Find the best Electronic Medical Records Software

Compare Products

Showing 1 - 20 of 445 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

athenaOne

athenaOne

FrontRunners 2024

The athenaOne Suite which includes athenaCollector a revenue cycle management solution and athenaClinials an EHR (electronic health records) recently ranked #1 in 2023 Best in KLAS for athenaClinials Ambulatory EMR for 11-75 physi...Read more about athenaOne

DrChrono

DrChrono

DrChrono’s iPad and iPhone compatible EHR and medical billing platform allows medical practices and healthcare providers to manage patient intake, patient care, clinical charting, billing and revenue cycle management. It includes ...Read more about DrChrono

RXNT

RXNT

RXNT’s cloud-based, ONC-certified medical software—Billing, Practice Management, EHR, and more—improves clinical outcomes & revenue cycle management. Simple, transparent pricing includes free setup and training, free data transfer...Read more about RXNT

AdvancedMD EHR

AdvancedMD EHR

AdvancedMD is a unified suite of software solutions designed for mental health, physical therapy and medical healthcare organizations and independent physician practices. Features include practice management, electronic health rec...Read more about AdvancedMD EHR

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Meet Eric, a software expert who has helped 1,534 companies select the right product for their needs.

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Tell us more about your business and an advisor will reach out with a list of software recommendations customized for your specific needs.

STEP 1 OF 4

How many doctors are in your organization?

ChartLogic EHR

ChartLogic EHR

ChartLogic offers an ambulatory EHR suite that includes electronic medical record, practice management, revenue cycle management, e-prescribing and patient portal. The solution caters to primary care, surgical care and other compl...Read more about ChartLogic EHR

Elation Health

Elation Health

Elation Health is the most trusted technology platform for high-value primary care. Since 2010, the company has delivered clinical-first solutions — built on a collaborative EHR platform — that help practices start, grow, communic...Read more about Elation Health

PracticeQ

PracticeQ

PracticeQ is a secure and cloud-based practice management software that assists healthcare practitioners with onboarding, managing, and securing patient interactions. Teams can streamline booking, billing, and charting processes. ...Read more about PracticeQ

MDnet EHR

MDnet EHR

FrontRunners 2024

Enable Healthcare presents a state-of-the-art electronic health records solution designed to transform the way doctors and providers manage patient data. Our AI-powered charting, powered by EnableAssist, revolutionizes charting ef...Read more about MDnet EHR

Compulink Healthcare Solutions

Compulink Healthcare Solutions

FrontRunners 2024

Compulink Advantage is an all-in-one database EHR solution for specialty practices such as optometry, ophthalmology, orthopaedics, ENT, mental health, podiatry, and more. Available cloud-based or server, Advantage includes smart f...Read more about Compulink Healthcare Solutions

PrognoCIS

PrognoCIS

PrognoCIS EHR and PrognoCIS Telemedicine have earned a reputation for fast, flexible individual provider workflow. The software package offers a full suite of highly desirable features and functions. PrognoCIS provides a cloud-bas...Read more about PrognoCIS

ModMed

ModMed

FrontRunners 2024

ModMed, also known as Modernizing Medicine®, is an award-winning software company that places doctors and patients at the center of care through an intelligent, specialty-specific cloud platform. Services include electronic health...Read more about ModMed

Nextech EHR & PM

Nextech EHR & PM

FrontRunners 2024

For more than 20 years, Nextech has provided a full-featured EMR and Practice Management solution within a single database. This system is a fit for dermatologists, plastic surgeons, ophthalmologists, and physicians, and is used b...Read more about Nextech EHR & PM

Practice EHR

Practice EHR

FrontRunners 2024

Practice EHR, a medical practice management software, was developed to accommodate the needs of small to mid-size businesses. The platform is customizable to internal medicine practices, chiropractors, physical therapists, family ...Read more about Practice EHR

AestheticsPro

AestheticsPro

AestheticsPro is a cloud-based, HIPAA compliant medical spa management software solution that offers staff and calendar management along with client management, a point-of-sale and marketing tools within a suite. The staff manage...Read more about AestheticsPro

