Best Mortgage CRM Software of 2026

Updated October 1, 2025 at 6:07 AM

- Popular Comparisons

- Buyers Guide

Compare Products

Showing 1 - 25 of 181 products

Compare Products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Average Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

Alphabetically (A-Z): Sorts listings by product name from A to Z.

Pipeliner has revolutionized CRM with our unique visual interface, no-code workflow automation engine, and instant, dynamic insi...Read more about Pipeliner CRM

Pipeliner CRM's Best Rated Features

See All

Pipeliner CRM's Worst Rated Features

See All

LeadMaster is a SaaS-based all-in-one lead management solution that offers capabilities to capture, track and follow up with lea...Read more about LeadMaster

BNTouch Mortgage CRM is a fully integrated digital mortgage system, CRM, marketing, and POS tool offering a comprehensive mortga...Read more about BNTouch Mortgage CRM

BNTouch Mortgage CRM's Best Rated Features

See All

BNTouch Mortgage CRM's Worst Rated Features

See All

Shape's cloud-based solution offers tools designed to manage online marketing and promotions, capture leads from online sources,...Read more about Shape

Shape's Best Rated Features

See All

Shape's Worst Rated Features

See All

LeadSquared is a cloud-based marketing automation and customer relationship management (CRM) solution for businesses of all size...Read more about LeadSquared

LeadSquared's Best Rated Features

See All

LeadSquared's Worst Rated Features

See All

Thryv is an all-in-one business management solution designed to help small businesses with essential business functions. With Th...Read more about Thryv

Thryv's Best Rated Features

See All

Thryv's Worst Rated Features

See All

Sales Cloud is equipped with customer relationship management (CRM) functionality that encompasses lead management, marketing au...Read more about Salesforce Sales Cloud

Salesforce Sales Cloud's Best Rated Features

See All

Salesforce Sales Cloud's Worst Rated Features

See All

Zoho CRM is a cloud-based business management platform that caters to businesses of all sizes. It offers sales and marketing aut...Read more about Zoho CRM

Zoho CRM's Best Rated Features

See All

Zoho CRM's Worst Rated Features

See All

Creatio is a new era CRM to manage all customer and operational workflows with no-code and AI at its core. Creatio Sales is an ...Read more about Creatio CRM

Creatio CRM's Best Rated Features

See All

Creatio CRM's Worst Rated Features

See All

MortgageHalo from Halo Programs is a cloud-based customer relationship management (CRM) solution designed for the residential mo...Read more about MortgageHalo

SAP Customer Experience is a cloud-based customer relationship management solution that helps small and mid-size businesses mana...Read more about SAP Customer Experience

SAP Customer Experience's Best Rated Features

See All

SAP Customer Experience's Worst Rated Features

See All

HelpCrunch is a customer communication platform combining live chat, email marketing automation and a help desk in one solution....Read more about HelpCrunch

HelpCrunch's Best Rated Features

See All

HelpCrunch's Worst Rated Features

See All

Zendesk is a cloud-based help desk management solution offering customizable tools to build customer service portal, knowledge b...Read more about Zendesk Suite

Zendesk Suite's Best Rated Features

See All

Zendesk Suite's Worst Rated Features

See All

NetSuite is an AI-powered cloud-based business management suite that incorporates ERP, financial management, CRM and eCommerce f...Read more about NetSuite

NetSuite's Best Rated Features

See All

NetSuite's Worst Rated Features

See All

LiveAgent is a cloud-based help Ddsk solution for eCommerce businesses at the small and midsize levels. The platform offers live...Read more about LiveAgent

LiveAgent's Best Rated Features

See All

LiveAgent's Worst Rated Features

See All

Google Contacts is a cloud-based solution that allows enterprises to store and manage contacts in a built-in directory. Professi...Read more about Google Contacts

Google Contacts's Best Rated Features

See All

Google Contacts's Worst Rated Features

See All

Flowlu is a cloud-based, all-in-one business management solution designed for teams of all sizes and industries. Whether you're ...Read more about Flowlu

Flowlu's Best Rated Features

See All

Flowlu's Worst Rated Features

See All

The Mortgage Office is a loan servicing solution designed for companies of all sizes. It offers loan tracking, payment processin...Read more about The Mortgage Office

