Find the best Payroll Software for Accountants

Compare Products

Showing 1 - 20 of 184 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

Vista

Vista

PDS’ Vista is the complete HCM software solution for organizations with employees based in the United States, Canada, or the Caribbean. All the pieces—recruiting, onboarding, human resources, benefits, payroll, time and attendance...Read more about Vista

NuView

NuView

NuView is a human resource management system that aims to streamline HR processes and enhance visibility across HR managers, employees, and senior leadership. It brings together all HR data in a single unified platform, allowing f...Read more about NuView

iCIMS Talent Cloud

iCIMS Talent Cloud

Support the entire candidate experience from start to finish with a unified recruitment platform. iCIMS offers best-in-class recruiting products for your hiring life cycle, available as part of one unified talent cloud platform, o...Read more about iCIMS Talent Cloud

Omniprise

Omniprise

Omniprise is an on-premise as well as cloud-based customer relationship management solution designed to provide companies a view of all customer interactions on a real-time basis. The solution is suitable for businesses of all siz...Read more about Omniprise

BambooHR

BambooHR

Instead of using fragmented spreadsheets, limited or clunky software, and physical paper, BambooHR helps you centralize your data and automate the way you complete key HR tasks. As you hire, onboard, and pay your employees, every ...Read more about BambooHR

People-Trak HRIS Suite

People-Trak HRIS Suite

People-Trak is a cloud-based HR Solution suite that allows users to deploy the application in the cloud or on-premise. Canopy's People-Trak solution comes with a free HR database which includes alerts, reporting and 1 GB of s...Read more about People-Trak HRIS Suite

isolved

isolved

isolved is the most-trusted HCM technology leader, providing the best combination of software and services to meet the needs of today’s People Heroes – HR, payroll, and benefits professionals. From talent acquisition to workforce ...Read more about isolved

Manage With Success

Manage With Success

Manage With Success is a cloud-based human resources (HR) solution for small to midsize businesses. It caters to multiple industries including finance, retail, food, non-profit, consulting, manufacturing, construction, distributio...Read more about Manage With Success

TriNet Zenefits

TriNet Zenefits

Zenefits is an all-encompassing HR SaaS platform designed specifically for small to midsize businesses. The Zenefits People Platform includes a robust offering spanning HR, Benefits, Payroll, Well-being and Performance apps that c...Read more about TriNet Zenefits

APS Payroll

APS Payroll

Automatic Payroll Systems (APS) has a mission: to make payroll and HR easier. They have been providing payroll and tax compliance services to companies since 1996. In 2004, APS released its cloud-based solution for workforce manag...Read more about APS Payroll

Namely

Namely

Namely provides modern, intuitive HCM solutions including scalable technology, expert-managed payroll and benefits services, and fully comprehensive professional employer services. Backed by a 24-7 customer success team, Namely em...Read more about Namely

Patriot Payroll

Patriot Payroll

Basic Payroll: $17/month + $4 per employee or contractor. You run payroll and handle your tax filings. Full Service Payroll: $37/month + $4 per employee or contractor. You run payroll, but let us handle the payroll tax filings. ...Read more about Patriot Payroll

HROffice

HROffice

Developed for companies seeking a workforce planning tool for both permanent and temporary staff, HROffice Planning is a web-based solution used to coordinate, plan, and report on an organization’s workforce. Staffing and temp age...Read more about HROffice

Paycor

Paycor

Paycor empowers leaders to build winning teams. Paycor’s human capital management (HCM) platform modernizes every aspect of people management, from recruiting, onboarding and payroll to career development and retention, but what r...Read more about Paycor

Wagepoint

Wagepoint

Wagepoint is a small-but-mighty company on a mission to simplify payroll – and even dare to make it delightful! Our online payroll software was built just for small businesses, automating the most “ugh” parts of payroll so that ou...Read more about Wagepoint

Avature

Avature

Avature is a highly configurable enterprise SaaS platform for talent acquisition and talent management that drives innovation in the HCM software space. Founded by Dimitri Boylan, Avature empowers the leading-edge HR strategies of...Read more about Avature

