Best Construction Categories

Best Facilities Management Categories

Best Human Resources Categories

Best Legal Management Categories

Best Manufacturing Categories

Best Medical Categories

Best Property Management Categories

Get 1-on-1 advice in 15 minutes. It's free.

Josh P.

5 Construction Trends in the New Normal

Almost overnight, the supply and demand for construction of every type changed due to the pandemic. And while some aspects, such as lumber pricing, are slowly starting to return to normal, the construction industry is still experiencing new trends never seen before. The risk of losing bids, losing new jobs from existing clients, and losing money from inaccurate estimates are higher than ever in this “new normal.”

To help small construction business owners such as you understand the new landscape and make informed decisions, we surveyed 538 construction professionals in our 2021 Small Business Construction survey* and analyzed the needs of thousands of construction software buyers to bring you this report.

Let’s kick things off with the highlights.

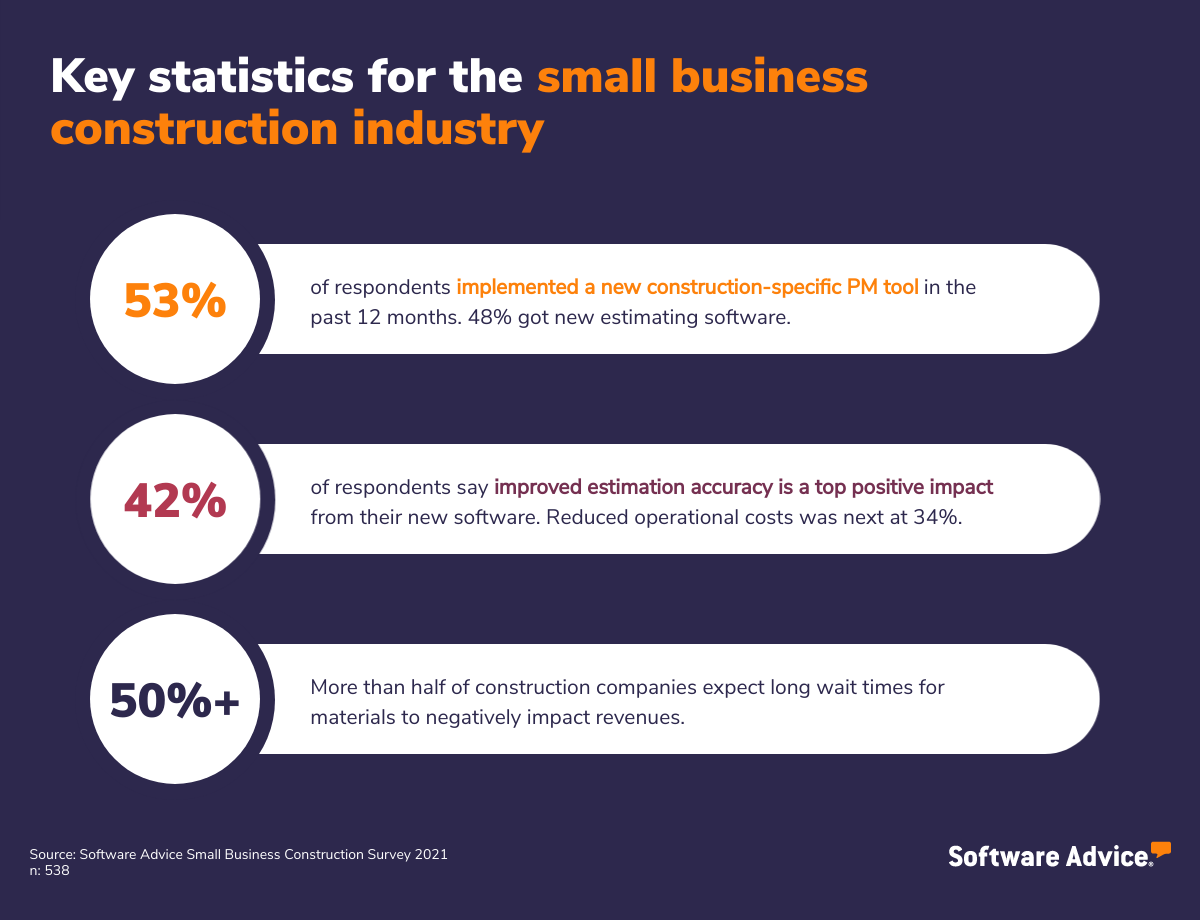

Key highlights

Most small construction businesses (53%) implemented new construction project management software in the past year, and nearly half (48%) purchased new estimating software.

42% of respondents say improved estimation accuracy was a top positive impact from new software. Reduced operational costs was next at 34%.

More than half of surveyed construction firms expect long wait times for materials to negatively impact revenues.

Prediction: Small construction businesses that use software for creating bids and project management can reduce operational costs by up to 20% and improve estimate accuracy by up to 90%.

A note on how the data is comprised:

For this report, we analyzed not only our survey results but also over 2,000 calls our advisors had with construction software buyers earlier this year. Throughout the report, we’ll use the terms “survey respondents” and “construction software buyers” to indicate which we’re talking about. You’ll also see the specific data set used for each chart stated in the bottom right of each one.

At the bottom of this report, we share the demographic details for each group. This way you can check that the insights and stats we share here are from your peers and competitors.

Now let’s get into the five construction industry trends we’ve discovered for 2021.

Trend #1: Small construction businesses aren’t ready for advanced software features quite yet

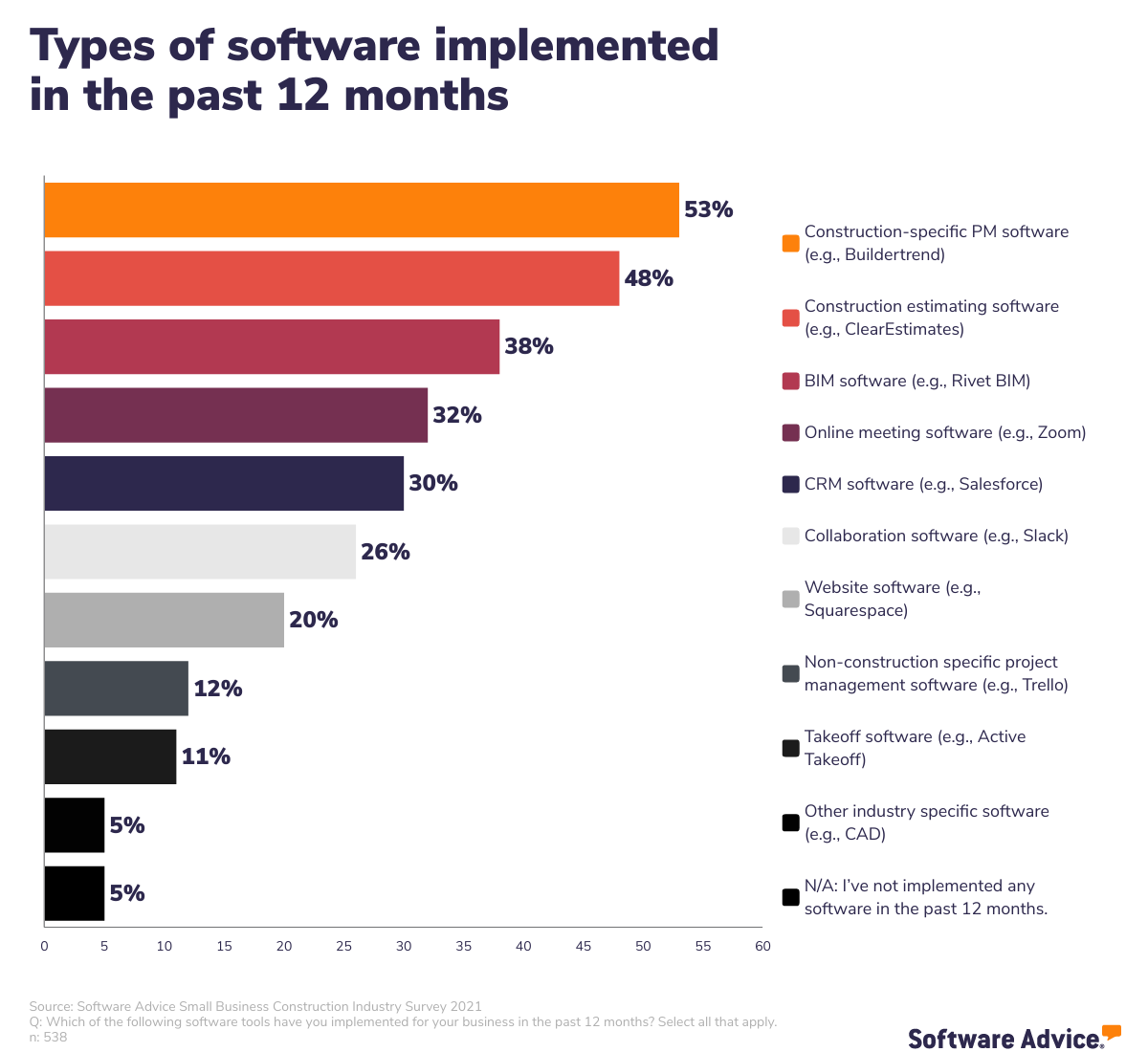

Over half of our respondents have implemented a new construction-specific project management software in the past 12 months (53%). Whether you are moving from pen and paper job management or from emails and spreadsheets, implementing a solution that covers the basics of all construction project management is a major upgrade in how your business operates.

