Best Construction Categories

Best Facilities Management Categories

Best Human Resources Categories

Best Legal Management Categories

Best Manufacturing Categories

Best Medical Categories

Best Property Management Categories

Get 1-on-1 advice in 15 minutes. It's free.

Josh P.

AI adoption in manufacturing: How aggressive and balanced approaches will shape the industry in 2026

Manufacturing success in 2026 hinges on balancing AI, cybersecurity, training, and seamless software integration amid market volatility.

Manufacturing leaders are facing pivotal decisions about their software investment strategies. Should they fully embrace AI to gain a competitive edge? Is it time to accelerate technology adoption in response to economic volatility? And how much should be allocated to IT security to protect against rising cyberthreats? As the sector evolves, these choices will shape not only operational efficiency but also long-term resilience and market position.

How can we answer these questions? Software Advice’s 2026 Software Buying Trends Survey* of 3,385 decision-makers reveals how manufacturers balance AI adoption with caution—and what sets bold adopters apart.

Key findings

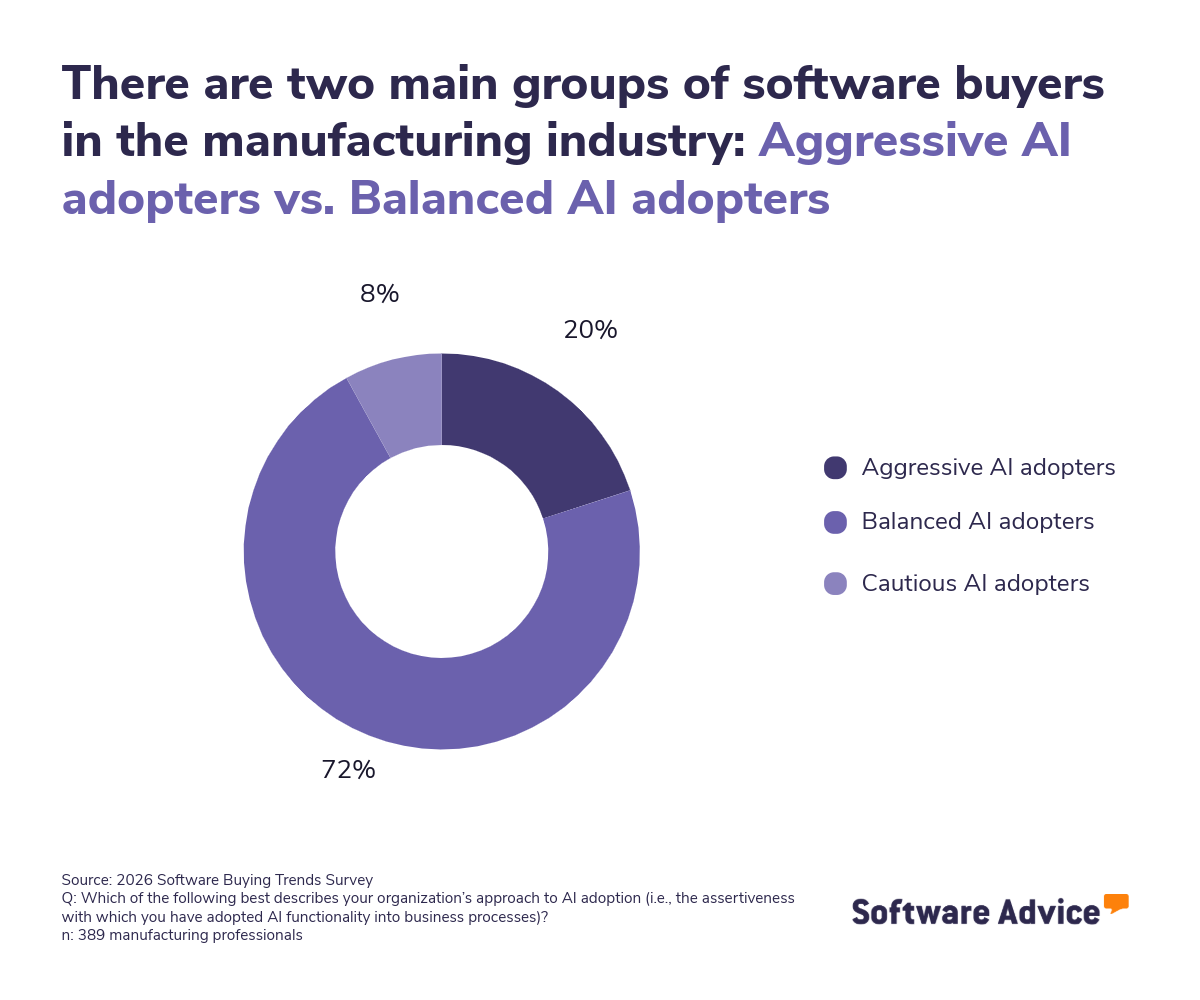

AI adoption preferences: 20% of manufacturing firms aggressively deploy AI, while 72% prefer a balanced approach; 8% remain cautious. Aggressive adopters consistently invest more in AI, security, supply chain, and training software than balanced or cautious firms.

Cybersecurity concerns: 44% of surveyed manufacturers cite cybersecurity/data privacy as a top challenge for 2026.

Economic uncertainty: 50% expect economic uncertainty to be a major challenge, with tariffs, inflation, and supply chain volatility as leading concerns.

Workforce training and system compatibility: 43% see training/upskilling as a challenge, and 44% cite compatibility with existing systems as a major barrier.

AI adoption in manufacturing: Understanding aggressive vs. balanced approaches

According to Software Advice’s study, the manufacturing industry can be categorized into two main groups in terms of AI implementation: aggressive adopters (20%) and balanced adopters (72%).

Aggressive AI adopters: They are characterized by their willingness to quickly test and implement emerging AI tools. Their primary objective is to gain a competitive advantage and optimize production and supply chain operations. These organizations are keen on experimenting and eager to take advantage of the latest advancements, often leading the way in innovation within the sector.

