Bank Accounting Software Buyers Guide

This detailed guide will help you find and buy the right bank accounting software for you and your business.

Last Updated on November 16, 2023For banks, lenders, credit unions and other organizations in the financial sector, accurate accounting is more than just a necessary evil to operate and remain in compliance. Instead, it’s a vital component to garnering consumer trust and growing the business. One calculation error caused Bank of America’s shares to fall more than 6 percent back in 2014. It’s not hard to imagine what a similar mistake might cost a much smaller financial institution.

Accuracy isn’t the only thing that’s important either. Banks need a secure accounting system that can not only act as a general ledger, but can also manage deposits and billing, generate a wide variety of standard and customized reports and manage customer relationships.

That’s why you should consider investing in bank accounting software―advanced accounting platforms designed with the specific needs of banks and other financial institutions in mind. These systems can provide greater transparency into numbers across your organization, while also providing the accuracy, security and ease-of-use that your workers and customers demand.

If you’re researching bank accounting software for the first time, or just want to be up-to-date on the latest trends, this Buyer’s Guide is here to detail everything you need to know before you make your purchase decision.

Here’s what we’ll cover:

What is financial services industry accounting software?

Common features of financial services industry accounting software

How much does bank accounting software cost?

How to evaluate banking, mortgage and financial services accounting software?

What is financial services industry accounting software?

Banking, mortgage and financial services industries handle large amounts of sensitive financial data for their customers every day. To help manage and make sense of these numbers, financial services industry accounting software provides additional security and levels of accuracy and reliability beyond what most accounting systems offer.

Besides standard accounts payable (AP) and accounts receivable (AR) functionality, financial industry accounting software delivers robust billing, deposit, and customer relationship management (CRM) capabilities. These systems can also integrate with banking and insurance systems, support collections for past due accounts and more.

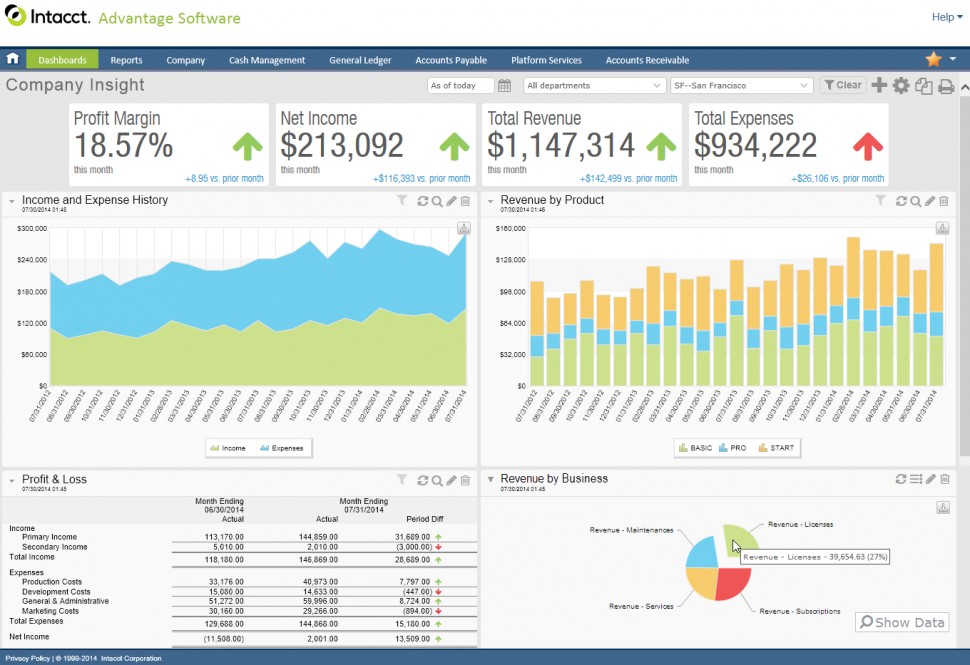

Screenshot of user dashboard in Intacct

Bank accounting software can be bought as a standalone system (otherwise known as best-of-breed), or as a module within a larger, more comprehensive enterprise resource planning (ERP) suite.

Common features of financial services industry accounting software

Accounting software for banks, mortgage companies and financial services institutions will typically include the following industry-specific features:

Integration with banking & insurance systems | The most advanced systems will incorporate the accounting with the banking features and functionality. Even dedicated accounting solutions, however, should integrate with your banking systems like Jack Henry or Metavante, as well as insurance solutions like Majesco and StoneRiver. |

Financial reports | Financial services accounting software can print the wide variety of reports used within the financial sector. Examples include income statements, trial balances, balance sheets, fund positions, audit trails, account roll-ups and profitability. |

Commercial billing system | Banks and other financial institutions are usually dealing with a large number of customers, each billed at different rates and often on an automated/recurring basis. Therefore, the billing function for a lending company needs to be highly accurate and highly repeatable, setting the user up for each stage of the lending process: targeting and prospecting; engineering the deal; daily operations (including billing, deposits, collections/recovery and interest rate adjustments) and refinancing. |

Customer relationship management | Financial institutions’ accounting software should leverage customer relationships for cross-selling and improved customer support. Key CRM features include complete customer profiles, relationships, mailing instructions, demographics, verification data, customer notes and more. |

Deposit management | One of the banking industry’s biggest issues is how to balance flexibility and responsiveness against security and accountability. A deposit management system should operate smoothly while still maximizing customer choices and accounting for standard deposit processing, transfers, special accounts (i.e., HSAs and retirement plans), regulatory support and even automated NSF processing. |

Recovery | To support cost recovery for past due accounts, banking and mortgage accounting software should have options like automated delinquency notices, reporting and letter generation. The more robust solutions automate these tasks even further, integrating with collections agencies and supporting cost control measures. |

How much does bank accounting software cost?

The answer to this question may be more complex than you think. As opposed to basic, out-of-the-box, accounting platforms that you pay for entirely upfront, many financial industry accounting systems charge a monthly or annual subscription fee to use their software. This is especially true for cloud-based systems, which are becoming increasingly popular.

Depending on which product you go with, and how much or how little functionality you choose to include in your purchase, that subscription fee can vary drastically. Some vendors charge a flat rate, while others change their rate from month-to-month or year-to-year based on how many users the system will have. If your system includes functionality for payroll, the vendor may base their rate on how many employees you have in your organization.

It’s also common for there to be one-time fees for things like implementation and setup, data migration and training. Whatever system you decide to go with, make sure to understand everything about the final price tag so you can budget accordingly.

How to evaluate banking, mortgage and financial services accounting software?

Accounting software for the financial sector automates the most tedious and error-prone tasks, which in turn increases accuracy, efficiency and overall customer experience. As with any software purchase, you’ll want to evaluate what you currently own, and then consider your specific needs such as: billing, customer relationship management, number of users and specific features offered by the program.

When evaluating banking, mortgage or financial services accounting systems, buyers should also consider the following:

Do your customers need a Web portal for online banking?

Do you need to integrate with other banking and insurance systems?

How many customers do you have? How are you managing those relationships?

Do you need robust billing and/or deposit management capabilities?

Do you have a large number of delinquent accounts to send to collections?

Do you deal in multiple currencies or operate internationally?