Best Construction Categories

Best Facilities Management Categories

Best Human Resources Categories

Best Legal Management Categories

Best Manufacturing Categories

Best Medical Categories

Best Property Management Categories

Get 1-on-1 advice in 15 minutes. It's free.

Josh P.

Operational Complexity is Rising in Field Service—Software Strategy is Pivotal to Staying Ahead in 2026

Field service professionals are navigating a uniquely complex landscape as they head into 2026. Compared to other industries, they face heightened operational pressures—from labor shortages and project complexity to rising customer expectations. These challenges are no longer just operational hurdles; they're prompting firms to reassess how they evaluate, select, and implement software to support day-to-day operations.

Operational demands are intensifying across the field service industry, raising the stakes for every software decision. However, this factor hasn’t automatically translated into more structured buying behavior among industry professionals. Findings from Software Advice’s recent study reveal that many professionals in the field still lack an outcome-driven approach to selecting software. With nearly half of buyers reporting disappointment in past purchases, the data indicates a clear opportunity for firms to improve their software strategies and avoid common pitfalls.

This report draws on insights from Software Advice 2026 Software Buying Trends Report*, which includes responses from 3,385 software decision-makers across 11 countries. Of those respondents, 72 field service professionals shared how these pressures are shaping their software strategies.

We analyze the priorities shaping field service software adoption today, highlighting the internal and external forces driving change, the influence of artificial intelligence (AI) on investment decisions, and the steps professionals can take to achieve better long-term outcomes through more deliberate selection.

Key findings

Growth remains positive, but slower than that of peers: Most field service professionals still expect growth, albeit at a lower rate than other industries. This could signal a shift in focus, from expansion to operational efficiency and smarter resource allocation.

Labor, project, and training complexity challenge service delivery: Labor availability is a growing concern as an external factor, more prevalent than in other sectors. At the same time, firms anticipate internal difficulties in managing projects and upskilling staff, while also navigating the challenge of acquiring new clients.

Software selection missteps are common: Nearly half of buyers report disappointment with past purchases. Among them, 41% say they would conduct a needs assessment before making a purchase again.

Security and ROI expectations are high: Buyers want fast returns—typically within the first year—but also need confidence in long-term reliability and data protection.

AI is cautiously adopted but drives investment: Most firms are taking a balanced approach to AI, yet functionality—including AI features—is the leading reason for increased software spending.