Balanced AI adopters: They prefer to wait until AI solutions have been proven and the associated risks are better understood. They prioritize stability, gradual improvement, and minimizing disruption. While this approach may lead to missing out on rapid gains, it also reduces the potential for costly mistakes and is more in line with a risk-averse culture.

Pro tip

It's essential to align your approach with your organization's risk tolerance and readiness for change. Then, review and compare manufacturing and AI tools that match your strategy.

Keeping these two distinct AI adoption profiles in mind, let's examine how aggressive and balanced manufacturing buyers tackle the four central challenges ahead: cybersecurity, economic uncertainty, workforce upskilling, and system integration. We’ll see how critical decisions in these areas shape software investments for 2026, and how each profile approaches them.

1. Cybersecurity in manufacturing: Aggressive AI adopters stay ahead of threats

Bottom line: Cybersecurity tops manufacturers’ 2026 priorities as rising threats drive major IT security investments and stricter safeguards for AI adoption.

As the adoption of digital technology continues to accelerate, cybersecurity has become a critical concern for organizations across all industries. According to a Gartner report, spending on information security is expected to grow from $183 billion in 2024 to $292 billion by 2028, [1] reflecting an estimated compound annual growth rate (CAGR) of 11.7%.

This trend is particularly evident in the manufacturing sector:

44% of manufacturing professionals identify cybersecurity and data privacy as top challenges for 2026.

38% indicated that security concerns are the primary challenge when planning new software investments.

80% of manufacturing firms have invested in IT security software over the last twelve months or more, and over a third have identified IT security as a top investment priority.

Why this matters: In 2025, the manufacturing sector experienced a significant increase in ransomware attacks [2], making it one of the most targeted industries. The consequences of such attacks can be severe, including operational downtime that disrupts production lines and substantial financial losses from ransom payments, recovery costs, and lost business. Consequently, cybersecurity has rightfully become a paramount concern for manufacturing firms and organizations.

Aggressive adopters of AI technology are especially vigilant: 84% are using IT security tools, compared to 79% of balanced adopters.

