Find the best Financial CRM Software

Compare Products

Showing 1 - 20 of 121 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

Shape

Shape

Shape's cloud-based solution offers tools designed to manage online marketing and promotions, capture leads from online sources, organize sales pipelines, connect with customers and automate everyday tasks. Shape is suitable for b...Read more about Shape

FreeAgent CRM

FreeAgent CRM

FreeAgent CRM is a fully-featured CRM that helps your team get organized, gain visibility into day-to-day work, and get more done with a powerful, easy-to-use sales platform your sales team will actually love. Work smarter and f...Read more about FreeAgent CRM

LeadSquared

LeadSquared

LeadSquared is a cloud-based marketing automation and customer relationship management (CRM) solution for businesses of all sizes. It serves clients in industries such as finance, e-commerce, education, health and wellness, market...Read more about LeadSquared

Rolldog

Rolldog

Rolldog is a Customer Relationship Management (CRM) solution, with the perks of Sales Enablement all rolled into one. Rolldog helps companies manage their business relationships, increase revenue, and boost sales & marketing effec...Read more about Rolldog

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Meet Eric, a software expert who has helped 1,534 companies select the right product for their needs.

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Tell us more about your business and an advisor will reach out with a list of software recommendations customized for your specific needs.

STEP 1 OF 4

How many are in your organization?

monday sales CRM

monday sales CRM

Built on top of monday.com Work OS, monday sales CRM is a no-code, customizable solution that empowers managers and sales teams to take control of their entire sales cycle - from lead capturing and sales pipeline management to pos...Read more about monday sales CRM

Creatio CRM

Creatio CRM

Creatio is a global vendor of a no-code platform to automate workflows and CRM with a maximum degree of freedom. Creatio offering includes a no-code platform (Studio Creatio), CRM applications (Marketing, Sales and Service), indus...Read more about Creatio CRM

Maximizer CRM

Maximizer CRM

Maximizer CRM is a powerful solution specifically designed for sales. We understand the unique challenges faced by sales managers and sales teams. That's why we provide a game-changing alternative to complex CRM solutions and cumb...Read more about Maximizer CRM

Zenith CRM

Zenith CRM

Z-CRM transforms how you connect with customers through a cloud-based, AI-powered CRM and comprehensive call center suite. Enhance your team's productivity with intelligent dialers, streamline multi-channel communication, and tail...Read more about Zenith CRM

Zoho CRM

Zoho CRM

Zoho CRM is a cloud-based business management platform that caters to businesses of all sizes. It offers sales and marketing automation tools with helpdesk, analytics and customer support functions. Zoho CRM helps users respo...Read more about Zoho CRM

HubSpot CRM

HubSpot CRM

With its cloud-based, customer relationship management (CRM) platform, HubSpot CRM helps companies of all sizes track and nurture leads and analyze business metrics. HubSpot is suitable for any B2B or B2C business in a variety of ...Read more about HubSpot CRM

Pipedrive

Pipedrive

Pipedrive is a web-based Sales CRM and pipeline management solution that enables businesses to plan their sales activities and monitor deals. Built using activity-based selling methodology, Pipedrive streamlines every action invol...Read more about Pipedrive

Nimble

Nimble

Nimble offers browser widget and mobile-based sales force automation and social CRM solution for small and midsize businesses. The solution automatically populates customer profiles and interaction histories from contact lists, em...Read more about Nimble

NetSuite

NetSuite

With an integrated system that includes ERP, financials, commerce, inventory management, HR, PSA, supply chain management, CRM and more – NetSuite enables fast-growing businesses across all industries to work more effectively by a...Read more about NetSuite

Keap

Keap

Keap (formerly Infusionsoft) is a cloud-based sales and marketing solution that offers customer relationship management (CRM), marketing automation, and e-commerce functionalities in one suite. Keap helps small businesses across v...Read more about Keap

Bitrix24

Bitrix24

Bitrix24 is an online workspace for small, medium, and large businesses. It features over 35 cross-integrated tools, including CRM, tasks, Kanban board, Gantt chart, messenger, video calls, file storage, workflow automation, and m...Read more about Bitrix24

Apptivo

Apptivo

Apptivo is a cloud-based suite of applications designed to help small businesses manage a range of functions including financials, human resources and supply chain management. Apptivo’s customer relationship management (CRM) app...Read more about Apptivo

EngageBay CRM

EngageBay CRM

EngageBay is an integrated marketing, sales, support and CRM solution designed to help small to midsize enterprises acquire, engage and convert website visitors into customers. The cloud-based platform lets businesses use marketin...Read more about EngageBay CRM

Freshsales

Freshsales

Freshsales is a salesforce automation solution that enables businesses of all sizes to streamline lead management, client interaction, marketing insights, customer relationship management and other operations. The platform enables...Read more about Freshsales

HoneyBook

HoneyBook

HoneyBook is the centralized clientflow management platform that empowers independent businesses to deliver remarkable client experiences and operate with confidence. Use one platform to see what’s happening with all projects. M...Read more about HoneyBook

Less Annoying CRM

Less Annoying CRM

Less Annoying CRM is a customer relationship management solution built for small businesses. It offers cloud-based deployment, various configuration options and a dashboard that provides an overview of contact information, project...Read more about Less Annoying CRM

Popular Comparisons

Buyers Guide

Last Updated: March 16, 2023Customer relationship management (CRM) is a crucial aspect of modern business. As we've defined it elsewhere, CRM is: “A system that stores and organizes the info a business has about its leads and customers. It can also take that info and provide actionable next steps for what do with those leads. It helps businesses that need to improve sales and/or be better organized in how they engage with prospects, leads and current customers."

