Find the best Applicant Tracking Systems

Compare Products

Showing 1 - 20 of 502 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

Rippling

Rippling

Rippling gives businesses one place to run HR, IT, and Finance. It brings together all of the workforce systems that are normally scattered across a company, like payroll, expenses, benefits, and computers. So for the first time e...Read more about Rippling

Paycor

Paycor

Paycor empowers leaders to build winning teams. Paycor’s human capital management (HCM) platform modernizes every aspect of people management, from recruiting, onboarding and payroll to career development and retention, but what r...Read more about Paycor

Keka

Keka

Keka is a cloud-based human resource (HR) solution, which helps businesses manage staff profiles, track attendance, process recruitments and analyze performance. Features include GPS, pulse surveys, document storage, helpdesk, rol...Read more about Keka

ClearCompany

ClearCompany

FrontRunners 2024

Since 2004, ClearCompany’s end-to-end Talent Management platform has enabled thousands of companies to maximize talent by empowering people at every stage of the employee journey. ClearCompany integrates data-driven best practices...Read more about ClearCompany

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Meet Eric, a software expert who has helped 1,534 companies select the right product for their needs.

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Tell us more about your business and an advisor will reach out with a list of software recommendations customized for your specific needs.

STEP 1 OF 4

How many employees are in your company?

BambooHR

BambooHR

Instead of using fragmented spreadsheets, limited or clunky software, and physical paper, BambooHR helps you centralize your data and automate the way you complete key HR tasks. As you hire, onboard, and pay your employees, every ...Read more about BambooHR

Workable

Workable

Workable simplifies HR with a suite of products for recruitment and employee management: Workable Recruiting is the leading Applicant Tracking System, enhancing hiring with AI, powerful sourcing tools, and seamless integration wi...Read more about Workable

Dayforce HCM

Dayforce HCM

Dayforce makes work life better. Everything we do as a global leader in HCM technology is focused on improving work for thousands of customers and millions of employees around the world. Our single, global people platform for HR, ...Read more about Dayforce HCM

Factorial

Factorial

Factorial is a cloud-based human resources (HR) solution that caters to small businesses across various industry verticals. Key features include a time-off manager, an organisational chart generator, a document manager and more. ...Read more about Factorial

ApplicantStack

ApplicantStack

An applicant tracking system is the foundation of strategic talent management. ApplicantStack capably empowers all stakeholders: internal recruiters, hiring managers, administrators and—most importantly—applicants. ApplicantStack ...Read more about ApplicantStack

PayPro Workforce Management

PayPro Workforce Management

Over the past 30 years, Paypro has grown into a full service Human Capital Management provider, helping its clients in all aspects of payroll, time and labor management, human resources and employee benefits. Paypro has built its ...Read more about PayPro Workforce Management

Greenhouse

Greenhouse

Greenhouse is the leading hiring software for growing companies. Thousands of the most successful companies, like DoorDash, Betterment, Wayfair and DocuSign, use Greenhouse to optimize all aspects of their hiring and onboarding. W...Read more about Greenhouse

JazzHR

JazzHR

JazzHR is a Software-as-a-Service (SaaS) applicant tracking system. Founded in 2009, JazzHR provides recruiting and hiring software accessible to businesses of all sizes. JazzHR’s sourcing tools enable users to post jobs, mir...Read more about JazzHR

TalentReef

TalentReef

Mitratech’s TalentReef platform enables hiring managers to focus on business operations and customers while decreasing time-to-hire. Today's candidates want a fast, intuitive way to find jobs and apply. We go beyond simple job bo...Read more about TalentReef

Humi

Humi

Humi is a best-in-one HR, payroll, and benefits software solution for Canadian businesses. A flexible platform for all of your people operation needs, Humi stores employee data and streamlines tasks related to onboarding, time off...Read more about Humi

ExactHire

ExactHire

ExactHire is cloud-based hiring software that offers applicant tracking, text recruiting, external job board posting, and offer letters. Optional integrated employee onboarding, background checking, and employee assessments are av...Read more about ExactHire

Workzoom

Workzoom

Workzoom is the all-in-one HR, Workforce, Payroll, and Talent solution that consolidates and automates your people management. Bring your whole team together with a centralized hub for accessing personal information, company updat...Read more about Workzoom

Arcoro

Arcoro

The Arcoro human resources (HR) management solution is the bridge to better HR. With over 10,000 customers and 360,000 daily users in 20 countries around the world, Arcoro offers configurable, easy-to-use, cloud-based HR software ...Read more about Arcoro