1. Field service growth expectations cool compared to other industries

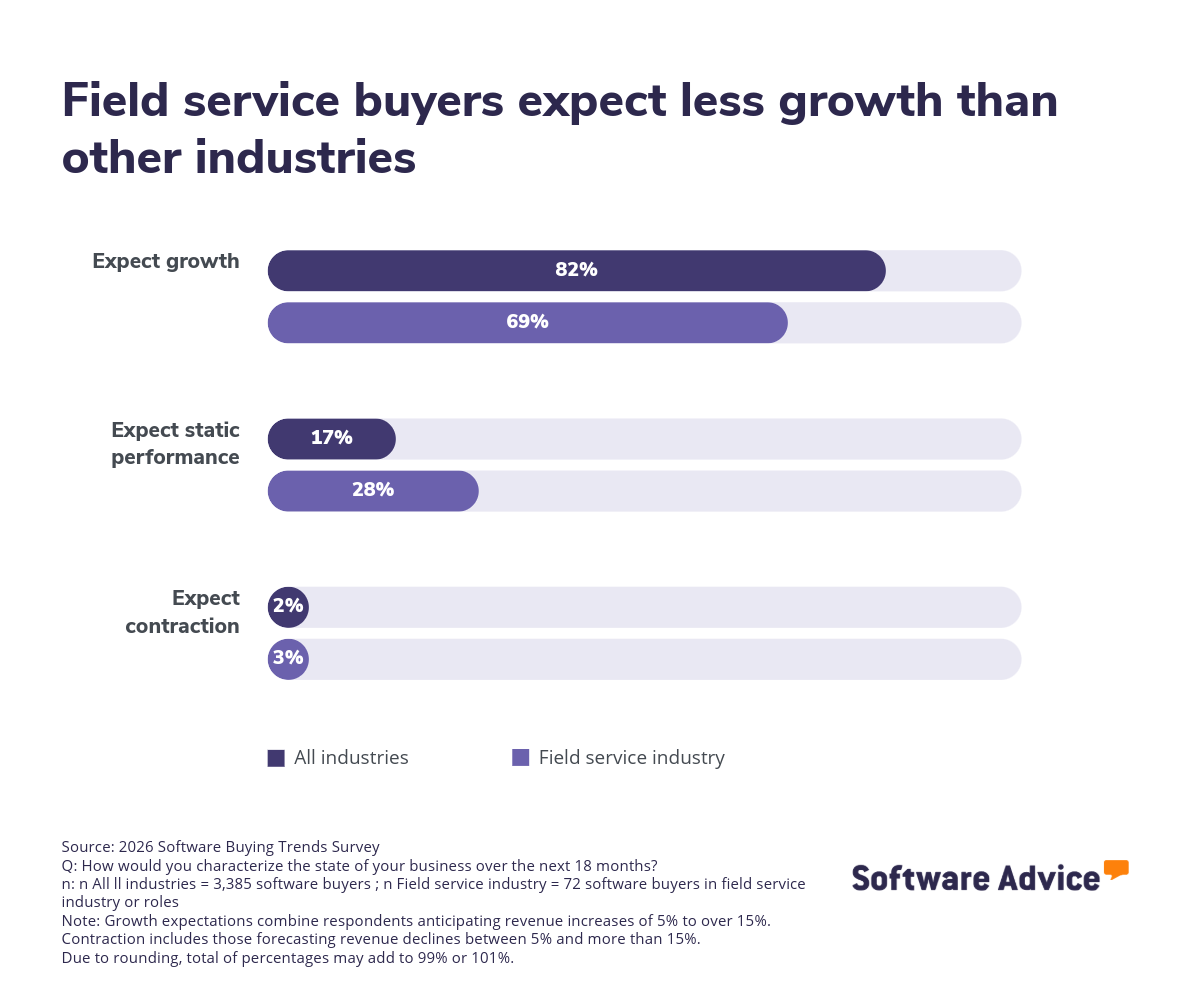

As 2025 draws to a close, our study suggests that optimizing existing processes is becoming more critical than chasing growth at any cost for the field service industry. While 69% of field service professionals anticipate growth, this figure trails the 82% average across all sectors. Meanwhile, 28% expect a flat performance, and 3% foresee a contraction—both rates are higher than the global average.

Gartner’s Market Guide for Field Service Management [1] reinforces this trend, noting that buyers are prioritizing efficiency as margin pressure and hybrid workforce models become more prevalent. This perspective could highlight a shift in priorities: instead of focusing solely on high-volume expansion, many firms are placing greater emphasis on resource allocation and operational efficiency to protect margins.

Success in 2026 might likely depend on strategies that emphasize cost control and enhance technician productivity.

How software can support smarter resource allocation

Slower growth doesn’t mean standing still: it means making every hour and asset count. Many field service firms are looking for ways to improve visibility and streamline processes to offset margin pressure and maintain service quality. [1]

Field service management (FSM) software can support these goals by centralizing scheduling, monitoring technician performance, and reducing downtime, ensuring resources are deployed where they have the most impact. For example, when technician availability is limited, the system can automatically assign jobs based on location, skill set, and urgency, helping teams complete more tasks with fewer delays.

Key features in FSM platforms that enable visibility, coordination, and cost control

Tools that help field service teams maximize existing capacities are central to support smarter resource management. FSM platforms offer a range of capabilities that can improve visibility, coordination, and cost control—key areas for firms navigating profitability hurdles and staffing challenges.

Each feature plays a practical role in helping firms ensure service consistency and reduce inefficiencies:

Asset tracking and performance monitoring help identify underused or overworked equipment, allowing managers to make informed decisions about repairs, replacements, or reallocation.

Job scheduling and dispatch optimization reduce idle time by assigning tasks based on technician availability, location, and skill set, helping firms complete more jobs with fewer delays.

Mobile access for technicians enables field staff to receive updates, access customer history, and report progress from any location, thereby minimizing communication gaps and improving responsiveness.

Expert tip

When service teams face rising complexity and potential tighter margins, visibility becomes more than a metric—it becomes a decision-making tool. Field service management software can help centralize key data points, from technician activity to asset usage, providing managers with a clearer view of where time and resources are being allocated.

To build on this foundation, some software products are designed to support specific operational goals. For example, maintenance management tools can help structure recurring service tasks and extend asset lifecycles, while fleet maintenance systems offer insight into vehicle condition and readiness.

The goal isn’t to expand tech stacks for the sake of it, but to ensure that core operations are supported by tools that bring clarity, not complexity.