WebPT

WebPT

Established in 2008, WebPT is the nation’s most trusted outpatient rehab therapy software platform in the country, helping more than 150,000 rehab therapy professionals from all practice sizes and specialties run successful and ef...Read more about WebPT

Nexus EHR

Nexus EHR

Nexus EHR is an ONC Certified 2015 Edition Cures Update cloud-based ambulatory EHR and PM platform. It is designed for small to midsize practices and various specialties including orthopedics, neurology, podiatry, cardiology, gene...Read more about Nexus EHR

AllegianceMD

AllegianceMD

AllegianceMD is a cloud-based medical software system that is designed to serve the needs of small and midsize practices, as well as ambulatory surgery centers. The solution includes practice management functionality for billing a...Read more about AllegianceMD

CharmHealth

CharmHealth

CharmHealth is a MU certified, cloud-based EHR, Practice Management and Medical Billing solution that helps healthcare organizations ranging from large multi-specialty groups to small independent medical offices function efficient...Read more about CharmHealth

NovoClinical

NovoClinical

NovoClinical is a completely secure, cloud-based system that can be implemented quickly. Reports and templates can be customized with features and fields specific to each practice and/or provider. NovoClinical offers insuranc...Read more about NovoClinical

NextGen Office

NextGen Office

FrontRunners 2024

NextGen Office is an award-winning, cloud-based, clinical and billing solution designed for smaller, independent practices (≤ 10 providers). This all-in-one, full-service solution includes specialty-specific EHR content, an easy-t...Read more about NextGen Office

Popular Comparisons

Buyers Guide

Last Updated: March 16, 2023Step 1: Ensure EMR software is right for your business

In order to determine which EMR software system is right for your practice, you first have to understand what EMR software is and how the features commonly included in these systems benefit you and your patients.

What is EMR software?

Electronic medical records software (EMR), often used interchangeably with electronic health records software (EHR), is a collection of features and tools that allow medical providers to create, store, and update patients' digital health records more easily and more securely than paper charts.

Common features of EMR software include digital charting, order entry, decision support, and clinical reporting. In addition to making life easier and processes faster for healthcare workers, this software can also help physicians qualify for government incentives, meet regulatory requirements, and improve overall care quality.

Essential features of EMR software

When comparing EMR software systems to choose the best system for your practice, it's important to know what features are included in each system. The most common features of EMR solutions include:

Charting: Prepare digital charts in real time related to patients’ medical problems and diagnoses. Merge all patient record information into a single chart. For charting, many EMR solutions offer customizable templates and users can select desired fields as per their needs.

E-prescribing: Electronically print and transmit prescriptions to pharmacies of the patient's choice. Receive automatic notifications related to various interactions with pharmacies such as dosage amounts, allergies, and prescriptions.

Patient portal: Enable patients to login and access various information such as their medication history, number of visits to the doctor, and lab results. Improve patient engagement by promoting active participation and ownership of their own healthcare.

Order entry: Enter, store, and transmit orders for lab tests, medication orders, and other services.

Decision support: Receive automated treatment alerts, reminders, or recommendations meant to help patients based on their specific conditions and demographics.

Of course, not all EMRs are created equal and many are designed specifically to serve large healthcare organizations instead of smaller, independent practices.