Wizehire

Wizehire

FrontRunners 2024

WizeHire is an award-winning top recruiting software for hiring agencies, growing businesses, and enterprises. Post job ads to 100+ job boards with one click. We offer an advanced applicant tracking system, a centralized dashboard...Read more about Wizehire

TestGorilla

TestGorilla

TestGorilla is a human resource (HR) management software designed to help businesses improve hiring processes by conducting pre-employment tests for potential candidates. Professionals can create personalized assessments by adding...Read more about TestGorilla

HiringThing

HiringThing

We're HiringThing, an applicant tracking solution designed to deliver Hiring Happiness for all. Our feature-rich software allows your company to attract top talent, automate recruiting workflows, and collaborate with the entire hi...Read more about HiringThing

Popular Comparisons

Buyers Guide

Last Updated: November 07, 2023In this buyers guide, we'll cover:

What is an applicant tracking system?

An applicant tracking system (ATS) is a type of software tool that organizes, tracks, and sorts job applicants. Its features include hiring workflows, job postings, candidate profiles, and applicant scoring.

Benefits of ATS software

The software tool provides businesses with a number of benefits, including:

Customized recruitment processes. No two companies evaluate and hire workers the same way. With an ATS software, you can customize the hiring workflow for every role in your organization to standardize the steps in your recruitment process, including interview scheduling, resume parsing, and application processing. Task lists, shared calendars, and automated alerts ensure that nothing falls through the cracks.

Automated job posting: Many ATS platforms allow users to post job openings to their company careers page, social media accounts and popular job boards, such as Indeed and LinkedIn, to be seen by interested candidates. The ability to reuse job posting templates and schedule posts in advance can save users valuable time.

Data management: As applicants from various sources submit their resumes to be considered for positions, the tool can automatically import them into a secure database for safekeeping. Comprehensive candidate profiles can be created, searched through and filtered by a number of criteria (e.g., location, role, skills) to easily hone in on what you're looking for.

Applicant scoring and ranking: The tool provides a centralized hub where recruiters, hiring managers and more can collaborate to evaluate applicants. Standardized rubrics ensure that everyone uses the same criteria for every candidate. Some systems can even rank candidates automatically based on what you value most in an employee at your organization for a given role based on the information provided in the job application.

Recruiting analytics and reporting. Where are candidates falling out in the recruitment process? Which online source sends your company the best candidates? Embedded analytics in an ATS can answer these questions and highlight areas where your organization can improve. You can also generate standardized reports for compliance purposes or to keep stakeholders up to date.

Competitive advantages of using ATS software

Every business needs an edge over competitors when it comes to finding, attracting, evaluating and hiring top talent. An applicant tracking system can give you that edge by helping you:

Hire people faster: A 2016 study by employment insight firm DHI Group found the average job vacancy in the U.S. is 29.2 days. The longer it takes for you to find and hire a qualified candidate, the longer it will take for them to become a productive employee. An ATS solution can help you diagnose bottlenecks in your hiring workflow to cut down the time it takes to fill your vacancies.

Lower the cost per hire: It's not always easy to understand where your recruiting spend isn't providing the best return without the proper tool to crunch the numbers. Using the historical information and data visualization tools housed in an ATS platform, you can better streamline hiring processes and identify new areas for optimization to lower recruiting costs.

Identify talent: Sometimes the unlikeliest of traits can predict worker success. With an ATS, you and your team can more consistently evaluate and rank applicants to find the best candidates. After someone's hired, you can look at their performance metrics to better understand what job applicant qualities are the most likely to translate well to specific roles within your organization.

Scale your business: If you have a small business or are in the middle of a hiring drought, manual applicant tracking methods, such as pen and paper or spreadsheets, can get you by. However, if you’re looking to grow and optimize your business, it’s best recommended to invest in an ATS tool.