2. Labor shortages and project complexity challenge service delivery ahead of 2026

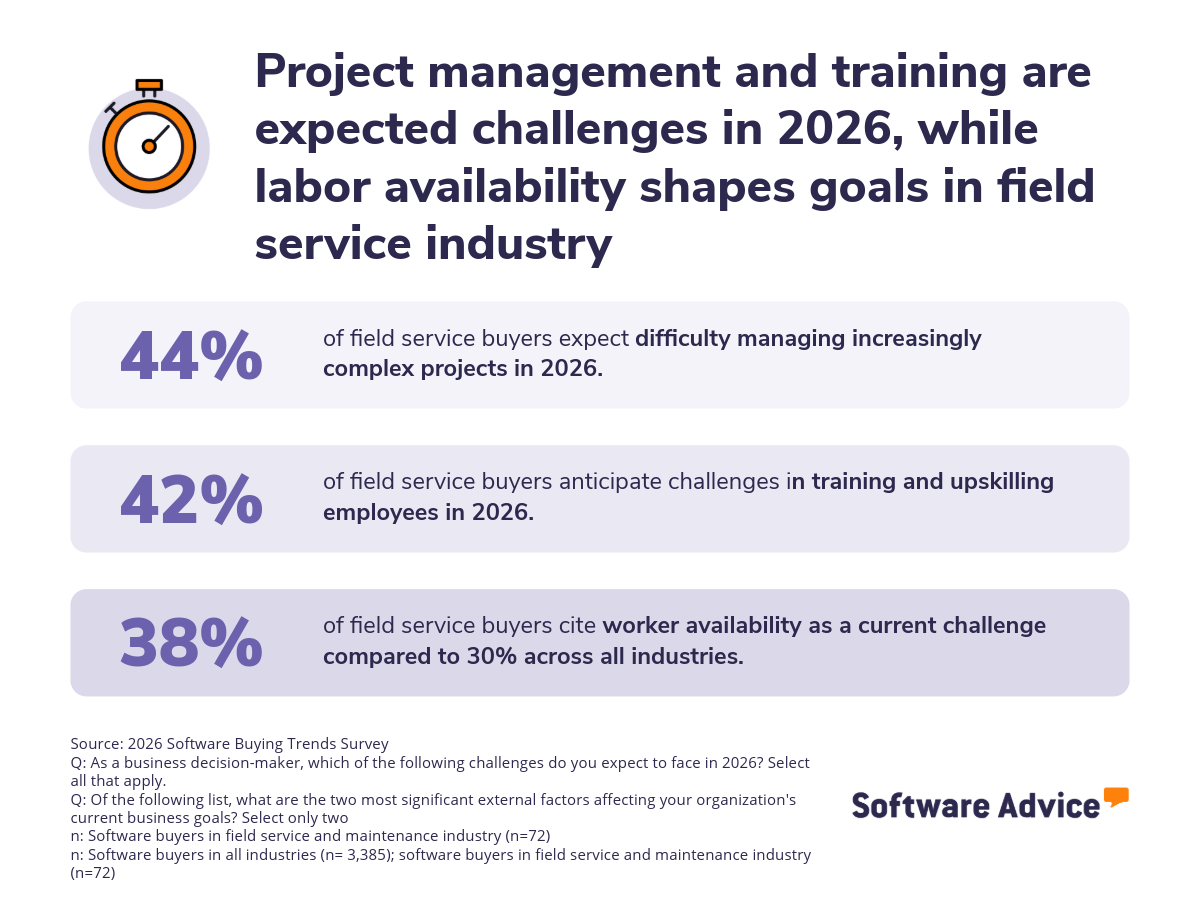

While AI remains the top external factor shaping business goals, field service faces a distinct workforce challenge: unlike other industries, labor availability is a more prominent concern. Internally, firms are also contending with complex project demands and gaps in technician training.

These issues often overlap: limited staffing can delay execution, while insufficient upskilling may prevent technicians from adapting to the changing service requirements, ultimately impacting the timely execution of projects.

Combined, these challenges can affect a firm’s ability to consistently meet customer expectations.

Labor shortages strain technician availability

The workforce gap in field service is deepening—and it’s not temporary. Half of all field service technicians are now over the age of 50, and the number of workers retiring is on the rise. At the same time, younger workers are turning away from skilled trades, instead being drawn to technology or gig roles. The result: a shrinking pipeline and widening coverage gaps, especially in tier 2 and tier 3 markets, with some organizations even rehiring retirees to fill critical roles. [2]

This trend is reflected in our study, as labor availability concerns—a key external factor—weigh more heavily on field service than on other sectors: 38% of respondents expect worker availability to impact business goals, compared to 30% across all industries.