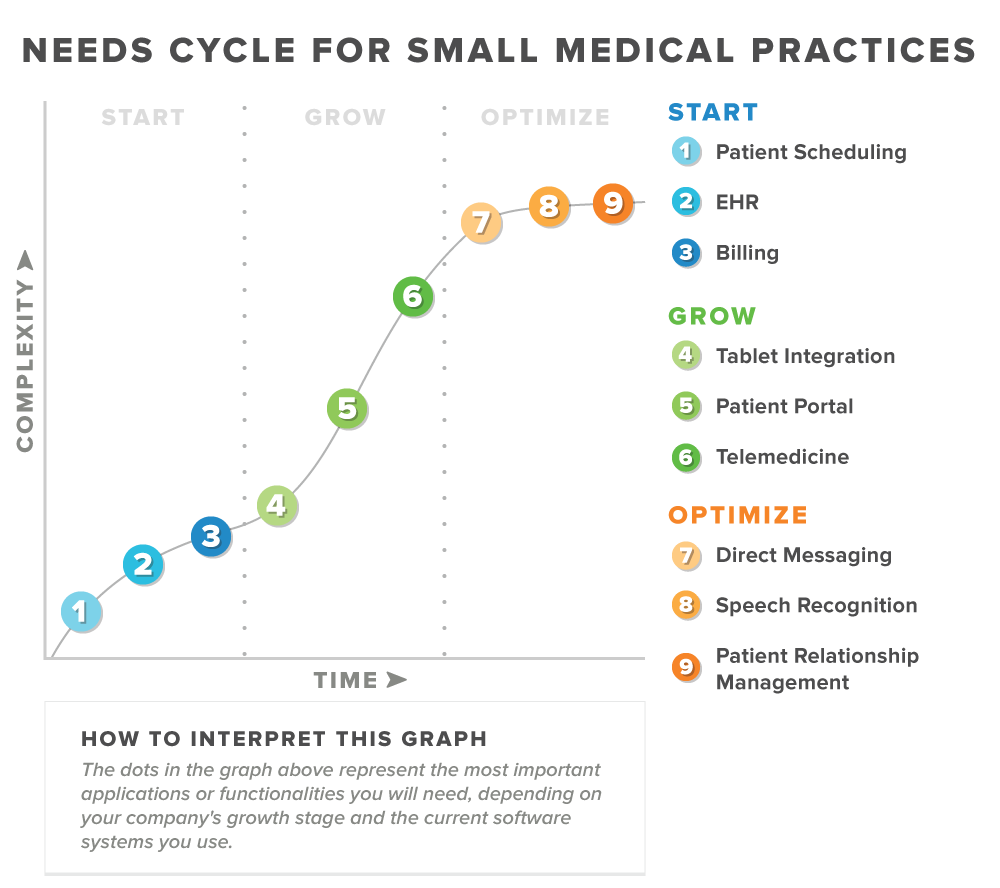

To better understand where you fall on that spectrum and which EMR software features you need to have at this point in your practice’s development, you can read our full IT needs cycle for medical practices here.

Benefits and competitive advantages of using EMR software

EMR software gives medical practices a number of benefits, including:

Better quality of patient care: Features such as integrated drug databases, symptom checks, and drug interaction verification help physicians prescribe the correct medications and dosages.

Improved clinical reporting: When patient information and medical record systems are digitized, it's much easier to create reports that identify and track health risks for individuals or groups of people. These reports can help physicians intervene earlier when a patient is developing a worsening health condition. An EMR's reporting tools can also make it possible for practices to participate in Medicare payment programs such as the Merit-Based Incentive Payment System (MIPS).

Enhanced care coordination: It's important for charts to be easily accessible and legible so they can be shared with all authorized providers on a patient's care team, such as specialists and technicians. An EMR system provides a standardized format to clearly present dated patient information that can be shared digitally—which is more secure than printing and transporting or faxing sensitive medical records to authorized colleagues.

More efficient collections: Electronic patient records give physicians the necessary documentation to support claims sent to insurance companies, Medicare, and Medicaid. Integrated features for E&M coding also help providers code visits appropriately and confidently.

Streamlined operations: Doctors and administrators can access patient health information without rifling through scores of paper-based records. Other time-saving EMR advantages include the ability to receive lab test results digitally and prescribe medications electronically.

Step 2: Set your EMR needs and budget

How much should you spend on EMR software?