Paylocity

Paylocity

Paylocity is a cloud-based human capital management (HCM) platform that provides human resources and payroll management tools to help businesses manage core HR functions. Key features include payroll processing, benefits administr...Read more about Paylocity

Dayforce HCM

Dayforce HCM

Dayforce makes work life better. Everything we do as a global leader in HCM technology is focused on improving work for thousands of customers and millions of employees around the world. Our single, global people platform for HR, ...Read more about Dayforce HCM

QuickBooks Payroll

QuickBooks Payroll

QuickBooks Payroll is a technology-enabled HR services platform that offers human resource (HR) and employee management services for small businesses. Serving clients across multiple geographical regions, it helps organizations ma...Read more about QuickBooks Payroll

Maxwell Health

Maxwell Health

The HealthCare Solution is a cloud-based human resource management (HRM) solution that offers businesses of all sizes across various industry verticals integrated benefits administration and on-boarding functionalities. The H...Read more about Maxwell Health

Popular Comparisons

Buyers Guide

Last Updated: March 16, 2023Whether you're a solo CPA or one of many at a large accounting firm, offering employee payroll services to clients can represent a significant boost to your bottom line.

It can also present significant challenges.

Not only do you need to ensure that all of your clients' employees are paid accurately and on time, but there's also the matter of making sure the government gets their correct cut too—something that's often easier said than done. The IRS estimates 40 percent of small to midsize businesses (SMBs) end up paying a payroll penalty each year due to an incorrect filing.

With so much on the line, having the right payroll software is crucial. But which system is best suited to meet your specific needs as an accountant?

This Buyer's Guide aims to provide some guidance. Below, you'll find information about payroll software functionality, pricing and more to help in your software search.

Click a link below to jump to that section:

What Is Payroll Software for Accountants?

Common Functionality Found in Payroll Software for Accountants

Benefits of Payroll Software for Accountants

How Much Does Payroll Software Cost?

What Is Payroll Software for Accountants?

Payroll software for accountants allows CPAs to manage worker wage information, calculate amounts for employee compensation and withheld taxes, do payroll runs, generate reports and more. Many popular payroll software systems cater to both internal accountants and outsourced accounting firms.

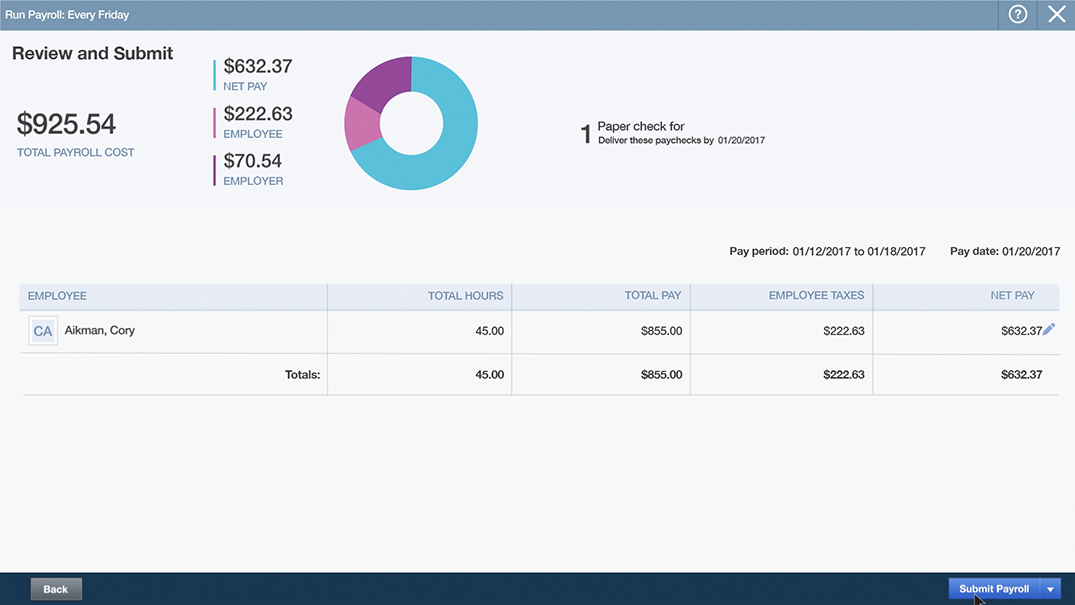

An example payroll run in QuickBooks Full Service Payroll

Payroll software offers accountants a secure digital environment to automate processes, set reminders and manage a vast amount of payroll data over time.