Expert tip

Labor availability remains one of the most pressing external challenges in field service. When technician coverage is limited, every minute and every task counts. One FSM capability that can make a measurable difference is real-time mobile access to inventory and job details.

This feature allows available technicians to take on complex tasks without delay, accessing the information they need directly from the field. It supports workforce efficiency by reducing back-and-forth communication, minimizing idle time, and helping teams stay aligned even when resources are stretched.

Skills shortages and hiring challenges in field service are closely linked. At a time when technical expertise is critical for meeting rising customer expectations and supporting advanced service models, the slow replenishment of qualified technicians tightens the labor market and limits operational flexibility. This challenge doesn’t just affect coverage; it amplifies pressure on internal processes, where project complexity and training gaps become harder to manage.

Project complexity and training gaps add pressure

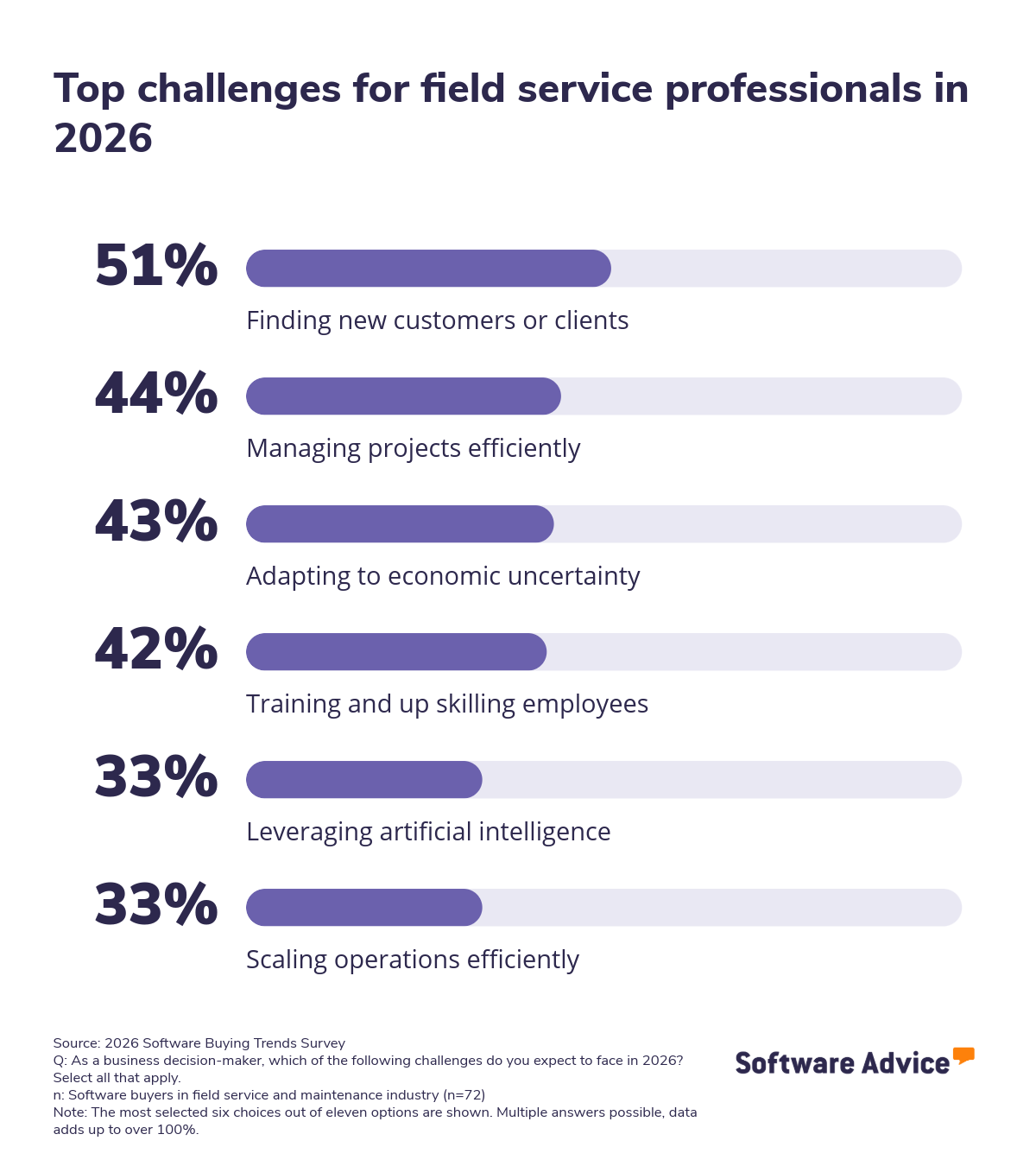

When it comes to internal challenges, finding new customers (51%) and adapting to economic uncertainty (43%) remain top concerns. However, difficulties in managing complex projects (44%) and problems with training and upskilling employees (42%) are also considered highly impactful.

