Best CPA Accounting Software of 2026

Updated January 27, 2025 at 9:54 AM

- Popular Comparisons

- Buyers Guide

Compare Products

Showing 1 - 25 of 126 products

Compare Products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Average Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

Alphabetically (A-Z): Sorts listings by product name from A to Z.

Sage Intacct operates within the Sage Business Cloud portfolio as a comprehensive cloud-based financial management software, exp...Read more about Sage Intacct

Sage Intacct's Best Rated Features

See All

Sage Intacct's Worst Rated Features

See All

Xledger is a cloud-based enterprise resource planning (ERP) solution that caters to midsize and large businesses and helps them ...Read more about Xledger

NetSuite is an AI-powered cloud-based business management suite that incorporates ERP, financial management, CRM and eCommerce f...Read more about NetSuite

NetSuite's Best Rated Features

See All

NetSuite's Worst Rated Features

See All

AccountMate is a hybrid accounting solution that caters to small and midsize businesses and offers them tools and functionalitie...Read more about AccountMate

AccuFund is 100% focused on serving nonprofits and government entities. The complete fund accounting financial management soluti...Read more about AccuFund Accounting Suite

AccuFund Accounting Suite's Best Rated Features

See All

AccuFund Accounting Suite's Worst Rated Features

See All

Procurify is the leading AI-powered procurement, accounts payable (AP), expense, and payment platform designed for mid-market or...Read more about Procurify

Procurify's Best Rated Features

See All

Procurify's Worst Rated Features

See All

Sage Accounting is a cloud-based accounting and invoice management solution for small to midsize businesses. It offers accountin...Read more about Sage Accounting

Sage Accounting's Best Rated Features

See All

Sage Accounting's Worst Rated Features

See All

Striven is a cloud-based enterprise resource planning (ERP) solution suitable for many industries and organizations of all sizes...Read more about Striven

Striven's Best Rated Features

See All

Striven's Worst Rated Features

See All

Canopy is a cloud-based practice management and tax resolution platform for accounting firms, tax professionals, tax attorneys a...Read more about Canopy

Canopy's Best Rated Features

See All

Canopy's Worst Rated Features

See All

Beyond Software is a project accounting and management software system available for small to mid-size companies. The system all...Read more about Beyond Software

Sage X3 is a powerful ERP software solution designed for midsized national and global manufacturers, distributors, and after-sal...Read more about Sage X3

Sage X3's Best Rated Features

See All

Sage X3's Worst Rated Features

See All

SAP S/4HANA Cloud is a cloud-based and on-premise enterprise resource planning (ERP) solution. It is suitable for small, midsize...Read more about SAP S/4HANA Cloud

SAP S/4HANA Cloud's Best Rated Features

See All

SAP S/4HANA Cloud's Worst Rated Features

See All

M3 Accounting Core Software is a cloud-based accounting solution that helps streamline financial operations for small to large b...Read more about M3 Accounting Core

Sage 300cloud (formerly Sage Accpac) is an enterprise resource planning (ERP) software system that serves small and medium-size ...Read more about Sage 300

Sage 300's Best Rated Features

See All

Sage 300's Worst Rated Features

See All

For over 26 years, DataServ has delivered cloud-based AP automation solutions to mid-sized to global Fortune 500 clients in the ...Read more about DataServ SaaS AP Automation

Elorus is an online invoicing, time-tracking, billing and expense management platform. At heart, it is the ideal professional so...Read more about Elorus

Elorus's Best Rated Features

See All

Elorus's Worst Rated Features

See All

Zoho Invoice is a 100% free cloud-based invoicing solution designed to help small businesses with invoicing, tracking expenses a...Read more about Zoho Invoice

Zoho Invoice's Best Rated Features

See All

Zoho Invoice's Worst Rated Features

See All

TimeSolv is a cloud-based legal time tracking and billing solution that caters to law firms, accountants, consultants, architect...Read more about TimeSolv Legal Billing

TimeSolv Legal Billing's Best Rated Features

See All

TimeSolv Legal Billing's Worst Rated Features

See All

Agiled is an all in one business management platform. It comes with built-in CRM, HRM, Financial Management, Project Management ...Read more about Agiled

Agiled's Best Rated Features

See All

Agiled's Worst Rated Features

See All

Patriot Accounting offers accounting software for American businesses and accountants. Patriot Accounting is affordable and easy...Read more about Patriot Accounting