What this means: Aggressive adopters are often the first to implement cutting-edge AI solutions, which can introduce new vulnerabilities and expand their attack surface. Their rapid pace of innovation means they must constantly monitor, update, and reinforce their security measures to stay ahead of increasingly sophisticated cyber threats.

In contrast, balanced adopters tend to deploy proven technologies at a slower rate, giving them more time to evaluate and integrate security protocols without the urgency faced by aggressive innovators.

Pro tip

Make cybersecurity and data privacy foundational to every software decision. Assess your organization’s risk profile and choose solutions that can protect sensitive data, defend against evolving threats, and support regulatory compliance as your digital footprint grows.

Aggressive AI adopters: Seek flexible, AI-rich platforms with strong security and invest in advanced, adaptable security tools that can keep pace with rapid innovation.

Balanced AI adopters: Choose proven, well-supported solutions and ensure new software integrates seamlessly with existing protections to maintain a consistent security posture.

2. Economic uncertainty: Balanced AI adopters prioritize a manufacturing stability strategy

Why it matters: Economic volatility—driven by tariffs, inflation, and supply chain risks—pushes manufacturers to invest in software that boosts agility and resilience.

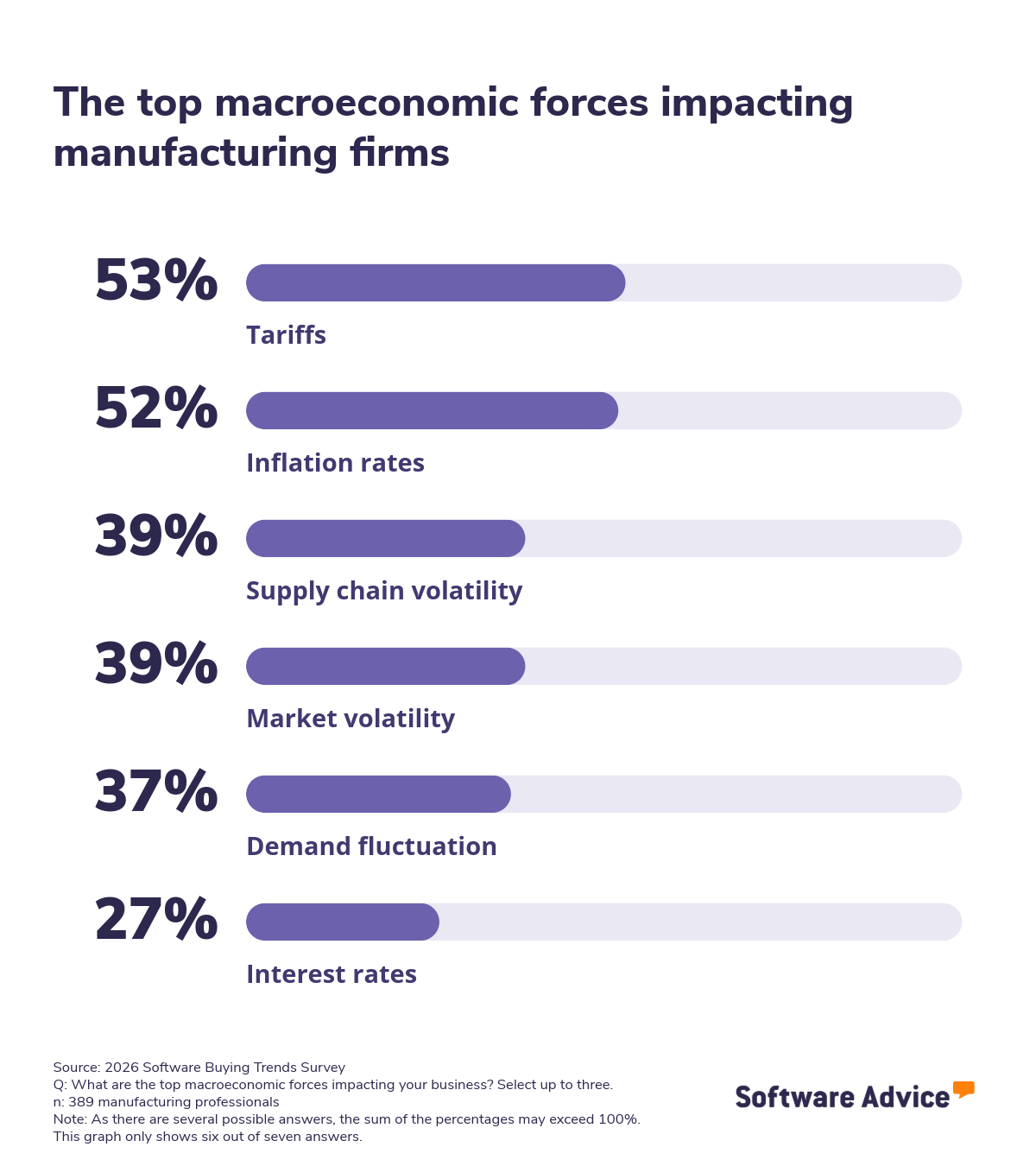

Economic uncertainty remains a significant challenge for manufacturers, with 50% of respondents anticipating it to be a major issue in 2026.

According to Gartner forecasts [3], macroeconomic uncertainty and tariff volatility will remain disruptive through 2026, pushing firms to prioritize resilience over cutting technology budgets. Moreover, tariffs and shifts in trade policy are now considered long-term dynamics [4]. In response, manufacturers are accelerating investments in software that improves agility and cost control.