Businesses sizes using ATS software

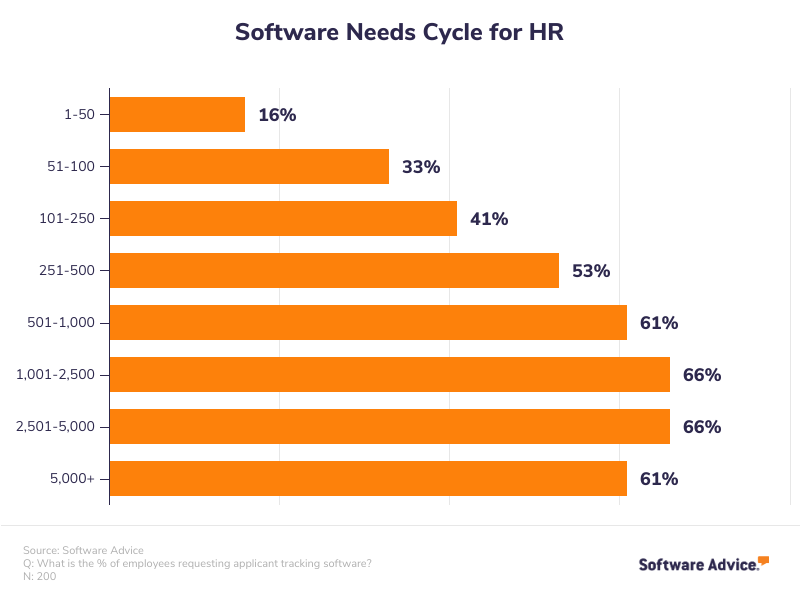

Buyers of applicant tracking software come from a wide variety of industries and sizes and are generally categorized by how many employees they have in their organization:

Small business buyers: These buyers have anywhere from 1-50 employees and don't have a department dedicated to human resources (HR) and recruiting initiatives.

Midsize business buyers: These buyers have anywhere from 51-500 employees and are experiencing rapid growth, prompting them to hire an internal recruiter.

Enterprise business buyers: These buyers have more than 500 employees, a hiring team and a dedicated IT department.

When you choose to purchase ATS software will depend entirely on your hiring needs, but Software Advice sees peak adoption at 1,001 to 5,000 employees:

Source: Software Needs Cycle for HR

Software related to applicant tracking systems

Here are some other types of software tools related to ATS platforms that can improve your recruiting efforts or your workforce as a whole:

Recruiting software: Extends beyond applicant tracking needs to help recruiters manage job descriptions and searches, improve the candidate experience, perform background checks, social recruiting, and more.

Staffing agency solutions: Specializes in helping external recruiting and staffing agencies better manage clients, external career sites, and quickly fill roles with high-quality talent. Offers features such as time and expense tracking, back office management, and email/calendar integration.

Onboarding tools: Helps businesses automate processes to turn new hires into full-fledged employees. Features include new hire task assignment, digital signature capabilities, and onboarding form management.

Talent management solutions: Allows HR professionals to manage the entire employee lifecycle, from attraction and hiring to management and development, with applications for applicant tracking, performance management and more.

HR apps: Gives hiring teams, HR managers, recruiters and employees the flexibility to complete important personnel tasks on their smartphone or tablet with features, such as mobile clock-in and out and one-click payroll runs.

Features Guide

A List of Common ATS Features

ATS software offeers a wide variety of features. Here are some of the most common ones to look out for:

Applicant tracking | Track the progress of all applicants for open roles, from start to finish. |

Candidate profiles | Upload resumes and manage applicant details and interactions in a searchable database. |

Job posting | Post job openings to company careers pages, social media platforms, and job boards. |

Applicant scoring and ranking | Grade applicants based on preset criteria and rank the remaining job seekers in the running for a position. |

Feature Details and Examples

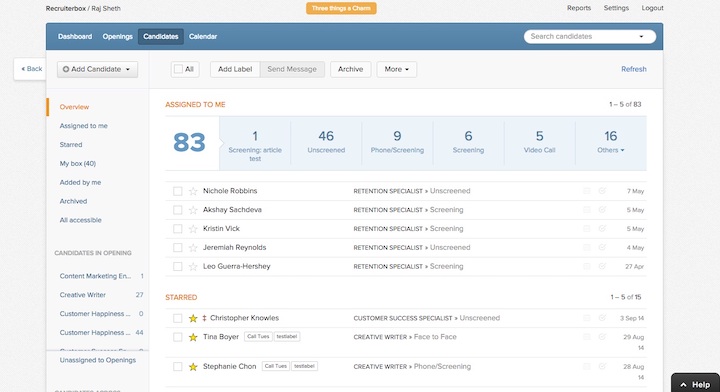

Applicant tracking: Allows you to track where all of your applicants are in the hiring process (e.g., interview, background screening) for a given role. As applicants are evaluated and pushed through to the next stage in your workflow or dropped from the running, their recruitment status gets automatically updated in your database.