Common Functionality Found in Payroll Software for Accountants

Browsing through payroll vendor websites can quickly become overwhelming if you're not sure what you're looking for. To help, here are some common functions you can expect to find in most systems:

Employee management | Track individual employee pay rates (hourly or salaried), withholding information for benefits and paid time off (PTO). |

Time tracking | Input hours worked, or pull them from an integrated time and attendance system, to calculate correct wages. |

Run payroll | Set a payment period (biweekly, monthly etc.) and calculate the total payroll cost for that period. |

Payroll allocation | Deposit owed payroll amounts to workers in their preferred form (direct deposit, check printing or pay card). |

Tax management | Calculate correct amounts for local, state and federal payroll taxes and file automatically. |

Accounting integration | Automatically log payroll amounts in the company ledger through integrated accounting software. |

Reporting | Generate standardized reports detailing organizational payroll costs. |

There can be small differences in features within these functions between products. For example, some products offer multistate or even multicountry payroll, while others don't. Another example is some payroll platforms can generate W-2s and 1099s for workers come tax time.

One increasingly popular feature is an employee self-service portal where workers can log in to do things such as update their bank accounts or download past pay stubs themselves. This article highlights a few benefits of implementing self-service features.

Benefits of Payroll Software for Accountants

In a 2015 report, Software Advice learned that one in every five payroll software buyers still relies on manual methods such as spreadsheets or pen and paper to handle their payroll needs. If you fall into this group, it's time for an upgrade.

Here are some benefits that dedicated payroll software can bring over manual methods:

Fewer errors. Clerical errors can lead to costly overpayments and penalties. Payroll software can calculate accurate wages and highlight any missing fields or strange discrepancies to ensure you don't make any major mistakes.

Less security risk. Features such as multifactor authentication and SSL encryption found in payroll software can mitigate the chances of your sensitive payroll data getting lost or falling into the wrong hands.

More time to focus on other needs. With features such as one-click payroll runs and automatic report generation, you can cut the time it takes to do payroll for a company from a few hours down to a few minutes.

How Much Does Payroll Software Cost?

How much you pay for a payroll software system is going to largely depend on two factors: the breadth of functionality in your system of choice and the number of employees you're doing payroll for. The more advanced the system is and the more employees you need to manage, the greater the cost.

Because most systems are cloud-based (meaning the software is hosted by the vendor on their own servers for you to access via a web browser), payroll software is almost always sold through subscription licensing. In other words, you should expect to pay a flat fee every month, every year or every pay period to use the software.

Software license prices can range from as little as $10/month for one employee all the way up to $3,500/month for 250 employees or more.

Download our payroll software pricing guide to learn specific cost information for popular systems such as Gusto, Xero and QuickBooks.

Final Considerations

We've covered the basics, but there are still a number of factors to consider when deciding which payroll system is right for you or your firm. Here are some last things to keep in mind during your search:

Do you need full service payroll? A number of payroll software vendors offer a “full service payroll" option where all you have to do is enter employee wage information and the vendor's team of experts will take care of the rest: running payroll, submitting tax forms, printing checks etc. This option tends to be geared toward small business owners who don't know a thing about payroll, but accountants can benefit too if they're looking to offload some work.

Pay attention to the UI and workflow. Payroll software products tend to have a lot of the same functions and features due to the payroll process being so standardized. Where they really differentiate is in their user interface (UI) and workflow. Demo systems and find one that's intuitively designed and easy to use.

Ask an expert. If you're overwhelmed by the software options available to you, don't worry. Give us a call at (844) 852-3639 and talk to one of our payroll software experts. We'll ask a few questions about your needs and send you a shortlist of best-fit, highly-rated products. This service is completely free, so don't hesitate.