These last two points highlight a broader issue: many firms face limitations not only in staffing but also in preparing their teams to handle increasingly complex service demands.

Our survey reveals that field service and maintenance professionals are acutely aware that success hinges on effectively managing complex project management and addressing the challenge of employee training and upskilling.

Their recent purchases reflect a clear intent to strengthen control over operations and knowledge resources:

Project management software: As one of the highest priorities for recent spending, over 33% of field service professionals reported purchasing project management tools in the past 12 months. This could signal efforts to improve service delivery, resource allocation, and workflow coordination for multi-stage jobs.

Application development platforms: Application development is a top-prioritized purchase, targeted by over a quarter of respondents (26%) within the next year, suggesting a push to build or customize tools that address unique service requirements beyond off-the-shelf solutions.

Document management systems: 26% of field service buyers expect to acquire document management software as one of their other top investments, reinforcing the need for centralized access to procedures, manuals, and compliance documentation—critical for both training and complex job execution.

How software can be used to mitigate project and training concerns

Project management systems: These platforms directly address the concern of managing complex projects by providing workflow management, task assignment, and resource tracking features. They are essential for field service firms to reliably schedule multi-stage jobs, optimize technician deployment, and maintain visibility into every step of a complex client project.

Application development platform: This type of software can allow firms to build or tailor mobile applications for field technicians, such as custom diagnostic tools, complex digital checklists, or interactive guides, that provide specialized support and training exactly where and when it’s needed most. These tools are critical for upskilling and adapting to complexity.

Document management systems: By centralizing technical manuals, standard operating procedures, and compliance documents, document management platforms ensure that field teams have immediate, reliable access to the necessary information for complex jobs, effectively turning knowledge into an on-demand resource.

Expert tip

Addressing workforce shortages and internal challenges isn’t just about choosing the right standalone tools—it’s about how those tools work together. Integrations between your FSM platform and systems such as project management and document management can eliminate duplicate work, reduce errors, and ensure technicians have the right information when they need it. Before shortlisting vendors, document which systems your FSM platform must connect to and include these as non-negotiable requirements. Software Advice’s Software Comparison Chart offers practical templates and checklists to help you evaluate integration capabilities alongside other critical features.

3. Better software selection and security focus help prevent disappointed software buyers and drive client acquisition

As we mentioned previously, finding new clients remains a top concern for field service firms. While market competition and economic uncertainty can play a role, internal factors—especially past software decisions—can also impact growth.

One overlooked factor? Buyer disappointment.

Our research shows that 47% of field service professionals identify as disappointed software buyers. Among them, 41% plan to conduct a formal needs assessment before their next purchase. This signals a clear takeaway: structured evaluation upfront can help firms avoid performance issues and improve outcomes.

And this matters for client acquisition. Poor software choices often result in unreliable tools, performance gaps, or weak vendor support, all of which affect responsiveness and service quality, two critical factors in winning and retaining clients.

Survey data reinforces this point:

32% cite software bugs or crashes as a reason for disappointment.

26% report performance below expectations.

26% mention poor vendor support.

These findings underscore the importance of evaluating reliability and vendor responsiveness during the selection process, not just feature lists.

Auditing vendor support during software selection

Vendor support can make or break a software investment. Our research indicates that 38% of disappointed buyers have asked or plan to ask their vendor to help remedy issues, and 32% have had or will renegotiate their contract. These actions highlight a critical point: support quality and contractual clarity are not afterthoughts. Instead, they’re decisive factors in long-term success.

3. Better software selection and security focus help prevent disappointed software buyers and drive client acquisition

As we mentioned previously, finding new clients remains a top concern for field service firms. While market competition and economic uncertainty can play a role, internal factors—especially past software decisions—can also impact growth.

One overlooked factor? Buyer disappointment.

Our research shows that 47% of field service professionals identify as disappointed software buyers. Among them, 41% plan to conduct a formal needs assessment before their next purchase. This signals a clear takeaway: structured evaluation upfront can help firms avoid performance issues and improve outcomes.