What aggressive AI adopters do: They’re turning to supply chain and logistics platforms at a higher rate (88%) than balanced AI adopters (72%) to optimize operations and improve resilience amid market disruptions. By leveraging AI, these firms gain real-time visibility into inventory and shipments, automate demand forecasting, and quickly identify bottlenecks or risks in the supply chain. This enables faster, data-driven decisions, reduces excess inventory, minimizes delays, and helps manufacturers adapt to sudden market changes or disruptions with greater precision and confidence.

What balanced AI adopters do: Prioritize stability and coordinated growth by investing more in sales management and project management software than their more aggressive counterparts. This strategy helps them strengthen customer relationships, track sales pipelines, and manage projects with greater accuracy and control. By focusing on these areas, balanced adopters can ensure smoother execution, improve cross-team collaboration, and maintain reliable performance, even during periods of economic volatility.

Pro tip

Build resilience by investing in smart software that enables your business to adapt quickly to market shifts and operational challenges. The right tools can help you anticipate disruptions, optimize resources, and maintain continuity under pressure.

Aggressive AI adopters: Use AI-driven supply chain and logistics platforms for greater agility, real-time visibility, and predictive analytics.

Balanced AI adopters: Focus on enterprise resource planning (ERP) and planning tools that offer reliable forecasting, cost control, and incremental improvements without overwhelming existing processes.

3. Workforce upskilling: Aggressive AI adopters leverage manufacturing LMS for a competitive edge

The big picture: Reshoring and tech adoption widen the skills gap, making workforce training and upskilling critical for manufacturing success in 2026.

The need for a skilled manufacturing workforce is more critical than ever, due to the increasing trend of reshoring and tariff pressures. These factors are leading to a significant increase in demand for entry-level labor and specialized skills as companies relocate production to the U.S [5]. However, advanced technology adoption by manufacturers has also resulted in a widening skills gap, making training and upskilling essential.

