on those other associated fees.

What are the deployment options for CPA accounting software?

CPA Accounting software can be deployed one of several ways: cloud-based, on-premise and hybrid.

Cloud-based. Cloud-based software is hosted on the vendor’s servers and is accessed through a web browser. Cloud-based deployment has become increasingly popular in recent years. Typically, cloud-based software is most associated with subscription pricing.

On-premise. The organization installs and hosts the software on their own computers and servers. Typically, on-premise software is most associated with perpetual licensing.

Hybrid. There are several hybrid approaches out there, but the most common is when an organization licenses a cloud-based platform to have it run on the organization’s own internal servers. This is done so the organization can have the flexibility of using cloud-based software while also having more control over how its data is stored.

One consideration to keep in mind is indeed data security. While cloud-based platforms can be just as secure as on-premise platforms, some organizations will nevertheless prefer to store their own data internally. CPAs might have certain clients who would prefer that their data never leave the CPA’s office, so at any rate it is critical for CPAs to understand where their clients’ data is being stored and how secure it is.

What are some other considerations when selecting a platform?

The strength of vendors offering CPA accounting software can often be determined by how agile they are when it comes to ensuring that their platform is continuously updated to reflect new regulations and laws pertaining to tax compliance. When selecting a platform, be sure to vet vendors’ commitment to updating their platform.

Also consider a vendor’s long term viability. The major players in this space can generally be seen as safe bets, while there can be less certainty smaller vendors. Smaller vendors may more adequately serve a particular niche, and may have more competitive pricing, but there is less of a guarantee as to how long that vendor will be around. As such, it’s important to note that every vendor has its own unique advantages and disadvantages in this regard.

How to evaluate accounting software for Certified Public Accountants?

When evaluating CPA-specific systems, the most important criteria to consider are the nature of your business and the number of clients. Do you primarily deal with tax preparation for individuals, or general ledger and payroll for corporations? Do you have two or three clients or 100?

In particular, CPAs seeking software should ask the following questions:

How many individual records will you need access to at a given time? Is the software designed for that level of usage?

Do you primarily serve individuals or corporations?

Will you need support on regulatory compliance?

Do you need to keep track of billable hours?