The price of EMR software is difficult to generalize because it depends on factors that vary by buyer, such as:

Number of users

Required features

Size of patient panel

Availability of IT support staff

Patient data migration needs

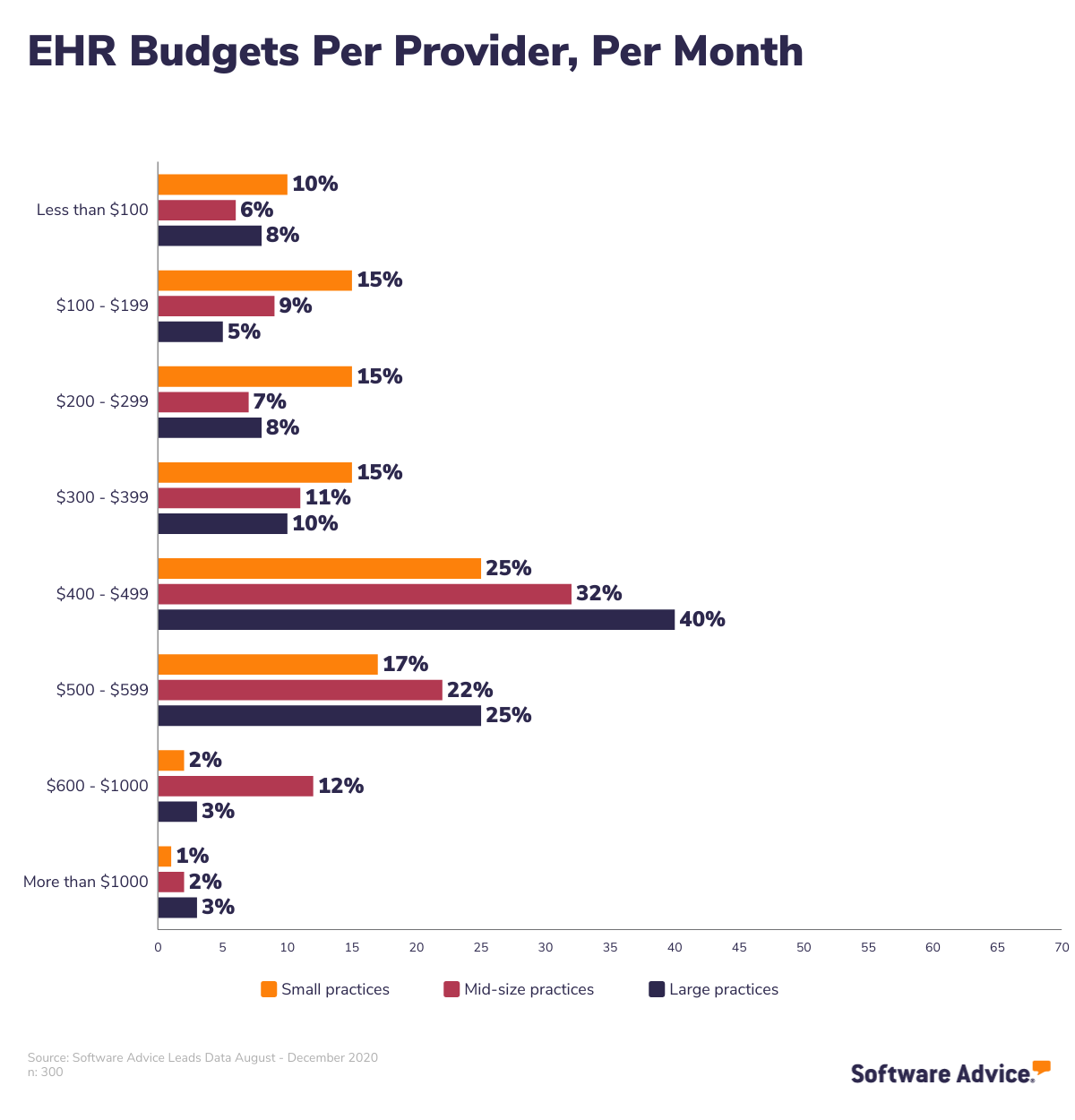

That said, we have some data-backed insights that can help small, midsize, and large practices determine how much they should budget for a stand-alone EMR system (excluding setup costs). The data in the chart below is based on conversations between our expert software advisors and real medical practices seeking software. The practices surveyed are budgeting for monthly subscription-based EMRs.