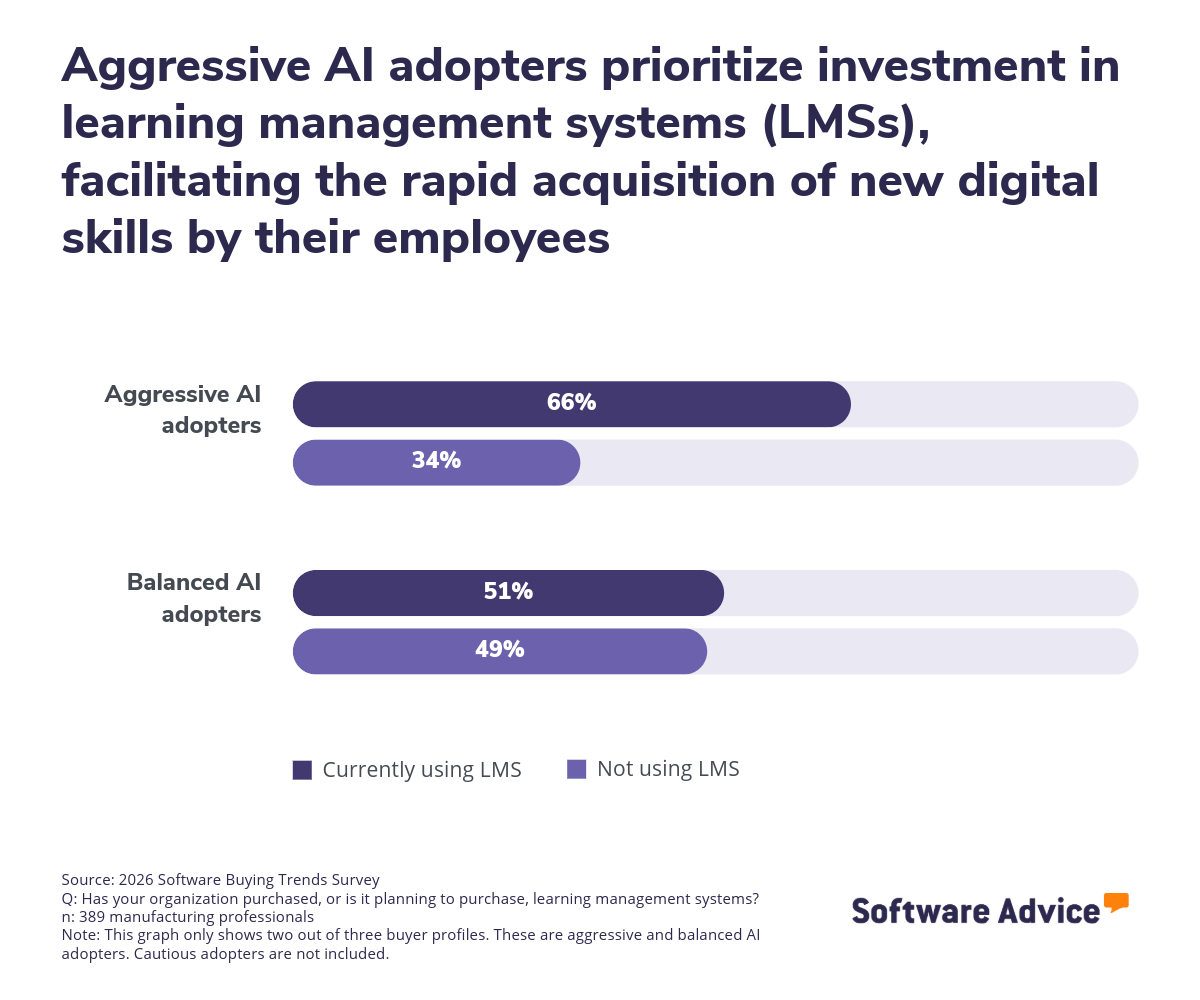

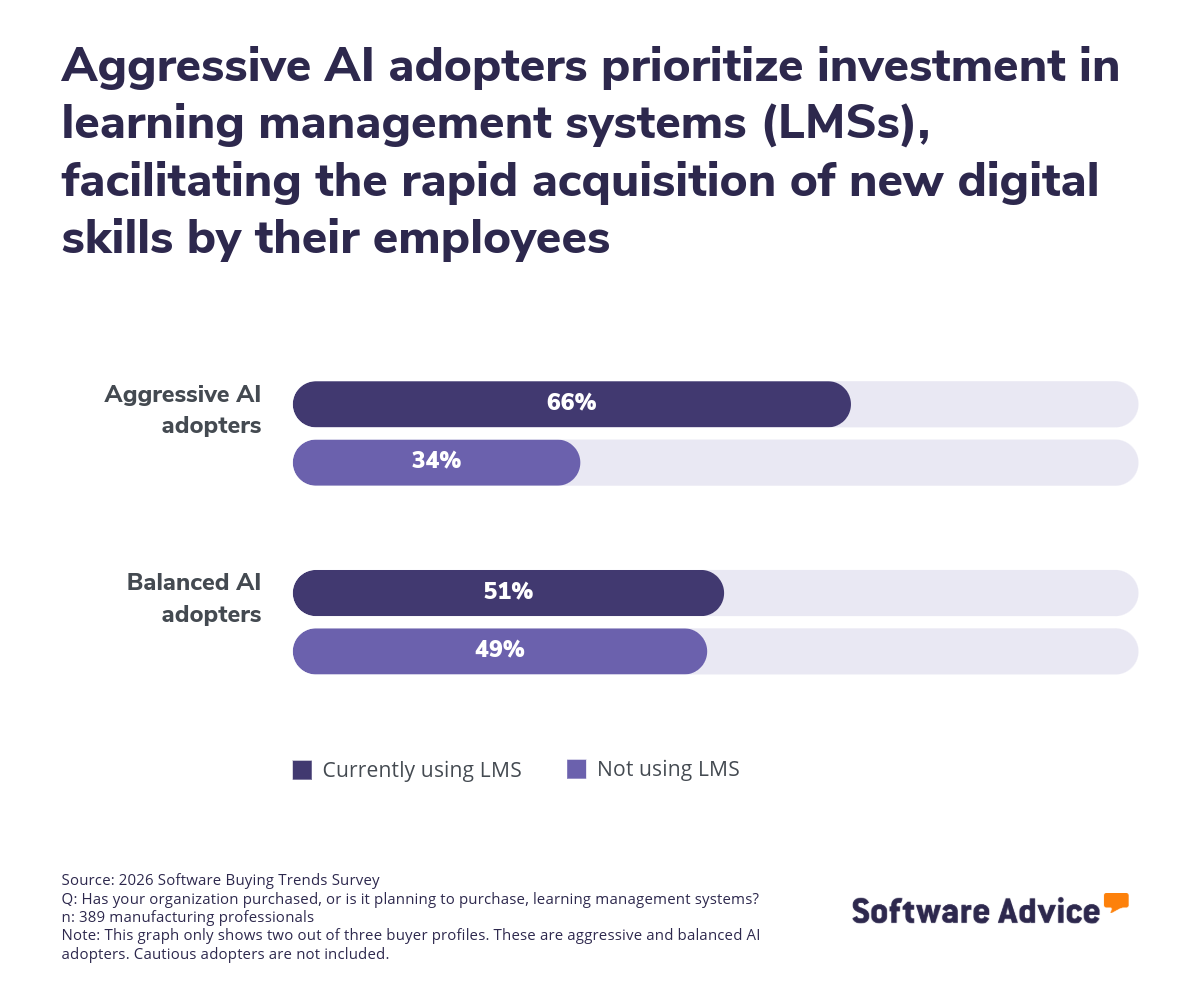

Survey results reveal that 43% of respondents anticipate significant challenges with training and upskilling. Aggressive adopters are taking the lead in this regard.

Aggressive adopters of AI tend to invest more in LMS platforms because they rapidly deploy new technologies, which demands that their employees quickly adapt and acquire new digital skills to keep pace with innovation. This proactive investment helps them avoid capacity issues and ensures their workforce can leverage advanced tools as soon as they are implemented.

Overall, this investment in LMS reflects an acknowledgment from both groups that the rapid pace of technological advancement requires continuous education and support for employees. Manufacturing firms must prioritize employee training and select software that provides personalization and complies with security standards to maximize the return on technology investments.

Pro tip

Invest in employee training to unlock the full potential of your technology investments. A skilled workforce is essential for successful adoption and long-term growth. Select LMS and training platforms that support secure, scalable learning and align with your organization’s pace of change. Here’s how both profiles leverage learning software:

Aggressive AI adopters: Choose an LMS with AI personalization for rapid upskilling and adaptive training experiences.

Balanced AI adopters: Opt for structured, compliance-friendly platforms that support ongoing development and regulatory requirements.

