Best Construction Categories

Best Facilities Management Categories

Best Human Resources Categories

Best Legal Management Categories

Best Manufacturing Categories

Best Medical Categories

Best Property Management Categories

Get 1-on-1 advice in 15 minutes. It's free.

Josh P.

Accounting Software Buyers Trends Report: 3 Action Areas to Prepare for 2026

Accountants are facing down a range of pressures from both external and internal sources ahead of 2026. On the external side, macroeconomic forces like inflation rates and tariffs are causing strategic priorities to shift. On the internal side, factors such as talent sourcing and customer acquisition concerns loom large. At the same time, AI is causing disruption and demanding the adaptation of classic accounting methods to more streamlined competitive ones that utilize new technology.

For accountants in small and midsize businesses, software helps maintain competitiveness and overcome some of these external and internal pressures. The right tool can mean the difference between correct forecasting, accurate error checking, and smoother collaboration between your team and stakeholders.

But accountants are underpreparing for the selection of the right software for their needs.

We polled 3,385 software decision-makers across 11 countries, including 139 accountants, in Software Advice’s 2026 Software Buying Trends survey*. Looking at their answers, we’ve found three areas where accountants need to adapt most:

External volatility is high. This requires better visibility over transactions and possible cost hikes.

Customer and staffing concerns prevail. Accountants need to focus on keeping consistent with customers while ensuring skills are up to standard internally.

Rushed software adoption. Better diligence is needed by professionals in the accounting sector to adopt software that delivers the best ROI.

This report examines the core issues that have affected accountants this year and are expected to impact the next twelve months. There have been many challenges to overcome in 2025, and some of these complexities are likely to extend into 2026. However, there are plenty of ways technology can help, as long as it doesn’t turn into a hindrance.