The Mortgage Office's Best Rated Features

See All

The Mortgage Office's Worst Rated Features

See All

EngageBay is an AI-powered all-in-one CRM that helps small businesses and startups manage marketing, sales, and customer service...Read more about EngageBay CRM

EngageBay CRM's Best Rated Features

See All

EngageBay CRM's Worst Rated Features

See All

noCRM is a cloud-based sales management system designed for small and midsize businesses which offers prospecting, lead tracking...Read more about noCRM

noCRM's Best Rated Features

See All

noCRM's Worst Rated Features

See All

Yonyx is a cloud-based solution designed to help call centers and customer service businesses create and manage interactive guid...Read more about Yonyx

Yonyx's Best Rated Features

See All

Yonyx's Worst Rated Features

See All

The AI-Powered Helpdesk for Modern B2B Teams Supportbench is the most complete helpdesk platform built specifically for B2B sup...Read more about Supportbench

Supportbench's Best Rated Features

See All

Supportbench's Worst Rated Features

See All

PhoneBurner is an outbound dialer and call center solution that empowers agents to conduct wildly efficient yet highly personali...Read more about PhoneBurner

PhoneBurner's Best Rated Features

See All

PhoneBurner's Worst Rated Features

See All

ActiveCampaign is the AI-first marketing platform built to transform how marketers, agencies, and entrepreneurs work. Use Active...Read more about ActiveCampaign

ActiveCampaign's Best Rated Features

See All

ActiveCampaign's Worst Rated Features

See All

Pipedrive is a web-based sales CRM solution that helps sales teams of all sizes and industries close more deals. Pipedrive lets ...Read more about Pipedrive

Pipedrive's Best Rated Features

See All

Pipedrive's Worst Rated Features

See All

Popular Comparisons

Buyers Guide

This detailed guide will help you find and buy the right mortgage crm software for you and your business.

Last Updated on October 01, 2025As most people know, CRM software is used for customer relationship management. That sounds simple enough ... and it even has an easy acronym to remember it by! It sounds simple right up until you ask the question—the question all buyers of CRM software really should ask—What kind of customers?

That’s a very important question. Not all customers are the same. Of course they vary from individual to individual, but that’s less important than the fact customers in different industries need and expect different relationships with the businesses they patronize. Purchasing CRM software that’s tailored to one specific industry will not work very well, unless you’re in that specific industry.

Similarly, if you’re in an industry that has unique relationships with customers, or requires lots of specialized outreach or management processes, then a generic CRM platform wouldn’t be the best choice. In this Buyer’s Guide, we look at CRM software designed very specifically for the mortgage industry.

Here's what we'll cover:

What Is Mortgage CRM Software?

Common Features of Mortgage CRM Software

Evaluating Mortgage CRM Software

Mortgage CRM Software In the News

What Is Mortgage CRM Software?

Mortgage customer relationship management (CRM) software is designed to help mortgage professionals run their front-end operations. And given all the ups and downs the mortgage industry has faced over the past ten years, it’s an industry that can use all the help it can get. The subprime mortgage crisis is anything but a distant memory. Delinquencies and foreclosures are still common occurrences, and mortgage lenders have realized the importance of focusing on the customer acquisition and management lifecycle as a means of recovery.

In particular, lenders and loan officers must overcome the hurdles of keeping detailed client notes and maintaining timely client follow-up. They require proper contact management coupled with loan pipeline management in order to stay in control of their business. On top of client retention, mortgage lenders also need to grow and expand their operation in a highly competitive market.