Overview of applicants in Recruiterbox (Source)

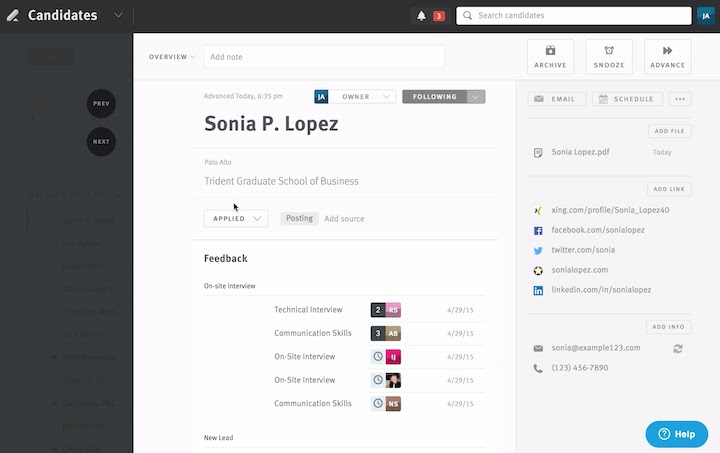

Candidate profiles: This feature allows you to maintain comprehensive profiles of all candidates, including resumes, contact information, social media profiles, assessment scores, manager feedback, interview notes, and more. You can search and filter for candidate profiles based on location, role, experience, keyword, etc.

Candidate profile in Lever (Source)

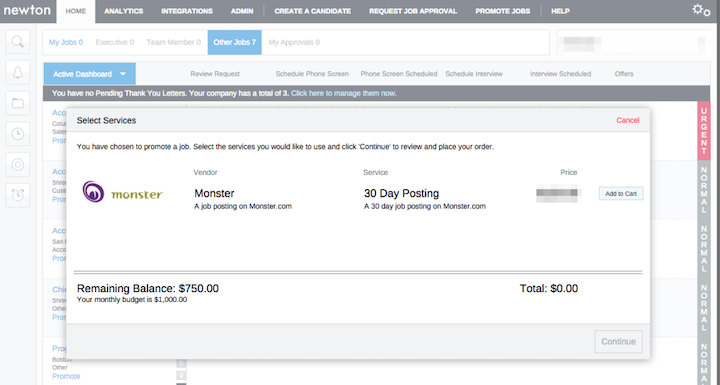

Job posting: This feature allows you to create online job listings for your vacancies and post them to your company's careers page, social media profiles and job boards. You can also schedule posts in advance, optimize postings to appear on Google and purchase job board ads from service providers that partner with ATS vendors.

Job board posting in Newton (Source)

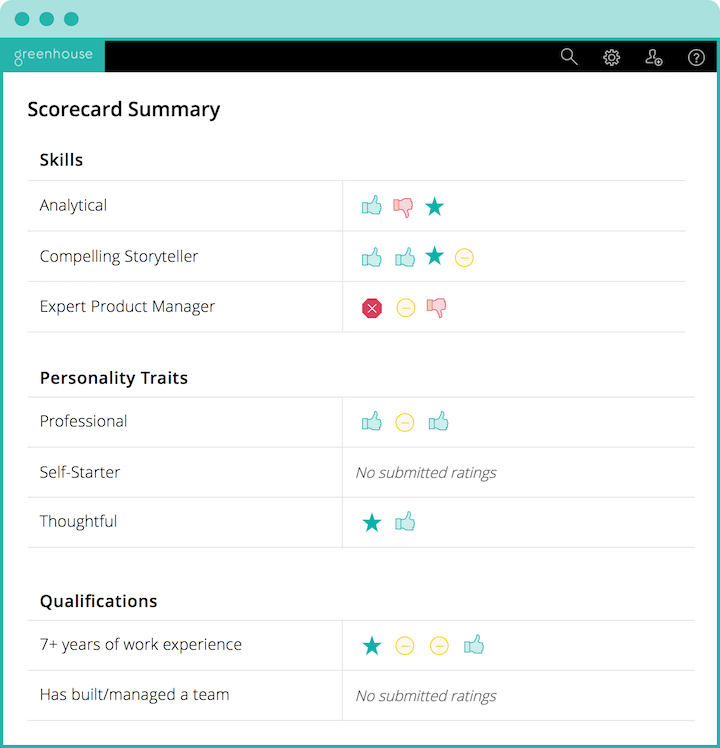

Applicant scoring and ranking: This feature allows you and your team to score applicants based on a variety of customizable criteria related to skills, experience and personality. Once all scores are in, hiring managers can rank the candidates manually, or in some cases, the tool does it automatically.

