Find the best Nonprofit Accounting Software

Compare Products

Showing 1 - 20 of 56 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

Blackbaud Financial Edge NXT

Blackbaud Financial Edge NXT

Blackbaud’s cloud fund accounting software Blackbaud Financial Edge NXT provides transparency across teams, security, and compliance, and reduces the need for manual processes. The fund accounting software provides a general ledge...Read more about Blackbaud Financial Edge NXT

AccuFund Accounting Suite

AccuFund Accounting Suite

AccuFund is 100% focused on serving nonprofits and government entities. The complete fund accounting financial management solution, available online or onsite, consists of a strong core system and modules that allow you to expand ...Read more about AccuFund Accounting Suite

MonkeyPod

MonkeyPod

MonkeyPod helps nonprofits get down to business. Accounting, donor management, grants management, CRM, email marketing, online fundraising, and more — all in one simple, integrated platform. Consider it your nonprofit-in-a-box. O...Read more about MonkeyPod

FUND EZ

FUND EZ

Fund EZ nonprofit accounting software gives visibility into every facet of their organization. The software helps users to create and track budgets across fiscal years, detailing actual vs. budget for multiple projects, programs, ...Read more about FUND EZ

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Meet Eric, a software expert who has helped 1,534 companies select the right product for their needs.

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Tell us more about your business and an advisor will reach out with a list of software recommendations customized for your specific needs.

STEP 1 OF 4

How many donor records do you have?

QuickBooks Desktop Enterprise

QuickBooks Desktop Enterprise

QuickBooks Enterprise is an accounting solution designed for SMBs across different industry verticals such as construction, nonprofit distribution, manufacturing, and retail. With QB Enterprise solution, any business owner can exp...Read more about QuickBooks Desktop Enterprise

QuickBooks Online

QuickBooks Online

QuickBooks Online is a small business accounting software and app that allows you to manage your business anywhere, anytime. Used by over 7 million customers globally, QuickBooks provides smart tools for your business, yet is easy...Read more about QuickBooks Online

NetSuite

NetSuite

With an integrated system that includes ERP, financials, commerce, inventory management, HR, PSA, supply chain management, CRM and more – NetSuite enables fast-growing businesses across all industries to work more effectively by a...Read more about NetSuite

QuickBooks Online Advanced

QuickBooks Online Advanced

QuickBooks Online Advanced is a cloud-based accounting solution that helps small to large enterprises manage expenses, projects, invoices and more. It comes with a centralized dashboard, which enables users to gain insights into b...Read more about QuickBooks Online Advanced

Sage Intacct

Sage Intacct

Sage Intacct is a provider of cloud-based financial management and accounting software. Sage Intacct's software solution is suitable for small to midsize accounting firms and can provide financial reporting and operational insight...Read more about Sage Intacct

Sage Accounting

Sage Accounting

Sage Business Cloud Accounting is a cloud-based accounting and invoice management solution for small businesses. It offers core accounting, project accounting, expense management and compliance management within a suite. Sage Bus...Read more about Sage Accounting

Aplos

Aplos

Start your free 15-day trial quickly and easily - No credit card required. Aplos is a best-in-class, award winning cloud-based system designed specially to serve the needs of nonprofit and church organizations. The Aplos platform...Read more about Aplos

MYOB Business

MYOB Business

MYOB Business accounting software is designed to help businesses of any size across Australia and New Zealand take care of GST, invoices, reporting, expenses & payroll (including Single Touch Payroll). Designed to save time, incre...Read more about MYOB Business

Kashoo

Kashoo

Kashoo is a cloud-based accounting solution for small business owners who want the control and simplicity of doing their own books. It’s time-saving, fully customizable, and easy-to-use. It’s a great alternative to complicated acc...Read more about Kashoo

ImportOmatic

ImportOmatic

ImportOMatic is a data integration solution for Blackbaud's Raiser's Edge and Raiser's Edge NXT fundraising solutions. It is deployed as a plug-in for the Raiser’s Edge platform. ImportOMatic allows users to filter and transf...Read more about ImportOmatic

Decimal

Decimal

Decimal is an online bookkeeping solution that enables small business owners to handle accounts and track financials. Decimal also offers additional services including income tax return preparation, business licensing, and R&D Fea...Read more about Decimal

ZipBooks

ZipBooks

ZipBooks is a cloud-based accounting and payment processing solution designed for small businesses and accountants. ZipBooks allows users to create customized invoices with logos, themes and messages. The online bookkeeping funct...Read more about ZipBooks