And this matters for client acquisition. Poor software choices often result in unreliable tools, performance gaps, or weak vendor support, all of which affect responsiveness and service quality, two critical factors in winning and retaining clients.

Survey data reinforces this point:

32% cite software bugs or crashes as a reason for disappointment.

26% report performance below expectations.

26% mention poor vendor support.

These findings underscore the importance of evaluating reliability and vendor responsiveness during the selection process, not just feature lists.

Auditing vendor support during software selection

Vendor support can make or break a software investment. Our research indicates that 38% of disappointed buyers have asked or plan to ask their vendor to help remedy issues, and 32% have had or will renegotiate their contract. These actions highlight a critical point: support quality and contractual clarity are not afterthoughts. Instead, they’re decisive factors in long-term success.

To avoid costly missteps, evaluating support and service terms as rigorously as core features is paramount. Use this checklist during demos and negotiations:

What support channels and service-level agreements (SLAs) are offered? Does the vendor guarantee response times for critical issues? Are live chat, phone, and email support available during your operating hours?

Is onboarding assistance included? Will the vendor provide implementation guidance, training sessions, or a dedicated success manager?

What escalation paths exist for unresolved issues? Is there a clear process for urgent fixes or bugs that impact operations?

Does the contract specify remedies for recurring problems? Are service credits, termination clauses, or upgrade options included if performance falls short?

Is the knowledge base comprehensive and accessible? Does the vendor maintain updated documentation, troubleshooting guides, and FAQs for your team?

Can support scale with your business? Will additional users or new service lines receive the same level of assistance without hidden fees?

Our findings suggest that negotiating support terms upfront, rather than reacting after issues arise, can prevent regret and protect operational continuity. A structured review of SLAs, escalation procedures, and contractual remedies ensures your investment delivers value beyond the initial purchase.