Key findings

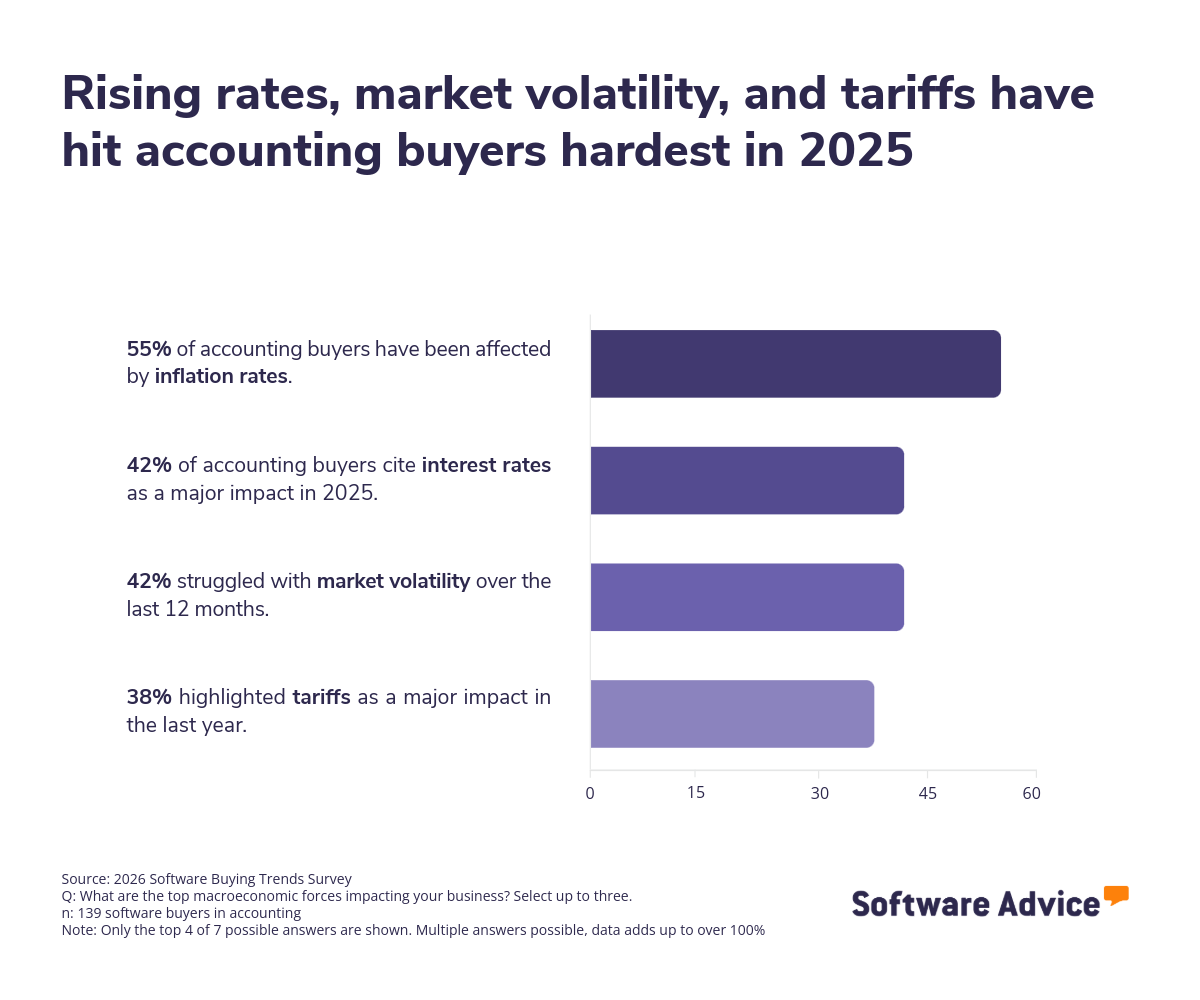

Inflation rates made an impact: Higher inflation adversely affected over half (55%) of accountants the most this year.

Volatility is the theme of 2025: Aside from inflation, interest rates, market volatility, and tariffs are affecting around four in ten in accounting.

Skills and client retention are the focus for 2026: More than half of accounting buyers expect challenges in client acquisition and staff skills shortages in the year ahead.

AI is gaining traction: Almost half (49%) of accounting sector buyers are adjusting their business goals around technological advancements like AI.

Missed opportunities: Buyers in the accounting sector are the most likely to be disappointed in their chosen software due to finding a better match later, compared to other sectors.

