Small Business Invoicing Software Buyers Guide

This detailed guide will help you find and buy the right small business invoicing software for you and your business.

Last Updated on November 06, 2023Invoicing can be time-consuming, and it may not be the most interesting task you do every day. But, as a small business owner, it's an essential part of growing and sustaining your cash inflow. You can save yourself some time and effort; however, by investing in small business invoicing software to automate your invoicing process.

There are several invoicing platforms on the market that offer functionalities for small businesses from a variety of industries. Some solutions are designed for specific fields, such as nonprofit, legal or distribution, while others are for specific business sizes and offer varying degrees of complexity in their features.

Searching through all the options can make choosing the right solution feel overwhelming. So, we've created this Buyer's Guide to provide the guidance you need to make the right software purchase choice.

You can use this guide whether you're researching small business invoicing software for the first time or want to replace your current solution with one that's a better fit.

What is small business invoicing software?

Small business invoicing software organizes and automates the invoicing process. It helps small businesses reduce manual data-entry errors and ensure the timely and consistent collection of payments.

Small businesses across several industries, including manufacturing, hotel, construction and logistics use invoicing software to bill customers and clients. Due to the wide range of industries served, most software vendors offer customizable solutions that support distinct business models, payment types and pricing structures.

For this reason, features can vary remarkably from one small business to another.

Invoicing software is useful for both time-bound as well as delivery-bound small businesses. For instance, freelance legal consultants or small law firms can charge a client based on the time spent working on a case, while a small manufacturer could charge the supplier upon final delivery of goods.

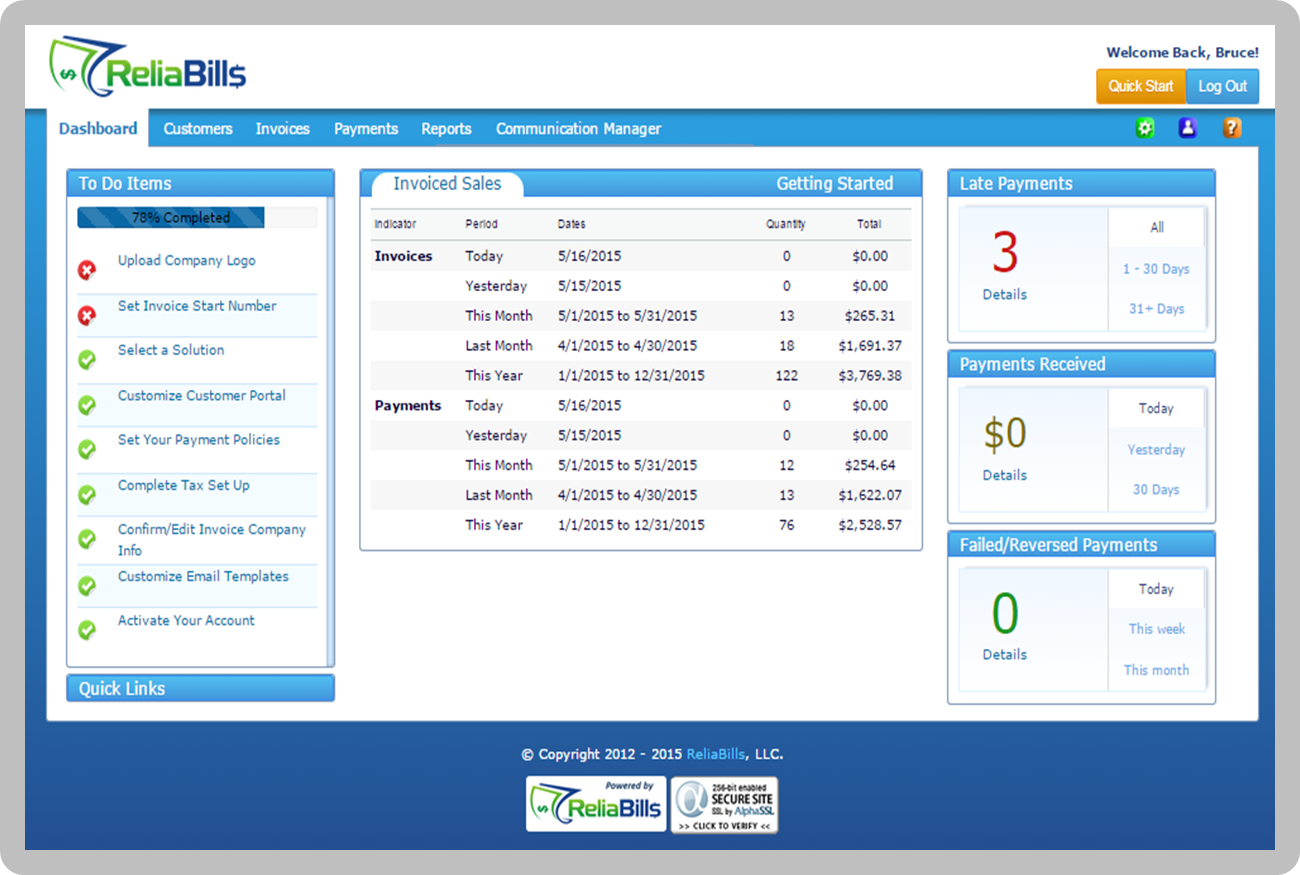

List of invoiced sales and incoming payments in ReliaBills

What are common features of small business invoicing software?