Patriot Accounting's Best Rated Features

See All

Patriot Accounting's Worst Rated Features

See All

Happay is a first-of-its-kind all-in-one Integrated Solution for Corporate Travel, Expense, and Payments Management. With over 7...Read more about Happay

Happay's Best Rated Features

See All

Happay's Worst Rated Features

See All

FloQast, an Accounting Automation Platform created by accountants for accountants, enables organizations to automate a variety o...Read more about FloQast

FloQast's Best Rated Features

See All

FloQast's Worst Rated Features

See All

Create. Send. Get Paid. Invoice Ninja is the leading small-business platform to invoice, accept payments, track expenses & time...Read more about Invoice Ninja

Invoice Ninja's Best Rated Features

See All

Invoice Ninja's Worst Rated Features

See All

QuickBooks Enterprise is an accounting solution designed for SMBs across different industry verticals such as construction, nonp...Read more about QuickBooks Enterprise

QuickBooks Enterprise's Best Rated Features

See All

QuickBooks Enterprise's Worst Rated Features

See All

N2F is a cloud-based expense report management software that enables enterprises to streamline processes related to expense reim...Read more about N2F

N2F 's Best Rated Features

See All

N2F 's Worst Rated Features

See All

Popular Comparisons

Buyers Guide

This detailed guide will help you find and buy the right cpa accounting software for you and your business.

Last Updated on January 27, 2025Here’s what we’ll cover:

What is CPA accounting software?

What are the common features of CPA accounting software?

CPA accounting software pricing

What are the deployment options for CPA accounting software?

What are some other considerations when selecting a platform?

How to evaluate accounting software for Certified Public Accountants?

What is CPA accounting software?

Since Certified Public Accountants (CPAs) manage the finances for dozens, or even hundreds of corporations and individuals, they need software that can keep up. CPA-specific accounting programs will be designed for payroll, expense and reporting for multiple companies, and will also include useful tools like auditing, tax preparation and time-based billing.

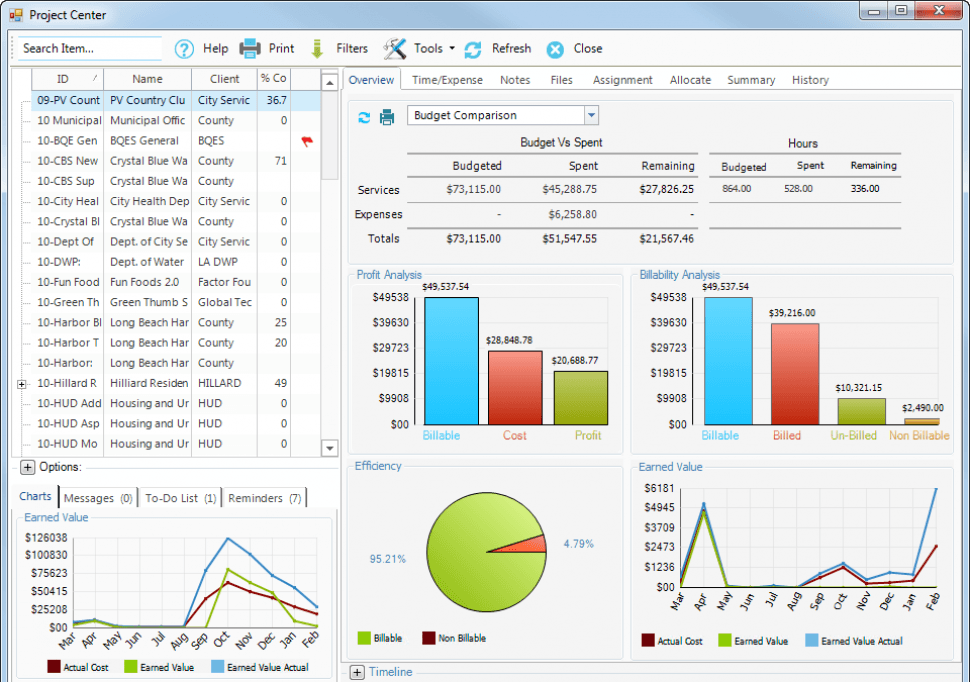

Screenshot of BillQuick user dashboard

Accounting software for CPAs isn’t just regular accounting software. CPAs typically need greater functionality and more features in order to handle multiple clients or otherwise ensure regulatory compliance.