4. Compatibility & system integration in manufacturing: Balanced AI adopters focus on smooth integration, not fast change

Key takeaway: Integration issues drive most software regrets—44% of manufacturers cite compatibility as a top challenge, making integration critical for success.

According to the Software Advice 2026 Software Buying Trends Report, nearly nine out of ten buyers who regretted their purchase encountered unexpected disruptions, with integration issues being the most frequently reported. This study also found that buyers who faced disruption during implementation were eight times more likely to regret their purchase. These findings underscore the critical importance of seamless integration for operational success, buyer confidence, and long-term satisfaction.

Integration is a significant obstacle for manufacturing software projects: 44% of respondents cited compatibility with existing systems as a primary challenge.

Aggressive adopters: Those who adopt AI technologies more aggressively are more likely (76%) to invest in IT architecture or cloud management tools than those who adopt them in a more balanced way (67%). This reflects their urgent need to connect diverse and rapidly evolving technology stacks to innovate quickly. However, this fast-paced approach also exposes aggressive adopters to greater risks of implementation disruption, costly downtime, and regret if integration challenges are underestimated.

Balanced adopters: In contrast, lower investment in these tools signifies their preference for stability and incremental change. Balanced adopters typically prioritize integrating new solutions with existing systems and avoid large-scale migrations unless the benefits and risks are clear. Through a more measured approach, balanced adopters aim to minimize operational disruption, even if it means slower transformation. While this cautious approach helps avoid operational disruption, it can also limit the speed of transformation.

Pro tip

Prioritize integration from the start to avoid costly disruptions, maximize ROI, and ensure your new software works seamlessly with existing systems. A well-integrated tech stack supports business continuity and scalability, no matter your adoption style. Here’s how the two profiles approach integration:

Aggressive AI adopters: Look for cloud management and integration platforms that connect diverse tools quickly.

Balanced AI adopters: Seek pre-built connectors for plug-and-play integrations and strong vendor support.

The future of the manufacturing industry: Navigating change and harnessing AI

The 2026 manufacturing software landscape presents both unprecedented opportunities and complex risks. With rapid AI innovation, heightened cybersecurity demands, economic volatility, and workforce transformation shaping the industry, the decisions made today will significantly impact tomorrow’s market leaders. According to survey findings, success in this landscape is not just about adopting the latest technology, but also about aligning each investment with organizational risk appetite, operational realities, and long-term vision.

Aggressive AI adopters are leading the digital transformation charge by leveraging advanced tools to drive efficiency and resilience. However, their bold approach exposes them to integration challenges and cyberthreats. On the other hand, balanced AI adopters are prioritizing stability, seamless compatibility, and incremental gains, even if it means slower progress.

Both approaches have merit, and the most effective strategies will combine innovation with robust governance, continuous workforce development, and a relentless focus on integration and security.

Useful resources

Sources

Information Security Spending: What Does the Future Hold?, Gartner

Ransomware Attacks Spike Again in Manufacturing, Manufacturing Business Technology

Gartner Forecasts Worldwide IT Spending to Grow 7.9% in 2025, Gartner

Gartner Says Supply Chain Organizations Can Use Tariff Volatility to Drive Competitive Advantage, Gartner

Tariffs, Reshoring and the Rising Demand for Entry-Level Labor, Manufacturing Tomorrow

Survey methodology

*Software Advice 2026 Software Buying Trends survey was conducted online in August 2025 among 3,385 respondents in Australia (n=281), Brazil (n=278), Canada (n=293), France (n=283), Germany (n=279), India (n=260), Italy (n=263), Mexico (n=288), Spain (n=273), the U.K. (n=299), and the U.S. (n=588), at businesses across multiple industries (including 389 respondents in manufacturing roles), ages (1 year in business or longer), and sizes (5 or more employees). Business sizes represented in the survey include: 1,676 small (5-249 full-time employees), 822 midsize (250-999), and 887 enterprise (1,000+). The goal of this study was to understand the timelines, organizational challenges, research behaviors, and adoption processes of business software buyers. Respondents were screened to ensure their involvement in business software purchasing decisions.