It’s clear that small business owners are still needing to invest in moving their core business functions online. And, construction companies are finding that the most cost effective and efficient way of doing so is choosing stand-alone tools that offer basic functionality such as project management, job costing, and estimating. The opposing idea would be to invest in an all-encompassing enterprise solution that will have you paying for many features that you’re not ready to use yet, such as advanced computer-aided design (CAD).

Let’s take a look at the types of software tools that have been implemented in the past 12 months by small construction businesses like yours:

While estimating-specific software is the second most popular solution to buy, many construction project management solutions have robust estimating features built in. In fact, estimation, also known as job costing, has been the top feature software buyers want each year that we’ve tracked since 2016.

Wait, what exactly is construction estimating software?

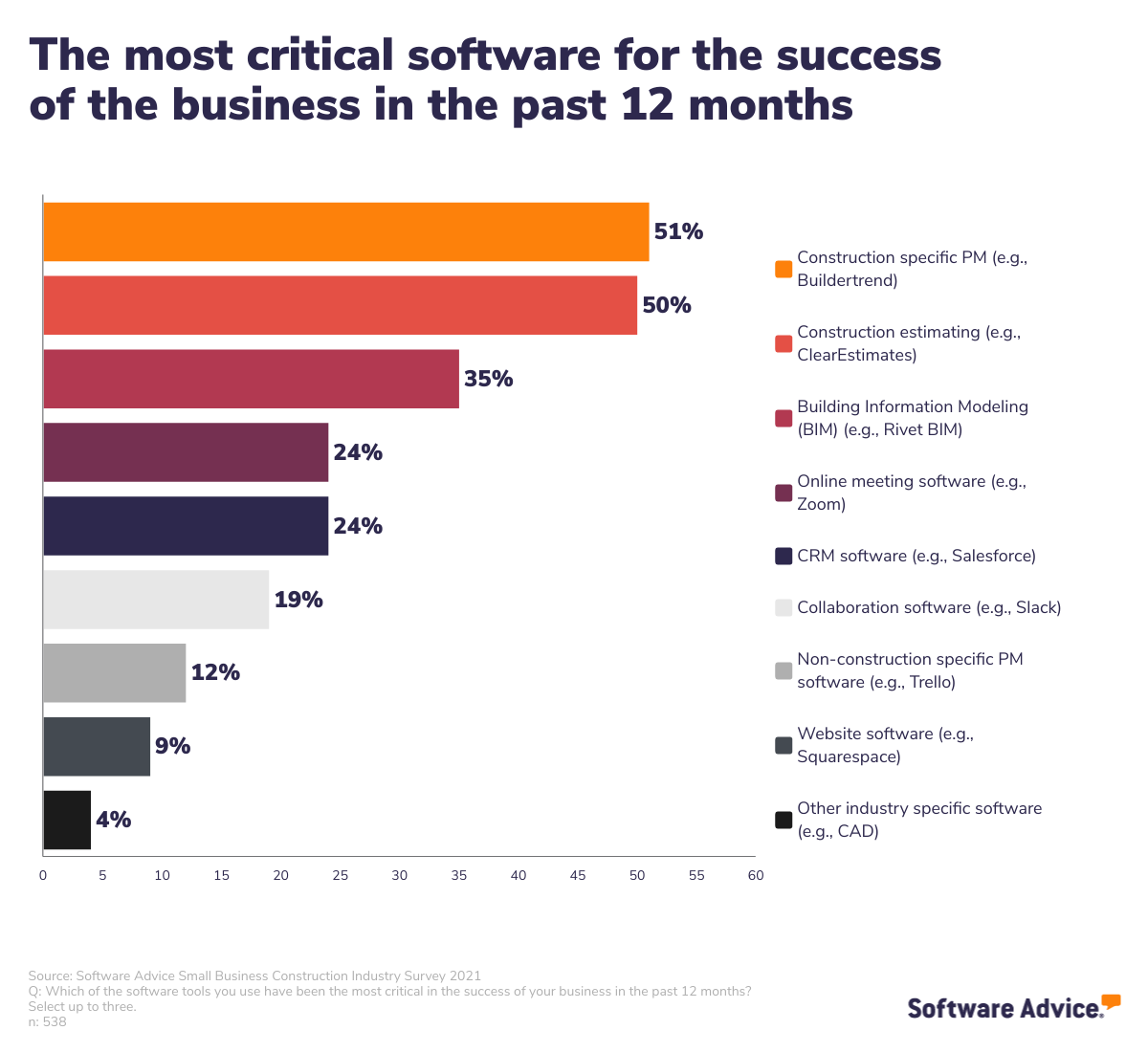

Along with asking respondents what tools they’d invested in, we also wanted to know which have been the most important to them. Below are the software tools that have been the most critical in the success of their businesses in the past 12 months:

Construction companies appear to know which tools to invest in based on how these two charts correlate to each other. This also supports the trend here that investing in the core tools is still where small construction businesses need to focus.

Trend #2: Investing in software is saving money for many

Even though investing in software to cover the core functions of your business should be a top priority (and is for your peers based on our survey), this doesn’t mean you have to blow your operational budget this year to do so.

We broke out our survey respondents into those who expect a decrease in their revenue this year versus those who expect an increase and asked about the impact the new software they purchased in the past 12 months had on their overall business costs. Here’s what we found:

38% of respondents who report expecting a decrease in revenue this year said their new software somewhat decreased overall business costs.

40% of respondents who report expecting an increase in revenue this year said their new software somewhat increased overall business costs.

While we aren’t sure exactly why those numbers are correlated this way, we do have insight into our respondents’ software buying habits.

Over half (57%) of businesses expecting a decrease in revenue for 2021 bought a new construction PM tool, whereas over half the businesses (57%, coincidentally) expecting an increase in revenue for 2021 purchased new estimating software in the past 12 months.

Construction PM software costs range from $25 – $299 for a single user, per month. And estimating software costs as a stand-alone tool range from $39 – $250 for a single user, per month.

The cost savings of the construction software can be seen when estimates are more accurate, timelines are better calculated, and materials lists and costs are automatically pulled for you. We’ll get into the benefits seen in the next section.

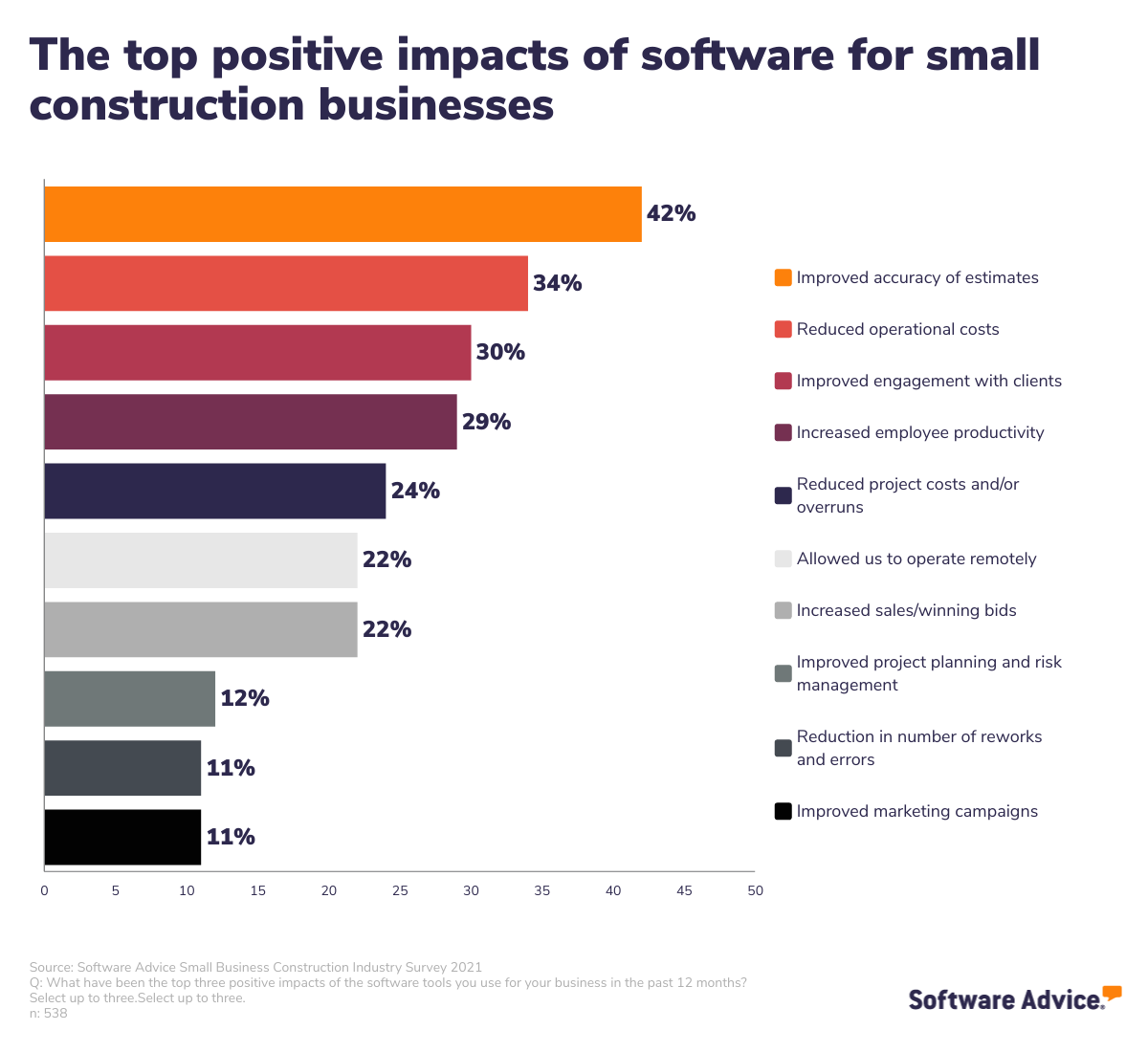

Software provides better estimates and can reduce costs

Your estimates have cascading effects across your business. Whether the effect is a good or negative one has to do with the accuracy of the estimates.