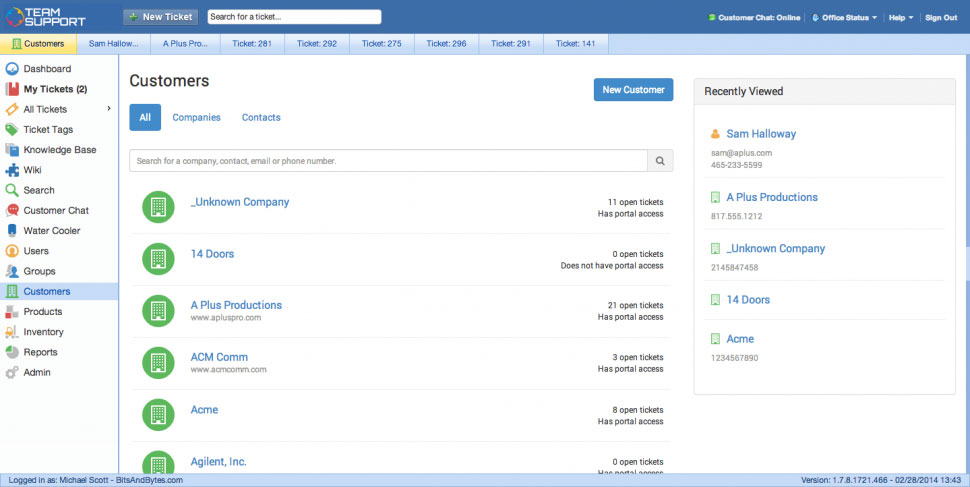

Customer management screen in TeamSupport

Common Features of Mortgage CRM Software

Mortgage CRM software often includes applications for contact management, so that lenders can organize client data into one, easily accessible location. However, if the tool is specific to the mortgage industry, it will also include additional key features:

Loan pipeline Management | Mortgage CRM software should tie in with existing loan-originating software (LOS) systems to improve loan pipeline management. This integration allows lenders to view loan reports on-demand, track loans as they go through the LOS and synchronize important data such as loan status values and 1003 application data. With a few clicks, the lender can access contact information, loan information, email and phone call history. |

In a highly competitive market, mortgage companies can benefit greatly from a program that facilitates drip marketing campaigns and campaign tracking to send targeted messages to clients and referral partners. Tracking these campaigns helps lenders know how to cultivate and reward client and partner loyalty. | |

Mortgage event alerts | There should also be tools for notes and alerts that remind the lender of important upcoming events, such as which clients want to refinance several weeks or months in the future. Some systems also have a news update application that provides the most up-to-date information, such as increased annual premiums or changes in upfront mortgage insurance rates (UFMIP). |

With the current instability in the market, it is even more important for lenders to stay abreast of new regulations and compliance issues in their industry. Integrated compliance modules are available in some products to help ensure that business operations are in line with regulations enforced by organizations such as the Federal Housing Administration (FHA). |

Evaluating Mortgage CRM Software

Mortgage CRM software can automate many of the day-to-day marketing and loan processing, facilitating marketing efforts and increasing accuracy and customer service. When selecting mortgage CRM software, ask the following questions:

Do you plan to host the software locally on your own servers or are you looking for a cloud-deployed solution?

Does the software integrate seamlessly with your existing LOS system for end-to-end loan visibility?

Does the software integrate with other existing legacy systems such as ERP or accounting?

Does your organization require a Web-based customer portal so customers can access loan applications and information online?

Does your organization require capabilities for multi-channel marketing (i.e., email, phone, direct etc.)?

Will you be producing and sending a lot of content and documents to send to customers?

Mortgage CRM Software In the News

Lenders make strides in personalizing borrower relationships. June, 2016. A report in Credit Union Times describes how many mortgage lenders are investing in tools to help them offer more personalized service to their customers. It suggests that consumers are expecting this personalized service and are less responsive to more outdated methods of non-personalized marketing, like generic mass emails.

Email marketing not dead in mortgage industry. July, 2016. NationalMortgageProfessional.com Writer Brent Emler makes the case for a renewed look at the efficacy of email marketing in the mortgage lending industry. Far from dead, Emler says, “E-mail marketing is evolving from the carnival barker pitching a new act to an engaging personalized conversation built on collaboration and timely delivery of appropriate opportunities to help consumers become happily involved with products and services.”

Mason-McDuffie Mortgage Corp. focuses on borrower experience. July 2016. “Borrowers can get lost in the huge amount of paperwork involved in the loan process,” writes Jason Frazier, chief information officer at Mason-McDuffie, in the latest issue of HousingWire magazine. With the company’s newly developed software solution, they’ll reduce paperwork redundancies, shorten wait times for customers and add several other customer experience improvement measures.