In this guide, we'll cover:

The functionality CPAs should be looking for when considering software solutions; and

Best practices for evaluating CPA-specific systems.

What are the common features of CPA accounting software?

Accounting software for banks, mortgage companies and financial services institutions will include the following industry-specific features:

Multi-company accounting | Unlike other industries, professional accountants need to manage the accounting for multiple companies, so the software should allow you to categorize access all their data to keep it separated but easy to recall. Non-accountant-specific programs can sometimes become overloaded by all the records, so it’s critical that your software can handle large volumes of data. |

Tax preparation | The U.S. tax code is thousands of pages long, and it changes every year. Tax preparation is a major part of a CPA’s job, and CPA-specific systems will contain specialized data to support preparation for all your clients. These will include updated tax tables, automated calculations and electronic filing for individuals and corporations on a state, local and federal level. |

Time & billing | Time and billing refers to the ability to track the time spent on certain projects and then bill clients based on the number of hours spent. Accounting software for any service provider should include time and billing capabilities. |

Regulations compliance | The system needs to comply with federal, state and local regulations and statutes like FASB, GASB 34, IFRS and DCAA. Ensure the software you select complies with these regulations and updates it for any changes. |

Financial reports | Reporting is a critical component for freelance accountants. In addition to standard executive reports, charts and summary statements, the software should be able to build customized reports using an intuitive interface. |

CPA accounting software pricing

Accounting software used by CPAs is generally priced one of two ways: subscription and perpetual licensing.

Subscription. The software is priced as a monthly fee, typically based on the number of users. While no upfront fee is paid, an organization might have to pay annual fees for support and maintenance.

Perpetual license. With a perpetual license, an organization pays an upfront fee and then in turn owns the software in perpetuity. The upfront fee is also typically based on the number of users or the relative size of the organization based on its annual revenue. However, organizations will still generally have to pay annual fees for support, maintenance and updates. A general rule of thumb is that an organization can expect to pay 20 percent of the perpetual license fee annually on those other associated fees.

What are the deployment options for CPA accounting software?

CPA Accounting software can be deployed one of several ways: cloud-based, on-premise and hybrid.

Cloud-based. Cloud-based software is hosted on the vendor’s servers and is accessed through a web browser. Cloud-based deployment has become increasingly popular in recent years. Typically, cloud-based software is most associated with subscription pricing.

On-premise. The organization installs and hosts the software on their own computers and servers. Typically, on-premise software is most associated with perpetual licensing.

Hybrid. There are several hybrid approaches out there, but the most common is when an organization licenses a cloud-based platform to have it run on the organization’s own internal servers. This is done so the organization can have the flexibility of using cloud-based software while also having more control over how its data is stored.

One consideration to keep in mind is indeed data security. While cloud-based platforms can be just as secure as on-premise platforms, some organizations will nevertheless prefer to store their own data internally. CPAs might have certain clients who would prefer that their data never leave the CPA’s office, so at any rate it is critical for CPAs to understand where their clients’ data is being stored and how secure it is.

What are some other considerations when selecting a platform?

The strength of vendors offering CPA accounting software can often be determined by how agile they are when it comes to ensuring that their platform is continuously updated to reflect new regulations and laws pertaining to tax compliance. When selecting a platform, be sure to vet vendors’ commitment to updating their platform.

Also consider a vendor’s long term viability. The major players in this space can generally be seen as safe bets, while there can be less certainty smaller vendors. Smaller vendors may more adequately serve a particular niche, and may have more competitive pricing, but there is less of a guarantee as to how long that vendor will be around. As such, it’s important to note that every vendor has its own unique advantages and disadvantages in this regard.

How to evaluate accounting software for Certified Public Accountants?

When evaluating CPA-specific systems, the most important criteria to consider are the nature of your business and the number of clients. Do you primarily deal with tax preparation for individuals, or general ledger and payroll for corporations? Do you have two or three clients or 100?

In particular, CPAs seeking software should ask the following questions:

How many individual records will you need access to at a given time? Is the software designed for that level of usage?

Do you primarily serve individuals or corporations?

Will you need support on regulatory compliance?

Do you need to keep track of billable hours?