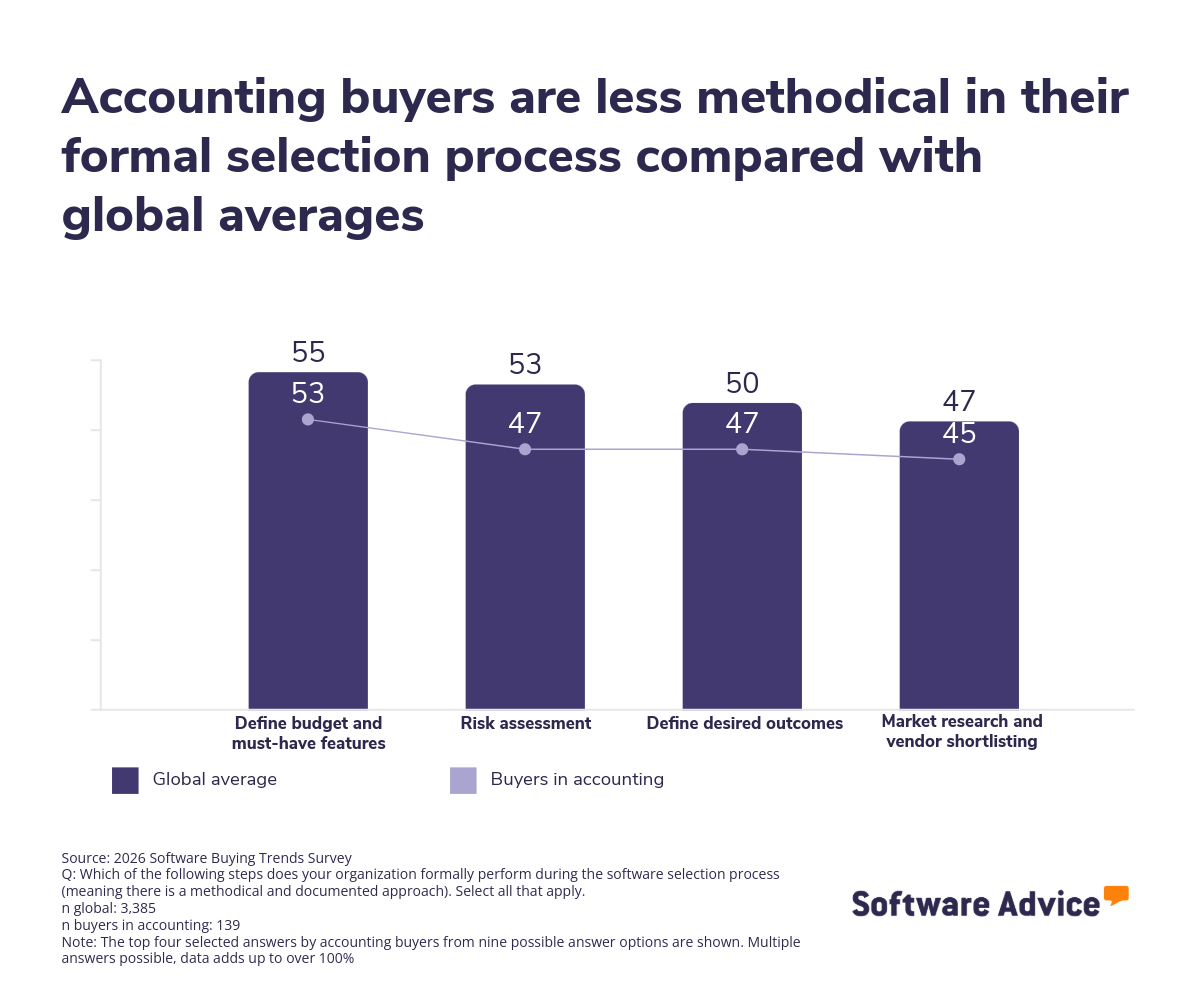

Diligence is needed: Accountants are less likely to define their goals, budget, and perform risk assessments during a software selection process than buyers across other sectors.

Rising rates risk disruption

Accountants are facing increasing external pressures due to macroeconomic trends that have seen rates of inflation and interest rise, and market volatility increase. Additionally, they have had to react to a new regime of tariffs placed on imports.

These issues affect the accounting sector professionals in particular. Understanding the impacts of factors such as fluctuating rates of pricing and debt, as well as new obligations like bearing the costs of tariffs, is of vital importance to businesses in their financial management planning. Accountants help firms visualize these impacts, measure their effects, and take necessary action.

To maintain good visibility, companies need to ensure their accounting tools and workflows are properly set up to identify and respond to sudden fluctuations in costs and to identify their cause. Tools such as expense tracking and tax management software can help when using accounting systems to manage company finances.

Quick tips

Focus on better financial visibility: Software features such as analytical insights, expense tracking, budgeting/forecasting, and tax management can prove most effective in getting a better picture of your business’s current financial flow.

Claw back revenue with sales management solutions: As costs are squeezed, businesses can focus instead on tools that can help them boost revenue. In our study, sales management software proves a key investment priority for buyers, and tools such as sales enablement, sales tracking, and sales forecasting software can assist in this way.

Skills, customers, and staffing are three key internal challenge points

Accountants see a number of challenges emerging to their business stability over the coming 12 months. These are manifesting through internal pressures that affect staffing and customers primarily.

When looking specifically at the topics accountants most commonly selected as challenges expected in 2026, half expressed doubts about finding new customers or training and upskilling their staff. In addition, just under half (45%) also highlighted worries about talent management in their firms more generally, as well as meeting the evolving expectations of customers.

In some ways, some of these concerns are unsurprising for the sector, as the staffing worries track with a general lack of Certified Public Accountants (CPAs) being reported over the last few months. [1] This is borne out by a greater number of retirements than intake into the sector and is likely to have impacted the skilling worries seen in our findings.

Furthermore, the issues surrounding customers noted by buyers suggest that services are all too often not meeting the current expectations of those hiring accounting teams. This implies that better forms of reaching buyers and smoothing out processes could be employed to help create a better experience of working with accounting departments and individual accounting professionals.

It’s, therefore, no surprise that we also observed in our data that over half (55%) of respondents in accounting have adopted marketing systems in the past 12 months or will adopt them in the next year. Additionally, the same amount (55%) have purchased in the past year or plan to adopt CRM systems in the next 12 months. These tools prove useful in this mission to keep on top of customer contact and acquisition by helping improve company visibility and nurturing relationships with existing clients.

In a similar vein, 53% have either recently bought or are about to invest in HR software, and learning management systems (LMSs) are the software that most accountants will prioritize in 2026, with over a quarter (26%) planning an investment. This suggests that software buyers in accounting are taking proactive steps to get on top of their staffing skills and talent acquisition and retention issues.