Software increases the accuracy of an estimate. An 11% reduction in the number of reworks and errors due to software means that there is 11% less of a chance that more time and money needs to be spent correcting work that was not done right in the first place.

In the chart below, you can see that an improvement in estimate accuracy is the top impact reported in our survey.

A small business story: Estimating software in real life

Below is a snippet of an interview we conducted with a construction professional of over a decade. In this interview, he shares how estimating software helped his business, and comparatively, how it can help yours. (You can check out the full interview here.)

Aaron Dumas has seen first hand the difference using software can make when working in the construction industry.

Dumas says that creating an estimate for a job is “the most dangerous time of a bid.” You’re committing to performing work for a specific price, and the customer isn’t going to want to pay more once they’ve seen that number. Dumas says, “I can’t even imagine [creating estimates] with pencil and paper and a tape measure.”

Features such as materials lists based on project type, price lists, and contractor labor costs in estimating and construction software save you hours each day and are more accurate than manually doing the calculations. Within the software, Dumas says, “I’ll download the price list for the specific zip code with the needed building materials and the contractor labor costs. The system will then produce an estimate for me and the client.”

He continues, “The software makes the process extremely efficient and accurate. And on top of that, it presents the estimate in a professional way for the client. What more could you want?”

Note: Responses have been edited for brevity and clarity.

To give your customers more accurate bids, thereby increasing your customer satisfaction (and likely your profits as well), look into an estimating tool. Check out the top estimating tools here in our FrontRunners report for 2021.

Trend #3: Labor challenges are currently pandemic related

A lack of skilled labor has plagued the construction industry for years and was the top concern in 2019 (read more in our 2020 Labor Report). The COVID-19 pandemic exacerbated this labor shortage as job sites had to reduce the number of workers onsite together for health safety concerns.

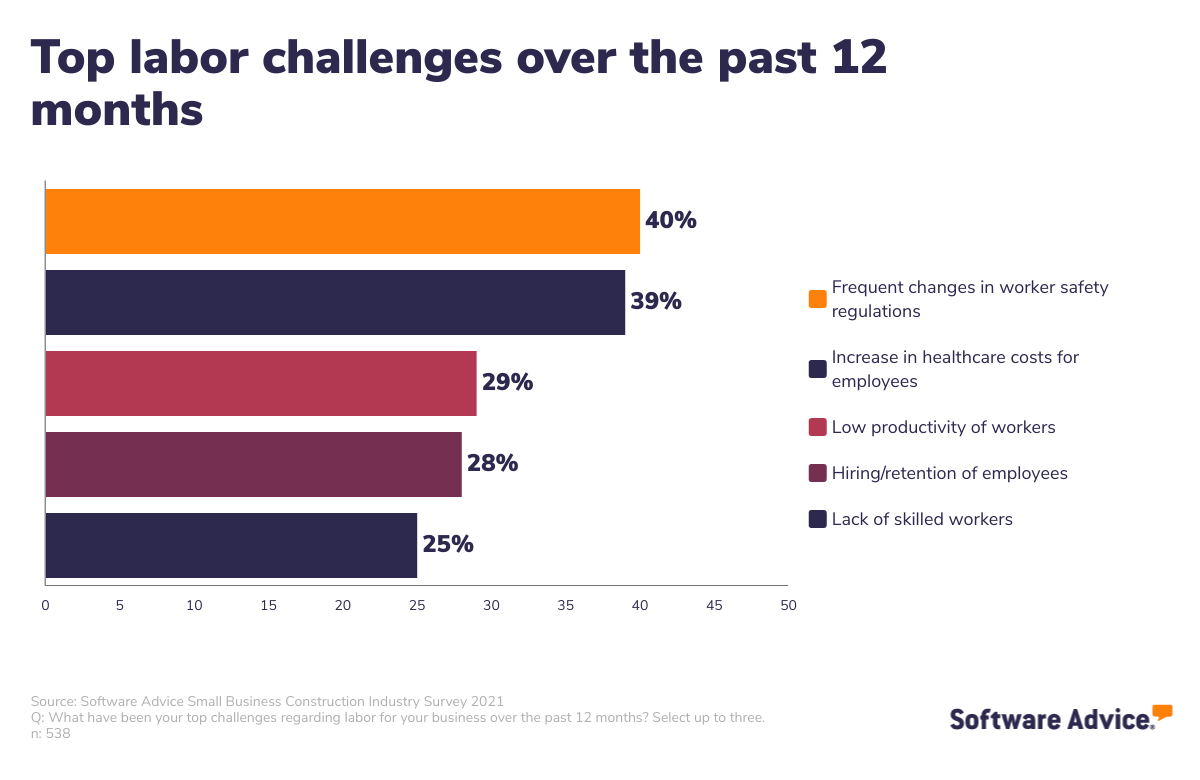

In fact, the new top labor challenges are adhering to safety regulations (40%) and the increased healthcare costs (39%).

Here is a breakdown of the top labor challenges reported by small construction businesses.

While a lack of construction workers slid down to the fifth number spot, the cause is directly pandemic related. It will return as a top challenge as the pandemic begins to recede, as the market is picking up rapidly and is already at 75% hiring levels compared to where they were at this time last year.

To help you take on the ongoing labor shortage, take a look at some of the solutions in our articles below:

Tools To Manage Construction Delays and Keep Your Customers Happy

4 Construction Industry Statistics Every Construction Manager Should Know

Trend #4: Shifting inventory management is top response to procurement delays

The supply chain bottlenecks have been well documented, and while there are some aspects that are getting better over time, not all of the challenges will be alleviated anytime soon. We asked small construction businesses about the procurement delays they’ve been experiencing and how they’re managing in response.

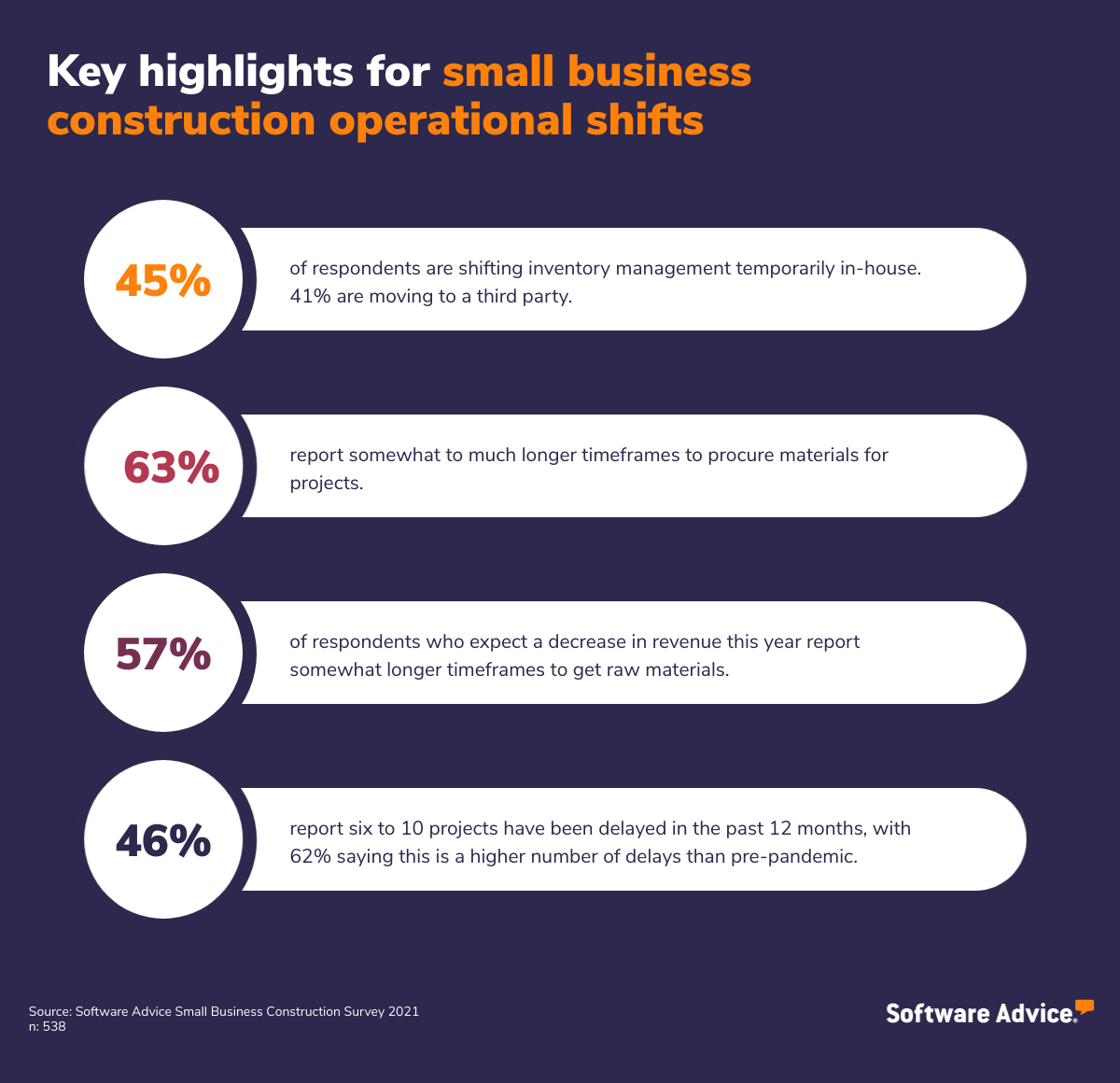

Here are the highlights of their responses.