AccountEdge

AccountEdge

AccountEdge is a powerful, easy-to-use, small-business accounting software for the Mac and Windows desktop. With AccountEdge, business owners can organize, process, and report on their financial information so they can focus on...Read more about AccountEdge

MoneyMinder

MoneyMinder

MoneyMinder is a comprehensive nonprofit financial management software designed to simplify and streamline financial operations for a wide range of group types. Whether you belong to a parent group, service club, youth club, sport...Read more about MoneyMinder

Martus

Martus

With online dashboards, scorecards, statistics, and financial reports including departmental account views, dimensional view summaries, and forecast views, MartusTools is a cloud-based budgeting and accounting system created to as...Read more about Martus

OneStream

OneStream

OneStream Software provides a market-leading intelligent finance platform that reduces the complexity of financial operations. OneStream unleashes the power of finance by unifying corporate performance management (CPM) processes ...Read more about OneStream

Popular Comparisons

Buyers Guide

Last Updated: March 16, 2023Here's what we'll cover:

What Is Nonprofit Accounting Software?

Common Features of Nonprofit Accounting Software

Benefits of Accounting Software for Nonprofits

What Is Nonprofit Accounting Software?

Nonprofit organizations, associations, churches and faith-based ministries face different challenges than their for-profit counterparts. Among these challenges are a nonprofit’s accounting needs. Rather than managing sales and revenue, nonprofits have to manage donor contributions, fundraising events, grants, investment income, membership fees etc. In addition, with limited funds for administrative tasks and strict reporting requirements, such as FAS 116 and 117, nonprofit organizations can save time and money, while reducing the likelihood of reporting errors, by implementing a nonprofit accounting system.

Common Features of Nonprofit Accounting Software

Nonprofit accounting solutions aim to help organizations manage their finances in both an accurate and transparent manner. These solutions should include accounting features that are specific to nonprofits and enable them to:

Manage funds and donations: Nonprofits receive funds and donations from numerous sources (individuals, organizations and websites) and locations. They have to meticulously keep track of their earnings and expenses, as they may be subjected to federal audits. Any inconsistencies in their reports can subject them to reputation damage, fines or even legal action.

Integrate online donations with primary fund pool: Donations from different countries via websites or payment portals, such as PayPal, need to be reflected in the nonprofit’s main fund pool and not as a separate account.

Filter reports by varying transaction codes: Different transactions need to be assigned different codes for clarity and efficient fund management. Adding filters to expense and earnings reports will help users easily view these different transactions and provide clarity into how funds are used.

Generate reports in multiple formats: Nonprofits need to be able to create and present reports in a variety of different formats, such as Excel files or PDFs. This is because most volunteers are not proficient in accounting and thus need to view reports in familiar, easy-to-use formats.

Convert donations in multiple currencies: Donations or funds received in different currencies need to be integrated with the nonprofit’s primary account and converted automatically.

What Type of Buyer Are You?

Identifying what type of buyer you are can help you choose the right solution. You should be aware of your unique needs and pay only for the features you deem necessary. Many buyers mistakenly pay for solutions that offer a plethora of features that they rarely use. Common buyers of nonprofit accounting software include:

Nonprofit or voluntary organizations: These organizations depend solely on volunteer donations and sometimes receive corporate funding. Their primary expense is implementing social welfare programs and initiatives.

Charities: These can be privately or publically funded organizations that work toward a single cause. These organizations receive donations from many different sources, and thus must establish a single fund for all their expenses.

Churches: Funding is received primarily in the form of weekly collections and member donations. Since accounting is primarily managed by church attendees, churches need a solution that offers a simple, easy to use interface.

Private schools, colleges and universities: These institutions receive state or federal funding, private donations and tuition fees. In addition to managing funds, they need to allocate resources toward staff incomes, administrative costs, maintenance, promotions and/or advertisements and other daily expenses. Most schools have in-house accountants, so their needs are more complex and varied, which means they will likely seek a more robust nonprofit accounting solution.

Benefits of Accounting Software for Nonprofits

Nonprofit accounting solutions provide organizations of all sizes the tools they need to manage income and expenses efficiently. As nonprofits are subject to federal audits, it’s important to accurately record all of an organization’s financial details. Therefore, these systems track an organization’s donations, grants, expenses, assets and transactions. Their focus in on maintaining a healthy balance between receiving donations and spending funds on welfare activities.