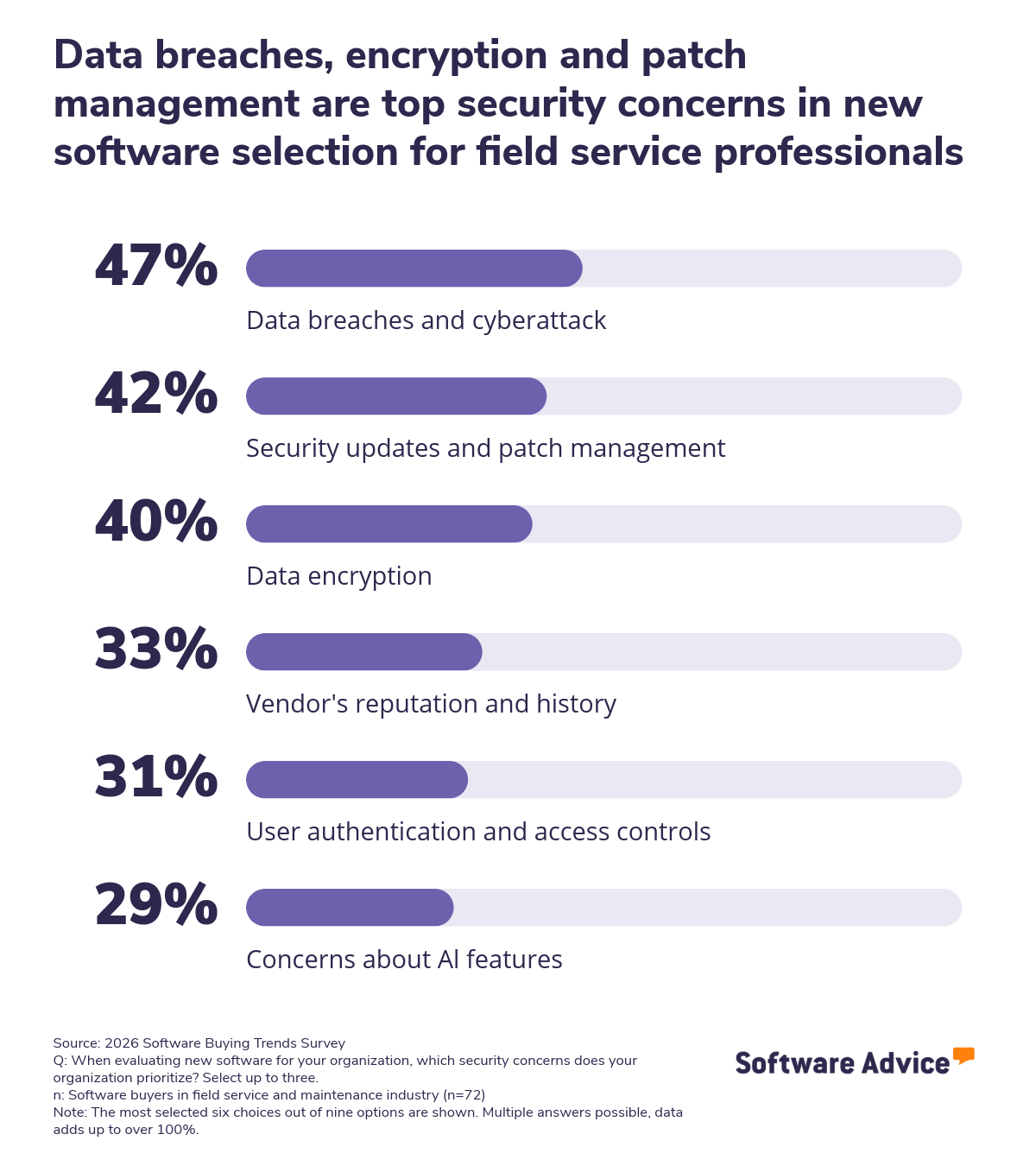

Security and ROI expectations shape buying priorities

Security is emerging as a top priority for field service professionals evaluating software in 2026. With many firms managing sensitive customer data and GPS tracking, concerns around breaches, encryption, and patch management are front of minds.

Security isn't just about risk mitigation: it's a trust signal. A company's visible commitment to data privacy allows it to differentiate itself from competitors, creating a safe harbor that actively attracts new customers and secures long-term loyalty. In field service, where customer data and location tracking are core to operations, secure platforms can help build client confidence.

At the same time, buyers expect fast returns. Survey data shows the average expected return on investment (ROI) is just 9.2 months. This urgency is understandable, especially for firms under margin pressure. The insights from Gartner’s Buyer Insights for FSM software highlight this trend, noting that firms are replacing fragmented tools with centralized platforms that offer stronger security and faster ROI. [3]

This dual focus on protection and performance can create tension. While quick ROI is important, over-prioritizing short-term gains may lead to software choices that lack long-term resilience or require early replacement. As highlighted earlier, disappointed buyers often cite poor vendor support or performance issues, and many plan to reassess their needs more thoroughly in the future.

Balancing security and ROI expectations during selection allows field service firms to avoid short-lived solutions and ensure longer-term value. A structured evaluation process—focused on both protection and performance—can guide buyers in making smarter, more sustainable software choices.

Expert tip

To ensure the utmost protection of sensitive data and minimize operational risk, field service leaders should utilize a strategic checklist for software selection. This approach involves prioritizing field service management platforms based entirely on their strong, built-in security protocols and proven ability to safeguard information.

When reviewing potential FSM vendors, prioritize those who demonstrate a clear commitment to protection through comprehensive data handling policies and verifiable security measures.

Concentrate on features that strictly mitigate risk:

Role-based access controls and data encryption to protect sensitive customer and operational data.

Mobile device management and secure GPS tracking to safeguard technician tools and location data.

Audit logs and compliance reporting to ensure traceability and meet regulatory requirements.

Conversely, you should exercise caution with tools that require long customization cycles or lack transparency on data handling. These characteristics can delay ROI and expose the firm to unnecessary and avoidable security risks.

4. AI adoption is cautious, but functionality drives spending

The embrace of artificial intelligence is certainly increasing within the field service sector, yet its adoption remains measured. According to our survey, 72% of field service professionals take a balanced approach to AI, while only 18% are aggressive adopters. This suggests that even as curiosity mounts, most organizations are still assessing the optimal methods for weaving AI capabilities into their day-to-day operations.

Despite this caution, functionality is a key driver of software investment. One-third (33%) of field service buyers identify adding features like AI as the top reason for increasing their software budget. This statistic highlights a growing recognition that AI can significantly enhance operational efficiency—particularly in areas such as scheduling, forecasting, and diagnostics.

When it comes to AI, field service professionals see the most value in:

Generative AI (42%)

Recommendation and personalization systems (36%)

Predictive analytics (33%)

Automated planning and scheduling (32%)

Description | Use case examples | |

|---|---|---|

Generative Al | Helps to create text, images, or other content based on prompts or data.

| Automatically generate service reports, technician notes, or customer follow-up messages. |

Recommendation and personalization systems | Suggests actions or configurations based on user behavior or context.

| Assign the best technician for a job based on skill set and location; personalize service plans for recurring clients. |

Predictive analytics

| Forecasts future outcomes using historical data and patterns. | Anticipate equipment failures and service demand; schedule preventive maintenance. |

Automated planning and scheduling | Organizes tasks and resources based on constraints and priorities. | Optimize technician routes, reduce idle time, and improve response speed for service requests. |

However, implementation isn't always smooth. Field service professionals are slightly more likely than average to face disruptions when adopting new tools (64% vs. 61% across all industries). Delays are the most frequently reported issue 41%), exceeding the all industries average. These setbacks can hinder operations—especially when businesses invest in advanced features without adequate planning or support.