It’s clear that shifting the way inventory is managed, by either bringing it in-house (45%) or moving it to a third-party vendor (41%), is the top response to new challenges in the industry. When you’re unsure of when materials will be delivered, keeping the open space in a warehouse or a room in a building you own can be less expensive than renting empty space. And on the other hand, if materials are now arriving at a port across the country from you, it makes sense to use a third-party vendor nearby to receive and house your inventory.

If you haven’t already reconsidered how you’re managing inventory, you’re missing out on a possible opportunity to address procurement delays.

Did you know?

You can use an inventory management system. This will allow you to view stock levels and track the movement of materials to better schedule out projects.

Construction trend #5: Finding new clients isn’t a top priority. Winning more bids takes precedence.

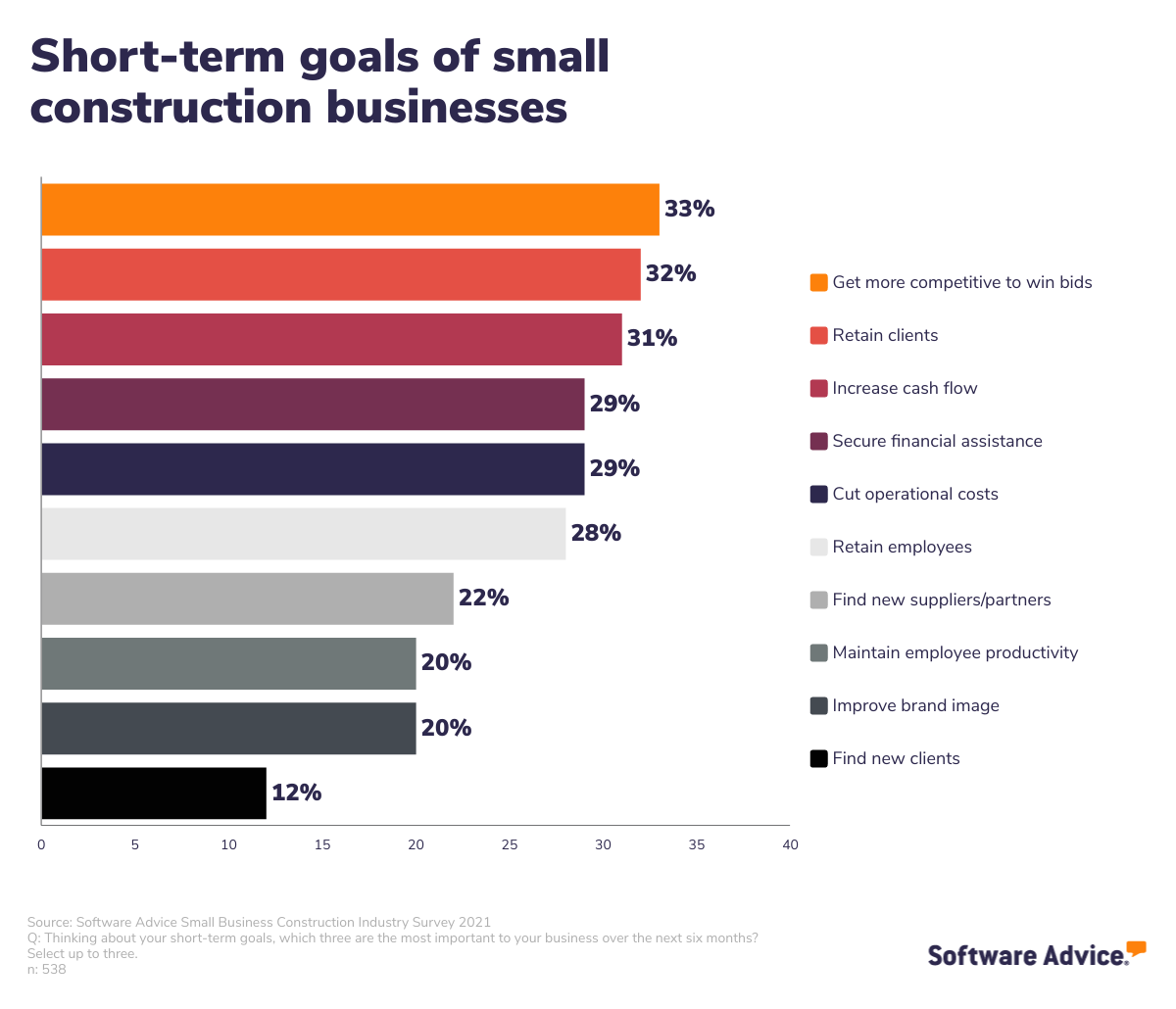

Throughout this report, you’ve seen that estimating has been the top priority for small construction businesses for years now, even during the pandemic. This trend is reflected in the short-term goals that businesses have, with the majority of them saying that getting more competitive to win bids is in their top three goals.

You may think finding new customers would also be a top goal, but it comes in last. Retaining existing clients is what takes the second spot.

Here’s a breakdown of the results when we asked about the top three short-term goals businesses have this year.

Retaining clients is indicative of the change in the type of demand construction has seen. New building projects have become less of a priority as homeowners and business owners have to make changes to their existing buildings to accommodate our new work-from-home lifestyles.

This means your previous or existing clients will likely have new needs that you can fulfill. But if their new requests differ from what you normally offer, see if you can expand your skillset or hire others with the skills to be able to meet those needs, rather than finding new clients.

Let’s get into how construction firms are pivoting to offer their existing clients the new services they’re now looking for due to the changes the pandemic has had in everyone’s work and life.