Similar to nonprofit accounting software, nonprofit financial software (sometimes called fund accounting software), helps achieve fiscal transparency, ensure federal reporting standards are met, maximizes donor dollars and minimizes unnecessary expenses.

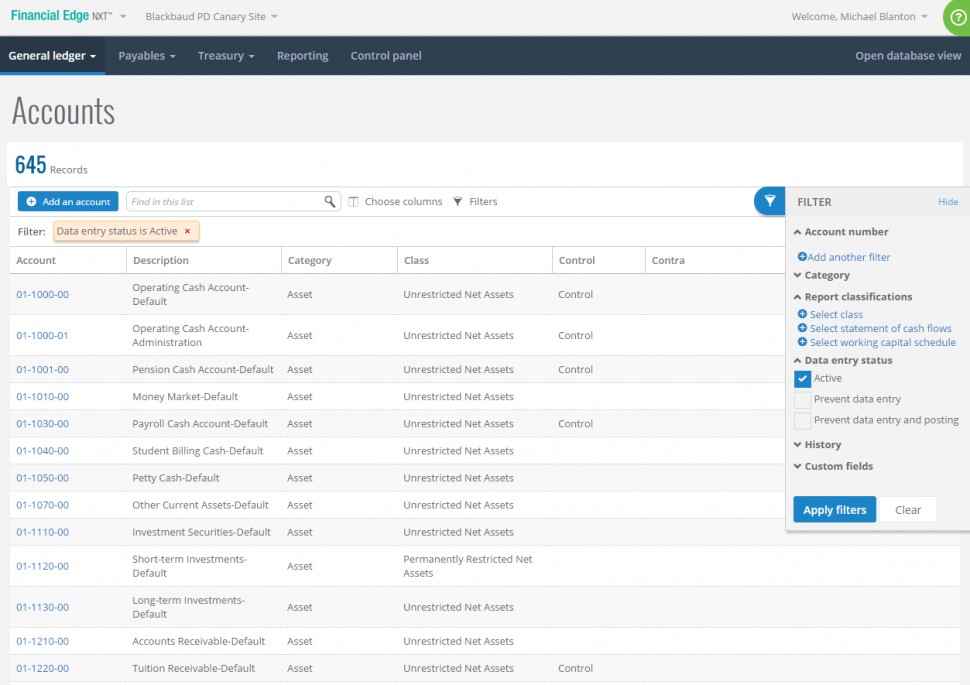

Accounts in Blackbaud Financial Edge

These features work together so a nonprofit organization can make the most of their assets, maintain fiscal visibility, nourish their reputation and acquire lasting trust from supporters.

Market Trends to Understand

At the end of each fiscal year, nonprofit accounting regulations and end-of-year acquisitions and partnerships often become newsworthy topics. There is increased scrutiny around their operations and they are under pressure to ensure transparency, lest their funding be affected due to accounting inaccuracies.

Here are some important trends to know about:

Keep fund ledgers separate. Nonprofits must keep different ledgers for all of their fund sources: direct donations, grant monies, fundraising dollars, pledges etc. Nonprofit accounting software independently tracks fund sources and expense types, simplifying reports and ensuring accuracy.

Prioritize expenditures. Ledger reports provide a holistic overview of an organization’s financial landscape. This allows an organization to strategically prioritize future investments and upcoming expenses.

Document and meet budget goals. Having a holistic picture of an organization’s entire financial portfolio allows board members to create realistic budgets and meet associated goals.

Simplify tax preparation. Many nonprofit accounting solutions include features that prepare the Form 990—a tax form requiring certain federal tax-exempt organizations to file with the IRS.

Reinforce trust in your organization. Transparency in an organization’s financial data shows current and prospective donors how their dollars are utilized.

Prevent fraud or errors. Omissions or errors may occur due to internal deficiencies. Therefore, nonprofits should stick to the legal definitions of what constitutes contributions (revenues, gains, gifts or transfer of assets), donated services and expenses (fundraising and management).

Understanding these trends and taking appropriate steps can help a nonprofit organization maximize their available assets, ensure fiscal transparency, boost its reputation and build trust. The right nonprofit accounting software will address all of an organization’s accounting needs. Daily operations also have to be run efficiently, as the goal of a nonprofit organization is benefit the community in which they operate. For more information on software especially for nonprofit organizations, read our nonprofit buyer's guide.