Best Online Accounting Software of 2026

Updated January 27, 2025 at 9:55 AM

- Popular Comparisons

- FrontRunners

- Buyers Guide

Compare Products

Showing 1 - 25 of 176 products

Compare Products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Average Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

Alphabetically (A-Z): Sorts listings by product name from A to Z.

Sage Intacct operates within the Sage Business Cloud portfolio as a comprehensive cloud-based financial management software, exp...Read more about Sage Intacct

Sage Intacct's Best Rated Features

See All

Sage Intacct's Worst Rated Features

See All

Sage 50 Accounting is an accounting solution designed to cater to the needs of small and medium-sized businesses. It offers a su...Read more about Sage 50 Accounting

Sage 50 Accounting's Best Rated Features

See All

Sage 50 Accounting's Worst Rated Features

See All

Xledger is a cloud-based enterprise resource planning (ERP) solution that caters to midsize and large businesses and helps them ...Read more about Xledger

NetSuite is an AI-powered cloud-based business management suite that incorporates ERP, financial management, CRM and eCommerce f...Read more about NetSuite

NetSuite's Best Rated Features

See All

NetSuite's Worst Rated Features

See All

AccountMate is a hybrid accounting solution that caters to small and midsize businesses and offers them tools and functionalitie...Read more about AccountMate

Aplos is a dedicated accounting solution engineered specifically for the unique financial demands of nonprofit organizations. We...Read more about Aplos

Aplos's Best Rated Features

See All

Aplos's Worst Rated Features

See All

Blackbaud’s cloud fund accounting software Blackbaud Financial Edge NXT provides transparency across teams, security, and compli...Read more about Blackbaud Financial Edge NXT

Blackbaud Financial Edge NXT's Best Rated Features

See All

Blackbaud Financial Edge NXT's Worst Rated Features

See All

Connected is a hybrid integrated accounting and enterprise resource planning (ERP) that caters to small and midsize businesses a...Read more about Connected

Versa is Modern all-in-one Cloud ERP software created for fast growing inventory heavy manufacturing, distribution, and e-commer...Read more about Versa Cloud ERP

AccuFund is 100% focused on serving nonprofits and government entities. The complete fund accounting financial management soluti...Read more about AccuFund Accounting Suite

AccuFund Accounting Suite's Best Rated Features

See All

AccuFund Accounting Suite's Worst Rated Features

See All

Procurify is the leading AI-powered procurement, accounts payable (AP), expense, and payment platform designed for mid-market or...Read more about Procurify

Procurify's Best Rated Features

See All

Procurify's Worst Rated Features

See All

Striven is a cloud-based enterprise resource planning (ERP) solution suitable for many industries and organizations of all sizes...Read more about Striven

Striven's Best Rated Features

See All

Striven's Worst Rated Features

See All

Sage Accounting is a cloud-based accounting and invoice management solution for small to midsize businesses. It offers accountin...Read more about Sage Accounting

Sage Accounting's Best Rated Features

See All

Sage Accounting's Worst Rated Features

See All

Deltek Costpoint is an enterprise resource planning (ERP) and management solution designed to meet the requirements of midsize a...Read more about Deltek Costpoint

Deltek Costpoint's Best Rated Features

See All

Deltek Costpoint's Worst Rated Features

See All

MIP is fund accounting for your mission-based organization’s future. Designed to track unlimited funds and manage your financial...Read more about MIP Accounting

Sage X3 is a powerful ERP software solution designed for midsized national and global manufacturers, distributors, and after-sal...Read more about Sage X3

Sage X3's Best Rated Features

See All

Sage X3's Worst Rated Features

See All

Beyond Software is a project accounting and management software system available for small to mid-size companies. The system all...Read more about Beyond Software

Sage 300cloud (formerly Sage Accpac) is an enterprise resource planning (ERP) software system that serves small and medium-size ...Read more about Sage 300

Sage 300's Best Rated Features

See All

Sage 300's Worst Rated Features

See All

M3 Accounting Core Software is a cloud-based accounting solution that helps streamline financial operations for small to large b...Read more about M3 Accounting Core

SAP S/4HANA Cloud is a cloud-based and on-premise enterprise resource planning (ERP) solution. It is suitable for small, midsize...Read more about SAP S/4HANA Cloud

SAP S/4HANA Cloud's Best Rated Features

See All

SAP S/4HANA Cloud's Worst Rated Features

See All

Deltek Ajera is an integrated accounting and project management solution built for architecture and engineering (A/E) firms. It ...Read more about Deltek Ajera