A quick review of operational pivots in residential construction

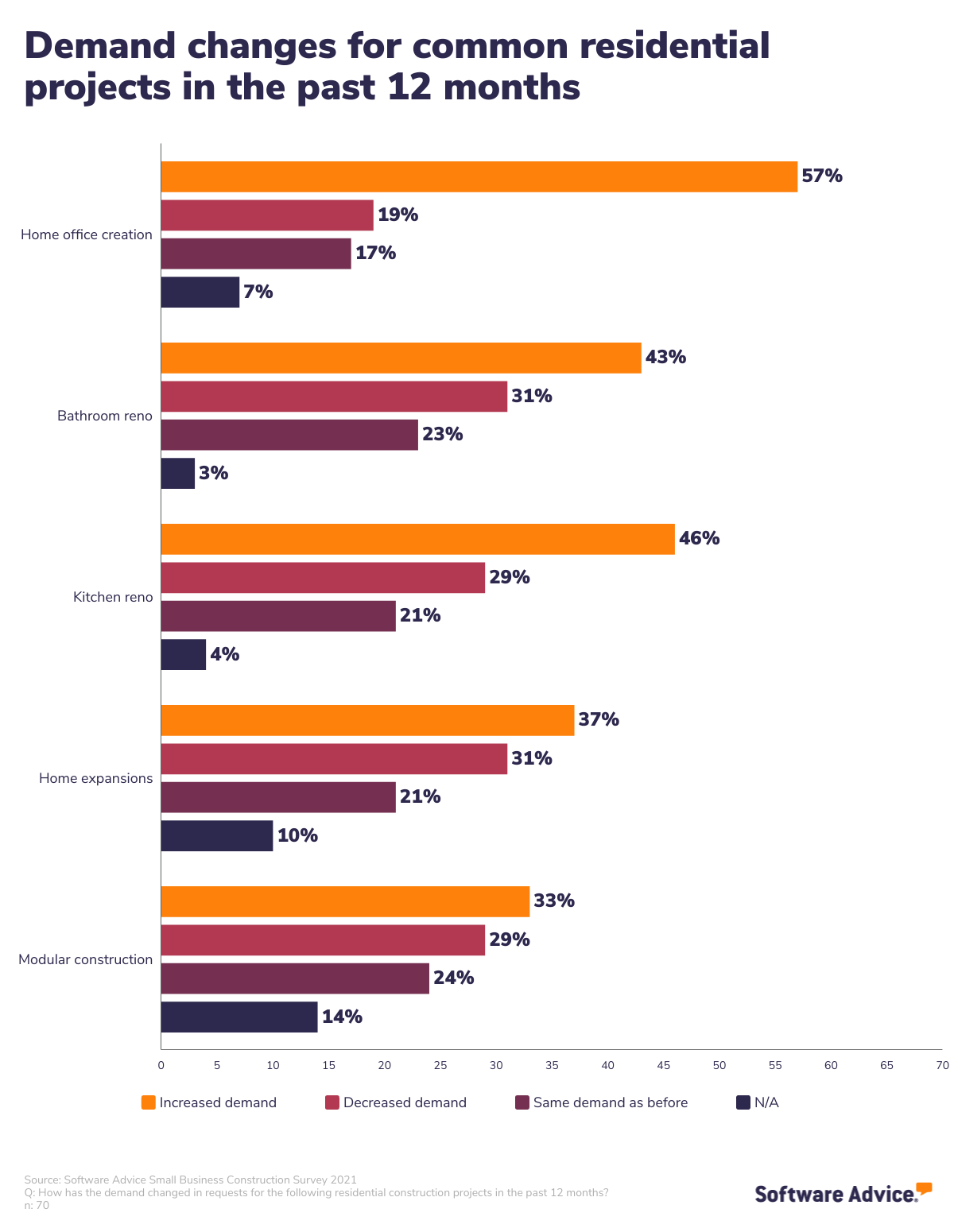

We narrowed in on our survey respondents who reported working in residential construction to find out how they’re meeting the new needs of existing clients. The creation of a home office saw the highest increase in demand (57%), to no one’s surprise. Kitchen and bathroom remodels (46% and 43% respectively) followed.

Here’s the breakdown of how demand changed in requests for the following residential construction projects in the past 12 months.

A residential project that saw an increase in demand similar to the numbers above at 34% is garage conversions to a living space. However, this isn’t included in the chart above because 36% of respondents say the demand is the same as before the pandemic.

Underestimated trend alert

33% of residential construction professionals report an increased demand in projects for an unattached or modular construction of an additional living space. Residential isn’t alone as Warren Buffet is going all in with modular commercial construction designs, too.

Are these stats applicable to you? Check where you fit in here.

Hopefully by now you’ve seen our analysis and advice is specifically meant for small construction businesses. But if you’d like to know exactly who we spoke with and the size of their business so you can compare yours, this section is for you.

Below we’ll break down the demographics for the thousands of construction software buyers our advisors have spoken with earlier this year and the over 500 survey respondents in the construction industry. This way, you can check that this report is representative of your peers and competition.