Candidate scorecard summary in Greenhouse (Source)

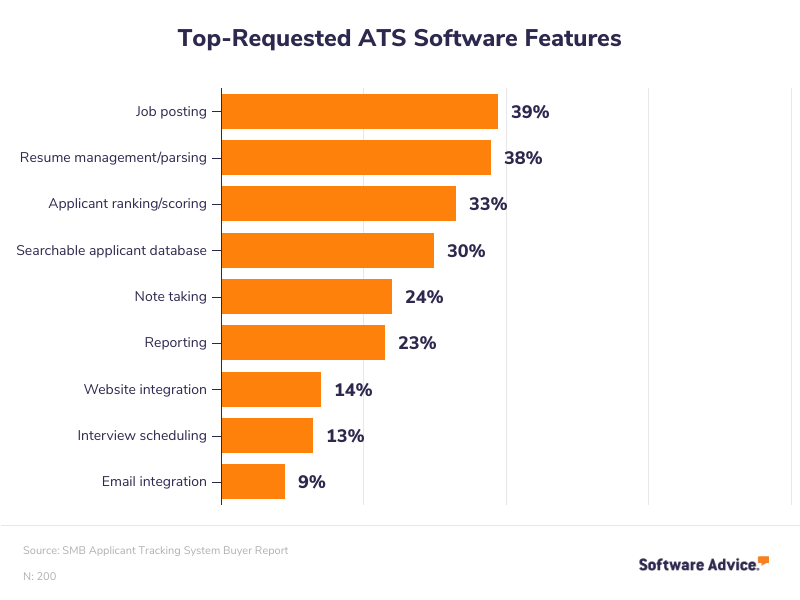

ATS buyers' top-requested features

Unsurprisingly, the most common features also tend to be the most requested by buyers. According to internal Software Advice data, job posting, resume management and parsing, applicant scoring and ranking and a searchable applicant database are the top requested ATS software features among small and midsize businesses (SMBs), i.e., businesses with $50 million or less in annual revenue.

Source: SMB Applicant Tracking System Buyer Report

The features you really need

When evaluating an ATS, it's important to prioritize certain features over others depending on your needs. With that in mind, here are the most crucial features for different business sizes (see the "Business sizes using ATS software" section of this guide for business size definitions):

Small business buyer | Applicant database: Track all of your applicants in a secure, centralized hub to eliminate the need for complex spreadsheets or paper files. |

Midsize business buyer | Resume parsing: Automatically look for important words and phrases in submitted resumes to create a shortlist of top prospects and eliminate unqualified applicants. |

Enterprise business buyer | Recruiting analytics: Dive deeper into your recruiting process to discover areas for improvement and optimization. |

Pricing Guide

For an accurate snapshot of what an applicant tracking platform costs, download our Applicant Tracking Systems Pricing Guide.

FAQs

What are the key functions of an applicant tracking system?

As we covered in the features guide, ATS platforms provide a number of key functions for your business, including:

Applicant tracking: Track the progress of all applicants for open roles, from start to finish.

Candidate profiles: Upload resumes and manage candidate details and interactions in a searchable database.

Job posting: Post job openings to your company's career page, social network accounts, and job boards.

Applicant scoring and ranking: Grade applicants on a variety of criteria and rank them from best to worst for open roles.

Recruiting analytics and reporting: Analyze your historical data to discover deficiencies in your recruiting processes, and generate standardized reports for stakeholders.

What questions should I ask vendors when evaluating applicant tracking software?

It can be easy for conversations with ATS vendors to become one-sided. After all, they're trying to sell you on their system over the competition. It's important, though, to ask questions and understand everything before signing on the dotted line.

As explained in "5 Questions To Answer Before Buying an Applicant Tracking System," some important questions to ask vendors are:

How is your system priced?

As we mentioned in the pricing section, ATS vendors use a lot of different methods to price their products. Know this information well ahead of time so you can budget accordingly.

Does this system work with our recruiting strategy?

If you rely on employee referrals for quality job candidates but your ATS focuses on sourcing from social media, that's a mismatch. Make sure that you find a tool that conforms with your recruiting strategy—not the other way around.

Do I really need this feature?

It's common for buyers to purchase a popular ATS system that's way too big for their needs and pay a lot of money for functionality they don't use. Don't get distracted by bells and whistles.

Do you offer local, high-quality support?