Deltek Ajera's Best Rated Features

See All

Deltek Ajera's Worst Rated Features

See All

aACE is a powerful, comprehensive business management solution designed for companies that have outgrown small-business packages...Read more about aACE

For over 26 years, DataServ has delivered cloud-based AP automation solutions to mid-sized to global Fortune 500 clients in the ...Read more about DataServ SaaS AP Automation

DealerCenter is a cloud-based dealer management system designed to help small to large businesses manage processes related to ac...Read more about DealerCenter

DealerCenter's Best Rated Features

See All

DealerCenter's Worst Rated Features

See All

Elorus is an online invoicing, time-tracking, billing and expense management platform. At heart, it is the ideal professional so...Read more about Elorus

Elorus's Best Rated Features

See All

Elorus's Worst Rated Features

See All

Popular Comparisons

Your Guide to Top Online Accounting Software, September 2022

Software Advice uses reviews from real software users to highlight the top-rated Online Accounting products in North America.

Learn how products are chosenExplore FrontRunners

“Usability” includes user ratings for Functionality and Ease of Use.

“Customer Satisfaction” includes user ratings for Customer Support, Likelihood to Recommend and Value for Money.

Reviews analysis period: The reviews analysis period spans two years and ends the 15th of the month prior to publication.

Buyers Guide

This detailed guide will help you find and buy the right online accounting software for you and your business.

Last Updated on January 27, 2025With online, or Web-based accounting software, an organization’s financial data is hosted by the vendor. In this software-as-a-service (SaaS) module, data is stored on secure servers with automatic back-up and redundancy capabilities. In recent years, these programs have become highly customizable: businesses only pay for the services that they consume. This flexibility, along with the lack of capital investment requirements, attracts small and medium-sized businesses especially.

Because of the hundreds of online accounting programs, it can be very difficult to decide which one is best for your business. This buyer’s guide is designed to help you navigate the online business accounting software market. Here’s what we’ll cover:

What is online accounting software?

Accounting solutions track the financial transactions within an organization. Typical features include:

Accounts payable/receivable

Payroll and reporting modules

Specialty systems often have additional features dedicated to a particular market. These include fund accounting for nonprofits, commission calculations for sales-oriented businesses like real estate, rate analysis for banking or claims scrubbing for medical practices.

Online accounting systems are specifically designed to be used through the Internet, rather than being installed locally onto company computers. This reduces information technology requirements like server hardware, backups and maintenance and shifts the expenditure from being a large up-front capital cost to a much smaller, but ongoing, monthly or annual fee.

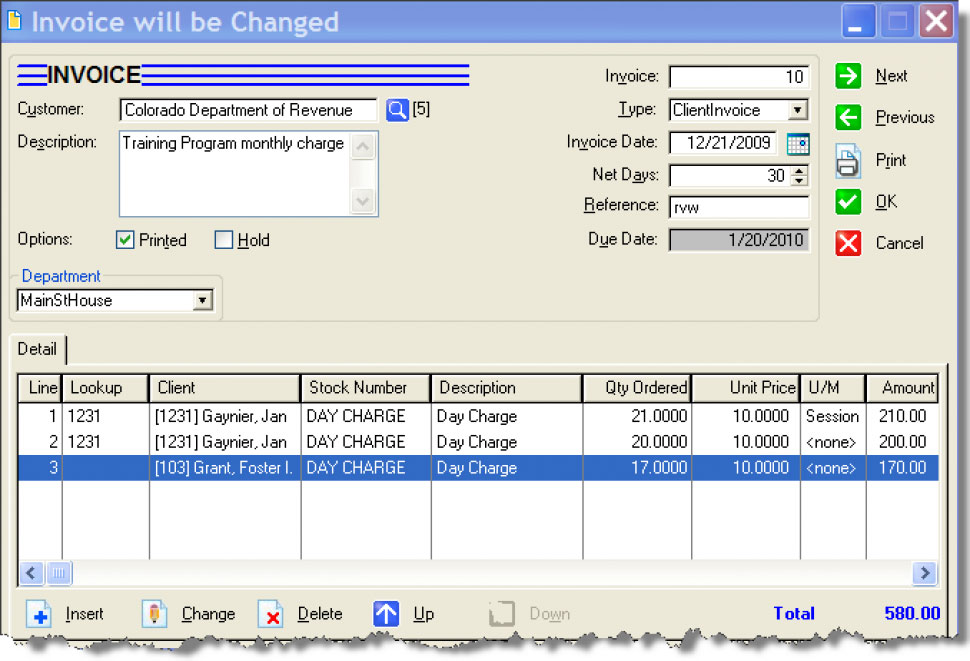

AR invoice screenshot in AccuFund

There are two types of accounting software online: browser-based, SaaS and application service providers (ASPs). SaaS solutions are designed for the user to access the information through an Internet browser like Internet Explorer, Firefox, Chrome or Safari. This allows the information to be accessed from anywhere, and it always looks exactly the same. An ASP is a client-server system, where the business installs a small software “client” onto their computers. In both models—SaaS and ASP—all of the data is hosted by the vendor on a remote server. Most ASPs are also “Web-enabled,” meaning that a Web-browser can be used if necessary, though it will come with a few disadvantages since it is not designed for that purpose.