Construction software buyers demographics

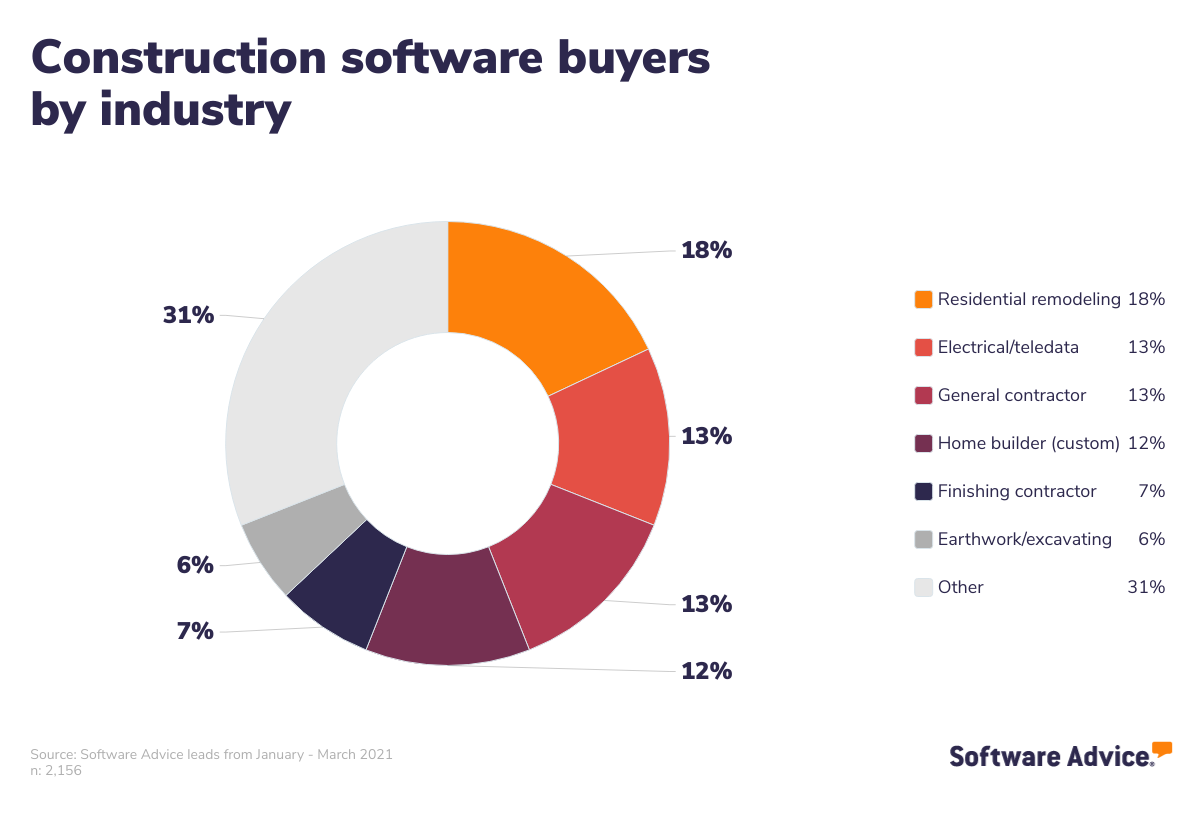

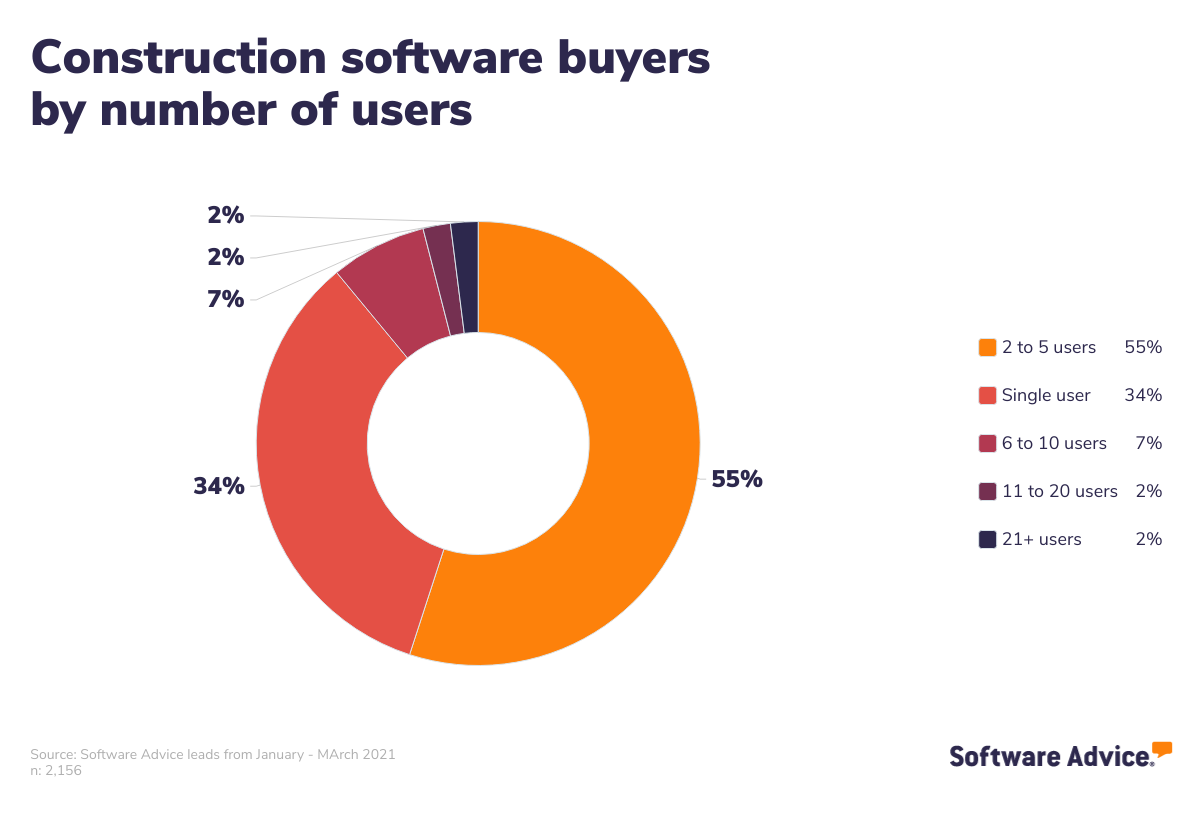

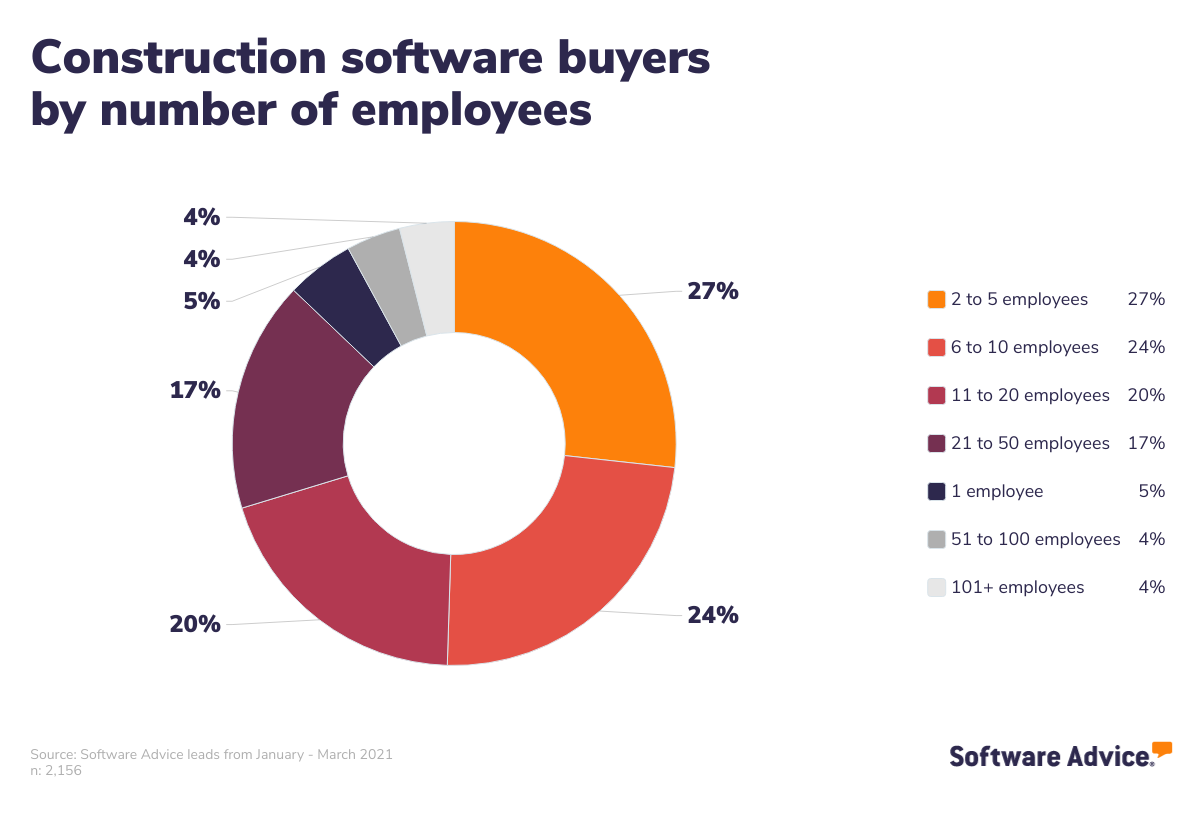

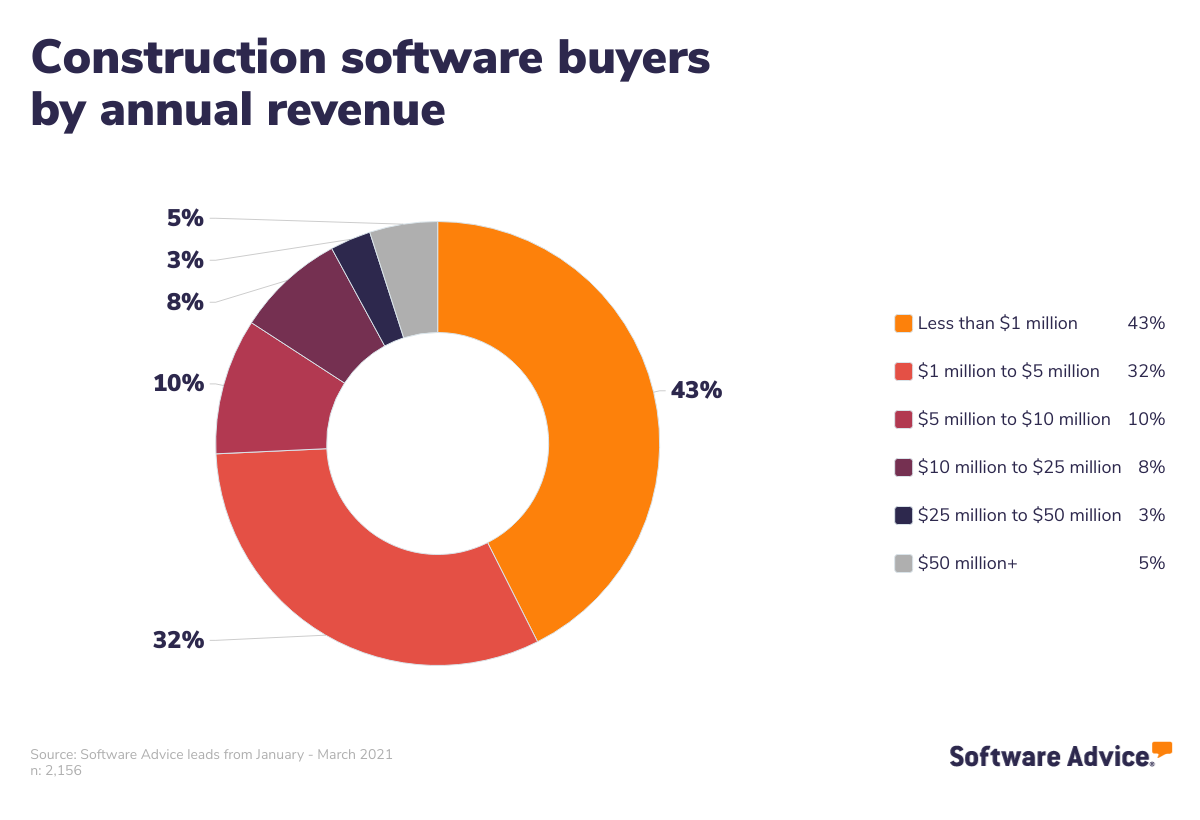

Throughout this report, we’ve shared insights on what construction business owners are wanting from a new construction software solution. But who are these nebulous people we’re referring to? The charts below will give the details on the industry they’re in, their business size, and how many employees they’ll have working in the tool.

Click the arrows to cycle through the demographic charts.