In the realm of financial advising and other financial services, CRM is even more important. Advisors need to have quick, ready access to all the information about their clients, including previous interactions, so that they can provide the most comprehensive, actionable advice possible.

In an industry that relies on personal relationships between advisors and their clients, CRM software can help businesses grow their client base while still personalizing their interactions with these clients and maintaining positive relationships. That's why CRM systems specifically geared toward financial services are so crucial for today's financial advisors.

This buyer's guide will explain what makes financial CRM software unique, explore some common features of many systems and discuss the specific questions your business should consider before purchasing.

Here are the aspects of financial CRM that we'll discuss:

What Is Financial CRM Software?

Common Features of Financial CRM

What Is Financial CRM Software?

On the most basic level, CRM software consolidates all customer information into one database, allowing users across the company to organize, manage and access that information without working cross-purposes. In addition, the software can automate some common practices, monitor performance/productivity and analyze data in order to provide reports that can help you predict trends or refine your practices.

Financial CRM software is an industry-specific type of CRM geared, as the name suggests, toward the financial services industry. This software is specifically geared toward financial advisors. Many top financial CRM software providers are, in fact, general CRM vendors offering a particular subsystem or add-on.

What differentiates CRM for financial advisors from a more generalized CRM system is that the software will not just capture the contact information of customers, but also their broad financial information, their relationship to the firm and their specific interactions with different advisors and other team members across the entire business.

The next section will discuss both general CRM features and those specific to financial CRM.

Common Features of Financial CRM

Customer data management | This core feature provides a searchable database to anyone with access to the system. That database will house customer information as well as relevant documents. In general, this means the database stores contact information, preferred means of contact and other general information about the customer. For financial CRM systems, this information will also include important financial information about the client, such as assets, liabilities and insurance policies. |

Interaction tracking | In addition to holding customer information, CRM databases will also store a history of all interactions with a client or prospect, whether those were conversations on the phone, in person or through live chat, email or any other channel. These can be either logged manually by advisors or automated by integrating with phone and email systems. This helps keep the entire advisory team on the same page with each client, to make sure that no efforts are doubled up or wasted due to miscommunication. |

Activity tracking | Similar to interaction tracking, this function will help prevent confusion and miscommunication by tracking all of the activity associated with a particular account. This way, multiple people across the company can help manage a client's financial assets and make sure that all activity is documented and tracked. |

Client segmentation | This feature can differentiate and segment clients (based on their information) into unique groups that require different services and different types/amounts of contact, helping your business streamline its best practices for each client. |

Workflow automation | This function allows you to standardize business processes through a combination of task lists, calendars, alerts and templates. For example, once a task is checked off as complete, the system can automatically set a task for the next step in the process. The software can thus provide a combination of automated messages and calendar alert reminders for advisors to reach out to clients personally. |

Analytics and reporting | Based on activities logged into the database, the CRM system can track the performance and productivity of individual advisors, in order to provide reports on how they can improve that performance. The same function can also be used to generate predictive forecasts of future activities. |

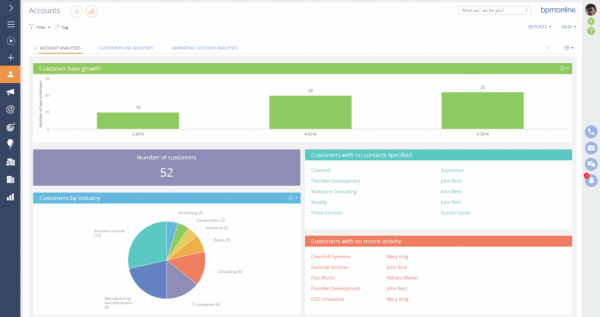

Account analytics in bpm'online

What Type of Buyer Are You?

Financial services firms can vary widely in size, and this variation will lead them to different requirements in their CRM systems. You will likely find your business falling into one of the following categories:

Single user. If you're an independent financial advisor, and thus the sole person using the software, you can probably get away with the lowest-tier CRM system, focusing simply on data management and interaction tracking. Any more than that is likely to be overkill.

Small business buyer. These are companies with between two and 100 employees that make under $50 million a year and have no IT department. With a small group of people accessing the CRM, you'll still want to focus on data management and interaction tracking, but activity tracking will be crucial, and client segmentation and workflow automation may also prove helpful.

Midsize business buyer. These are also companies that have between two and 100 employees and make under $50 million a year, but they do have an IT department. In addition to all the features needed by a small business buyer, analytics and reporting will likely prove beneficial, especially since you will have access to an IT department to help make sure these reports are generated properly.

Key Considerations

Other factors to take into consideration when choosing the right financial CRM for your business include:

Integration with other systems. In the field of financial services, you're probably using a lot of software besides just CRM. While CRM is crucial for maintaining a good relationship with your clients, accounting software, financial reporting software and other systems will allow you to actually manage those clients' funds. In order to best track those activities, you'll want to make sure that the CRM you choose integrates with that other software so that they can all work in harmony rather than bucketing information into separately walled off systems.

Cloud-based software vs. on-premise software. Traditionally, software was licensed through the purchase of physical hardware that a business would have to house on their own premises. This required space for the equipment, as well as IT resources to make sure that it was properly functioning, alongside high setup costs to get the system up and running. Today, though, most software (especially CRM) will be purchased as a cloud-based system that is simply accessed through the internet, with the hardware housed elsewhere by the vendor. This is especially beneficial for smaller businesses that can't afford the high upfront costs or the IT resources required for hardware maintenance, and which may not have the available space for the hardware. However, larger businesses, especially enterprise-level financial advisory firms, may prefer the added speed of on-premise housing.