What type of buyer are you?

Online financial software falls into three main categories:

Enterprise resource planning (ERP) solutions. This describes an integrated suite of features that includes manufacturing, sales, customer relationship management, project management, supply chain management etc. Buyers will want an ERP if they’re looking for a full-suite comprehensive solution, of which accounting is just a small part.

Basic systems. Basic programs online that aren’t part of an ERP tend to be much more cost effective to purchase outright and install locally, and there aren’t very many Web-based systems that focus in this market. But there are a handful available, if this is the deployment model you prefer and all you need is basic functionality. There are also a number of online vendors that will let you select only the features you wish to use.

Fund accounting solutions. There are several products out there designed specifically for the nonprofit market, which include industry-specific features like fund accounting, requisitions and grant and donation management.

What are the benefits and potential issues of online accounting software?

A Web-based system has a number of significant advantages over traditional on-premise software platforms:

Greater level of interactivity. Online bookkeeping software extends system capabilities with functions such as online payments and employee portals. An online accounting system can support a user interface for business employees and customers for communication and sales. Online payments save time by integrating with accounts payable/receivable and the general ledger to automatically update a company’s books. Online employee portals can increase the flexibility of communication and collaboration.

Limited IT burden. Browser-based access for Web accounting software avoids potential compatibility problems, which can sometimes happen when installing these kinds of programs locally to your system. In addition, the vendor handles all of the routine back-ups, upgrades and maintenance, saving considerable time and money on IT infrastructure, a particular benefit for smaller businesses.

Lower up-front costs. Rather than paying a large installation fee, Web-based systems come on more of a subscription basis. In the SaaS model, the user pays a monthly or annual fee, making it a low but ongoing operational expense rather than a capital one.

Data security. Web-based software vendors have stringent security requirements to ensure that your data is secure from hackers and protected from loss. Therefore, an on-premise crash, theft or other hazard to the company’s computers will not destroy the business accounting data. Many online solutions also allow businesses download their data locally, if that’s preferred.

Although Web-based solutions don’t require the same investment in hardware as traditional software installations, subscription costs can accrue over time. The longer it stays in use, the more the user pays, and after a few years the costs may exceed whatever would have been paid for an on-premise system. This is especially true for larger organizations that have the capital and IT infrastructure to make an on-premise system more cost-effective.

Another issue to consider whenever purchasing any new product is to ensure user buy-in. If people feel like they’re having new software “forced” on them, they’re more likely to resist its implementation. Therefore, it’s important to get them excited about the benefits of the new program. A great way to do this is to involve them in the selection process, either inviting them to the demos directly or, if there are too many users for that to be practical, at the very least surveying employees for their opinions on the features they’d want in a new program.

What are the market trends of online accounting software?

Customization. A growing trend in the SaaS accounting market is the ability to select the features your organization needs or wants. If all you need is core accounting, that’s all you pay for, and if you want forecasting but not grant management, the software won’t include it.

Electronic payments. The ability to pay invoices and collect receipts electronically is a great way to save time and money. The benefits are strong enough that most solutions are developing electronic payment features to allow their customers to take full advantage of those capabilities.

SaaS for larger businesses. In the past, Web-based systems were being marketed exclusively as online small business accounting software for companies that couldn’t afford the up-front costs associated with an on-premise system. Today, however—although many small business systems still offer SaaS models—more and more vendors are targeting larger companies with SaaS solutions offering extremely high-level functionality, as in the ERP realm, offering the best of both worlds.

The vendor landscape

These are the best online accounting software solutions and vendors to consider, categories by program type:

These types of buyers... | Should evaluate these systems... |

Enterprise resource planning (ERP) solutions | NetSuite, Epicor, Microsoft Dynamics GP, SAP, Royal 4 |

Basic programs | HIntacct, Accumatica, Lawson S3 |

Fund solutions | FastFund, Serenic, Accufund, Sage MIP Fund |