You can also explore free and open source EMR software options. Read our guide to understanding these EMR options and choosing the best one for you here.

Understanding cloud vs. on-premise EMR software pricing

Another aspect of EMR pricing that often complicates the buying decision is the difference between cloud-based and on-premise software purchase options. Generally, the biggest difference between these options is how the software is actually deployed and then accessed by users.

Cloud-based EHR software is hosted on a secure, remote server and can be accessed using compatible devices (tablets, laptops, etc.) over the internet. This type of deployment is usually associated with monthly subscription payments, and the price can be based on number of licensed users, number of patients, or appointment volume.

On-premise EHR software is hosted on your own practice’s servers, and you will be responsible for security and maintenance. This type of deployment is most commonly available through a perpetual license, which involves a one-time purchase fee followed by additional fees for system updates as they become available.

Read more about different EMR pricing options in our guide to understanding EMR pricing.

Step 3: Make a shortlist of EMR software

Get qualified help from an advisor

At Software Advice, we can guide you to the right software with real advice from real people—our advisors have helped hundreds of healthcare providers. We’re here to help you find solutions that meet your needs and budget.

"We have helped practices find simple ways to track patient information, scaling to more robust EMRs with practice management applications built-in.

The issue with searching EMRs is the vast amount of options. We can help with narrowing down the search based on specialty, price, and functionality."

-

You can chat online now with an advisor or schedule a phone call. In just a few minutes, your advisor will help you narrow down a list of options that meet your needs.

Explore our list of EMR FrontRunners

If you’re not ready to speak to an advisor just yet, you can also start compiling your shortlist of EMR software with our FrontRunners report. Only products that earn top user ratings make this list. To be eligible for consideration, a product must:

Have at least 20 unique user reviews in the last 24 months

Be a stand-alone EMR software product

Offer these features:

Charting

Decision support

Coding assistance

Check out our full methodology description for more detail on how the report is compiled.

Step 4: Pick your best option

Consider federal regulations when selecting your EMR

Many practices are in the market for an EMR specifically because they want to participate in government health care initiatives that incentivize the use of health IT.

Whether you were one of the thousands of physicians who got an EMR to cash in on Meaningful Use incentives or you're a first-time buyer preparing for the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), it's clear that regulatory compliance is a huge purchase driver for practitioners.

Your best bet for ensuring a system has the robust functionality necessary to meet government health care regulations is to choose an "ONC-certified" EMR. These systems have been tested and certified to confirm they offer a set of technological capabilities, functionalities, and security requirements approved by the Office of the National Coordinator for Health Information Technology (ONC).

Be aware of potential drawbacks

While there are many benefits of implementing EMR software, there are also potential pitfalls you may encounter while purchasing EMR. The good news is, they’re very avoidable. Here are some of the most important ones to be aware of:

Security: One common concern for EMR software buyers is data security. Patient privacy and HIPAA compliance are typically on the front of providers' minds, so buyers should make sure that the EMR is implemented properly and that standard security features exist in the system. Most vendors are well aware of buyers' security concerns and have taken steps to ensure proper data encryption technology is in place for both on-premise and web-based systems. Additionally, a digitized medical record is often safer than a paper chart.

User adoption: A second consideration is user adoption, primarily among providers. Some providers find EMRs difficult to use because they are used to working with paper charts. Most user adoption issues can be solved with adequate training. The amount necessary depends on the user's tech savviness.

Interoperability challenges: Interoperability is the transfer of patient data between different EMR systems so authorized providers can access and interpret that data. While vendors are making progress toward achieving interoperability, it's still an issue the industry is struggling with. Fortunately, technologies such as direct messaging make it easier to share records electronically.

How to prepare for vendor demos

Once you’ve compiled your shortlist of EMR software systems, you’ll begin to schedule demo sessions with each vendor in order to learn more about their product. This is your chance to ask questions about the features they offer, pricing, technical support, training tools, and anything else that might be an important factor in choosing the right EMR system for your practice.