Vendors offer a variety of functional breadth and depth in their small business invoicing software. We've listed some of the common capabilities below:

Invoice creation | Customize and create invoices that include the company logo, client details and all the terms of payment. |

Invoice sending | Set up one-time or recurring invoices to be sent to clients. Some systems also send alerts when an invoice has been viewed by the recipient. |

Reporting | Generate various financial statements such as a profit and loss statement, expense report and payments collected statement. |

Online payments | Accept online payments through automatic bank transfer, credit card or payment gateways such as PayPal. Add late fees for overdue invoices and send payment reminders. |

Time tracking | Assign fees or rates based on project, employee, flat-fee or per hour billing. Users can track billable time and import this data into the invoices. |

API | Integrate the invoicing software with other systems such as a CRM application or project management tool. |

What type of buyer are you?

Before you start evaluating small business invoicing software, you should understand what buyer category you fall into to better gauge your needs. You'll also know which specific features other small businesses like yours consider to be most important.

We believe almost all buyers can be categorized as one of the below types:

Small businesses that invoice based on project/unit. These buyers (e.g., small consulting or manufacturing firms) focus more on their specific invoicing needs than any other business process. They require a stand-alone invoicing system that offers a high level of customization and flexibility to suit their specific needs.

Buyers looking for a complete software package. These buyers generally need an invoicing module that's part of a complete software suite. In other words, they're looking for an integrated software and prefer a holistic software experience. This type of buyers usually value a specific invoicing functionality in a system rather than integrating with other systems. For example, an auto shop repair software offers invoicing along with various other modules such as work order management and customer relationship management (CRM).

Industry-specific, unique buyers. These buyers (e.g., small utility companies or legal consultants) have such unique invoicing processes that they need systems designed exclusively for their industry. For that reason, they either purchase an industry-specific solution, or build their own system, or outsource the software development process to a third-party organization.

What are benefits of small business invoicing software?

We've already talked about some of the benefits of small business invoicing software in the article, but here are the most key benefits:

Automated invoicing. One of the biggest advantages of invoicing software for small businesses is automation. The software allows users to set up recurring payment options for their long-term clients. The system automatically sends payment reminders and follow-ups to clients for invoices that are past due and upcoming.

This helps minimize late and missed payments, and hence, reduce business losses.

Improved professional reputation. A good invoicing system could boost your small business's reputation. Many invoicing software vendors offer features that allow users to create customized logos and make other design enhancements, which they can add to their invoices and payment documents.

This helps users showcase professionalism to their clients and suppliers, which can lead to more business opportunities.

What are the market trends of small business invoicing software?

You should be aware of the following market trends as you begin your search for small business invoicing software:

Preference for cloud-based software. Many small business buyers prefer cloud-based software, as easy and quick accessibility is critical for them. Cloud software enables users to send and manage invoices from any location, using any device at any time. This convenience of doing business is vital for small businesses that have a limited number of staff members handling a lot of responsibilities.

Availability of mobile apps. Small business invoicing software is also offered in the form of mobile apps, and several vendors offer this feature. The portability and convenience of mobile devices allows users to continue working while on the move. For instance, EBizCharge offers an Android mobile app to monitor invoicing transactions on the go.

What should you consider when purchasing small business invoicing software?

Here are some important factors you should think about before you buy or implement a small business invoicing software:

System integration. Consider a small business invoicing solution that integrates with whatever existing software you currently use, such as a CRM, vendor management software or project management tools. Seamless integration makes it easy to share existing data with the new system.

Mobile support. If you are among those users who prefer to access the software remotely, check whether the vendor offers a mobile app, so you can access invoices and receive updates on your mobile device.

Cloud or on-premise deployment. Check with vendors about the deployment options they offer. Many small businesses prefer cloud-based deployment due to the low upfront costs and easy access to invoicing data.

However, some businesses may consider the on-premise option based on budget and other unique requirements.

Free or paid software. You'll find there are vendors that offer a free version of their software with limited features. If you only require basic features, such as creating and sending invoices in a limited volume, a free version may be right for you.

However, if you need advanced features such as an API and online payments then you'll most likely need to pay extra for them.