Accounting for the rise of AI

Accounting is, unsurprisingly, an area where businesses are interested in applying AI features and workflows. There are many routine accounting tasks where steps or entire processes can be run automatically, freeing up staff for more interpretation and analysis activities.

It’s therefore not a big shock to see that our study shows that accounting buyers place tech adoption and AI as an area of focus for their business goals, with almost half (49%) identifying it as a top factor. This is leading to increased software spending, with a third (36%) of buyers identifying AI specifically as the primary goal for their extra investment.

Most (94%) of accounting buyers are taking an adoptive stance to AI when making new software acquisitions. Around a quarter of all buyers in accounting (24%) take it to an extreme, pursuing an aggressive adoption strategy.

Accounting buyers are focusing mostly on generative AI as their application or function of choice within this technology framework. However, predictive analytics, computer vision, automated planning and scheduling, and recommendation systems also rank among the highest AI priorities.

Quick tips

Prioritize training tools: LMSs and other training provisions can help businesses enhance their learning programs to grow skills among their existing accounting employees. HR systems can also help businesses focus on acquiring skills from the external talent pool.

Centralize around customers: To overcome worries about customer consistency, focus on improving the experience and relationship with customers so they are more likely to stay on board. Marketing and CRM tools can help nurture customer interactions in this way and improve communication.

Be AI-ready before pushing go: AI systems will only deliver ROI for your business if they can work with your tech infrastructure and workflows. That means making sure some non-negotiables, such as compatibility with other tools in your business and secure interconnectivity with data systems, need to be planned well in advance. This also counts when preparing staff to use and maintain such systems, especially where wide automation is intended.

Accountants miss the ideal software match more than other buyers

Accountants are less likely to prioritize forward planning for software selection than peers across other sectors on average. This under preparation can have significant costs further down the line, potentially leading to a misplaced purchase decision.

A key point is that the margins between a successful and unsuccessful purchase are very fine. Just over half (56%) end up making a satisfactory purchase, vs 44% that end up disappointed. In other words, the odds of success and failure are little better than a coin flip.

To exacerbate things further, accountants are putting themselves at greater risk of failure during the software purchasing journey. There are noticeable differences between the level of work put into understanding a business’s needs and goals that a new software system should meet, done by accountants and peers across the business world.

This was a surprising trend we noticed, given that accounting is known as a precise and detail-focused practice. Despite this, accounting software buyers, in some cases by wide margins, focus less on essential tasks such as budget definition, outcome planning, and, notably, risk assessment.

This underpreparation appears to have an impact on the products bought as well. Among all the sectors studied, accountants are the most likely to end up disappointed with a purchase after finding a better matching system for their business post-purchase, affecting 36% of buyers. This ranks as the top cause for buyer remorse for the profession, alongside software proving too simple or complex for its intended use and poor performance overall.

Preparation is the key to success

Accountants have a great deal to think about when setting out their strategy for 2026. In a time when flexibility and agility are necessary, it is worth reflecting on the findings seen in this report.

There is a lot of awareness among accountants that they have much to do to counteract the effects of fluctuating financial rates, while combating skills and customer shortages internally. Technology seems to play a part in that recovery, yet there are gaps in the process of achieving that goal effectively.

Accounting is a business that requires detail and precision. However, that focus needs to go beyond the day-to-day and extend to the process of finding technology solutions, too.

Survey methodology

*Software Advice 2026 Software Buying Trends survey was conducted online in August 2025 among 3,385 respondents in Australia (n=281), Brazil (n=278), Canada (n=293), France (n=283), Germany (n=279), India (n=260), Italy (n=263), Mexico (n=288), Spain (n=273), the U.K. (n=299), and the U.S. (n=588), at businesses across multiple industries, ages (1 year in business or longer), and sizes (5 or more employees). Business sizes represented in the survey include: 1,676 small (5-249 full-time employees), 822 midsize (250-999), and 887 enterprise (1,000+). The goal of this study was to understand the timelines, organizational challenges, research behaviors, and adoption processes of business software buyers. Respondents were screened to ensure their involvement in business software purchasing decisions.

For the purposes of this report, we focused primarily on the buyers who identified their primary industry as accounting (n=139).