No product is perfect. Ask questions about support options so when you encounter a problem, you can be certain that you'll be able to reach someone who can help you immediately.

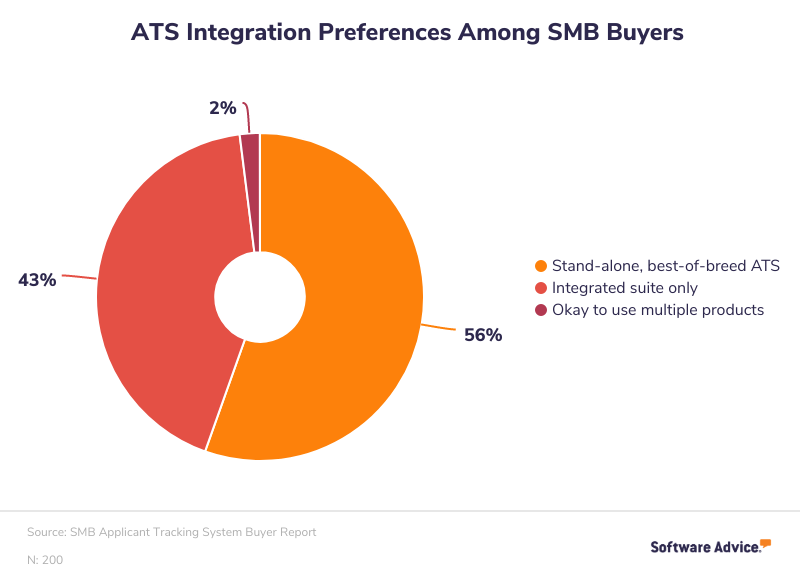

Should I purchase standalone applicant tracking software or an integrated suite?

You can purchase applicant tracking software by itself (e.g., Jobvite) or as part of an integrated HR suite with other applications such as personnel tracking, payroll, and time and attendance management (e.g., BambooHR). According to internal Software Advice data, 56% of ATS software buyers choose the former while 43% choose the latter.

Source: SMB Applicant Tracking System Buyer Report

Which way you go will depend entirely on your needs. If your focus is on advanced recruiting functionality, choose a stand-alone product. If you have additional needs besides applicant tracking or value tight integration between your various HR processes, choose a suite.

Do ATS Software Vendors Update Their Products Often?

The applicant tracking software market is highly competitive, and the labor market and what employers value in their workforce are constantly in flux. Because of this, ATS software vendors are constantly adding features to their flagship products to gain an edge and attract attention.

Stay on top of the latest functions to look out for with our article, "5 Recruiting Trends in 2017 (and the 9 ATS Features You Need to Capitalize on Them)."

What Are Some Drawbacks I Should Watch Out For?

Don't expect ATS platforms to be the cure-all for your hiring woes. While these systems can help you organize, streamline, and scale your recruiting operations, they can't fix bad hiring strategies or an inferior employer brand.

Also, keep in mind that a poorly chosen or implemented applicant tracking system can do significant damage to your online candidate experience, which can cause talented applicants to drop out of your hiring funnel. Take time to ensure this transition for job seekers into your system to apply for positions is seamless, regardless of device or web browser.

Tips and tools

Build a Business Case for your investment

It can be tough to convince executives to invest in a new tool. When making your business case, focus on these three ROI drivers:

Lower your cost per hire: Using embedded analytics, you can identify areas to refocus your recruiting budget and save your company money.

Hire people faster: Being able to discover bottlenecks in your hiring process can allow you and your team to evaluate and hire talent quicker and fill empty seats faster.

Retain better talent: ATS software can help your team uncover which traits truly translate to role success, increasing worker productivity.

Relevant Articles

Here are some recent articles about ATS platforms you should check out:

Popular ATS Software Comparisons

Check out some recent articles comparing ATS software products:

Recent Events in the ATS Software Market

Here are some important recent events concerning ATS vendors and the ATS software market:

Google debuts Google Hire: In April 2017, a website went live for what's predicted to be Google's entry in the ATS software market: Google Hire. Details about the product are scarce, but Google is expected to reveal more information soon.

Microsoft debuts Dynamics 365 for Talent: In April 2017, Microsoft announced a new recruiter-focused offering in its popular Dynamics suite called Dynamics 365 for Talent. The platform integrates with LinkedIn, which Microsoft acquired in 2016.

Saba Software acquires Halogen Software: In February 2017, Saba Software announced that it had acquired ATS vendor Halogen Software, makers of Halogen Talent Acquisition.