Some questions you should consider asking vendors in each demo include:

What kind of customer support do you offer during implementation?

One of the major reasons implementations fail is a lack of proper customer support and assistance. Be sure to ask vendors what plan they have to assist your staff members during the implementation process.

How often do you update your EMR software and what updates are you planning for your next release?

Look for answers such as, "Yes, we update our software regularly and offer free updates to our customers," or "Yes, we update our software regularly and our next version is scheduled to be released in three months." Products that are updated regularly are usually better when it comes to addressing customer requests and offering functionality to meet changing regulatory requirements.

What customization options are currently available?

The ability to customize existing EMR features can help you get exactly what you want from your new software. A given system may include specialty-specific features that don't apply to your practice, for example, so the ability to tailor a system to your specific needs will make it more efficient and cost effective.

To help you keep track of the questions you want to ask each vendor and their answers, we’ve created an EHR vendor scorecard. Use this checklist to ensure you’re asking the right questions and objectively considering their answers.

Step 5: Finalize your EMR purchase

Build a business case for EMR software

Once you’ve finalized your EMR selection, you may need to pitch your choice to the rest of your team before making your purchase. The best way to do this is by creating a business case for EMR software.

Purchasing EMR software can generate a strong return on investment (ROI) for your medical practice. The top three ROI drivers for purchasing EMR software are:

Improved patient care

Reduced administrative costs

Improved billings and collections

The primary measures of effectiveness are:

The claims collection rate

The number of patient visits per day

The amount of time spent managing faxes and paper charts

The direct costs of paper charts (e.g., cost of materials, storage, destruction)

You can follow our template to start building your own business case.

Step 6: Make the most of your EMR software

Best practices for implementing EMR software

Once you’ve made your selection and finalized your EMR software purchase, you’ll begin the implementation process. Whether you’re switching from one EMR to another or going from paper charts to your first electronic system, there are some important considerations you’ll want to pay attention to during this process:

Data migration: Transferring all of your patient data and records from an existing EMR to a new system is time consuming, but it’s crucial to get this part of the process right. Communicate with both your old and new EMR providers to make sure nothing gets missed in this part of the process.

Training: Once you have the new system in place, you’ll want to make sure your staff fully understands how to use it. If possible, you should lean on your new EMR provider to run staff training sessions and provide training materials. Be aware that this will take some time, so plan on holding multiple training sessions and refresher courses until everyone feels confident with the new EMR.

Communication: Realistically, the implementation process may cause some delays or confusion for your staff that could impact patients. In order to head off any potential issues, it’s helpful to communicate with patients that you’re in the middle of an EMR transition. This is a great way to set expectations, reassure patients that any issues will be temporary, and remind them that you’re doing this in order to provide even better care.

For more details on how to ensure a smooth transition, check out our guide here.

Software related to EMR

Depending on which EMR you choose, you may need to supplement some features with related software systems in order to provide the most convenient care to your patients. Some types of software that are closely related to EMR, but may or may not be included in your EMR system, include:

Behavioral/mental health EHR software Electronic medical record (EMR) systems for mental and behavioral health providers have unique features for counselors, mental health clinics, and group practices.

Medical billing software: Medical billing systems help providers generate patient statements and submit claims. This software is ideal for practices that want to handle billing in-house.

Patient portal software: Patient portal systems allow patients to access their own healthcare information, pay bills, schedule appointments, and communicate directly with providers. This software is an ideal way to keep patients engaged with their own care and improve outcomes.

Patient scheduling software: Patient scheduling systems make it easier to set and manage your schedules by automating the process. You can enable patients to schedule their own appointments without needing to call your office, and automated appointment confirmation and reminder notifications can be sent to decrease no-show rates.

Telemedicine software: Telemedicine systems are HIPAA-compliant tools that allow medical professionals to provide care to patients remotely using features such as secure video conferencing, chat, and messaging.