Respondents, by Industry

Respondents, by Number of Users

Respondents, by Number of Employees

Respondents, by Revenue

Construction industry survey respondents

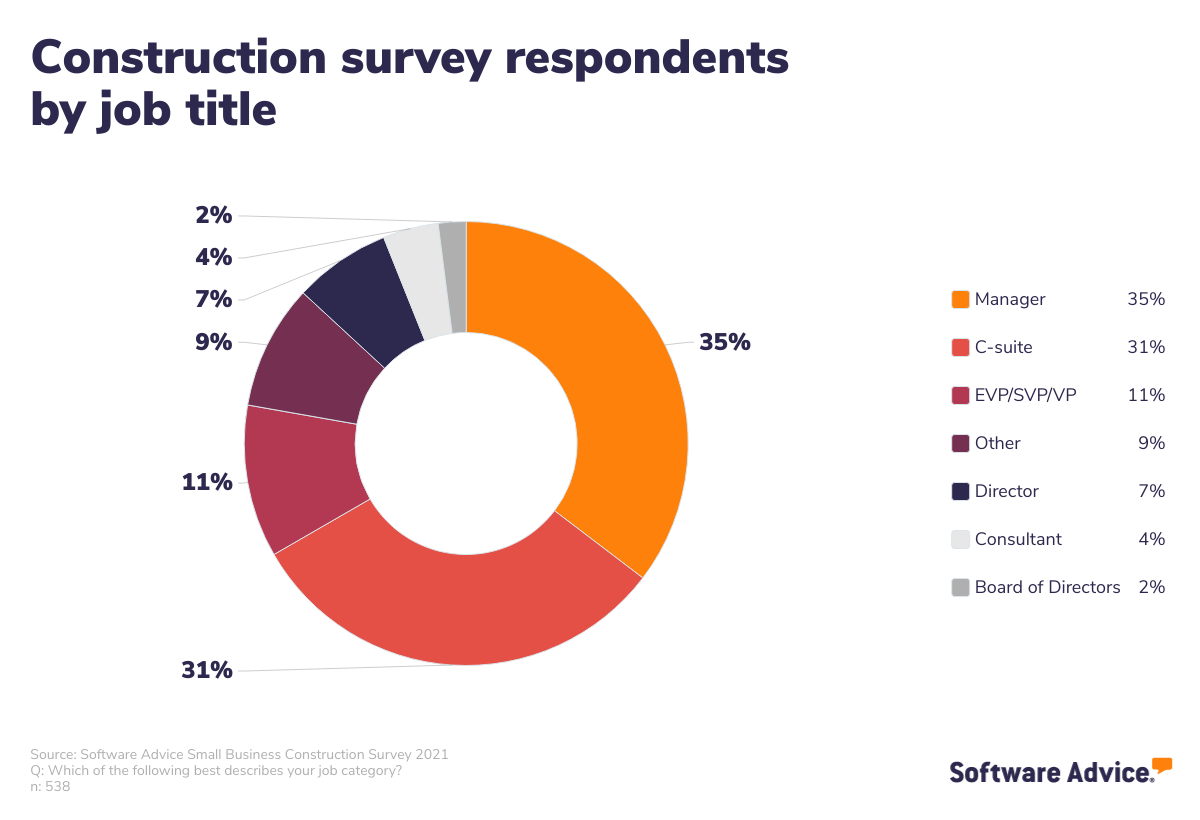

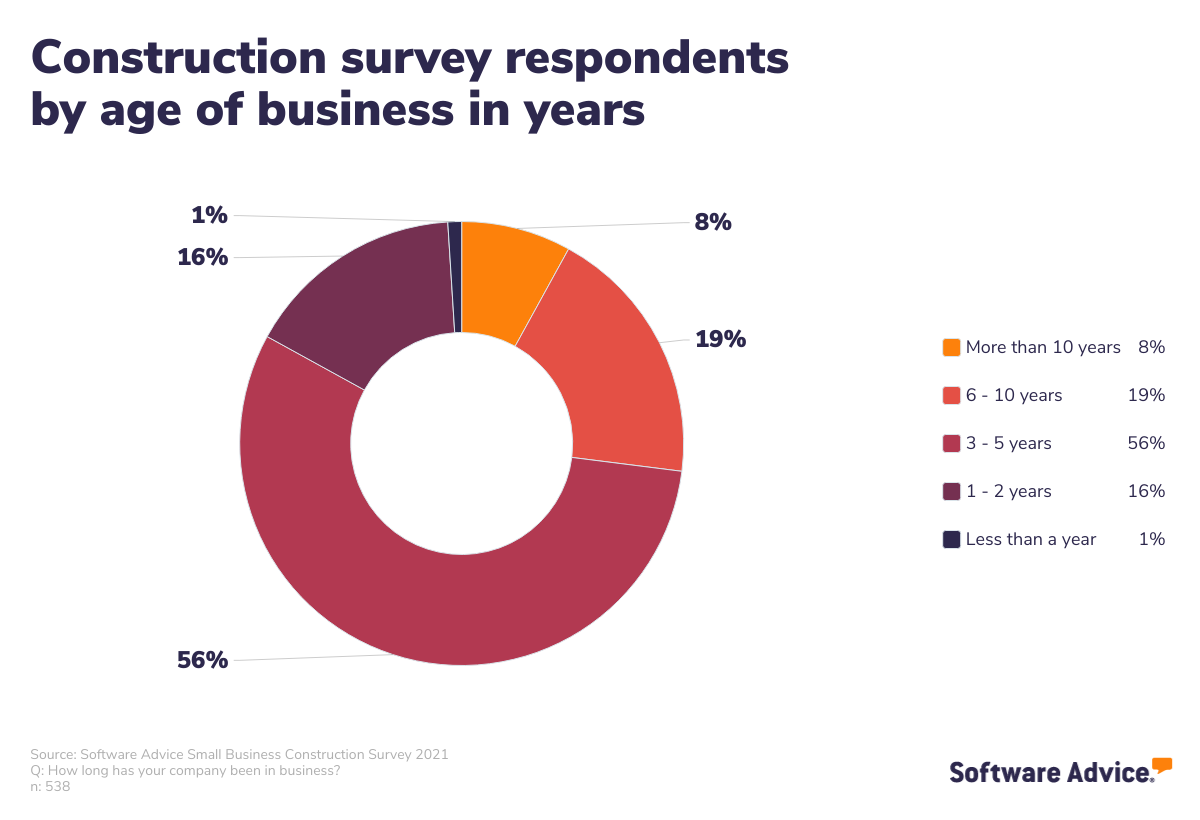

For our survey, we screened for respondents who work in construction for businesses with an annual business revenue of $100 million or less and 250 or fewer employees. In the charts below, you can see a detailed breakdown of business location, the job title of the respondents, age of business, and more.