Preparing your field service business for AI implementation and adoption

Integrating AI into field service operations emphasizes treating this tool as a strategic enabler—not just a technical upgrade. That’s why it demands thoughtful preparation, clear alignment with business goals, and a readiness to adapt workflows and team dynamics to new technologies.

When planning an AI implementation, strategic consideration must be given to these influential factors:

Scheduling maturity: Before implementing AI-driven scheduling, assess how well your current system handles technician dispatch, route planning, and job prioritization. Evaluate your scheduling maturity to ensure AI is built on a solid operational foundation and can scale effectively with your service goals. [4]

System interoperability (APIs): AI tools must integrate smoothly with existing platforms such as work order, service dispatch, or customer relationship management (CRM) systems. Without fluid API access, AI systems may fail to read or synchronize critical data.

Cloud readiness: Many advanced AI systems operate in the cloud. Ensure your internal data infrastructure supports cloud access to enable real-time processing and analytics.

Security preparation: AI systems often handle sensitive customer and operational data. Prioritize platforms with strong encryption, role-based access controls, and compliance reporting. As discussed earlier, security is not just a technical requirement—it’s a trust signal that can influence client confidence and long-term loyalty.

Skills and training: Field service teams may need upskilling to use AI tools effectively. This connects directly to the training gaps highlighted earlier; addressing these through targeted learning programs can improve adoption and performance.

Workflow mapping: To automate tasks successfully, document each step of your service workflows. This helps AI systems understand dependencies and execute tasks without missing critical actions.

When planning software investments, field service buyers are prioritizing foundational concerns that also shape AI readiness. Our study shows that compatibility with existing systems (42%), data management (33%), in-house skills to manage the solution (32%), and the ability to leverage AI effectively (31%) rank among the top considerations.

These priorities reflect broader software purchasing concerns—but they’re equally relevant when introducing AI into field service operations.

Expert tip

By aligning roles with AI capabilities, firms can reduce resistance, preserve service quality, and create space for upskilling—ensuring that technicians grow alongside the technology they use.

AI adoption in field service isn’t just about upgrading tools—it’s about evolving roles. As illustrated by Gartner’s insights, successful AI integration depends on aligning technician roles with AI-enabled workflows. [4] This means shifting focus from routine execution to tasks that require human judgment, such as interpreting diagnostics, solving complex service issues, and making strategic decisions.

By redesigning roles and upskilling teams, firms can reduce resistance to AI, preserve service quality, and ensure technicians grow alongside the technology they use.

Navigating field service challenges in 2026

Field service leaders face a complex mix of external and internal pressures heading into 2026—from labor shortages and project complexity to the growing role of AI in service delivery. These aren’t isolated issues—they’re interconnected, and they’re reshaping how service is planned, delivered, and sustained.

Our data shows that buyers are responding by investing in software that supports operational control, technician enablement, and long-term adaptability. But successful adoption—especially of AI—depends on more than choosing the right tool. It requires aligning purchases with business goals, mapping workflows, and preparing teams for evolving roles.

As service expectations rise and workforce constraints deepen, clarity becomes critical. Whether you're investing in AI or other field service solutions, define what success looks like, understand how technology fits into your operations, and ensure your teams are ready to grow with it.

Survey methodology

Software Advice 2026 Software Buying Trends survey was conducted online in August 2025 among 3,385 respondents in Australia (n=281), Brazil (n=278), Canada (n=293), France (n=283), Germany (n=279), India (n=260), Italy (n=263), Mexico (n=288), Spain (n=273), the U.K. (n=299), and the U.S. (n=588), at businesses across multiple industries, ages (1 year in business or longer), and sizes (5 or more employees). Business sizes represented in the survey include: 1,676 small (5-249 full-time employees), 822 midsize (250-999), and 887 enterprise (1,000+). The goal of this study was to understand the timelines, organizational challenges, research behaviors, and adoption processes of business software buyers. Respondents were screened to ensure their involvement in business software purchasing decisions.