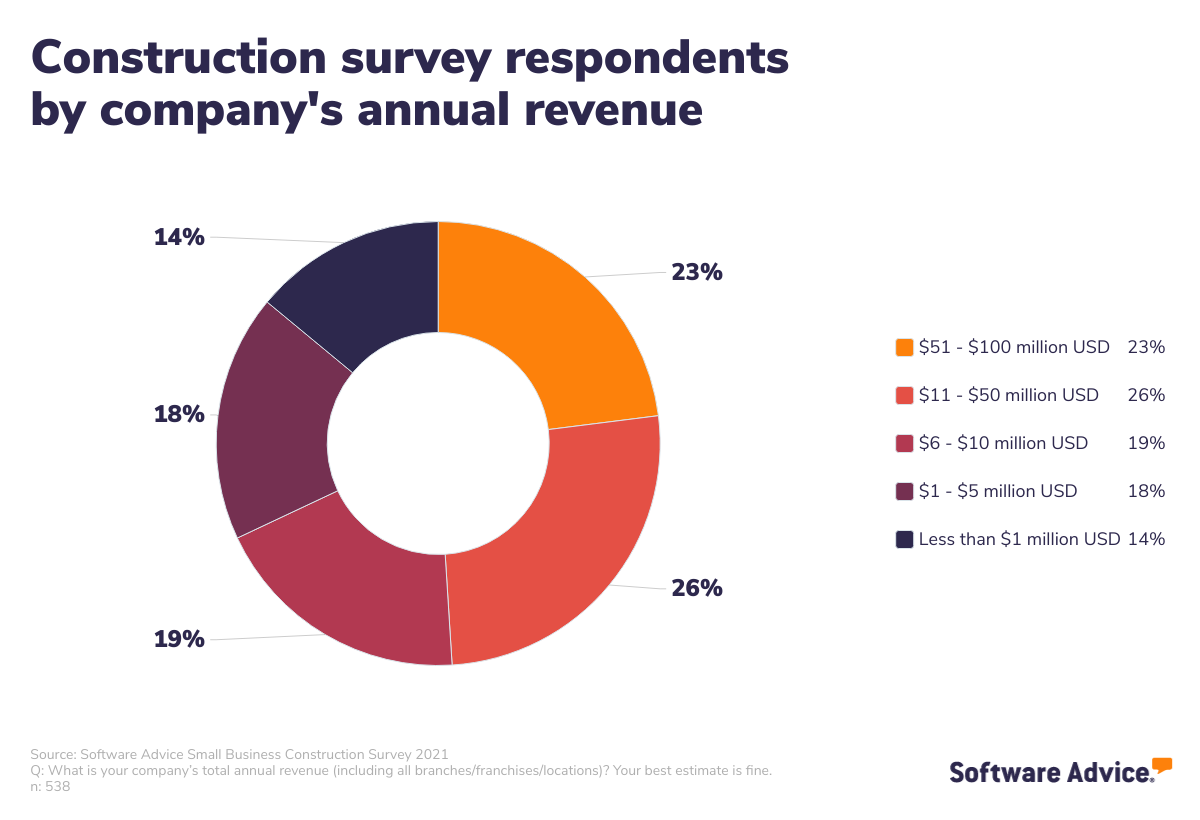

Respondents, by Company's Annual Revenue

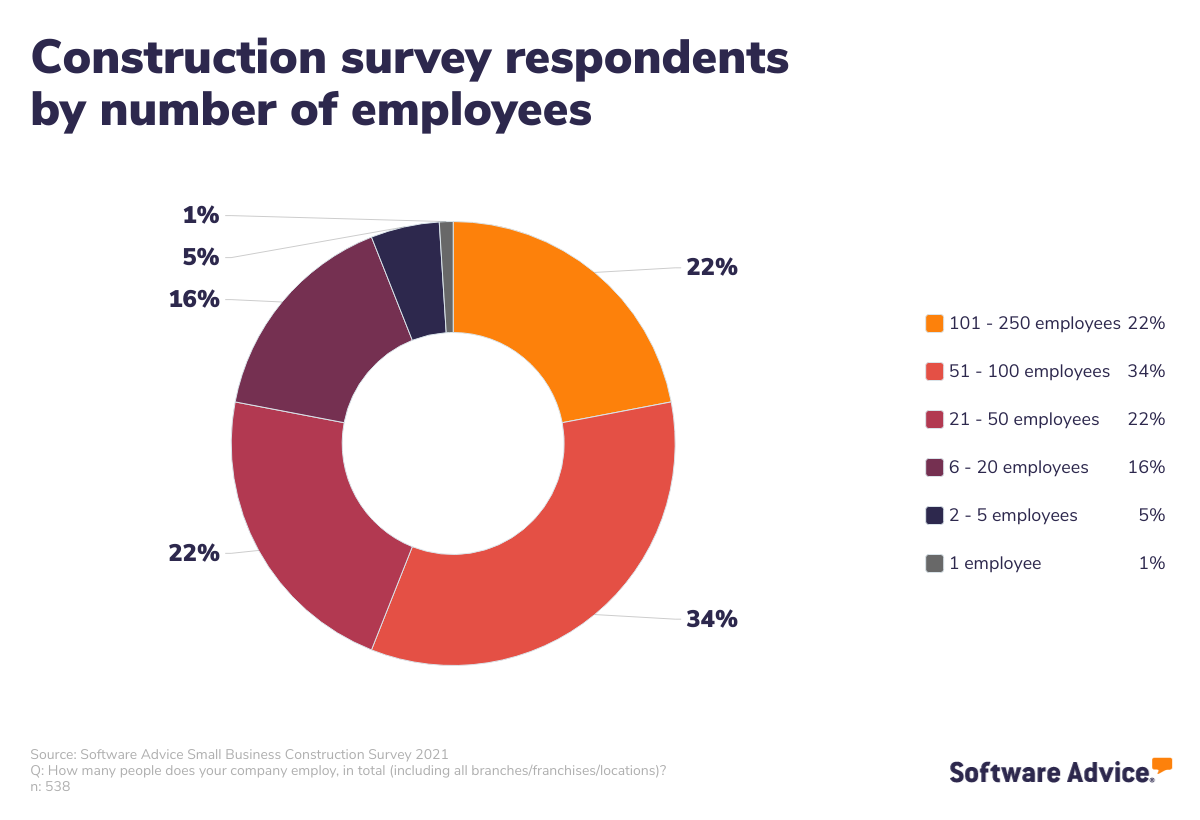

Respondents, by Number of Employees

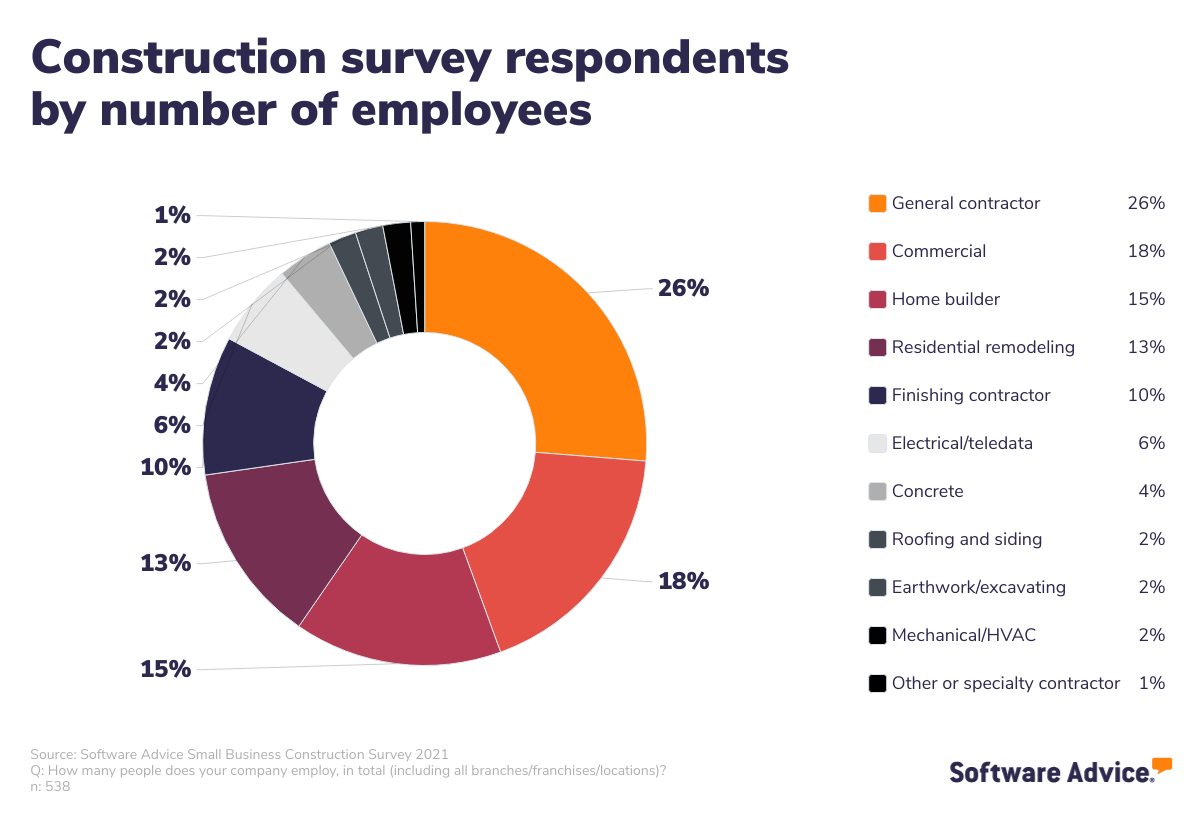

Respondents, by Number of Employees

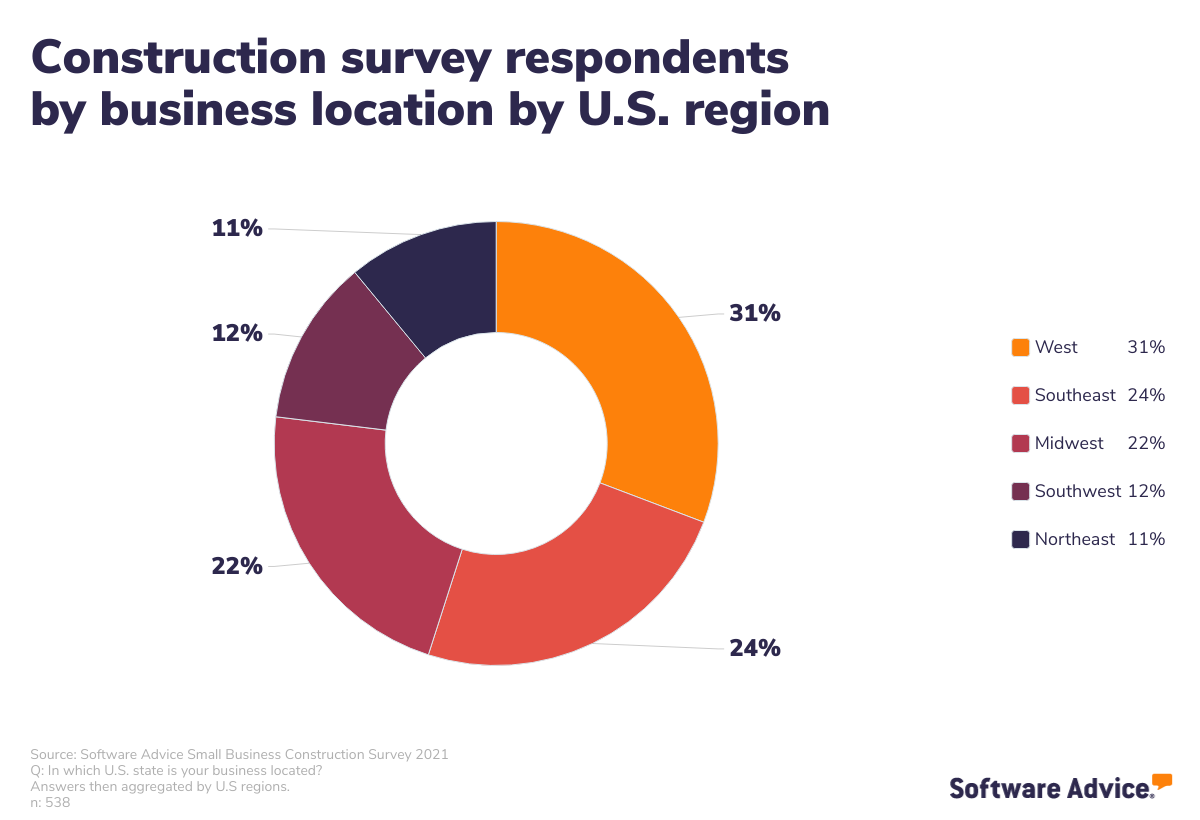

Respondents, by Business Location

Respondents, by Job Title

Respondents, by Age of Business

Looking for more information on construction software? We’ve got you

Whether you prefer to have someone help guide your software search or do the research on your own, we’ve got the resources you need to make sure you find the best fit for your business.

Schedule a call with a software advisor to get one-on-one advice from an expert who will help match you to the right solution based on your needs. Or give us a call when you’re ready at (844) 847-3290 for a fast, free consultation.

Read thousands of user reviews of the top construction software solutions. These users share their likes and dislikes quite openly so you can learn exactly how the software is performing for them.

Compare the Construction Estimating FrontRunners report. We’ve compiled the top 10 estimating software products based on how users rated their usability and satisfaction.

Learn more about the features and benefits of construction software in our Buyers Guide. We’ve also made one for estimating software.

Methodologies

Survey methodology

Software Advice conducted the Small Business Construction Survey in April 2021 of 538 U.S.-based workers in the construction/contracting industry in small business. Respondents were screened for employment status (employed full time), annual business revenue (<$100mil), and number of employees at respondent’s company (1-250).

Software buyers analysis methodology

Our software advisor team regularly chats with people like you who reach out to us for help finding construction software. The data used to create this report was collected by our advisors during those conversations to provide software guidance, rather than for market research. We analyzed 2,156 interactions from U.S. software buyers between January to March 2021 for the purposes of this report.

These findings exclusively represent those people who contacted Software Advice for guidance on software selection and may not be indicative of the market as a whole. Our commentary solely represents the views of the author. Data points are rounded to the nearest whole number.